I preserve saying issues like “the social gathering is over” and that the correction has some time to go and that “we’re within the midst of a bear market” and that these toddler or two day rallies are actually only a good time to “unload some ache” and nothing extra.

However individuals don’t wish to hear this. There are huge losses on the market from the highest in a number of the hottest progress shares. The concept it’s not carried out but is a troublesome idea to swallow. 70% of the Nasdaq is in a 20% drawdown or worse. 20% of the Nasdaq has been greater than minimize in half. And each week it will get worse not higher. Individuals wish to hear Purchase the Dip. Life was a lot less complicated when that was a clockwork proposition. Now the dips have dips. It’s not working in any respect. It’s truly making issues worse for lots of parents. A inventory that will get minimize in half can get minimize in half once more after which once more. It’s so painful.

And that is what bear markets have to supply, in spades. One disappointment after one other.

So now what?

That is going to sound overly simplistic however I promise it’s the one clever factor to be stated on the matter: The bear market will finish when shares cease taking place.

I warned you it was going to be considerably unsatisfying.

It’s not terribly useful, but it surely’s extra helpful for you than anybody’s forecast. It’s a must to belief me on this – I do know the individuals making the forecasts. All of them.

We don’t predict bear markets. We handle cash as if they’re a traditional a part of investing, occur throughout each decade and differ in size, breadth and depth relying on what they’re being brought on by. And whereas we don’t try to anticipate them, we do handle a portion of our purchasers’ accounts tactically. That is mandatory for a lot of of our households as a result of we’re speaking about individuals’s life financial savings on the road. The older you get, the extra unlikely it’s which you can rebuild a profession or proceed to greenback value common by way of these moments that, for youthful people, can be characterised as main shopping for alternatives.

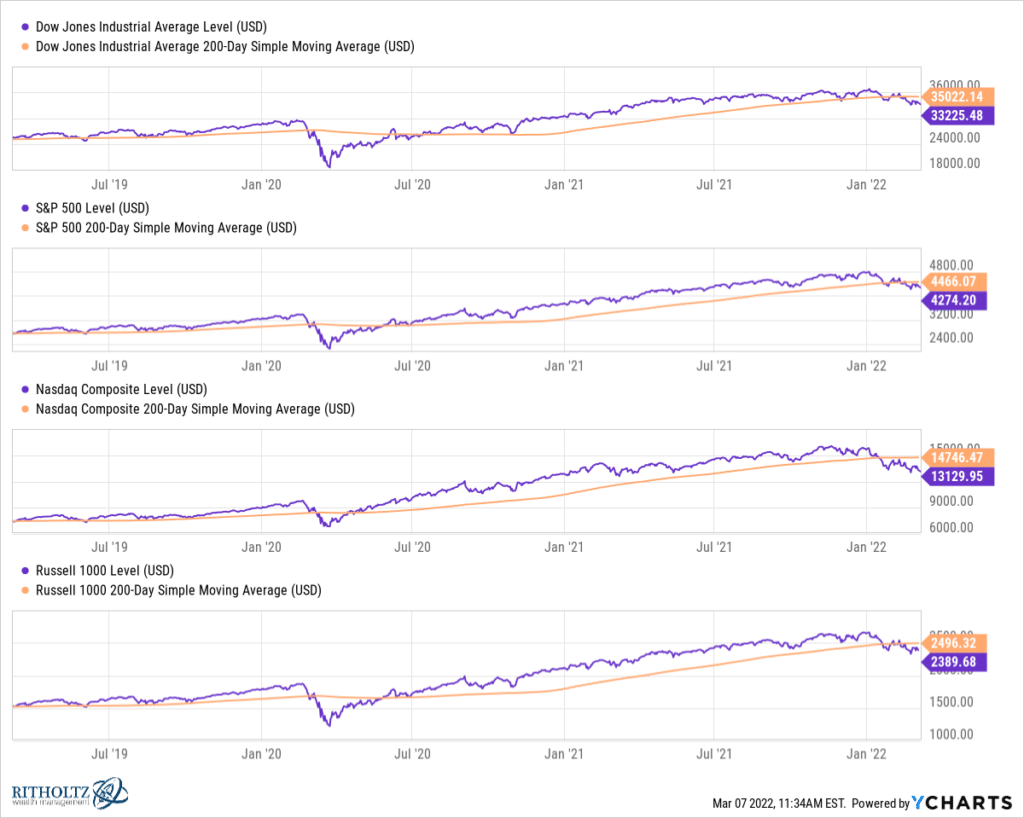

The present bear market will, in time, be seen as a type of main alternatives for many who continued to put money into the face of all the assorted fears presently occupying the headlines. However that’s sooner or later. Proper now, it could not really feel that manner in any respect. It appears like this, a downtrend step by step sapping the investor class’s enthusiasm away, drip by drip:

In some methods, that is a lot worse than a crash. It’s a bandaid being slowly pulled off with all types of false hope alongside the best way.

The index statistics haven’t but caught up with the fact of the internals – the market of shares appears to be like and feels manner worse than the inventory market. You possibly can thank Microsoft and Apple for that.

Don’t be fooled by a technicality. That is the actual factor.