When the clock strikes midnight on new yr’s, bam! It’s about time to finish Kind 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return. The FUTA tax return differs from different employment tax varieties in just a few methods. So, tips on how to fill out a 940 tax kind additionally differs. Discover ways to fill out Kind 940 the best solution to keep away from penalties and fines.

FUTA tax overview

Earlier than understanding tips on how to fill out 940 varieties, first perceive what the shape is. Kind 940 experiences federal unemployment taxes to the IRS at first of every yr.

Employers pay federal unemployment tax on the primary $7,000 of every worker’s wages. The present tax price is 6%, however most states obtain a FUTA tax credit score of 5.4%. So, many companies solely pay a 0.6% (6% – 5.4%) FUTA tax price. Nonetheless, credit score discount states don’t obtain the complete FUTA tax credit score of 5.4%.

A credit score discount state is one which took loans from the federal authorities to fulfill its state unemployment tax liabilities however has not repaid the loans in time. A state with a credit score discount would obtain a credit score discount price of 0.3% for every year they don’t repay the federal mortgage in full. For instance, a state that has not paid in full for one yr would obtain a tax credit score of 5.1% as an alternative of 5.4% (5.4% – 0.3%).

If a enterprise doesn’t obtain the FUTA tax credit score, the corporate pays as much as $420 per worker (6% X $7,000). Companies that obtain the tax credit score pay as much as $42 per worker (0.6% X $7,000).

So, who’s liable for paying FUTA Tax? In accordance with the IRS, qualifying employers do a minimum of one of the next:

- Pay wages of $1,500 or extra to workers throughout any quarter within the calendar yr.

- Have a number of workers for a minimum of some a part of a day in a minimum of 20 totally different weeks throughout the calendar yr. Embody all short-term, half, and full-time workers. Don’t embody companions in a partnership within the worker depend.

Methods to fill out Kind 940

IRS Kind 940 experiences your federal unemployment tax liabilities for all workers in a single doc. Employers should submit the shape to the IRS by January 31 of every yr in the event that they qualify.

And now, right here’s tips on how to fill out FUTA tax varieties.

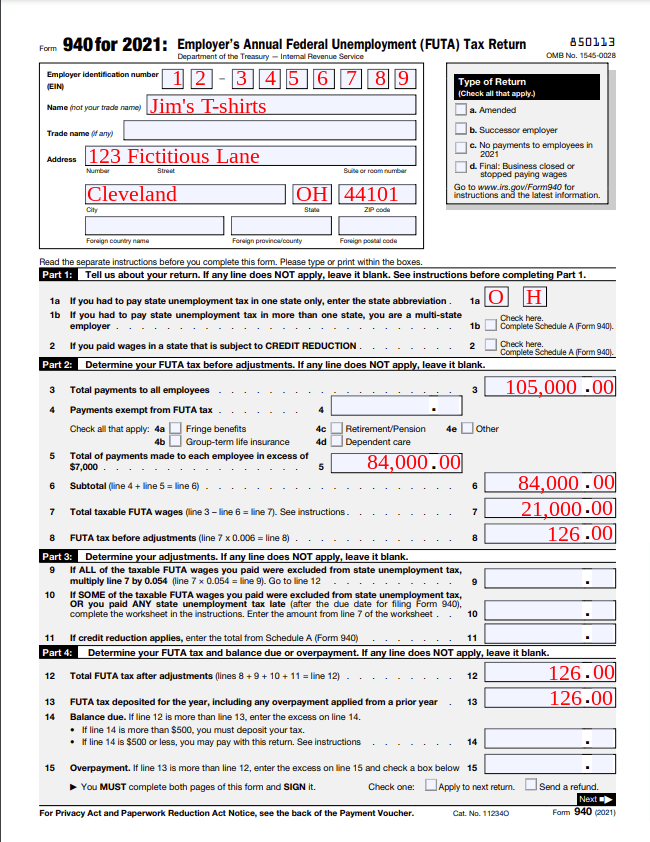

1. Full employer info

A bit for what you are promoting’s info is on the prime of every 940 kind. Enter your employer identification quantity (EIN), enterprise title, and tackle. When you function underneath a doing enterprise as (DBA), embody the DBA on this part. You should use a enterprise EIN, not a Social Safety quantity (SSN) or Taxpayer Identification quantity (TIN).

2. Enter state unemployment particulars

Half 1 of Kind 940 applies to state unemployment info. There are three traces. Chances are you’ll want to finish multiple line:

- Line 1a: Enter the state abbreviation for those who paid state unemployment in solely one state.

- Line 1b: When you paid state unemployment in extra than one state, test the field to establish your self as a multi-state employer.

- Line 2: Test the field for those who paid worker wages in a state with a FUTA tax credit score discount.

If you’re a multi-state employer or obtain the FUTA tax credit score discount (aka test Strains 1b and/or 2), full Schedule A (Kind 940), Multi-state Employer and Credit score Discount Info.

Once more, the credit score discount on Kind 940 consists of any state that has not repaid cash it borrowed from the federal authorities to pay unemployment advantages. Credit score discount states should pay the complete 6% FUTA tax price.

3. Decide pre-adjustment FUTA tax quantities

Half 2 of the 940 kind consists of six traces. Don’t full any traces that don’t apply to what you are promoting or workers.

- Line 3: Enter the full funds made to all workers. Embody all funds made to workers, even wages not topic to FUTA tax. Funds embody compensation, fringe advantages, retirement or pension advantages, and different funds (e.g., ideas).

- Line 4: Report the full quantity of all funds exempt from FUTA (e.g., fringe advantages). Line 4 consists of checkboxes for the kind of exempt funds. Test the suitable field or containers for every sort of fee included within the whole on Line 4.

- Line 5: Enter the full quantity of funds made to every worker over $7,000. The primary $7,000 in wages, minus the full quantity exempt from FUTA, is topic to the tax. Record on Line 5 the full quantity over the wage base you paid to every worker after subtracting the exempt wages.

- Line 6: Add collectively the quantities from Strains 4 and 5 and enter the full right here.

- Line 7: Subtract Line 6 from Line 3 (Line 3 – Line 6) and enter the full right here. That is your whole taxable FUTA wages.

- Line 8: Multiply the quantity listed on Line 7 by 0.006 and enter the full on Line 8. This quantity is the FUTA tax earlier than changes.

4. Calculate FUTA tax changes

In Half 3 of Kind 940, go away any line that doesn’t apply to what you are promoting clean. This part determines the full changes you will need to make to your FUTA taxes.

- Line 9: Full this line if all taxable FUTA wages had been excluded from state unemployment tax. Multiply Line 7 by 0.054 (the quantity of the FUTA tax credit score) and enter this quantity.

- Line 10: If solely some of the taxable FUTA wages paid had been excluded from state unemployment tax OR you paid any state unemployment tax late, full Line 10. Use Worksheet—Line 10 within the Kind 940 Directions to calculate the quantity. Enter this on Line 10.

- Line 11: Use Line 11 if the FUTA credit score discount applies. Enter the quantity from Schedule A (Kind 940).

5. Decide FUTA tax stability due or overpayment

In Half 4, decide the full quantity of FUTA tax you owed for the calendar yr. Use this part to calculate for those who owe FUTA tax or overpaid. Solely full relevant traces. Depart traces clean if they don’t apply.

- Line 12: Add collectively Strains 8, 9, 10, and 11. Enter the full on Line 12.

- Line 13: Enter the quantity of FUTA tax you deposited for your entire yr, together with any overpayments utilized from the earlier yr.

- Line 14: If the quantity on Line 12 is larger than the quantity on Line 13, enter the surplus quantity on Line 14.

- Deposit the tax if the surplus is greater than $500.

- You may pay the tax with the return if the quantity is lower than $500. Use the directions listed on Kind 940 if paying when submitting the return.

