A standard query I’m receiving by way of e mail and the Monday free DecisionPoint Buying and selling Rooms (register right here to be a component and/or obtain the recordings): “How will we all know it’s secure to broaden publicity or when seas aren’t so stormy?” On this week’s DecisionPoint show, Carl and I mentioned the indicators we’re going to be on the lookout for. The title of the video was “This Indicator Referred to as the 2020 Bear Market Low“. On this article, I’ll present you that indicator!

What is that this magical indicator? It is the New Highs/New Lows indicator.

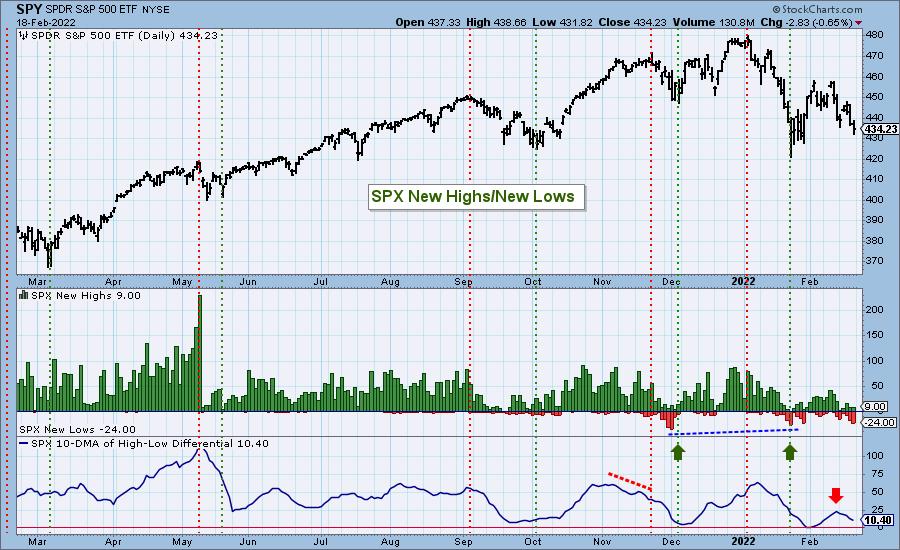

Under is the most recent NH/NL chart. Discover the optimistic divergence we had with New Lows contracting over time and value lows going decrease. We had been very inspired by this chart within the brief time period. However (there’s all the time a “however”)…

The NYSE New Highs/New Lows chart didn’t affirm with its personal optimistic divergence. In actual fact, it was clearly confirming that this is not over but.

However wait! There’s extra!

Click on right here to register prematurely for the recurring free DecisionPoint Buying and selling Room! Recordings can be found!

Take a look at these identical charts on the finish of the 2020 Bear Market. We steeply cheaper price bottoms, but New Lows had been contracting anyway. Increase! It was the top of the bear market.

We’re not completed but. Under, I’ve our main short-term and intermediate-term indicators, the Swenlin Buying and selling Oscillators (STOs) and ITBM/ITVM. The shorter-term STOs began confirming a doable backside arriving, nevertheless it was truly confirmed by the retreat of the ITBM/ITVM.

Carl and I are of the opinion we’re in a bear market. It might not be “official” with a 20% decline, however why wait to play protection? These indicators referred to as the top of bear market circumstances final time. There is no such thing as a assure they’ll this time, however not less than we all know what we’re on the lookout for. DP Alert subscribers would be the FIRST to know when the circumstances are ripening and it’s secure to dip our toes again in.

Good Luck & Good Buying and selling!

Erin Swenlin

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Useful DecisionPoint Hyperlinks:

DecisionPoint Alert Chart Record

DecisionPoint Golden Cross/Silver Cross Index Chart Record

DecisionPoint Sector Chart Record

Worth Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

DecisionPoint just isn’t a registered funding advisor. Funding and buying and selling selections are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a suggestion or solicitation to purchase or promote any safety or to take any particular motion.

Erin Swenlin is a co-founder of the DecisionPoint.com web site alongside together with her father, Carl Swenlin. She launched the DecisionPoint each day weblog in 2009 alongside Carl and now serves as a consulting technical analyst and weblog contributor at StockCharts.com. Erin is an lively Member of the CMT Affiliation. She holds a Grasp’s diploma in Data Useful resource Administration from the Air Drive Institute of Expertise in addition to a Bachelor’s diploma in Arithmetic from the College of Southern California.