Many merchants would like to take trades proper at the beginning of a contemporary pattern and exit proper on the finish of that pattern. It offers merchants essentially the most bang for his or her buck. Merchants who had been in a position to commerce proper originally of the pattern and exit on the finish are those who would have gained essentially the most revenue out of a given pattern.

Nonetheless, that is simpler stated than performed. It’s because it is rather tough to foretell tops and bottoms. Merchants can solely dream of being good at selecting tops and bottoms. Positive, we might guess the best determine typically, however we might by no means be as correct as we’d need.

As an alternative of aiming for the tops and bottoms, what merchants can do as a substitute is journey the pattern proper close to the start of the pattern. That is after the highest or the underside, after the pattern is confirmed to have reversed. This permits merchants to be extra correct with their pattern reversal setups.

Now, how can we affirm if a pattern has reversed? There are various methods to substantiate a pattern reversal. Some commerce primarily based on breakouts of an opposing assist or resistance. Others commerce on retests after the breakout.

Value motion merchants outline a pattern primarily based on the sample of the swing highs and swing lows. If the swing factors are rising, then the market is bullish. If the swing factors are dropping, then the market is bearish. Reversals are characterised by a shift within the sample, from a rising sample to a falling sample, or vice versa.

Huge Development Swing Foreign exchange Buying and selling Technique trades on pattern reversals which are confirmed by worth motion patterns. It makes use of a few indicators to assist merchants simply determine developments and potential pattern reversals, in addition to the short-term momentum of the market.

TSR Huge Development

TSR Huge Development, also called the Slope Path Line, is a customized pattern following indicator primarily based on a modified shifting common.

Transferring averages are extensively used to determine pattern path and pattern reversals. Many determine pattern primarily based on the final location of worth motion in relation to a shifting common line. Others base it on the slope of the road. Development reversals are sometimes recognized primarily based on the crossover of worth motion and a shifting common line or the crossover of two shifting common traces.

Though shifting averages are glorious pattern following instruments, most are both too lagging or too vulnerable to uneven market situations.

The TSR Huge Development indicator is a smoothened-out model of a shifting common line, which makes it much less vulnerable to uneven market situations. It’s also developed to scale back lag considerably making it reply to cost motion modifications a lot sooner.

The TSR Huge Development indicator can be utilized to determine developments and pattern reversals primarily based on the slope of the road, in addition to the situation of worth motion in relation to the road. The indicator additionally modifications shade relying on the path of the pattern. A light-weight blue TSR Huge Development line signifies a bullish pattern, whereas a tomato TSR Huge Development line signifies a bearish pattern.

Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator developed to assist merchants determine the path of the short-term pattern or momentum.

It plots two oscillator traces primarily based on the historic common worth actions. One line is quicker than the opposite. Development or momentum path relies on how the traces intersect. If the sooner line is above the slower line, then the pattern is bullish. If the sooner line is under the slower line, then the pattern is bearish.

The Stochastic Oscillator additionally has markers on degree 20 and 80. These markers point out the place the market shall be thought of oversold or overbought. Strains under 20 point out an oversold market, whereas traces above 80 point out an overbought market. Crossovers occurring on these ranges are likely to have the next likelihood of truly reversing.

Buying and selling Technique

This buying and selling technique is a pattern reversal technique primarily based on the crossover of the TSR Huge Development line and worth motion. Nonetheless, as a substitute of taking trades as quickly as worth crosses over the road, we shall be ready for worth motion to substantiate the pattern reversal.

After worth crosses over the TSR Huge Development line, we’ll look ahead to worth motion to both create the next low in a bullish pattern reversal or a decrease excessive in a bearish pattern reversal. This may affirm the pattern reversal primarily based on worth motion.

The Stochastic Oscillator traces could be used to substantiate the path of the short-term pattern or momentum. That is merely primarily based on how the 2 traces overlap.

Indicators:

- (T_S_R)-Huge Development

- Stochastic Oscillator

- %Ok Interval: 15

- %D Interval: 6

- Slowing: 6

Most well-liked Time Frames: 1-hour, 4-hour and day by day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York periods

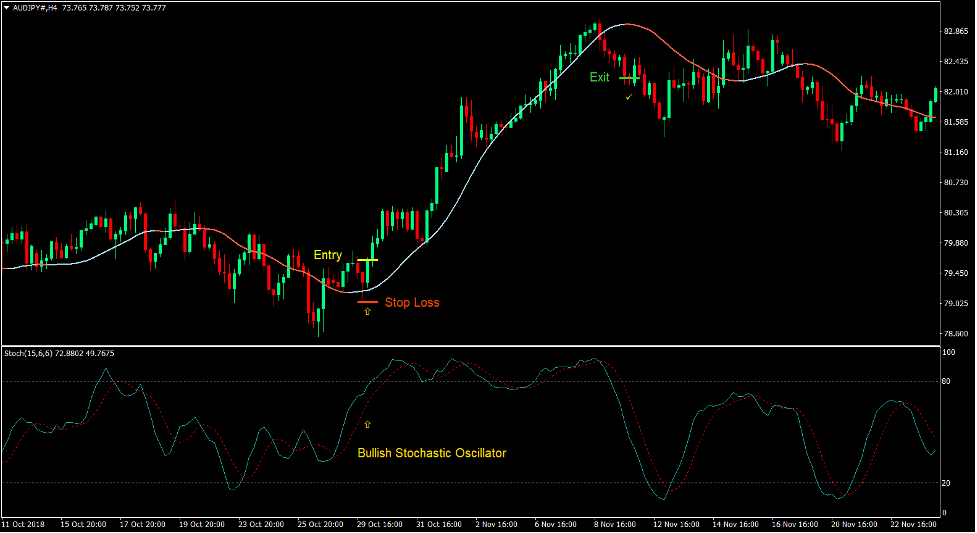

Purchase Commerce Setup

Entry

- Value motion ought to cross above the TSR Huge Development line.