- Line 15: If Line 13 is larger than Line 12, you overpaid. Enter the surplus quantity on Line 15 and choose the checkbox beneath the road. Chances are you’ll select to use the overpayment to the subsequent return or request a refund.

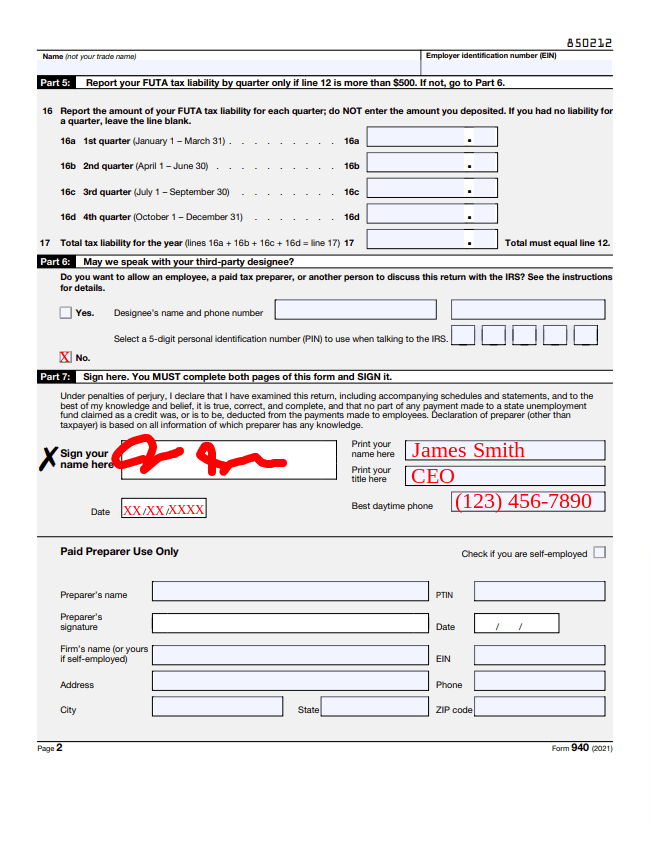

6. Report quarterly FUTA tax liabilities

Solely full Half 5 of the 940 kind if Line 12 of Half 4 is greater than $500. If Line 12 is lower than $500, skip Half 5 and full Half 6.

- Line 16: Enter the quantity of your FUTA tax legal responsibility for every quarter. Don’t enter the quantity of tax you deposited. Strains 16a by way of 16d specify every quarter.

- Line 17: Add traces 16a by way of 16d collectively and enter the full tax legal responsibility on Line 17. The full on Line 17 should match the quantity on Line 12.

Your FUTA tax legal responsibility for the quarter is the full quantity of FUTA tax calculated on relevant wages for every worker as much as the $7,000 wage base.

7. Select who might communicate with the IRS

Half 6 of the shape means that you can select who might communicate with the IRS concerning your Kind 940 tax return. If you choose ‘Sure,’ enter the designated contact’s title and cellphone quantity. Then, enter a five-digit private identification quantity (PIN) the contact can use when chatting with the IRS to substantiate their authority.

You might also test the ‘No’ field to make sure the IRS can solely communicate to you concerning your return.

8. Signal the shape

In Half 7, you will need to signal and date the shape. And, print your title and title and supply a daytime cellphone quantity for the IRS to contact you.

Half 7 additionally features a part for paid preparers to finish. If you’re not a paid preparer, go away this part clean.

Instance of 940 kind crammed out

Check out a Kind 940 instance. You’ve got three workers: Bob, Sara, and Tom. Bob earned $30,000, Sara earned $35,000, and Tom earned $40,000 final yr. You didn’t provide fringe advantages, group-term life insurance coverage, retirement or pension plans, or dependent care.

Your state presents the utmost FUTA tax credit score of 5.4%, so that you solely pay 0.6% for FUTA tax on every worker. You paid $126 for federal unemployment tax throughout the yr. And, you didn’t have any overpayments from the earlier yr to use.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.