Merchants usually search for correct buying and selling methods. Merchants would simply be drawn to buying and selling methods that may declare “90% win charge” traded on any market situation. You’d see this marketed by “gurus” in Youtube. Nonetheless, though it’s not unimaginable to commerce with 90% accuracy, it might additionally entail having big losses at any time when such errant trades come alongside. It’s because many merchants who declare such excessive accuracy are likely to by no means shut a commerce till it’s in revenue. They’re prepared to threat big losses to realize only a bit.

As an alternative of being too caught up with these grand win charges posted on-line, many profitable retail merchants decide to suppose by way of possibilities. As an alternative of aiming for the 90% win charge or that good buying and selling technique that appears to do no mistaken, they’re prepared to just accept methods which have combine between an honest win charge and risk-reward ratio.

Buying and selling methods are likely to have totally different likelihood mixes relying on the kind of market situation being traded. Pattern reversal merchants are likely to have decrease win charges with greater risk-reward ratios. Imply reversal merchants are likely to have greater win charges with decrease risk-reward ratios. Pattern following merchants are likely to have combine between an honest win charge and an honest risk-reward ratio.

Kijun Tenkan Plus Foreign exchange Buying and selling Technique is a development following technique that gives combine between the 2 elements. It makes use of technical indicators that assist filter out commerce setups which are occurring on a non-trending market, in addition to present exact entry indicators based mostly on short-term momentum. It additionally makes use of value motion in addition to help and resistances to offer a greater grasp on what the market is doing.

Kijun Tenkan+

Kijun Tenkan+ indicator is a development following indicator based mostly on the Ichimoku Kinko Hyo or Ichimoku Cloud indicator. Ichimoku Kinko Hyo is an entire development following indicator which supplies info concerning the long-term, mid-term and short-term developments and momentum shifts. It additionally supplies info concerning the short-term value motion actions which ought to assist merchants keep away from errant trades.

Whereas the Ichimoku Kinko Hyo indicator supplies a extra full info, the Kijun Tenkan+ indicator supplies info concerning the mid-term development, which is the primary entry and exit triggers of the Ichimoku Kinko Hyo indicator.

Kijun Tenkan+ consists of two strains, that are the Kijun-sen and the Tenkan-sen.

Kijun-sen, also called the Base Line, is the longer-term line between the 2. It’s computed based mostly on the midpoint between the excessive and the low of the previous 26 durations.

Tenkan-sen, also called the Conversion Line, is the shorter-term line. It’s computed because the midpoint between the excessive and low of the final 9 durations.

Pattern path is predicated on how the 2 strains are stacked. Having the Tenkan-sen above the Kijun-sen signifies a bullish development bias, whereas having it inverse signifies a bearish development bias. Crossovers between the 2 strains point out a potential development reversal.

Octopus 1 Indicator

Octopus 1 is a development bias indicator. It’s a easy indicator developed to assist merchants determine the final development path and commerce in accordance with it.

The Octopus 1 indicator is an easy indicator which produces bars that change colours to point development path. Inexperienced bars point out a bullish development bias, whereas purple bars point out a bearish development bias.

This indicator is principally used as a development bias filter. Merchants might determine the path of the development utilizing this indicator and filter out trades that go in opposition to the path of the development.

It may be used as an entry and exit set off. Merchants might use the altering of the colour of the bars to point a potential development reversal. Merchants might then enter and exit trades utilizing this info.

Buying and selling Technique

This buying and selling technique is a development following technique that makes use of a shifting common, the Kijun Tenka+ indicator, the Octopus 1 indicator, and help and resistance strains to determine potential development following entries.

To determine the path of the development, we will likely be utilizing the Octopus 1 indicator and a 50-period Exponential Shifting Common (EMA). Pattern path will likely be based mostly on the placement of value in relation to the 50 EMA line, in addition to the slope of the 50 EMA line. Worth motion must also signify a trending market situation based mostly on its swing highs and swing lows. The Octopus 1 indicator would function a affirmation of the development based mostly on the colour of the bars.

As quickly as we determine development path, we might then search for potential commerce setups by plotting help and resistance strains the place value might breakout from if the development continues. We then watch for value to interrupt the development strains. Entries are then confirmed by the crossing over of the Kijun-sen and Tenkan-sen strains.