- The TSR Huge Development line ought to change to mild blue.

- Value motion ought to create the next swing low.

- The sooner Stochastic Oscillator line needs to be above the slower line.

- Enter a purchase order upon the affirmation of the situations above.

Cease Loss

- Set the cease loss on the assist degree under the entry candle.

Exit

- Shut the commerce as quickly because the TSR Huge Development line modifications to tomato.

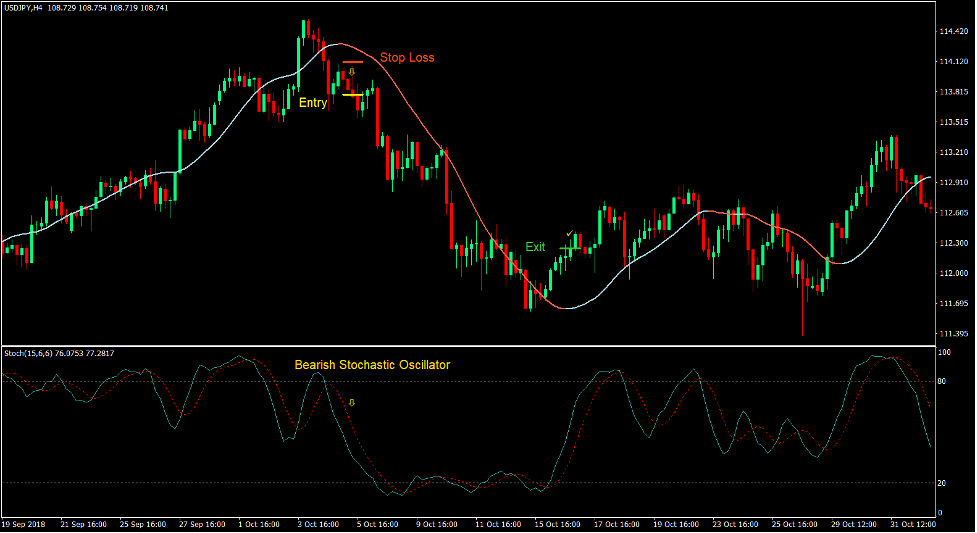

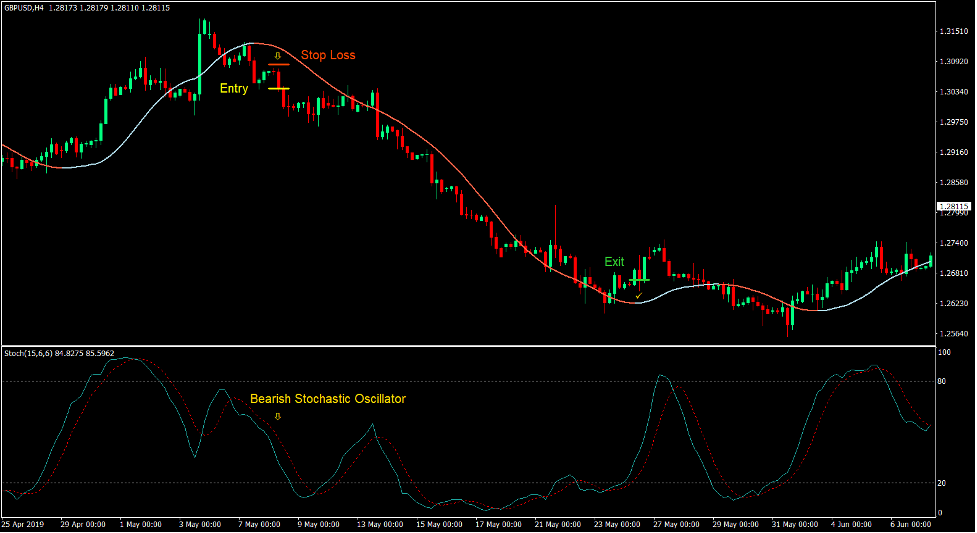

Promote Commerce Setup

Entry

- Value motion ought to cross under the TSR Huge Development line.

- The TSR Huge Development line ought to change to tomato.

- Value motion ought to create a decrease swing excessive.

- The sooner Stochastic Oscillator line needs to be under the slower line.

- Enter a promote order upon the affirmation of the situations above.

Cease Loss

- Set the cease loss on the resistance degree above the entry candle.

Exit

- Shut the commerce as quickly because the TSR Huge Development line modifications to mild blue.

Conclusion

Huge Development Swing Foreign exchange Buying and selling Technique works properly due to the truth that it incorporates the affirmation of worth motion with the standard shifting common and worth motion crossover.

The crossover of shifting averages or shifting common and worth motion is known as the Dying Cross for a motive. It’s a level of indecision. Value can reverse however it may possibly additionally bounce off the shifting common traces and proceed the pattern. Ready for worth motion itself to substantiate the pattern reversal considerably will increase the chance of the pattern reversal persevering with.

Merchants who can precisely determine the swing factors can use this technique to constantly revenue from the foreign exchange market.

Foreign exchange Buying and selling Methods Set up Directions

Huge Development Swing Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past information and buying and selling alerts.

Huge Development Swing Foreign exchange Buying and selling Technique offers a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and modify this technique accordingly.

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Tips on how to set up Huge Development Swing Foreign exchange Buying and selling Technique?

- Obtain Huge Development Swing Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Huge Development Swing Foreign exchange Buying and selling Technique

- You will note Huge Development Swing Foreign exchange Buying and selling Technique is out there in your Chart

*Observe: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: