Welcome to Ignition Lane’s Tech Wrap, the place they lower via the noise to carry you their favorite insights from the expertise and startup world.

Ignition Lane works with bold enterprise leaders to use the Startup Mindset to their expertise, product and commercialisation issues.

This wrap goes out free to subscribers on Saturdays. Don’t neglect you may catch Gavin Appel each fortnight on the Startup Each day present on Ausbiz Mondays at 2pm (due to Anzac Day he’s on this Tuesday). For those who miss it, you may make amends for the week’s reveals right here.

Right here’s their assessment of all the large information in tech.

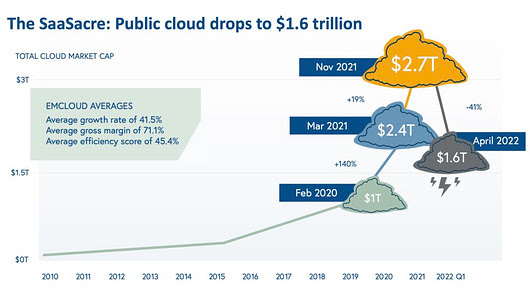

State of the Cloud: Don’t be petrified of the ‘SaaSacre’

Bessemer Enterprise Companions (BVP – a VC that has been investing in non-public cloud corporations for 20 years) launched its annual State of the Cloud report for 2022.

The gist? Regardless of the worth of publicly traded cloud corporations plummeting 40% or US$1.1tr within the 5 months to April, a.ok.a. the ‘SaaSacre,’ there’s loads of potential within the international cloud economic system.

Tendencies and alternatives on BVP’s radar:

To distinguish, startups are interested by oblique monetisation from day one, e.g. card issuing, banking, insurance coverage. Each firm will likely be a fintech.

Cloud software program is important in bettering international productiveness, e.g. provide chain points, The Nice Resignation and future of labor.

Cloud adoption is rising: Early adopters are transferring extra delicate knowledge to the cloud, e.g. safety logs; Deploying SaaS merchandise inside a buyer’s digital non-public cloud (VPC) is now a lot simpler; and Middleware platforms now carry the ability of the cloud to knowledge wherever, e.g. fintech infrastructure and legacy banking programs.

Cloud squared: Cloud marketplaces have gotten more and more important as a gross sales and fulfilment channel for enterprise software program.

Depend Centaurs (income), not Unicorns (valuation): Lastly, BVP units a brand new goalpost to measure distinctive SaaS corporations: the Centaur – a enterprise that reaches US$100 million of annual recurring income (ARR).

The unicorn-or-bust mentality has sadly pushed many startups and traders to give attention to valuation as their main purpose, as a substitute of constructing an awesome enterprise… monitoring Centaur development affords a extra correct pulse on the general well being of the cloud ecosystem.

Agreed. However for these of you simply beginning out (or not chasing VC cash), don’t let that focus on overwhelm you. $1m, $5m or $10m ARR is nothing to sneeze at.

All over the world (actually, simply the USA)

VCs doll out recommendation for a down market: Reevaluate your valuation (Andreessen Horowitz affords a technique), perceive your burn multiples, and construct state of affairs plans (Meritech recommends getting ready for a discount in development in addition to opex).

Maybe one of the best abstract of this VC recommendation (h/t Benedict Evans):

Associated: Andreessen Horowitz launched a brand new $600m fund for video games investments.

Has Tiger misplaced his stripes? The Monetary Occasions reported that Tiger World’s hedge fund has misplaced about US$17bn, which marks one of many largest greenback declines for a hedge fund in historical past. Eep. Tiger not too long ago bought its whole stake in public shopper tech corporations Bumble, Airbnb and Didi, and considerably lowered its publicity to Robinhood and Peloton. In the meantime Tiger continues to write down massive cheques in Australia in current weeks, investing in Stake’s $50m Sequence A high up, Shippit’s $65m Sequence B extension and Carma’s $75m Sequence A.

The way forward for streaming is… TV! Netflix subscribers fell for the primary time. Worse nonetheless, it expects to lose extra this quarter. Shares tanked, jobs and prices are being lower, and in an effort to extend income, Netflix is now exploring an advertisements mannequin and is getting strict on password-sharing.

Not-so-stablecoin. Algorithmic stablecoin TerraUSD (also referred to as UST) and the crypto token that backed it, LUNA, collapsed final week – dropping over US$40bn in worth mixed. UST was designed to be pegged to the US greenback, however was undercollateralised. So there was nothing propping up the worth aaand a demise spiral ensued.

Crypto bros yesterday vs. Crypto bros right this moment #welcomeaboard pic.twitter.com/w7gSUE1DJI

— Ryanair (@Ryanair) Might 13, 2022

The following Blockhead. Jack Dorsey, the Twitter cofounder and Block (Sq.) CEO, has modified his title to “Block Head and Chairperson.”

Native celebrations & commiserations

For those who want video, we additionally cowl this information in a vlog – Half 1, Half 2.

Xero’s billions. Xero reported a 29% enhance in income to NZ$1.1bn and a 28% soar in annualised month-to-month recurring income (AMRR) to NZ$1.2bn. Complete subscribers grew throughout all markets to three.3 million. Nonetheless EBITDA solely grew by 11% to $212.7m. The market wasn’t tremendous impressed – shares dropped 12% following launch of the outcomes.

Spoils within the supply wars. Lower than 12 months after it launched, 10-minute grocery supply service Ship has been positioned in voluntary administration. With 300 workers, 13 darkish grocery shops and bases, the Ship community lined 50+ suburbs throughout Sydney and Melbourne – all amounting to a pricey burn charge reported to be as much as $1.5m/month. One other two hour supply startup, Quicko, has additionally shut down operations. That leaves Tiger World-backed Milkrun in addition to Sequoia Capital-backed Voly nonetheless within the prompt grocery race. However will the unit economics ever stack up?

Uber goober. Uber agreed to a $26m tremendous for deceptive Australians. Beneath Uber’s insurance policies, you could have 5 minutes from the time a driver has accepted a experience to cancel it at no cost. However the app warned “chances are you’ll be charged a small price since your driver is already on their manner.” Tsk tsk. The ACCC can be taking Uber to court docket over its Uber Taxi experience possibility, saying it overinflated the estimated value.

Hurrah! You’ll be able to lastly afford* an $8 chai. Sq. built-in with Afterpay. That opens up Afterpay to an entire new world of smaller retailers, e.g. cafes. In the meantime strain to control BNPL continues to mount all over the world.

*we offer no assure you may really afford the repayments

Accelerating philanthropy. AirTree founding companion Daniel Petre is launching StartUpGiving – a “concierge service” to make it simple for founders and startup execs to donate their unrealised wealth. Philanthropy bigwigs Invoice Gates and Peter Singer (a well-known ethicist) will be a part of the advisory board.

VC information

- NZ-based VC World from Day 1 (GD1) launched the nation’s first devoted fund within the crypto, blockchain and web3 house – a $5m fund.

- Elaine Stead (former Blue Sky MD) is becoming a member of Alan Jones and Emily Wealthy as a basic companion at M8 Ventures. The crew are elevating a $5m pre-seed fund.

- Archangel Ventures is elevating a brand new pre-seed and seed fund, with $12m already dedicated.

Native M&A galore

Woolworths has proposed to accumulate 80% of homewares market MyDeal for $218m, which is $1.05/share or a 62.8% premium on yesterday’s closing worth. That’s a really engaging provide in right this moment’s surroundings.

Superior Navigation acquired Vai Photonics, which is in talks with NASA to make use of its navigation expertise on the subsequent moon touchdown.

myDNA acquired Batchelor star Sam Wooden’s on-line eating regimen and health program in $71m deal.

Airtasker plans to accumulate duties outsourcing competitor Oneflare in a $10m deal, topic to the ACCC’s tick of approval. That’s a large drop in worth – in 2016 Area Group bought a 35% share in Oneflare for $15m.

Australia’s “Airbnb of the alternate asset house” (parking, storage, warehousing) Spacer Applied sciences acquired Toronto-based parking market WhereiPark.

Accounting, enterprise & bookkeeping software program agency Reckon Accountants Group is being acquired by UK-based The Entry Group in a $100m deal. This would be the tenth AsiaPac acquisition for Entry within the final three years.

Restaurant ordering startup Mr Yum made its first main acquisition – advertising and marketing automation and occasions administration instrument MyGuestlist.

Sensible metering and vitality knowledge enterprise Intellihub acquired GreenSync. GreenSync’s DeX answer allows tradable vitality companies and expands the attain of current digital energy vegetation.

eCommerce reward and flower startup LVLY was acquired by Malaysian tech agency Limitless Know-how, for $35m.

In PE land: Accel-KKR acquired a majority stake in Humanforce (workforce administration) for $60m. IFM Traders acquired a majority stake in Render Networks (development administration).

I bid you all adieu

The brand new CNN+ streaming subscription service has been canned, only a month after launch.

Amazon shut down one of many oldest staples on the web, Alexa.com (not the voice assistant). Alexa supplied net site visitors evaluation however its hottest function was World Rank, which listed the most well-liked web sites all over the world primarily based on their site visitors stats.

21 years after the primary ever iPod was launched, Apple has discontinued the final remaining iPod mannequin. This was as soon as 40% of Apple’s income!

That’s a wrap! We hope you loved it.

Bex, Gavin and the crew at Ignition Lane