Indicators:

- 50 EMA

- KijunTenkan+

- Octopus_1

Most popular Time Frames: 15-minute, 30-minute and 1-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

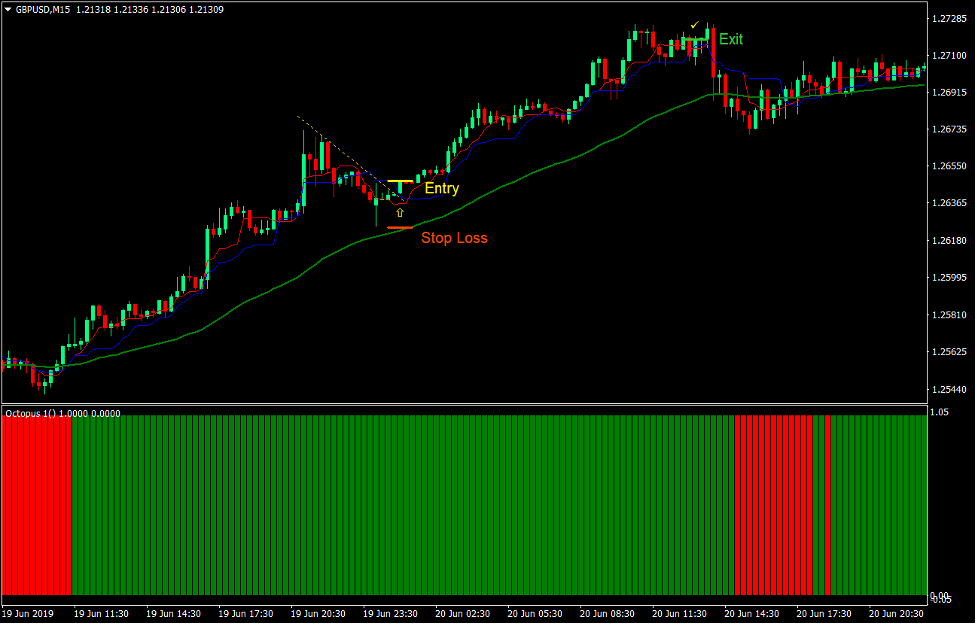

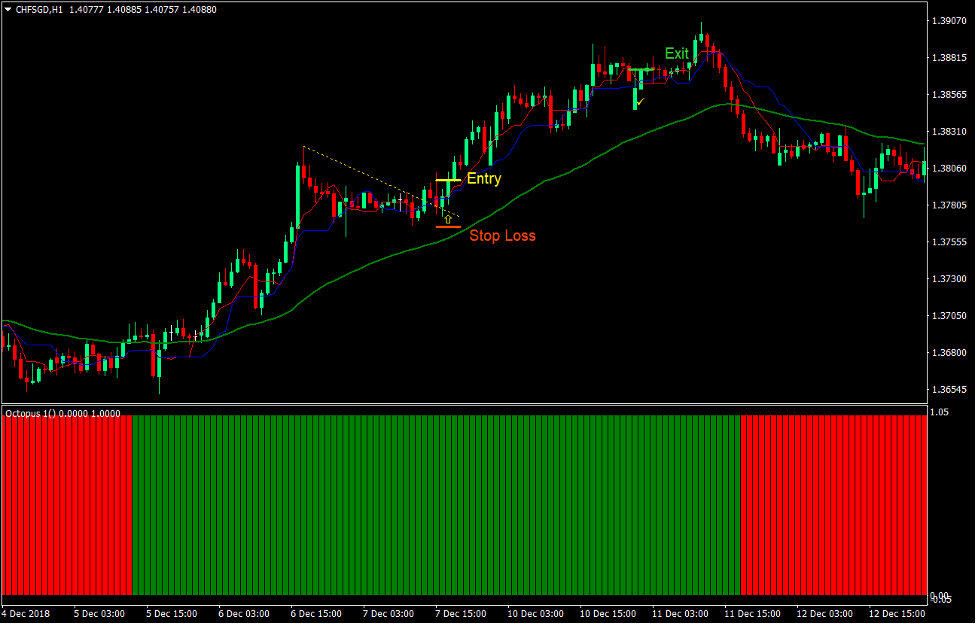

Purchase Commerce Setup

Entry

- Worth motion ought to be above the 50 EMA line.

- The 50 EMA line ought to be sloping up.

- Worth motion ought to be making greater swing highs and swing lows.

- The Octopus 1 bars ought to be inexperienced.

- A resistance line ought to be observable.

- Worth ought to break above the resistance line.

- The Tenkan-sen line ought to cross above the Kijun-sen line.

- Enter a purchase order on the affirmation of the circumstances above.

Cease Loss

- Set the cease loss on the swing low under the entry candle.

Exit

- Shut the commerce as quickly because the Tenkan-sen line crosses under the Kijun-sen line.

