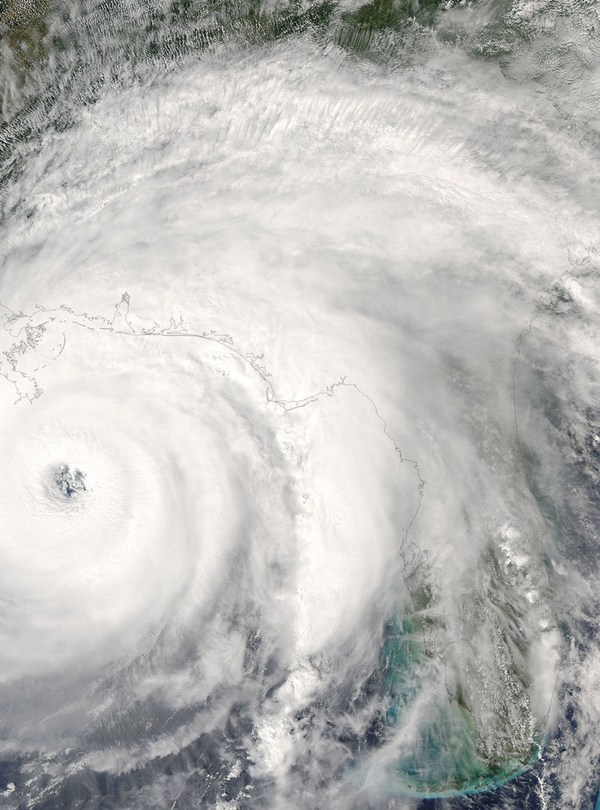

Hurricane Ian, which started on September 23, barreled via the state of Florida, North Carolina, and South Carolina leaving tens of millions with out energy and in a state of catastrophe. If you happen to have been impacted by Hurricane Ian we would like you to know TurboTax is right here for you, and we need to hold you updated with essential tax reduction data that will assist you on this time of want.

The Federal Emergency Administration Company (FEMA) declared the latest occasions as a catastrophe and the IRS introduced that victims of Hurricane Ian anyplace within the state of Florida and within the Carolinas have till February 15, 2023 to file numerous particular person and enterprise tax returns and make sure tax funds. At present tax reduction is on the market to all the state of Florida, North Carolina, and South Carolina. Taxpayers in sure Ian-impacted localities designated by FEMA will mechanically obtain the identical submitting and fee reduction. The present listing of eligible localities is on the market on the catastrophe reduction web page on IRS.gov.

What are the prolonged tax and fee deadlines for victims of Hurricane Ian ?

Florida

The tax reduction postpones numerous tax submitting and fee deadlines that occurred beginning on September 23, 2022. Because of this, affected people and companies could have till February 15, 2023 to file returns and pay any taxes that have been initially due throughout this era. These embrace:

- 2021 Particular person and Enterprise Returns with Legitimate Extensions: People that had a sound extension to file their 2021 return resulting from run out on October 17, 2022 will now have till February 15, 2023 to file. Companies with extensions even have till February 15, 2023 together with, amongst others, calendar-year firms whose 2021 extensions run out on October 17, 2022. The IRS famous that as a result of tax funds associated to 2021 returns have been due on April 18, 2022, these funds should not eligible for an extension.

- Tax 12 months 2022 4th Quarterly Estimated Tax Cost: Tax 12 months 2022 4th quarter estimated tax fee with a deadline of January 17, 2023 has been prolonged till February 15, 2023

- Quarterly Payroll and Excise Tax Returns: Quarterly payroll and excise tax returns which can be usually due on October 31, 2022 and January 31, 2023, are additionally prolonged till February 15, 2023. As well as, penalties on payroll and excise tax deposits due on or after September 23, 2022 and earlier than October 10, 2022 will likely be abated so long as the deposits have been made by October 10, 2022.

North Carolina and South Carolina

The tax reduction postpones numerous tax submitting and fee deadlines that occurred beginning on September 25, 2022 in South Carolina and September 28, 2022 in North Carolina. Because of this, affected people and companies could have till February 15, 2023 to file returns and pay any taxes that have been initially due throughout this era. These embrace:

- 2021 Particular person and Enterprise Returns with Legitimate Extensions: People that had a sound extension to file their 2021 return resulting from run out on October 17, 2022 will now have till February 15, 2023 to file. Companies with extensions even have till February 15, 2023 together with, amongst others, calendar-year firms whose 2021 extensions run out on October 17, 2022. The IRS famous that as a result of tax funds associated to 2021 returns have been due on April 18, 2022, these funds should not eligible for an extension.

- Tax 12 months 2022 4th Quarterly Estimated Tax Cost: Tax 12 months 2022 4th quarter estimated tax fee with a deadline of January 17, 2023 has been prolonged till February 15, 2023.

- Quarterly Payroll and Excise Tax Returns: Quarterly payroll and excise tax returns which can be usually due on October 31, 2022 and January 31, 2023, are additionally prolonged till February 15, 2023. As well as, in South Carolina, penalties on payroll and excise tax deposits due on or after September 25, 2022 and earlier than October 11, 2022 will likely be abated so long as the deposits have been made by October 11, 2022. In North Carolina, penalties on payroll and excise tax deposits due on or after September 28, 2022, and earlier than October 13, 2022, will likely be abated so long as the deposits are made by October 13, 2022.

What do I must do to say the tax extension?

The IRS mechanically offers submitting and penalty reduction to any taxpayer with an IRS deal with of report situated within the catastrophe space. Taxpayers don’t must contact the IRS to get this reduction. Nevertheless, if an affected taxpayer receives a late submitting or late fee penalty discover from the IRS that has an unique or prolonged submitting, fee or deposit due date falling inside the postponement interval, the taxpayer ought to name the quantity on the discover to have the penalty abated.

The present listing of eligible localities is at all times accessible on the catastrophe reduction web page on IRS.gov.

Do surrounding areas outdoors of Florida, North Carolina, and South Carolina qualify for an extension?

The IRS will work with any taxpayer who lives outdoors the catastrophe space however whose information essential to fulfill a deadline occurring through the postponement interval are situated within the affected space. Taxpayers qualifying for reduction who reside outdoors the catastrophe space must contact the IRS at 866-562-5227. This additionally consists of employees, aiding the reduction actions, who’re affiliated with a acknowledged authorities or philanthropic group.

How can I declare a casualty and property loss on my taxes if impacted?

People or companies who suffered uninsured or unreimbursed disaster-related casualty losses can select to say them on both the tax return for the yr the loss occurred(on this case the 2022 tax return filed in 2023) or the loss will be deducted on the tax return for the prior yr. People may deduct private property losses that aren’t lined by insurance coverage or different reimbursements.

Make sure to write the next FEMA declaration quantity on any return claiming a loss:

- DR-4673-FL for Florida

- DR-3585-EM-SC for South Carolina

- DR-3586-EM-NC for North Carolina

The tax reduction is a part of a coordinated federal response to the harm attributable to the cruel storms and is predicated on native harm assessments by FEMA. For data on catastrophe restoration, go to disasterassistance.gov.

In case you are not a sufferer, however you might be seeking to assist these in want, this can be a nice alternative to donate or volunteer your time to authentic 501(c)(3) not-for-profit charities who’re offering reduction efforts for storm victims.

Test again with the TurboTax weblog for extra updates on catastrophe reduction.