As a enterprise proprietor, there are lots of paperwork it’s essential to hold monitor of in your firm. Worker paperwork, payments, invoices, and so on., are all important paperwork to retailer in your information. Maintaining information isn’t only a good enterprise observe, both. There are particular IRS recordkeeping necessities it’s essential to comply with. A kind of necessities is sustaining tax information. Find out how lengthy to maintain tax returns for your corporation.

How lengthy to maintain tax returns

Chances are you’ll understand how lengthy it’s essential to hold your private tax information. However, IRS recordkeeping necessities for people are totally different than the principles for companies. In actual fact, the IRS recordkeeping necessities for companies are usually longer than the period of time for particular person tax information.

So, how lengthy do it’s essential to hold tax returns for your corporation? In keeping with the IRS, there are totally different quantities of time for recordkeeping for tax functions. How lengthy to maintain tax information can rely upon what it’s essential to hold them for. Publication 583, Beginning a Enterprise and Maintaining Data, particulars how lengthy it’s best to hold totally different information.

Interval of limitations

There’s a interval of limitations for tax recordkeeping. What’s a interval of limitations? It’s the interval by which a enterprise can amend its returns to assert credit or refunds or by which the IRS can assess extra tax.

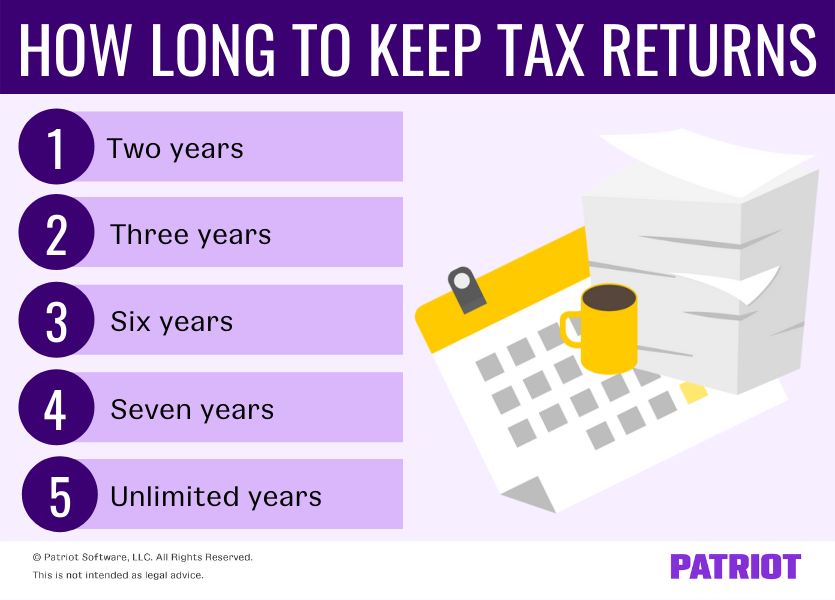

In keeping with Publication 583, your submitting state of affairs determines how lengthy it’s essential to hold your tax information. Relying in your tax state of affairs, chances are you’ll have to hold your information for the next variety of years:

- Two

- Three

- Six

- Seven

- Limitless

Publication 583 explains that these are the interval of limitations for preserving tax information for particular causes. Check out the interval of limitations for every state of affairs.

Two years of tax recordkeeping

Maintaining tax information for 2 years applies to companies that file a declare for credit score or a refund after submitting a return. Firms should preserve tax information for 2 years after they pay the tax. However, the fee date should come after the submitting date for companies to qualify to maintain information for less than two years.

Three years of tax recordkeeping

There are two causes chances are you’ll have to hold your tax information for at the least three years. First, it’s essential to hold your information for at the least three years in the event you file a declare for a tax credit score or refund after you file your return. If that sounds acquainted, it’s as a result of it goes hand in hand with the 2 years of tax recordkeeping.

You should hold tax information for 3 years in the event you file a declare for a refund or credit score after you pay the taxes. However, you solely have to hold the information for 2 years in the event you file the declare first and pay second.

The IRS additionally states that it’s essential to hold tax information for no less than three years in the event you owe extra taxes and particular circumstances don’t apply to you. The actual circumstances embody:

- If your corporation has workers, it’s essential to hold all employment tax information on file for no less than 4 years after the tax due date otherwise you pay it, whichever is later.

- Companies with property belongings should hold tax information till the interval of limitations expires for the 12 months the corporate disposed of the property.

- When you’ve got tax information that non-tax companies might have to make use of, hold your tax information till they inform you they now not want the paperwork. Preserve the paperwork for longer, even when the interval extends previous the IRS recordkeeping necessities. For instance, collectors could have an extended interval of limitations than the IRS.

If the above circumstances don’t apply to your corporation, chances are you’ll select to eliminate your information after three years.

Six years of tax recordkeeping

There’s a six-year interval of limitations for companies that don’t report revenue they need to have reported. However, the enterprise’s unreported revenue have to be greater than 25% of the gross revenue proven on the return.

For instance, a enterprise reviews $100,000 however ought to have reported $130,000. As a result of they didn’t report $30,000 ($130,000 – $100,000) value of revenue and that’s greater than 25% ($100,000 X 25% = $25,000) of the reported revenue, they need to hold their returns for six years.

Seven years of tax recordkeeping

Companies should hold their tax information in the event that they file a declare for a loss from nugatory securities or a dangerous debt deduction.

A nasty enterprise debt is one an organization incurs whereas working as a part of the taxpayer’s enterprise or commerce. The enterprise can then deduct the dangerous enterprise debt from bizarre revenue as a substitute of treating it as a capital loss. Firms should report it as a deduction on tax returns.

Nugatory securities apply to shares of inventory, inventory rights, or proof of debt issued by an organization. Inventory could turn out to be fully nugatory, creating nugatory safety. Or, companies can abandon their securities by completely surrendering them and giving up all their rights. Deal with nugatory securities like capital belongings offered or exchanged efficient the final day of the tax 12 months. Report nugatory securities on tax returns.

Limitless years of tax recordkeeping

There are two conditions by which companies should hold all tax information, together with tax kinds and different paperwork:

- Firm filed a fraudulent tax return

- Enterprise didn’t file a return in any respect

You should hold all tax information and knowledge for an infinite interval in the event you meet one of many above circumstances.

What number of years of tax returns do you have to hold?

So, simply how lengthy do you retain tax returns? Think about preserving tax information for at the least seven years to be on the secure aspect. Seven years’ value of tax returns helps within the occasion of an IRS audit or if lenders, collectors, or different events want extra data from your corporation.

The IRS usually contains solely three years’ value of returns when conducting audits. However, they could return as much as six years, if essential. Preserve substantial sufficient information to guard your corporation and supply sufficient proof to events.

This isn’t meant as authorized recommendation; for extra data, please click on right here.