The S&P 500 has struggled to date in 2022, however a mix of vitality shortages, booming reopening demand, inflation and geopolitical unrest has oil costs buying and selling at multi-year highs. Oil shares like Exxon Mobil Corp (NYSE: XOM) and Marathon Oil Company (NYSE: MRO) are among the many market’s greatest performers year-to-date.

In truth, eight out of the ten best-performing shares within the S&P 500 to date in 2022 are oil and fuel shares, together with each Exxon and Marathon. WTI crude oil costs are up 26.8% year-to-date and 61.5% general previously yr.

Associated Hyperlink: Fuel Costs: Why Russia’s Invasion Of Ukraine Will Enhance Your Prices At The Pump

What’s Occurring: Reopening demand from the worldwide financial system has been a contributing issue, and the drop-off in circumstances of the omicron variant of COVID-19 may imply that journey demand for crude oil will see an enormous bounce when the spring and summer season journey season begins.

In fact, the battle in Ukraine is one other main issue that has pushed crude oil costs above $90 per barrel for the primary time since 2014. Russia is the world’s second-largest oil producer, and any main sanctions on Russia by the U.S. or different international locations may create a serious provide imbalance within the international oil business.

In the meantime, a big portion of the cash being invested within the vitality business lately has gone towards creating clear vitality know-how, which nonetheless represents a comparatively small a part of the worldwide vitality provide.

Why It is Essential: Rising oil costs enhance prices for a lot of firms, however vitality demand is definitely excellent news for oil and fuel shares. Buyers ought to intently monitor oil costs within the coming weeks, particularly because the battle in Ukraine escalates. If elevated oil costs attain a sure tipping level, a so-called oil shock may inflict severe financial injury.

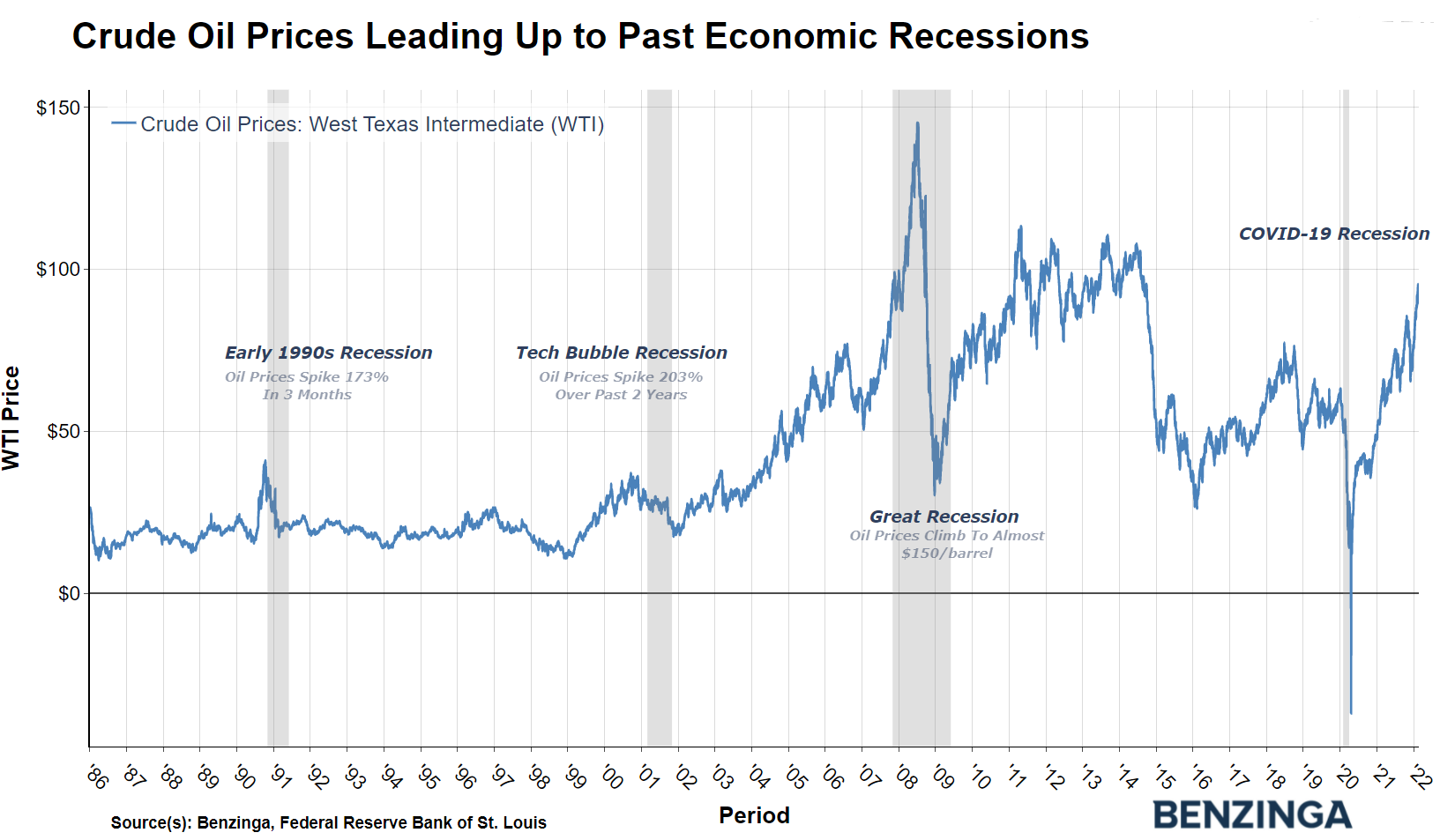

In truth, DataTrek Analysis co-founder Nicholas Colas just lately famous that oil shocks have precipitated extra U.S. financial recessions previously 50 years than another catalyst. Buyers could do not forget that crude oil costs spiked as excessive as $140/barrel previous to the financial disaster in 2008.

Benzinga’s Take: For now, oil costs appear to be in a candy spot for oil and fuel firms, contributing to elevated margins with out weighing down the financial system. It is not apparent at what value rising oil costs would begin to meaningfully eat into company earnings and decelerate the financial system, however traders ought to proceed to watch the state of affairs, particularly if oil costs cross over the $100 psychological stage.

© 2022 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.