Final week, the Federal Reserve (Fed) elevated its benchmark price by 50 bp to 0.75%-1.00%, the most important single hike since Might 2000 in an try to sort out a 40-year excessive in US inflation. Along with decreasing asset holdings, Fed Chair Powell signaled a few price hikes by 50 bp within the coming conferences. He additionally reiterated that the central financial institution will go right down to price hikes of 25 bp “if inflation comes down”.

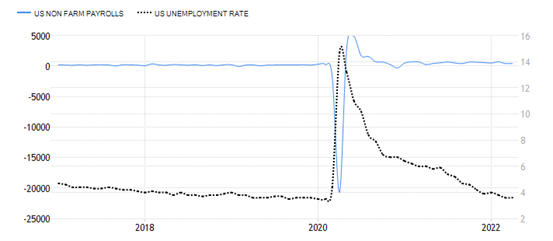

Fig.1: US Non Farm Payrolls and Unemployment Price. Supply: Buying and selling Economics

However, the Non-Farm Payrolls in April 2022 recorded a rise of 428K in employment, marking job positive aspects above 400K for twelve consecutive months. The unemployment price stayed flat on the earlier stage of 3.6%, barely greater than consensus estimates at 3.5%. Labor drive participation marked its lowest stage since January, at 62.2%. As well as, common hourly wage hits new low since March 2021, at 0.3% – this can be a sign of inflation slowing down. Whatever the outcomes, the CME watch software exhibits that the Fed’s choice for tightening financial coverage stays unchanged.

Tightening of financial coverage might not be pleasant to the inventory market. On this circumstance, its pretty important to find shares that would probably stand up to a rising-rate setting. Mastercard Inc. could also be one of many candidates. Being one of many conglomerates within the international cost area, Mastercard facilitates cost transactions in additional than 200 nations with greater than $7 trillion circulate by way of its community and over 2.5 billion playing cards in circulation. Following the central financial institution’s price hike, Mastercard will acquire greater charges for every transaction by serving as a intermediary between sellers and shoppers.

Nevertheless, it’s also value noting that the financial situations performs a terrific position in figuring out the outlook for the corporate. If economies fall into recession, decreased demand and spending could inevitably damage the enterprise of all international cost corporations. On a optimistic notice, collaboration with Microsoft and Zeta gives a extra aggressive edge for Mastercard in features equivalent to security, safety, comfort of e-commerce, on-line banking and contactless transactions.

Technical Overview:

The day by day chart exhibits #Mastercard buying and selling inside an ascending wedge, at the moment testing the decrease line at $341.30, or FR 38.2% prolonged from the very best level ($399.90) in February’22 to the bottom level ($305.15) in March’22. Breaking beneath the extent would point out bearish potentialities for the corporate’s share value to check the subsequent assist zone $324.00 – $327.50, and $300.15 – $305.15. However, $352.50 (FR 50.0%) serves as the closest resistance to look at. A powerful candlestick shut above the mentioned stage in addition to the 100-day SMA could counsel extra shopping for pressures in the direction of the subsequent resistance at $363.70 (FR 61.8%) $379.60 (FR 78.6%) and the very best level seen this 12 months at $399.90.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is supplied as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distribution.