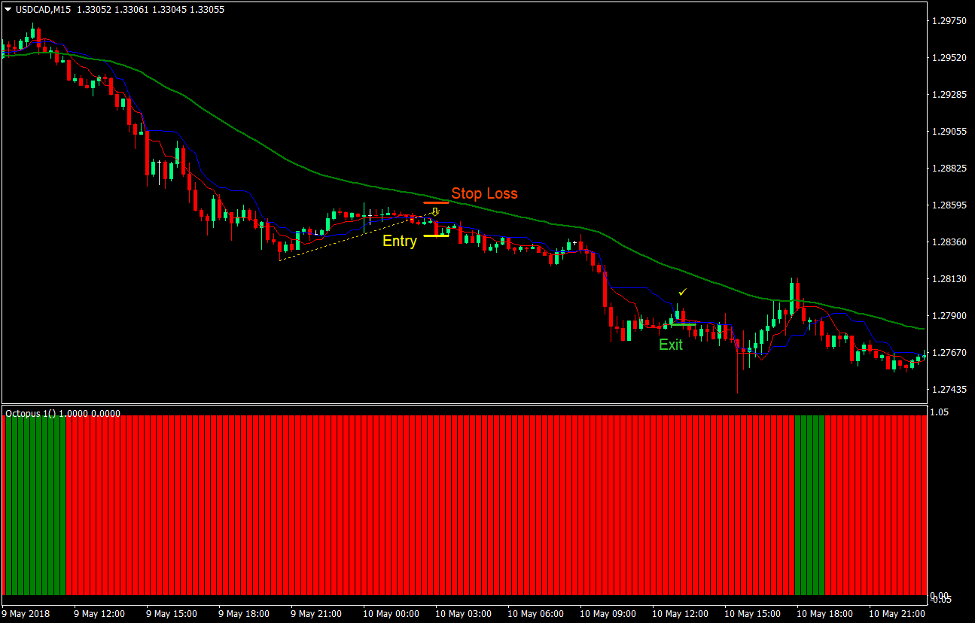

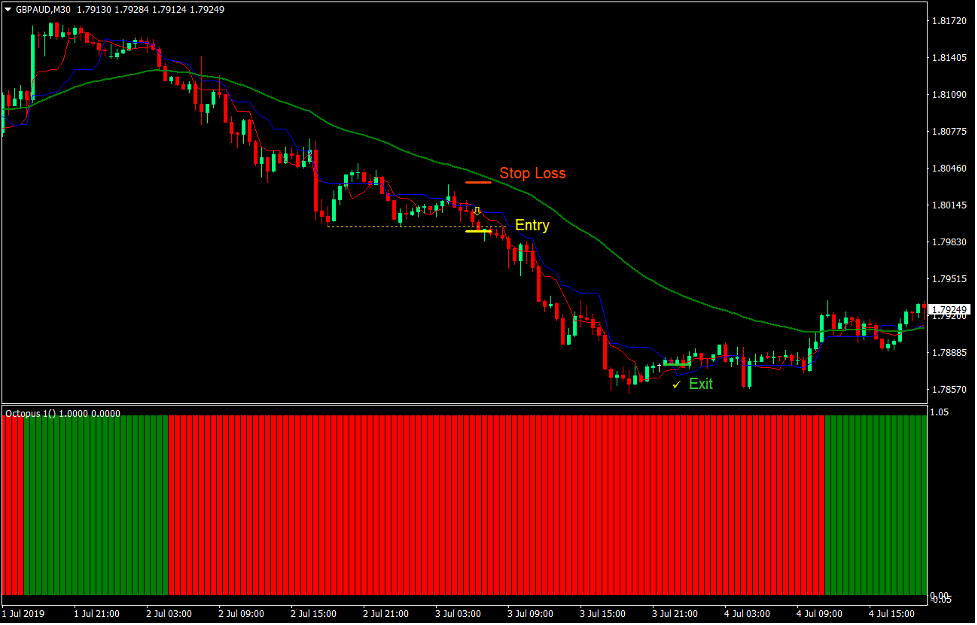

Promote Commerce Setup

Entry

- Worth motion ought to be under the 50 EMA line.

- The 50 EMA line ought to be sloping down.

- Worth motion ought to be making decrease swing highs and swing lows.

- The Octopus 1 bars ought to be purple.

- A help line ought to be observable.

- Worth ought to break under the help line.

- The Tenkan-sen line ought to cross under the Kijun-sen line.

- Enter a promote order on the affirmation of the circumstances above.

Cease Loss

- Set the cease loss on the swing excessive above the entry candle.

Exit

- Shut the commerce as quickly because the Tenkan-sen line crosses above the Kijun-sen line.

Conclusion

One of these development following technique is a broadly used buying and selling technique. It’s common to see merchants use the 50 EMA line as a foundation for development following methods buying and selling on retracements. It is usually widespread apply to make use of help and resistance line breakouts to set off trades.

Nonetheless, merchants would generally make the error of buying and selling on the mistaken help or resistance line or taking trades too early whereas the retracement shouldn’t be but accomplished.

Utilizing the Kijun Tenkan+ indicator permits us to filter out trades that haven’t but fully reversed. It’s because we might solely plot the help or resistance line when the Kijun Tenkan+ strains have quickly reversed.

Foreign exchange Buying and selling Methods Set up Directions

Kijun Tenkan Plus Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past information and buying and selling indicators.

Kijun Tenkan Plus Foreign exchange Buying and selling Technique supplies a possibility to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional value motion and regulate this technique accordingly.

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

How you can set up Kijun Tenkan Plus Foreign exchange Buying and selling Technique?

- Obtain Kijun Tenkan Plus Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Kijun Tenkan Plus Foreign exchange Buying and selling Technique

- You will notice Kijun Tenkan Plus Foreign exchange Buying and selling Technique is obtainable in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: