Gone are the times when Center Jap nations was once far behind the remainder of the world with regards to technological developments, that can be relevant to on-line banking, cash switch, and eCommerce. In reality, most of those nations boast not solely the highest cost gateways within the Center East however throughout the globe. However earlier than we get to them, let’s focus on what a cost gateway is.

What’s a Fee Gateway?

To grasp what a cost gateway is and the way it works, consider a intermediary. Should you’ve ever needed to work with one in your line of occupation, you’d already be accustomed to a intermediary’s function. If not, they’re the middleman in a deal, course of, or work; in different phrases: a dealer.

On-line cost gateways are a digital cost resolution to a extra widespread gadget – POS terminals for in-store card funds. Though, the principal working of each is similar.

Taking from that, cost gateways are third-party firms that authorize transactions between prospects and retailers. In different phrases, they’re a software program mechanism that reads the cost information acquired from the client’s financial institution. Subsequent, it transfers the info to the service provider’s financial institution. Upon information validation and availability of funds, the cost gateway then sends the approval to the buying financial institution to maneuver the quantity to the service provider’s account. In case of inadequate funds, the cost gateway declines the cost proper there.

Surprisingly, all of this occurs inside seconds, due to know-how!

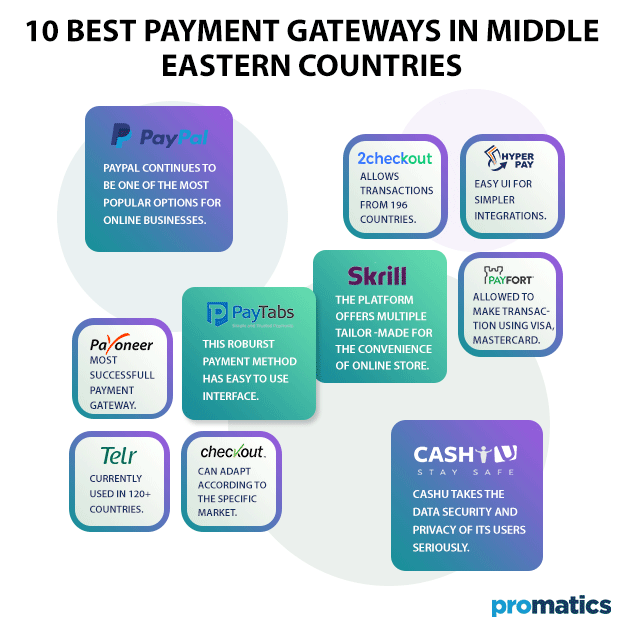

10 Finest Fee Gateways in Center Jap Nations

To remain forward within the race of a aggressive ecommerce market, it’s good to degree up with every development. Contemplating that prospects prioritize their cost particulars’ safety together with comfort like something, choosing the proper cost gateway is prime for any enterprise. In any other case, you’ll be able to wave goodbye to potential prospects. Satisfied that your online business is determined by realizing the perfect cost gateways within the Center East? We’ve bought you lined.

1. Paypal

Anybody coping with on-line transactions couldn’t have missed out on Paypal. One of many pioneers in on-line cost gateways, Paypal continues to be one of the crucial common choices for on-line companies.

Latest numbers counsel an escalating utilization of energetic customers within the Center Jap nations, multiple million! With that mentioned, the corporate does plan to develop its operations however is at the moment out there in Bahrain, Jordan, Kuwait, Oman, Qatar, and UAE.

The advantages of Paypal are limitless, to say the least. From signing up solely with an e-mail deal with to receiving funds in 25+ currencies to language choice. Moreover, the platform accepts all the main bank cards, together with Visa, Mastercard, Uncover, American Categorical, UnionPay, and many others. The corporate can be well-known for its superior safety measures. Let’s not neglect it’s quick cost programs, the place on the spot card funds or transfers take only some minutes.

So far as the charges go, Paypal expenses between 1.9 p.c to three.5 p.c of the quantity, relying on the Paypal product used, along with a hard and fast price from $0.05-0.45. The foreign money conversion price is at the moment 4.5% of the quantity.

2. Telr

Telr, or what you might need beforehand referred to as Modern Funds, has a number of nice digital advertising packages that not solely enhance your eCommerce enterprise mannequin but additionally bury your rivals. Telr is at the moment utilized in 120+ nations globally, and this truth alone ought to be sufficient to account for Telr’s competence and credibility.

