It’s simple to seek out an opinion on something and every part nowadays. Whereas listening to out the opposing views on the actual property market could be a good way to make knowledgeable selections on investments, the reality is that a few of these opinions might use some scrutiny.

As such, it’s necessary to offer some readability and extra perception concerning some generally held actual property market beliefs—particularly as they pertain to inflation. There are many myths surrounding how inflation will have an effect on actual property, and in the event you aren’t cautious about what inflation-related actual property opinions you purchase into, the fallacious opinions might drive the way you select to speculate.

That mentioned, these are difficult subjects with myriad elements at play. It’s powerful to foretell what precisely will occur as inflation impacts actual property, however what we are able to do is begin with what we all know to be right after which add in sound logic. By doing this, we might be able to draw conclusions which can be completely different from what you’ve been listening to about this material. Let’s begin by breaking down two frequent inflation-related myths.

Delusion #1: Inflation is sweet for actual property investments.

One frequent perception is that inflation is sweet for actual property investments, however at greatest we are able to name this one a half-truth. There are some circumstances wherein excessive, sustained inflation over a few years could be nice for actual property house owners. That mentioned, that is largely predicated in your debt construction.

In case you’ve received a long-term, fixed-rate mortgage, just like the loans that may be obtained by Fannie Mae on 1-4 household properties, or 30–40 yr time period HUD debt, you possibly can completely crush it during times of excessive inflation. That’s as a result of your cost stays mounted for the mortgage time period, which implies that your funds aren’t being straight impacted by inflation.

In flip, rents and bills go up, however your cost stays mounted, so a bigger portion of the money circulate goes into your pocket. The cash you do pay again to the financial institution, however, continues to lose worth over time.

However let’s take a deeper dive into what inflation is and the way markets will probably react to it.

Rates of interest and inflation

One of many extra elementary financial relationships is the connection between rates of interest and inflation. This relationship makes intuitive sense. Let’s say you had been going to lend somebody cash and the speed of inflation was 3% over the lifetime of the mortgage. On this case, you would wish to get an rate of interest of at the very least 3% simply to interrupt even when it comes to buying energy. However breaking even isn’t the purpose. On this scenario, you’d have to get the inflation charge plus a degree of actual return. In any other case, what’s the level of investing?

The chart above exhibits the CPI progress alongside the rate of interest on the 10-year treasury. It’s clear from this chart that rates of interest usually rise as inflation rises. Conversely, rates of interest usually fall as inflation nosedives.

Whereas it’s attainable that the Fed might maintain down the lengthy finish of the rate of interest curve, I wouldn’t wager on it. If we get actually non-transitory, long-term inflation, the course for rates of interest is more likely to development up.

Now let’s suppose by the implications of upper rates of interest. These of you who’ve a working actual property mannequin ought to pull it up and have a look at the final deal you bid on. Now increase the rate of interest within the mannequin by 2%.

What occurred to the returns? How a lot much less would you need to pay to get the identical returns as earlier than?

Now lengthen that idea to your complete market. Patrons merely can’t pay as we speak’s valuations if rates of interest go up considerably.

Let’s take that logic a step additional. If cap charges are up and rates of interest are up, what occurs to traders trying to refinance? Effectively, DSCR ratios are tougher to hit. Mortgage proceeds are restricted by LTV at greater cap charges.

Buyers that tackle excessive leverage could then discover they’re unable to refinance, bringing additional promoting stress into the markets on a relative foundation.

Length and inflation

Quite a lot of actual property of us don’t suppose a lot concerning the idea of length, and I don’t blame them. It’s boring funding portfolio concept stuff that’s often related to bonds, however each asset successfully has a length.

You may consider length because the period of time it takes to get your a reimbursement. It’s a bit extra difficult than that, however for our functions that’s how we’ll outline it as we speak.

So, for instance, a 30-year bond paying low curiosity goes to have a really lengthy length. A 30-day bond, however, goes to have a shorter length.

Why must you care? Inflation hurts lengthy length belongings a lot worse than brief length belongings.

If I personal a 30-day bond, whether or not or not inflation is excessive isn’t a difficulty as a result of I’m getting my a reimbursement in 30 days—and as such, it can nonetheless have most of its buying energy.

Then again, if I personal a 30-year bond, I’ve to attend a very long time for my money circulate to come back again to me. If inflation is excessive, the longer I watch for my return, the extra worth my future money circulate will lose.

If I count on very low inflation, I can purchase an extended length asset at a comparatively low return. But when inflation expectations rise, I can’t provide the identical worth for the asset. I have to get a lower cost and the next return as we speak to compensate me for the buying energy I’m shedding by ready years for my money circulate to come back again.

However how does this relate to actual property?

Effectively, the “length” on a typical actual property asset is so long as it has ever been. At a ten% cap, assuming no leverage and no value-add, you get your a reimbursement by money circulate in about 10 years. At a 4% cap, the length is 25 years.

Primarily based on what we learn about inflation and lengthy length belongings, what could be the probably impression on cap charges if the market believed excessive inflation was right here for the lengthy haul? I believe the bias could be towards greater cap charges and decrease actual property valuations.

So the subsequent time you learn or hear about why actual property investing is the most effective place to focus throughout excessive inflation, suppose again to the concepts above.

After rates of interest and cap charges have been adjusted to replicate the brand new regular, actual property can completely do extraordinarily effectively for the entire causes you’ve undoubtedly heard many instances over. However at as we speak’s valuations, traders can get into bother pondering actual property will save them from the inflation monster.

Delusion #2: Excessive inflation is right here to remain

See what I did there?

I don’t suppose inflation is a long-term challenge. I believe an excellent signal for the highest of accelerating inflation was J-Pow on the Fed “retiring” the phrase transitory. These guys are all the time behind the curve. By the center of 2022, uncomfortably excessive inflation will probably not be a part of the mainstream dialogue.

Right here’s the logic on this one: Not one of the long-term financial fundamentals have modified in favor of upper inflation. If something, the basics have gotten worse and are pointing towards weaker GDP progress and disinflation.

In fact, when the federal government borrows plenty of cash and provides it to anybody and everybody with a pulse, costs are going to go up. This was very true as provide chains had been put beneath pressure resulting from closures and security measures throughout the pandemic.

However what causes sustained inflation that lasts for a few years?

Effectively, you both have market contributors who’re shedding religion in a foreign money resulting from excessive deficits—which makes it appear unimaginable to repay what’s owed with out printing cash, or you will have strong financial demand that outpaces the flexibility to provide the products and providers demanded.

Let’s take them one after the other:

Cash printing received’t trigger inflation – at the very least not within the CPI

The greenback is robust relative to different currencies—and, imagine it or not, the U.S. is within the strongest place relative to simply about each main economic system on the earth.

When the Fed buys bonds and “prints” cash, what they’re truly doing is eradicating one authorities legal responsibility from circulation—a bond—and changing it with a 0-duration, 0% curiosity authorities legal responsibility, like a federal reserve be aware, financial institution deposit, or financial institution reserve, relying on who bought.

The pension funds, insurance coverage corporations, and overseas governments that bought the bonds aren’t going to expire and purchase Cheerios and dishwashers. They’re going to purchase one other safety to retailer their financial savings. This is the reason we’ve had huge will increase within the valuation of shares, bonds, actual property, and many others.—however very low progress within the CPI.

With out drastic modifications to QE or the Fed printing on to customers, the QE applications from the Fed are more likely to have the identical impression on CPI as they’ve had the previous decade—so, not a lot. The inflation will proceed to be seen in asset costs, which isn’t captured within the CPI.

The economic system is simply too weak for inflation

The final inflationary growth we had was within the Seventies. That was a interval of very low authorities debt and really robust demographics. Peak Boomer was born in 1953 and turned 18 in 1971.

The large wave of latest family formation and new households was the driving force of inflation at this level. If you’re younger and beginning a household, you’re considerably desensitized to cost fluctuations due to want. You may’t watch for costs to drop to purchase a home, dishwasher, diapers, or toothpaste. You purchase them—and borrow for them—since you want them proper now.

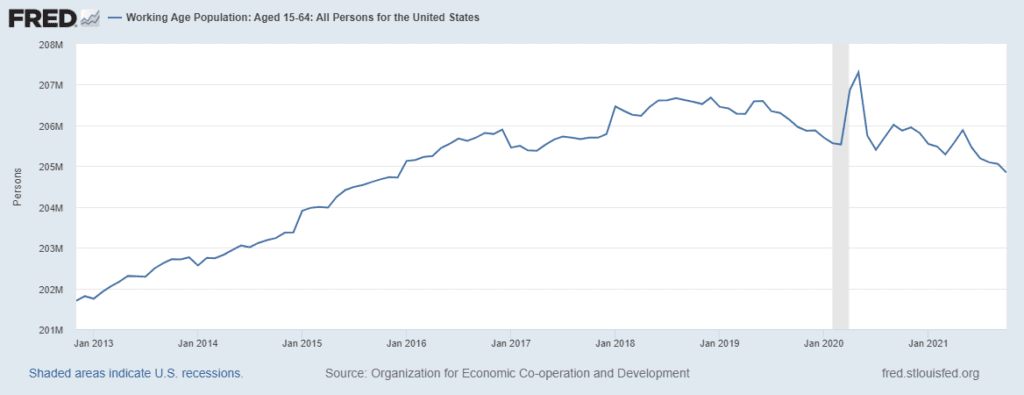

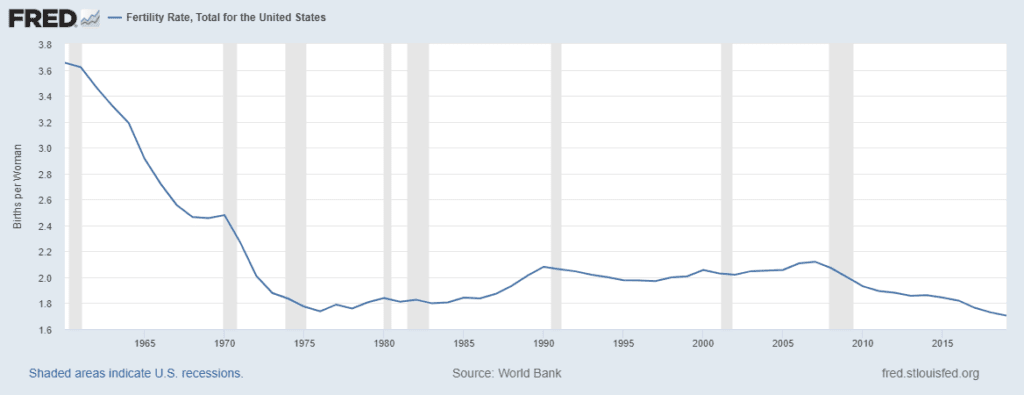

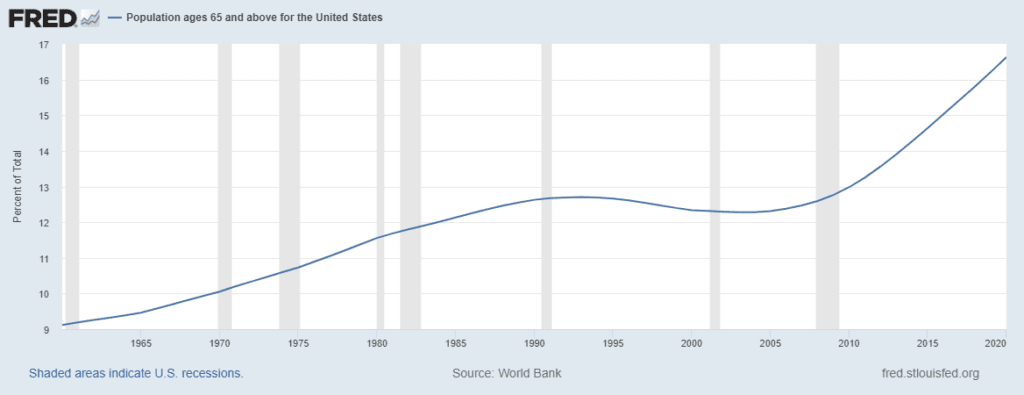

We’re at the moment dealing with the other scenario, nevertheless. An growing older inhabitants doesn’t spend aggressively, and beginning charges are extraordinarily low. The working age inhabitants has rolled over.

There’s additionally robust proof that prime authorities debt results in weaker financial progress, and we’ve received boat a great deal of that:

Fewer employees imply much less demand:

Future inhabitants progress just isn’t coming down the pipeline:

I like the era that got here earlier than me, however an rising share of the inhabitants being much less productive, coupled with web “takers” from the system, places the burden on a shrinking inhabitants base. They have to present for themselves, their households, and enter the tax {dollars} wanted to cowl the advantages for earlier generations.

This implies there may be much less revenue to spend as we speak.

At 122% of GDP, debt ranges are effectively above the 90% threshold, which tends to trigger considerably diminished financial progress.

Last ideas

Once we put all of this info collectively, we see that the more than likely long-term consequence—which will definitely have cyclical suits and begins in shorter time frames—is a slow-growing, much less productive economic system with low inflation and low rates of interest.

Whereas that appears like a bummer, and it’s in some ways, these are additionally actually respectable situations for actual property. With rates of interest remaining low, capital in search of a house, and actual property a secure, cash-flowing different to excessive danger and extra speculative investments, actual property can thrive in these situations. That’s barring a recession, anyway—which is actually on the desk.

As such, these hoping to see extra inflation to assist their actual property portfolios needs to be cautious what they want for.