The IRS is sending two new kinds this yr. One to individuals who obtained the month-to-month advance Youngster Tax Credit score Funds and one to individuals who obtained a stimulus cost in 2021. If you happen to bought both of these, you’ll need these kinds to file – don’t throw them out!

Letter 6419, 2021 Advance Youngster Tax Credit score (CTC): If you happen to obtained month-to-month CTC funds this previous yr, you must obtain this letter from the IRS in January. If you happen to filed as married submitting collectively in your prior yr tax return, then each you and your partner will obtain a Letter 6419.

You want each letters when submitting your return as you’ll enter each quantities to be added to your tax return. This letter can have the overall quantity of advance Youngster Tax Credit score funds you obtained from July 2021 to December 2021, and you’ll need that quantity whenever you file your taxes. Why? The IRS will use this quantity to assist reconcile your advance Youngster Tax Credit score funds – mainly to ensure you bought the correct amount. If you happen to ought to have gotten greater CTC month-to-month funds, you’re going to get that extra cash as a part of your refund. If you happen to obtained an excessive amount of in CTC funds, you could owe that cash again at tax time.

Letter 6419

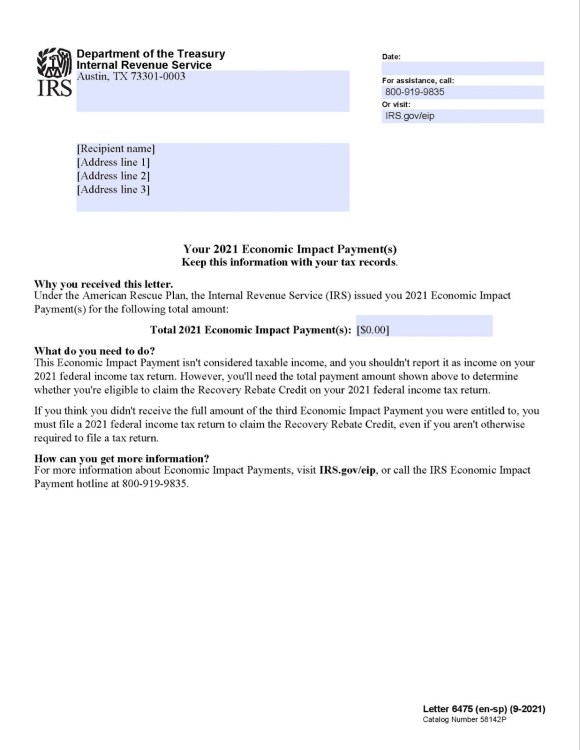

Letter 6475, Your Third Financial Influence Fee: This letter can have the overall quantity of your stimulus cost in 2021 (simply the third one, you obtained in 2021). If you happen to didn’t get the complete stimulus quantity you have been eligible for, then you definitely might be able to declare these {dollars} by means of the Restoration Rebate Credit score in your tax return. This letter has all the data it’s essential to report the correct quantity of the third stimulus you obtained and perceive in case you are eligible for added stimulus {dollars} and the way a lot. If you and your partner are submitting a married submitting joint return you’ll need so as to add the quantities from each your letters when finishing your tax return.

Don’t fear about understanding about these new letters and guidelines. TurboTax has particular steerage associated to those new provisions and can make it easier to simply report your advance Youngster Tax Credit score funds and your third stimulus cost you obtained, so you possibly can declare the extra credit you’re eligible for.

Letter 6475

Often Requested Questions (FAQs)

Q: My partner and I each bought a Letter 6475, how a lot do I enter when submitting my taxes?

A: The Letter 6475 confirms the overall quantity of the third stimulus examine (Financial Influence Fee) and any plus-up funds you obtained for tax yr 2021. If you happen to obtained joint funds along with your partner, the letters present the overall quantity of cost. If you happen to file married submitting a joint return you’ll need each letters when submitting your tax return as each quantities will have to be added collectively in your tax return. If you happen to file separate 2021 tax returns, every of it’s essential to enter your half of the cost quantity.

Q: I didn’t obtain my Letter 6475, is there another strategy to get this data?

A: If you happen to didn’t obtain your Letter 6475, you possibly can examine Your IRS On-line Account to securely entry your particular person IRS account data. The quantity of your third Financial Influence Fee is proven on the Tax Data tab/web page beneath the part “Financial Influence Fee Data”. If you happen to and your partner obtained joint funds, every of you’ll need to signal into your personal account to retrieve your separate quantities.

Q: My partner and I each bought a Letter 6419, how a lot do I enter when submitting my taxes?

A: Married filers, you each will obtain your personal IRS Letter 6419. If you’re married submitting a joint tax return, you’ll need each letters when submitting your tax return as each quantities will have to be added collectively in your tax return.

Q: I didn’t obtain my Letter 6419, is there another strategy to get this data?

A: If you happen to didn’t obtain your Letter 6419, you possibly can examine Your IRS On-line Account to securely entry your particular person IRS account data. In your IRS On-line Account it is possible for you to to get your advance Youngster Tax Credit score cost whole and variety of qualifying youngsters.

Associated

TurboTaxKat (24 Posts)

Katharina Reekmans is an Enrolled Agent and a contributor to the TurboTax Weblog staff. Katharina has years of expertise in tax preparation and illustration earlier than the IRS. Her passions encompass monetary literary and tax regulation interpretation. She has a powerful dedication to utilizing all sources and data to finest serve the curiosity of shoppers. Katharina has labored as a senior tax accountant, operations supervisor, and controller. Katharina prides herself on unraveling tax legal guidelines in order that the typical individual can perceive them.