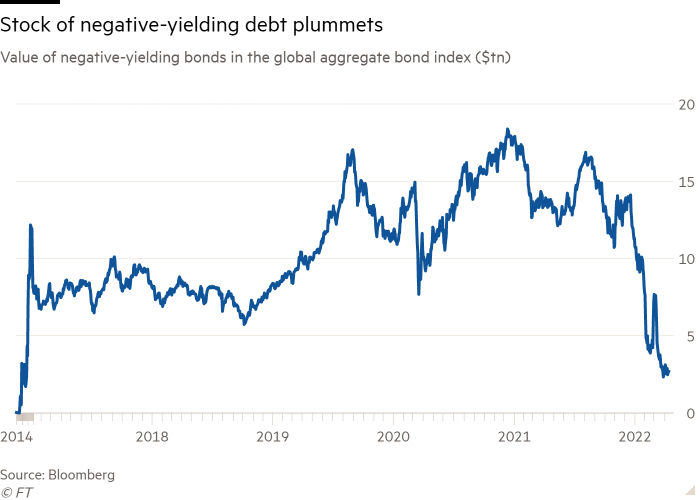

This yr’s hawkish change in tack from central banks is near ending the period of negative-yielding debt, shrinking the worldwide tally of bonds with sub-zero yields by $11tn.

Bond costs have tumbled this yr as central banks transfer to finish large-scale asset purchases and lift rates of interest of their battle with hovering inflation, pushing yields in lots of huge economies to their highest ranges in years.

In consequence, bonds price $2.7tn presently commerce at a yield of lower than zero, the bottom determine since 2015, and a pointy plunge from greater than $14tn in mid-December, in accordance with the Bloomberg world mixture bond index — a broad gauge of the mounted revenue market. Wiping out destructive yields completely would mark a return to normality for a broad vary of massive buyers.

“Central banks are belatedly attempting to get forward of this inflation shock, so the bond market has abruptly priced in a giant shift in rates of interest,” stated Mike Riddell, a senior portfolio supervisor at Allianz International Buyers.

Damaging yields have been as soon as thought-about inconceivable, then as a novelty, and later as a longtime characteristic of world markets. They imply that costs for debt are so excessive, and curiosity funds so low, buyers are sure to lose cash in the event that they maintain their bonds to maturity. They mirror a perception that central banks would preserve rates of interest at all-time low and have turn out to be entrenched in giant portions of debt in Japan and the eurozone in recent times.

That evaluation has shifted dramatically in current months, notably within the euro space, the place the European Central Financial institution on Thursday reiterated plans to finish its bond-buying programme this yr, and merchants are betting that rates of interest will return to zero for the primary time since 2014 by December.

An finish to ultra-low or destructive yields is a “double-edged sword” for bond buyers, in accordance with Riddell. “On the one hand persons are nursing losses on the bonds they maintain. However the flipside is that constructive risk-free charges imply future returns arguably look higher.” He added that may be “excellent news” for buyers equivalent to pension funds that want to carry giant portions of secure property like authorities bonds but additionally must earn ample returns to fulfill future payouts.

The dwindling inventory of negative-yielding debt additionally displays excessive ranges of inflation, which has pushed buyers to demand better compensation for rising costs, in accordance with Salman Ahmed, world head of macro at Constancy Worldwide.

“Sure, nominal yields are transferring up however long-term buyers ought to actually care about actual returns. It’s what’s left after inflation that counts, and inflation could be very excessive proper now,” he stated.

The eurozone has been the large driver of the discount in debt buying and selling at sub-zero yields. In December, the forex bloc accounted for greater than $7tn of such bonds, together with all of Germany’s authorities bonds. That determine has declined to simply $400bn. Japan, the place the central financial institution has to date resisted the worldwide shift in the direction of tighter financial coverage, now accounts for greater than 80 per cent of the world’s negative-yielding bonds.

Damaging yields are more likely to multiply once more within the euro space, except the ECB delivers the rate of interest rises already priced in by markets. The central financial institution will battle to raise charges a lot from the present degree of minus 0.5 per cent given the menace to the area’s restoration posed by Russia’s invasion of Ukraine and the ensuing rise in vitality costs, Ahmed stated.

“I believe the ECB has missed the window to normalise coverage as a result of the expansion shock from Ukraine shall be rather more extreme in Europe,” he added. “In our view they aren’t getting again to zero this yr, and which means negative-yielding bonds should not about to vanish.”