Greetings fellow merchants!

On this article, I’ll attempt to cowl the subject of utilizing the iPump indicator in buying and selling.

The principle points that we are going to take into account:

1) Utilizing an oscillator

1.1 What values of the overbought / oversold index are vital and the way to decide them visually on the chart

1.2 How you can set an overbought/oversold alert

2) Resistance and help ranges

2.1 Classification of ranges

2.2 What ranges do I take advantage of in buying and selling, my expertise

3) Pattern panel

3.1 What TFs comply with the pattern indicator

3.2 Which era body is extra important for me to find out the pattern

I

Utilizing the oscillator

1.1 What values of the overbought / oversold index are vital and the way to decide them visually on the chart

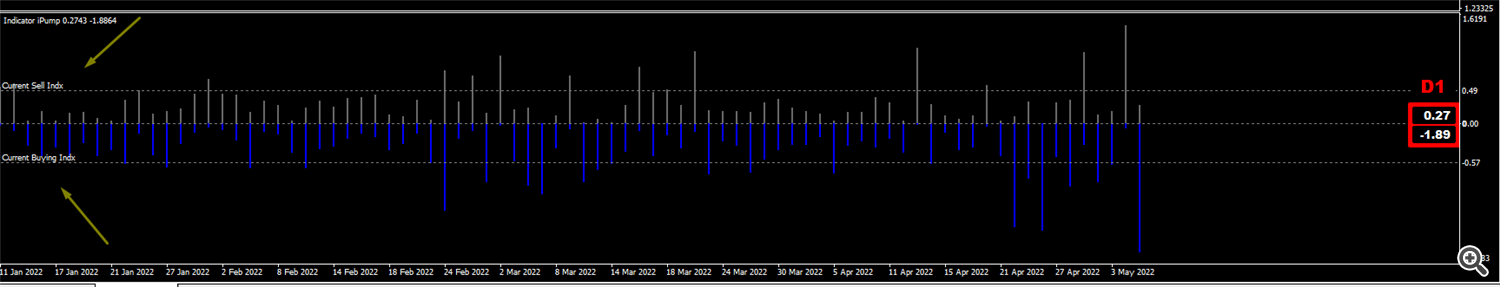

The upper the oscillator index, the higher. A excessive index signifies a powerful sign. We take 0 as the idea for Overbought, a zero worth signifies that the asset has the bottom overbought stage, respectively, the upper the index, the extra the asset is overbought.

With oversold, every thing is similar, solely the extra unfavourable the worth, the higher. We take 0 as the idea, 0 signifies that the asset has the bottom oversold stage, the additional the unfavourable worth, the stronger the sign.

What’s the that means of the indicator – for instance, you’re buying and selling EUR / USD and as you’ll be able to know, the pair is especially traded in a sure vary more often than not, that’s, it can both fall or rise, with the indicator you’ll be able to analyze the instrument that more often than not inside every day time-frame, EUR/USD falls 0.41% after which rises, and the pair additionally rises by 0.35% after which falls. Understanding these values, you’ll be able to perceive when it’s best to attempt to promote an asset, and when to purchase.

Essential! The technique is to work like this:

– for a downtrend ↓, we’re in search of property with a excessive overbought index and promote, following the pattern.

– for an uptrend ↑ we search for property with a excessive stage of oversold and make purchases with the pattern.

Common worth of the oscillator

To do that, level the Crosshair device on the oscillator itself and within the place the place the tails of the bars would be the most and would be the common worth. Accordingly, all values above the typical will probably be of most curiosity to us.

For the comfort of understanding how a lot the present instrument is oversold or overbought, a panel has been added to the indicator displaying the typical values of the oscillator for the chosen interval.

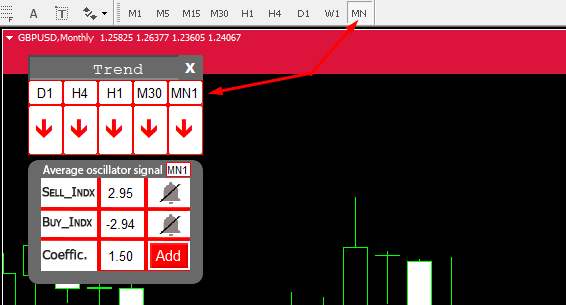

The panel calculates indicators for every TF. By clicking on the bell, you’ll obtain a notification when the present worth turns into greater than the typical, bearing in mind the set coefficient.

The Coefficient subject is used to multiply the typical by the coefficient, for instance, the typical overbought worth for EURUSD for the every day TF is 0.27 (progress / fall by 0.27% ), if we use a coefficient of 1.5, for instance, then we’re 0.27 * 1.5 = 0 ,41, that’s, a coefficient that will probably be 1.5 instances greater than the typical worth, respectively, this would be the most favorable sign for promoting, after all, you could additionally take into consideration the pattern and ranges.

Probably the most optimum coefficients are 1.5 and a couple of.

Common worth knowledge can be displayed within the oscillator window, strains are drawn mechanically.

II

Resistance and help ranges

2.1 Classification of ranges

1. verified stage – the extent at which help/resistance has already been confirmed.

2. Turning stage – a reversal stage inside which a value reversal can happen.

3. weak stage – weekly stage

4. not examined stage – not a examined stage, which implies that this stage has not but been confirmed its significance as a value barrier.

2.2 What ranges do I take advantage of in buying and selling, my expertise

Probably the most important ranges for me, at which affirmation occurred, verified stage . Concerning the timeframe, probably the most related ranges for me are H 1, H 4, D 1.

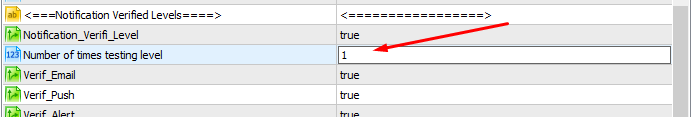

Within the indicator, you’ll be able to arrange a separate notification for verified ranges by the variety of retests. You possibly can set the retest values your self 1/2/3 and so forth. Additional.

III

Pattern panel

3.1 What TFs comply with the pattern indicator

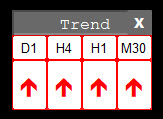

With the assistance of the pattern panel, you’ll be able to view the pattern on any TF, the letter L – exhibits the pattern on the native time-frame, which isn’t initially included.

In primary mode, you all the time see the path of the pattern on timeframes, D 1, H 4, H 1, M 30.

Rice. 6 iPump Trending

If you wish to see the pattern, for instance, on M 5 or MN , simply go to the specified TF and the path of the pattern will probably be displayed within the final cell of the pattern panel .

Rice. 7 Figuring out the native iPump pattern

3.2 Which era body is extra important for me to find out the pattern

From my buying and selling expertise, I can say that probably the most important time frames from my standpoint are D 1 / H 4.

Probably the most favorable state of affairs happens after we see a unidirectional pattern on most timeframes.

Used automated translation utilizing Google translate authentic article in russian language ( there could also be inaccuracies within the translation, for those who write within the feedback, I’ll right it)

I ask you to specific all incomprehensibility within the feedback, then this text will probably be extra comprehensible and in depth.