However, gladly, Telr has much more in retailer to show why it deserves to be included on this listing. To begin with its options, Telr is supported on a number of eCommerce platforms, the likes of which embrace Woocommerce, Shopify, OpenCart, Magneto, and Prestashop. So far as out there cost choices are involved, prospects and purchasers can use Visa, Grasp Card, and American Categorical Playing cards. Telr additionally accommodates SADAD, or native Saudi banks, along with N.E.T. Banking.

Telr has 3 totally different choices for integration. Both Telr will host the transaction and redirect the client again to the web site after the completion of the cost. Or, it is going to use an iFrame technique by incorporating the checkout web site into the web site utilizing an iFrame. Lastly, it will probably incorporate the whole cost kind into the web site.

Telr is accessible in a number of Center Jap nations, together with UAE and Saudi Arabia. The three entry ranges of Telr, specifically Entry, Small, and Medium, are wonderful for SMEs, on-line companies, or small startups within the rising market.

3. PayTabs

Chances are high that when you utilize PayTabs on your on-line enterprise, you gained’t look again. From Saudi Arabia and UAE to Bahrain, Kuwait, and Qatar, PayTabs is regularly increasing its progress within the Center Jap nations.

This strong cost gateway is already miles forward of its rivals by way of state-of-the-art safety layers to guard retailers and prospects. If that’s not all, Visa and Mastercard have licensed their safety administration. On prime of that, the corporate has additionally gained a number of rewards, together with “greatest fintech firms within the Center East.”

For starters, its easy-to-use interface already provides a +1 to its tabs. Apart from that, the platform presents an integration field that enables enterprise homeowners to customise their shops utilizing plugins. Plus, you may as well get cost options catered to numerous industries. They’ve acquired quite a few constructive opinions for his or her responsive customer support, together with specialists absolutely skilled in dealing with disputes.

PayTabs has not too long ago switched to month-to-month packages. So if you happen to’re bored with calculating prices for every transaction by way of a cost gateway, that is your greatest guess. For transactions as much as $2000/month, the corporate presents a start-up plan for $49.99/month. Companies with extra gross sales can go for the expansion plan priced at 2.85% and $0.27 per transaction.

4. CashU

Say whats up to the primary and the most important on-line cost resolution firm within the Center East AND North Africa! These working on-line shops from UAE, Jordan, Saudi Arabia, Oman, Bahrain, or Qatar would by no means should face on-line cost troubles once more when CashU is at your service.

CashU takes the info safety and privateness of its customers severely. Should you’re not one to fall for statements, their agile fraud prevention programs present ample proof. They go so far as assured transactions in order that their 2.3 million customers don’t should danger every part in one other on-line fraud.

On the intense aspect, that’s not all there’s to the listing of advantages CashU presents. The platform comes with the characteristic of enabling prospects to deposit funds of their CashU account and make funds to partnered retailers throughout the MENA area.

CashU works on an annual pricing system. After the preliminary setup price, $1,000, and safety deposit, $10,000, you’ll solely be charged as soon as each twelve months between $1,000-3,000 relying in your gross sales. Don’t need to hold the cash in your CashU account? To not fear, the platform lets you switch funds to your native account with a minimal transaction price of two.9-3.3%.

5. HyperPay

Are you up for the duty of leveling with fast-growing companies within the business? If that’s the case, HyperPay could also be the perfect choice you make as a MENA-based on-line retailer.

The place some on-line cost gateways have a number of restrictions on transaction sorts, HyperPay has made it it’s enterprise to permit retailers to simply accept all transaction sorts whereas managing danger aspect by aspect. A bonus level is that their superior safety measures utilizing Synthetic Intelligence don’t fall quick in any case.

The platform additionally takes satisfaction in its straightforward UI for less complicated integrations. If you realize massive e-commerce platform names like WordPress, Oracle, and Magento, HyperPay presents integration with these and extra.

One other helpful characteristic most on-line shops search for, particularly people who take care of recurrent purchasers, is an invoicing characteristic. HyperPay goes all out to supply that for its enterprise customers, too, with out having to modify tabs.

The service provider expenses differ from nation to nation. To search out out extra about their service provider expenses, e-mail them at [email protected].

6. Skrill

To say that Skrill has taken over the world by storm could be an understatement. Initially referred to as the MoneyBrooker, the corporate has managed to develop into a number one cost gateway in 200 nations throughout the globe, together with UAE, Saudi Arabia, Bahrain, Qatar, Kuwait, Oman, and Jordan.

The platform presents a number of options tailored for the comfort of on-line shops. From fast transfers and seamless integration to a singular multi-currency account and superior analytics, Skrill hasn’t left a single clean spot.

This cost gateway is certainly giving its main rivals a run for his or her cash, particularly contemplating its low charges. If the no start-up price wasn’t the cherry on prime, the corporate solely expenses 0.9% on accepting funds from card transactions and 0.5% on speedy transfers. Their customer support is accessible 24/7 by way of telephone, e-mail, and dwell chat ought to you have got any queries or points. To prime all of it off, the corporate is FCA-regulated and PCI-compliant, that means that each one transactions are 100% protected always.

7. 2CheckOut

Numbers are one method to describe 2CheckOut. It’s the solely on-line cost gateway that enables on-line transactions from 196 nations, has 8 cost channels, makes use of 26 currencies, and operates in 15 totally different languages. The corporate went all out to put a stable basis, scale it up, and current it not solely to a couple chosen nations however to the whole globe.

2CheckOut boasts a number of options that make the corporate a notch above its rivals. For starters, it’s supported by all of the eCommerce platforms which can be out there, aside from only some. Furthermore, the corporate doesn’t require any setup expenses or month-to-month upkeep charges.

The corporate permits Visa, MasterCard, Financial institution Switch, American Categorical, PayPal, and Apple Pay. It both makes use of the API integration technique with PCI DSS compliance or the iFrame technique.

You need to use 2CheckOut in various nations, together with UAE, Saudi Arabia, Bahrain, Kuwait, Oman, Jordan, and Qatar.

8. Checkout

With regards to famend cost gateways, nothing is extra common at seamless transactions than Checkout. The corporate’s aim is to permit its purchasers’ companies to be moved quickly, and for that, it presents quite a lot of scalable and customizable options.

The corporate boasts a number of distinctive options that assist it rank among the many greatest cost gateways in Center Jap nations. Checkout’s app can adapt in keeping with the precise market. Consequently, prospects and purchasers can take pleasure in an distinctive expertise.

Checkout’s supported eCommerce platforms embrace Woocommerce, Magneto, Prestashop, and Shopify. The setup is straightforward and free, which makes it wonderful for younger entrepreneurs dwelling within the UAE.

9. PayFort

PayFort is Amazon’s cost processing firm that may be the cost gateway that you really want and wish, whether or not you might be planning on accepting funds, rising your organization, or searching for business insights that can assist you make higher, data-driven choices.

The corporate helps many eCommerce platforms, together with Woocommerce, Shopify, Magneto, C-S Cart, OpenCart, and Prestashop. Whereas utilizing PayFort, you can be allowed to make transactions and funds utilizing Apple Pay, Visa, and MasterCard. So far as PayFort’s integration is worried, the corporate makes use of One API-API integration along with plugins. You’ll be able to select from both of the 2 checkout strategies, together with the Service provider Web page or the Tokenization.

The platform is tailor-made completely to the developments within the Center Jap nations, which is why it has excelled in Saudi Arabia, UAE, Lebanon, Oman, Qatar, Kuwait, and Jordan.

10. Payoneer

Individuals who took up freelancing through the lockdown or earlier know rather a lot about Upwork and Fiverr. Nicely, the cash you earn from these web sites involves your Payoneer account after which to your private checking account. So, Payoneer is likely one of the most profitable cost gateway providers, not solely within the Center East however throughout the globe, for digital cost and worldwide or home cash transfers.

Payoneer has a number of benefits over different cost gateways. Firstly, all transfers made between Payoneer account holders are free. Moreover, the corporate presents an honest change fee which is healthier than what many of the rivals supply. Furthermore, the sign-up course of is just not that hectic and might be executed fairly simply.

For these causes, many voters of Center Jap nations like Saudi Arabia, UAE, Qatar, Lebanon, and Jordan contemplate Payoneer as the perfect cost gateway within the Center East.

Take-Residence Message

Just a few years again center japanese nations realized that web sites and apps are the brand new oil and have accelerated digital adoption. Now that you’ve got the perfect cost gateways within the Center East at your fingertips, it’s time to hop on the seamless transactions bandwagon. Whether or not you have been in quest of one on your newly launched ecommerce retailer otherwise you’re pondering of switching out of your earlier cost gateway, those listed above gained’t disappoint you. Be sure that to pick a cost gateway greatest suited on your necessities from the guidelines above, and also you’re good to go!