The foreign exchange market is exclusive. In contrast to the inventory market, which is the preferred buying and selling market, the foreign exchange market operates 24 hours a day for greater than 5 days per week. It by no means closes. So long as there’s a nation that’s exchanging the forex pair, that specific forex pair would nonetheless transfer.

Having a market that doesn’t shut on the finish of the day implies that there are limitless alternatives that merchants can benefit from. Merchants have the choice to not relaxation and attempt to revenue from the market so long as they need. This seemingly limitless alternatives trigger many merchants to consider that it’s of their greatest curiosity to commerce 24 hours a day for the entire buying and selling week.

Though theoretically merchants ought to be capable to revenue extra in the event that they commerce the foreign exchange markets extra typically, for many handbook retail merchants, this doesn’t do them properly. Fatigue might set in inflicting merchants to make errors and lose cash. Some use buying and selling robots or algorithms to commerce for them continuous. Nonetheless, you might be additionally on the mercy of the algorithm not making a mistake.

One good possibility can be to commerce the foreign exchange markets solely through the occasions of the day the place probably the most alternative is offered. The London buying and selling session might be one of the crucial energetic occasions in a buying and selling day. It’s because the London market is the biggest market in foreign exchange. London opens additionally often have a powerful breakout momentum which ends up in an intraday pattern that will dictate the path of the remaining market hours.

London Development Continuation Foreign exchange Buying and selling Technique revolves across the concept of buying and selling based mostly on the explosive potential of the London open. It makes use of a number of indicators to assist merchants determine the upper timeframe momentum and the particular entry factors the place merchants can enter the market.

Classes Indicator

Classes indicator was developed to be able to help merchants in figuring out the open markets or buying and selling periods each time they commerce.

