Rallies and selloffs will be so loopy throughout unstable intervals, and 2022 positively qualifies as unstable. The Volatility Index ($VIX) has now been elevated and above 20 each single day since January 18th. That is roughly 9 weeks. It comes after a 12 months wherein the VIX has bottomed within the 14-16 vary. The one time this century that we have seen the VIX rise off of lows beneath 15, earlier than then buying and selling for 9 steady weeks or extra above 20, was 2020, because the pandemic unfolded. In different phrases, all pandemics apart, that is new territory. There stays a TON of nervousness available in the market, which is why we MUST keep on guard for the chance of additional draw back motion.

I stay absolutely satisfied that we’re in a secular bull market and any weak spot that we see all through 2022 will dissipate; we’ll finally return to new all-time highs later this 12 months or in 2023. The timing of the all-time highs will likely be primarily based off of whether or not the underside is already in. If the February low sticks, then I believe we may see a brand new excessive in 2022 after a interval of consolidation. Nevertheless, if we have now one other leg decrease and we pierce that February low, then I would not anticipate to see a full restoration to new highs till 2023.

Submit-Pandemic Merchants are at It Once more

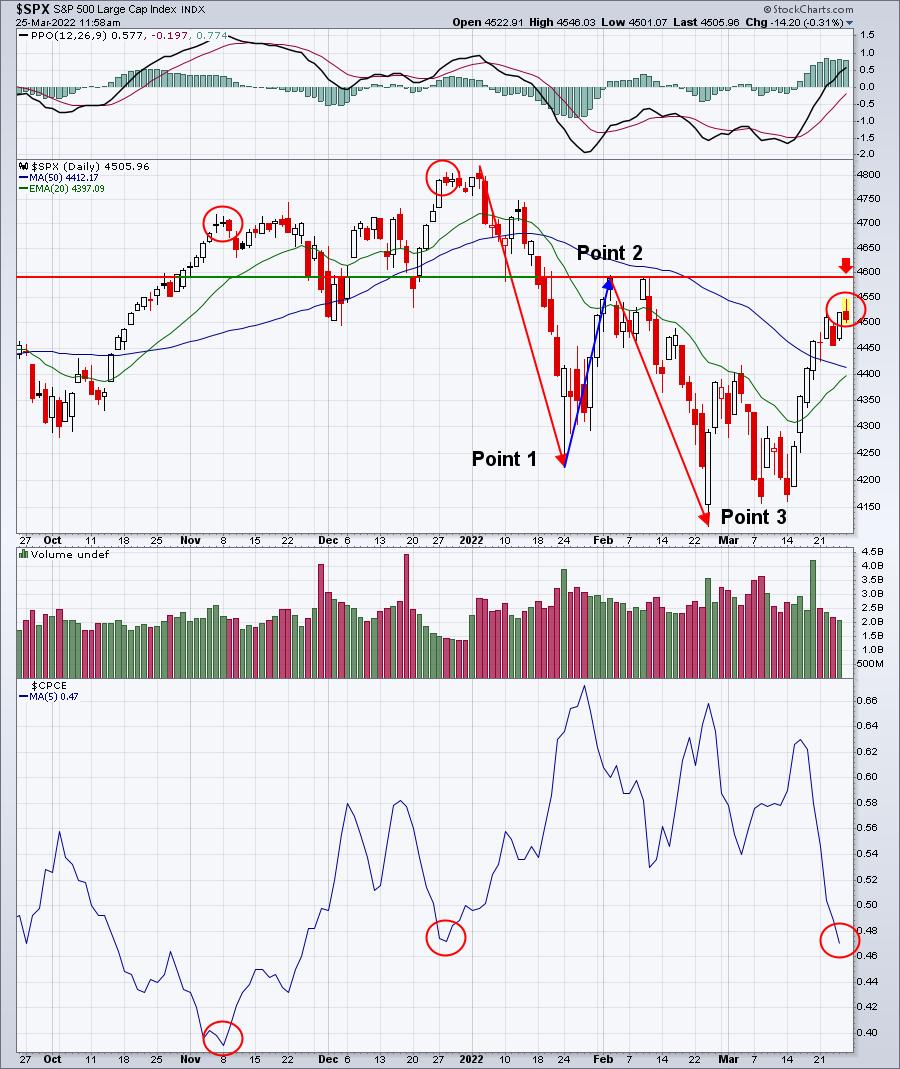

One massive drawback the inventory market faces is that many new traders can’t consider the inventory market may truly be in a bear market, cyclical or in any other case. Regardless of the nervousness displayed by the elevated VIX, merchants are pouring proper again into fairness calls throughout this rally. The truth is, the 5-day shifting common of the equity-only put name ratio ($CPCE) has reached its lowest stage of 2022, indicative of extreme bullishness. The 5-day shifting common has reached a stage the place key tops have fashioned up to now:

The crimson circles spotlight the current intervals of bullishness within the choices world. You possibly can see the outcome every time because the S&P 500 usually tops. Will it matter this time? Most likely, however we’ll see. The opposite key level on this chart is the present 2022 downtrend. A downtrend is nothing greater than a collection of decrease highs and lows. I’ve marked these above as Factors 1, 2 and three. The crimson arrow highlights the extent that should be cleared to probably reverse this downtrend by clearing Level 2. Till that occurs, we should stay on alert for an additional potential leg decrease in U.S. equities.

Beneath the Floor, Alerts are Weakening

Hear, nothing gives us any ensures. However Wall Avenue does ship us messages sometimes, which is able to inform us a narrative if we’re solely prepared to pay attention. I’ve an inventory of “sustainability ratios” that I like to observe to assist information me throughout rallies and declines. They seem within the panels beneath the QQQ value chart. Whereas the extra aggressive NASDAQ 100 (QQQ is the ETF that tracks this index) simply retains motoring larger, Wall Avenue is sending us a smoke sign. Take a look at this chart:

Whereas the QQQ has been trending larger the previous 5 days, a number of key ratios have placed on the brakes and even shifted to reverse. Once more, this is not a assure that the market will not go larger, however it definitely lets us know that Wall Avenue’s urge for food for threat has modified. All I can say is that rallies do not are inclined to final if Wall Avenue is not prepared to proceed taking dangers.

The one actual key space of remaining relative power this week belongs to the large-cap development names. They seem to have damaged their relative uptrend line, however I would not say they’ve fully damaged down at this level.

If we do high immediately, or earlier than the 4600 stage on the S&P 500 is cleared, then I believe we will see one other speedy decline within the days forward. How will that unfold? Properly, that is what I plan to debate in our free EB Digest e-newsletter on Monday. To register, merely present your title and electronic mail deal with HERE. There isn’t any bank card required and you could unsubscribe at any time. Additionally, we’ll preserve your privateness as we don’t present electronic mail addresses to any third celebration.

Pleased buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Each day Market Report (DMR), offering steering to EB.com members day by day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as properly, mixing a singular talent set to method the U.S. inventory market.