As the usage of plane like drones, electrical vertical take-off and touchdown automobiles and uncrewed aerial automobiles take off, Japanese startup Terra Drone needs to verify trafficking the skies doesn’t get neglected.

“Our airspace goes to get extra crowded than ever, however most corporations at this time are concentrating solely on {hardware} growth,” stated Terra Drone CEO and founder Toru Tokushige, who can be serving because the CEO of Terra Motors, which develops electrical automobiles. “There’s an pressing want for a world air visitors administration answer to allow protected and environment friendly drone and concrete air mobility (UAM) operations, and Terra Drone goals to be the main participant constructing the digital infrastructure within the sky.”

Based in 2016, Terra Drone develops drone software program, {hardware} and uncrewed plane system visitors administration options. The corporate stated Wednesday it has closed a $70 million (8 billion JPY) Sequence B spherical led by Mitsui Company. The most recent spherical, which brings its whole funding raised to $83 million, comes roughly a 12 months after elevating $14.4 million Sequence A in February 2021.

Different buyers SBI Funding, Tokyu Land Company, Kushu Electrical Energy, Seika Company, JOIN (Japan Abroad Infrastructure Funding Company for Transport & City Growth) and exiting investor Enterprise Lab Funding additionally joined within the spherical.

Teppei Seki, COO of Terra Drone, stated in an interview with TechCrunch that the corporate will use the Sequence B to extend its headcount and gas its international growth into Europe, the U.S. and Southeast Asia. The funds may even be used to amass corporations in these areas, stated Seki, who didn’t disclose the corporate’s valuation.

The agency acquired a Netherlands-based drone firm, Terra Inspectioneering, in 2018 and invested in Belgium’s drone firm Unifly in 2016.

Moreover, the startup says its proceeds can be used to help autonomous past visible line of sight know-how for drone and air taxi operations by means of its uncrewed plane system visitors administration options and strengthen the event of Terra’s UAM companies.

When requested about its subsequent plan after Sequence B, Seki advised TechCrunch that Terra Drone considers going public. The corporate additionally may increase one other funding earlier than its IPO, Seki added.

Terra Drone has about 500 clients together with oil and fuel corporations like Shell, Chevron, BP, ExxonMobil, ConocoPhillips, Vopak and Japan’s Inpex Company in addition to chemical corporations like BASF and Kansai Electrical Energy. Seki advised TechCrunch that the agency additionally gives its inspection companies to meals firm Bunge and survey companies to development corporations.

Notably, the oil and fuel trade, primarily specializing in rig inspection for security and higher efficiency, invests roughly $50.76 billion yearly to watch onshore and offshore pipelines, in response to a report by Fortune Enterprise Insights launched in February 2022. Terra Drones can determine defects like corrosion in constructions, coating failures, and another structural damages, Seki stated. The worldwide drone surveillance market is anticipated to develop to $476.5 million in 2028, from $142 million in 2021. The worldwide UAM market is projected to extend to $1.5 trillion by 2040, in response to Terra’s IR deck.

Terra Drone is engaged on tasks with numerous Japanese corporations and authorities similar to TEPCO, Japan Airways, KDDI, Japan’s main telco firm, Inpex, and Ministry of Land, Infrastructure and Transport. The startup has additionally been working with the Japan Aerospace Exploration Company (JAXA) to coordinate crewed and uncrewed plane flight administration.

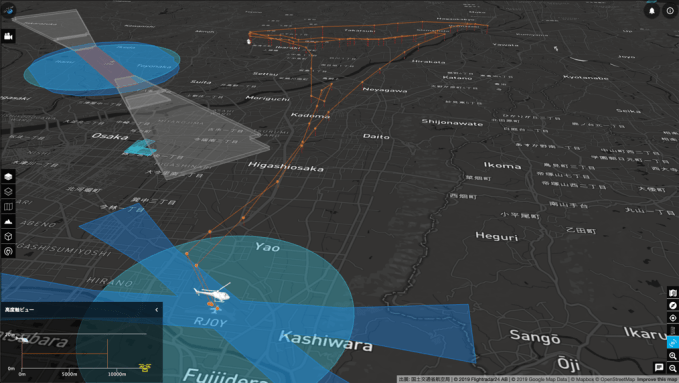

Terra Drone’s uncrewed visitors administration

Seki advised TechCrunch that the corporate’s key specialization and differentiator is its patented know-how that permits the drone to press the ultrasonic testing, or ultrasonic thickness probe, in opposition to a floor with out the scaffold to measure the thickness of partitions.

“A deal with rising recurring income by means of the sale of survey-grade {hardware} and software program similar to Terra LiDAR (mild detection and ranging) and Terra LiDAR Cloud, offering specialised companies similar to ultrasonic thickness (UT) measurements and non-destructive testing (NDT) utilizing drones by means of our [subsidiary] Terra Inspectioneering; and a strategic consolidation of abroad enterprise has made us well-positioned for achievement,” Tokushige stated. “We will scale up operations and innovation sooner.”

Terra Drone competes with international drone corporations, together with UK’s Sky-Futures, CyberHawk and Malaysia’s Aerodyne. AirMap and France-based YellowScan, a developer of UAV lidar programs for drones, are additionally its rivals, Seki talked about.

Terra Drone has 60 workers, whereas its subsidiaries have about 500 workers throughout the globe.