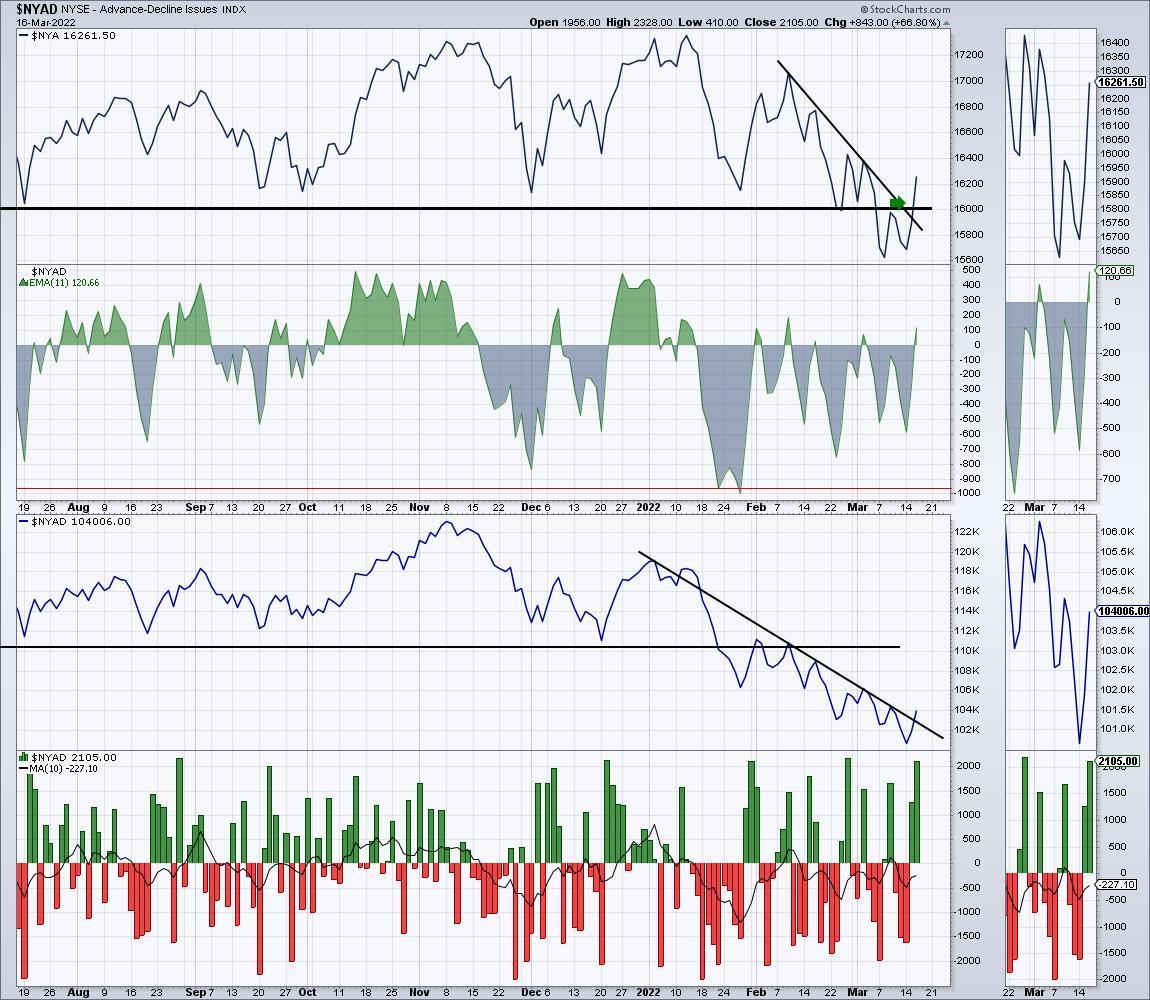

We’ve been on the lookout for a tradable low.

Just a few clues kicked off some curiosity right this moment. The NYSE composite advance/decline line lastly broke on the third panel. The worth of the $NYA broke above the horizontal resistance line and the downtrend line.

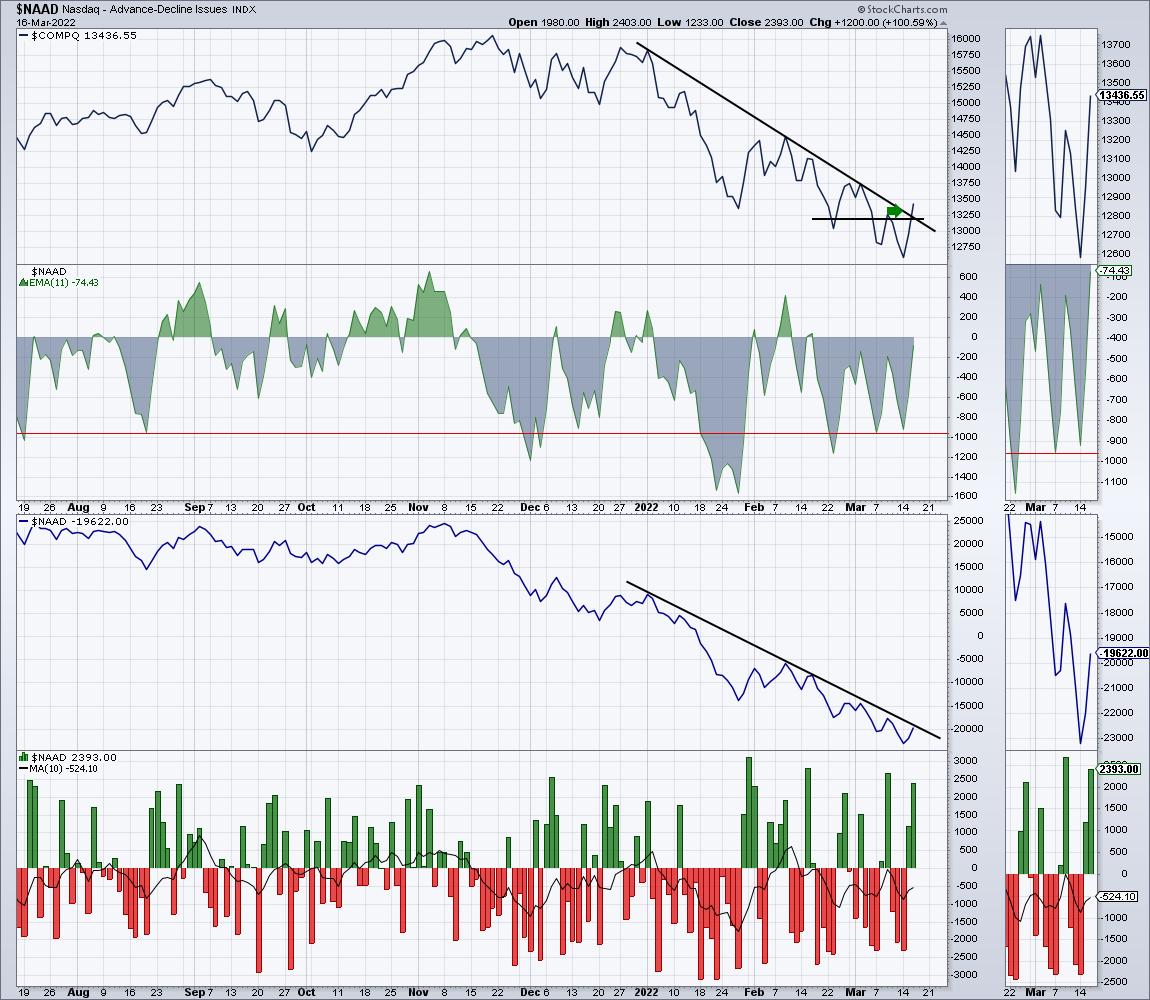

For the Nasdaq Composite, it isn’t fairly pretty much as good, as we now have not damaged the downtrend line on the third panel, however issues are enhancing. Value lastly broke the downtrend line!

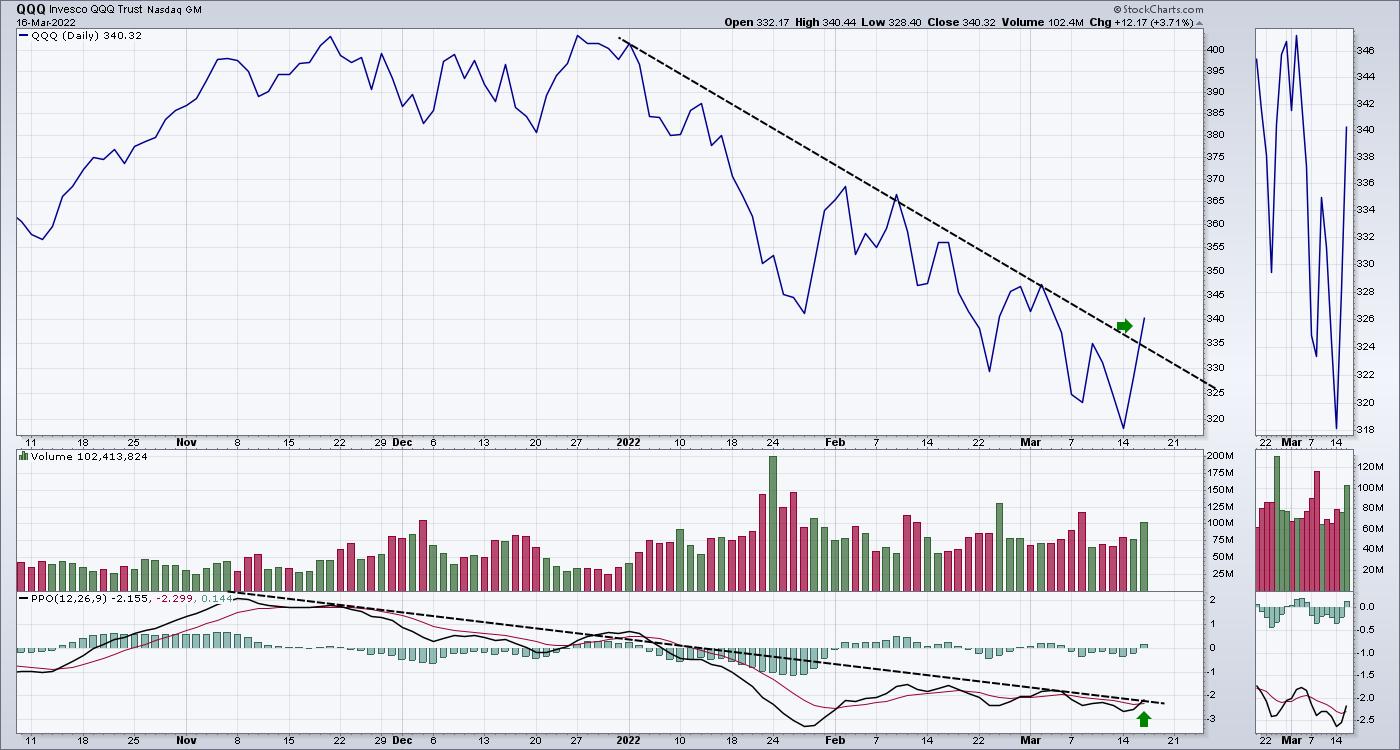

The SPY ETF broke the one-month downtrend line in addition to the horizontal resistance line on increased quantity, which is sweet to see. We nonetheless have a downtrend line overhead. I additionally just like the PPO lastly breaking the downtrend line, for the reason that $SPX topped in early January as properly.

The Nasdaq 100 wants a bit extra work, however it, too, is attempting to interrupt the downtrend line on worth pattern and the pattern in momentum on the PPO.

Some encouraging indicators, lastly!

Tons extra content material at OspreyStrategic.org. I at all times put up the updates of the power indexes on daily basis to maintain our members knowledgeable. You may check out the service for one month for under $7.

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Primarily based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an lively member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).