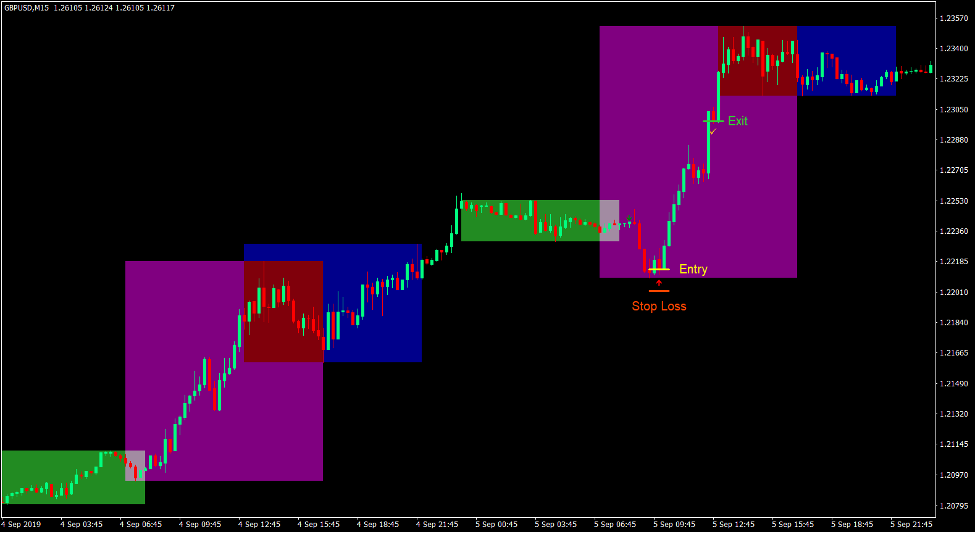

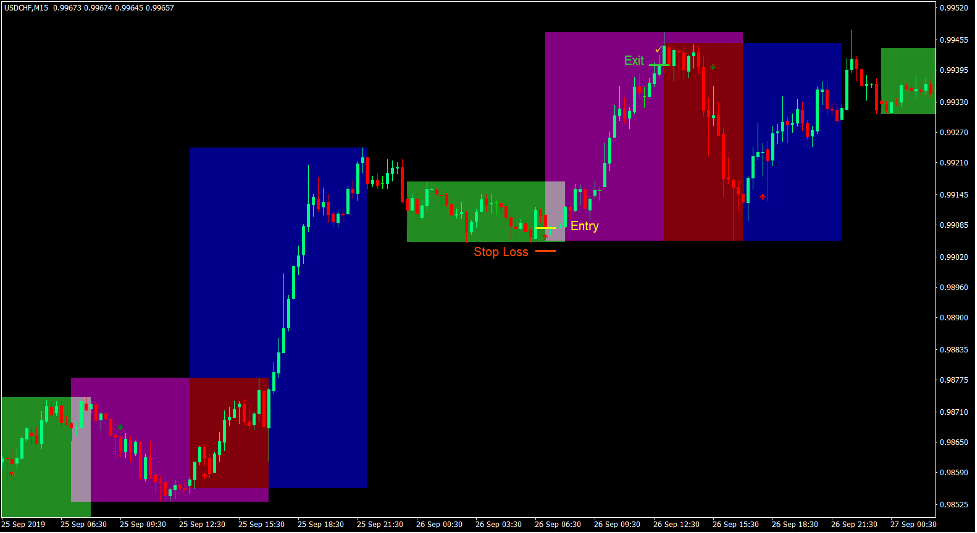

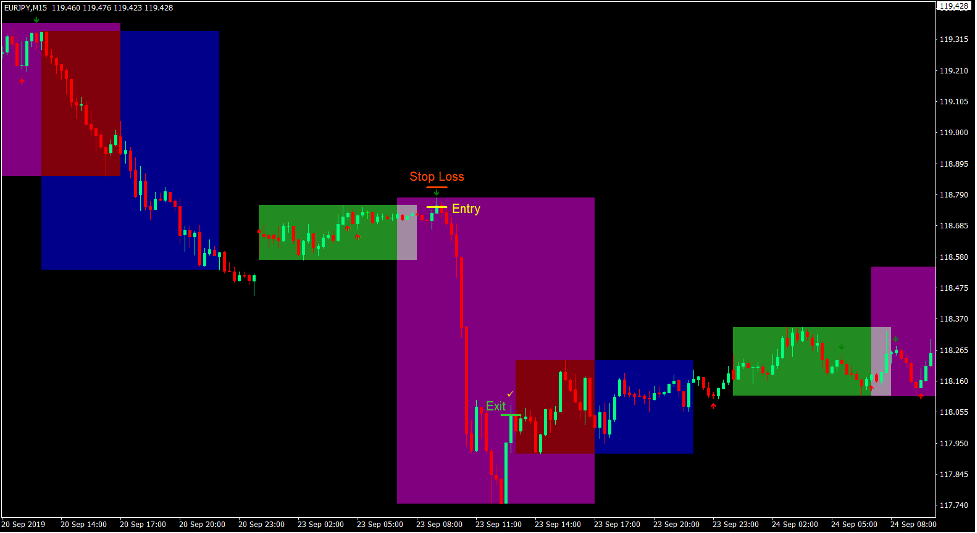

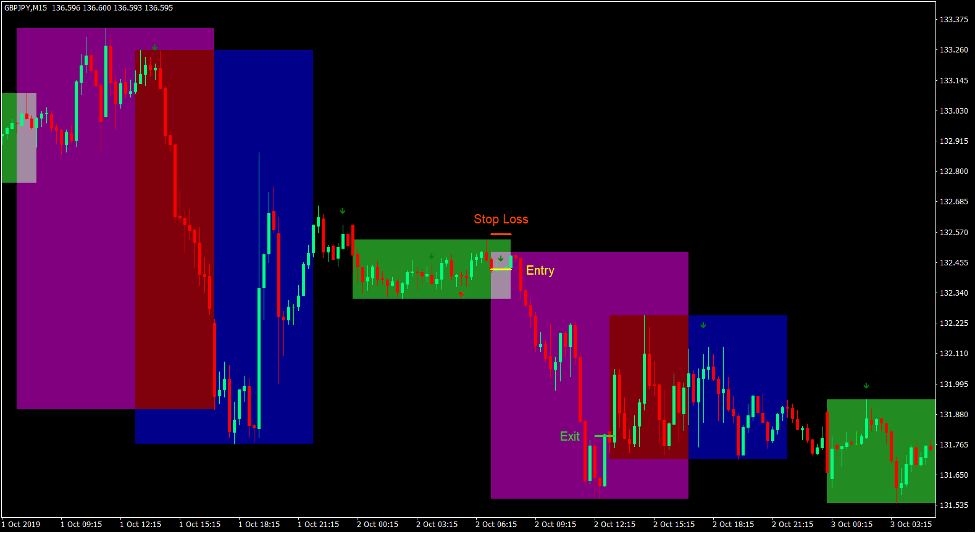

This indicator identifies and signifies the open markets by plotting packing containers with totally different colours to point the market session. The Asian session is shaded with coloration forest inexperienced. The European or London session is shaded with purple. The US session is shaded with blue.

Merchants might then use this data to assist them time when they need to commerce and when they need to cease buying and selling. Some merchants would favor to commerce solely through the London open. Others commerce solely when the London and US periods overlap. Others commerce solely through the Asian session. Others would keep away from buying and selling through the quiet Asian periods. It will depend upon what technique you might be utilizing and the logic behind the timing of the commerce.

3 MA Cross with Alert

3 MA Cross is a pattern following indicator which gives pattern reversal entry alerts based mostly on transferring common crossovers.

Transferring averages are one of the crucial broadly used technical indicators on the subject of pattern following and pattern reversal methods. Merchants largely use it to determine pattern path. Nonetheless, one other widespread method to make use of transferring averages is by utilizing the crossovers of transferring averages as a pattern reversal sign.

Crossovers of transferring averages point out {that a} sooner transferring common is crossing over a slower transferring common. Which means the short-term pattern or momentum is shifting or reversing inflicting it to cross over the longer-term pattern.

Some merchants use the crossover of two transferring averages, others use the crossover of value motion and a transferring common line, whereas others use the crossover of a number of transferring common strains.

3 MA Cross with Alert makes use of three modified transferring averages to assist merchants determine the best pattern reversal entry level. The indicator merely plots an arrow indicating the pattern reversal. Merchants might use these alerts to enter and exit trades.

Buying and selling Technique

This buying and selling technique is a momentum following technique which trades within the path of the pattern established through the prior day.

To determine the path of the momentum, we are going to take a look at the place the situation of the Asian session is in relation to the US session. If the Asian session is above the higher half of the US session of the prior day, then momentum is taken into account bullish. If it on the decrease half, then momentum is taken into account bearish.

Except for this, we might additionally contemplate the vary of the present Asian session. If the Asian session is contracted, we might assume that the market nonetheless has a powerful potential to realize momentum as soon as once more as London session opens.

If the factors above are met, we might then await a pattern reversal sign coming from the three MA Cross with Alert indicator to level the path of the momentum. This could happen through the early components of the London session. Trades are then closed earlier than the US open as there may be some information releases that may trigger the momentum to reverse.

Indicators:

- 3_MA_Cross_w_Alert_v2

- Classes

Most well-liked Time Frames: 15-minute chart solely

Foreign money Pairs: FX majors and minors

Buying and selling Classes: Tokyo, London and New York periods

Purchase Commerce Setup

Entry

- The Asian session field must be on the higher half of the US session field.

- The Asian session field ought to have a decent vary.

- The three MA Cross indicator ought to plot an arrow pointing up through the early levels of the London session.

- Enter a purchase order upon the affirmation of those circumstances.

Cease Loss

- Set the cease loss under the Asian and London field.

Exit

- Shut the commerce earlier than the beginning of the New York session.

Promote Commerce Setup

Entry

- The Asian session field must be on the decrease half of the US session field.

- The Asian session field ought to have a decent vary.

- The three MA Cross indicator ought to plot an arrow pointing down through the early levels of the London session.

- Enter a promote order upon the affirmation of those circumstances.

Cease Loss

- Set the cease loss above the Asian and London field.

Exit

- Shut the commerce earlier than the beginning of the New York session.

Conclusion

London breakout methods are a number of the hottest buying and selling methods.

It’s because London breakout methods have the potential to provide big returns whereas permitting merchants to danger a bit utilizing tight cease losses. It’s because the transition from the tight ranging Asian periods to the robust momentum breakout markets of the London periods permit merchants to position tight cease losses whereas permitting value to run in line with the power of the pattern.

Merchants who can logically determine pattern path, value motion and momentum can use this technique to take advantage of the sudden burst of momentum that happens through the London open.

Foreign exchange Buying and selling Methods Set up Directions

London Development Continuation Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past information and buying and selling alerts.

London Development Continuation Foreign exchange Buying and selling Technique gives a possibility to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional value motion and modify this technique accordingly.

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

How one can set up London Development Continuation Foreign exchange Buying and selling Technique?

- Obtain London Development Continuation Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick London Development Continuation Foreign exchange Buying and selling Technique

- You will notice London Development Continuation Foreign exchange Buying and selling Technique is accessible in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: