USD began the week off its 20-year highs. China knowledge disillusioned –industrial manufacturing down -2.9% y/y in April, whereas retail gross sales plunged -11.1% y/y. China saved MLF and repo fee charges unchanged. The PBOC disillusioned hopes for additional easing in gentle of lockdown measures and saved the MLF coverage fee unchanged as soon as once more. Inventory markets principally managed beneficial properties, however mainland China bourses struggled, after a weak knowledge spherical that highlighted the unfavourable impression of the nation’s zero Covid coverage (CSI300 -1% however Nikkei -0.3%). Yields had fallen to their lowest ranges in a few weeks, which was seen as overdone given inflation stays elevated and the Fed can be sustaining a hawkish coverage stance to deliver pressures underneath management. Oil corrected to $108 while Gold dipped to $1804.

- USDIndex regular at 104.60.

- Equities – USA500 turned decrease (–0.6%) at 3984 now, USA100 fell 0.5%. EUROSTOXX 50 and UK100 futures each eased 0.3%.

- Yields corrected, with a -1.3 bp correction within the 10-year Treasury fee, which is at present at 2.906%.

- Oil additionally corrected as China jitters clouded over the demand outlook, and USOIL dropped again to at present $108.10 from ranges over $111 earlier within the session.

- Gold droop continued with a take a look at of the important thing $1800 ground.

- Bitcoin languishes at $29K now, after bouncing to $31K early within the morning.

- FX markets – EURUSD sideways between 1.0390 to 1.0415, USDJPY eased to 128.70 and Cable continues to wrestle; returned to 1.2200 space. AUD decrease in Asia.

In a single day – Shanghai aiming to reopen broadly and permit regular life to renew from June 1. Markets in Thailand, Malaysia and Indonesia had been closed for holidays.

Right now – The calendar contains the second studying for Eurozone Q1 GDP, which is prone to affirm the quarterly development fee at 0.2% q/q. BoE Financial Coverage Report Hearings. NY Fed’s Williams will participate in a moderated dialogue. The Empire State is anticipated to fall to 16.0 in Could after surging 36.4 factors to 24.6 in April.

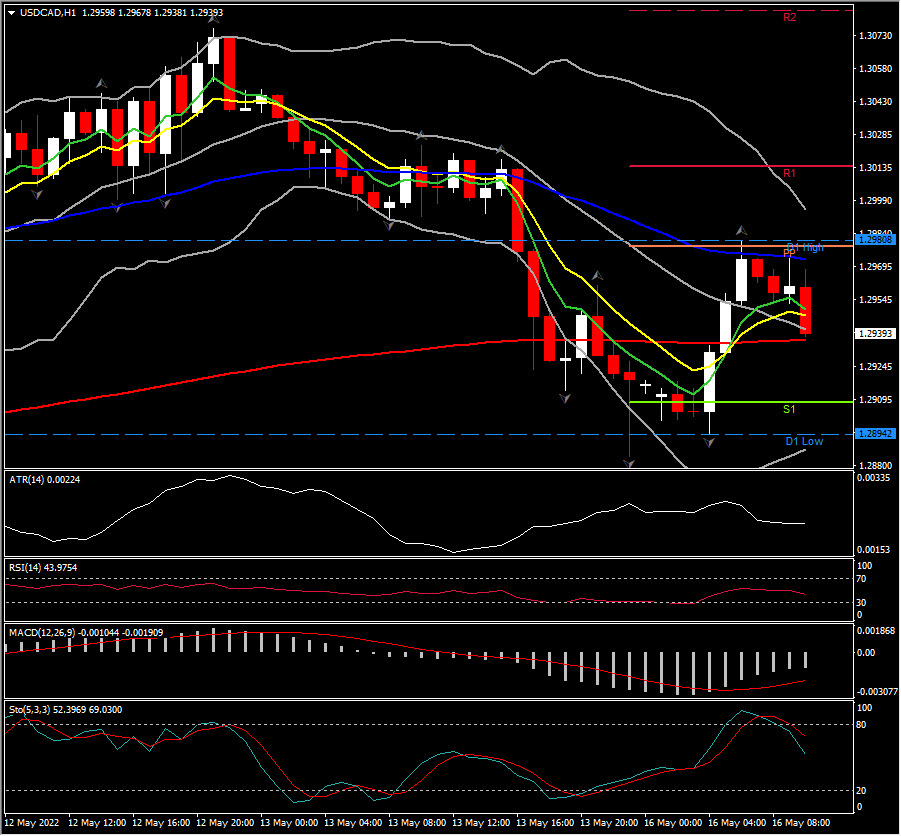

Largest FX Mover @ (06:30 GMT) CADJPY (+1.44%) Rallied to 1.2980 earlier than pulling again once more to 1.2900 lows. Now again to 1.2938. MAs aligning decrease however not bearishly crossed but, MACD sign line & histogram holds beneath 0, RSI 44 & declining, H1 ATR 0.00225, Each day ATR 0.01077.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distribution.