In early December of final 12 months, I wrote an article on whether or not Bitcoin had reached the tipping level by way of signaling a peak within the crypto bubble. Some could disagree concerning the “bubble” label; nonetheless, it appears to me {that a} monetary class popping out of nowhere 10-years or so in the past and reaching a $3 trillion capitalization at its November 2021 peak (13% of US GDP) is a rare and possibly unprecedented feat. Checked out one other manner, the value stood at $164 in 2015 and touched $68,000 final November.

There isn’t a doubt that the blockchain idea is sound, however so was the know-how underpinning the tech bubble within the 12 months 2,000. It was simply that the costs of know-how corporations had obtained forward of themselves. My conclusion final December was that that some cracks had begun to look within the Bitcoin technical place, however the consensus of proof continued to level to an uptrend. Within the intervening months, the technical place has deteriorated additional. Additionally, the charts have established some key help ranges past which one may use to fairly argue that the bubble has burst.

Bitcoin Momentum

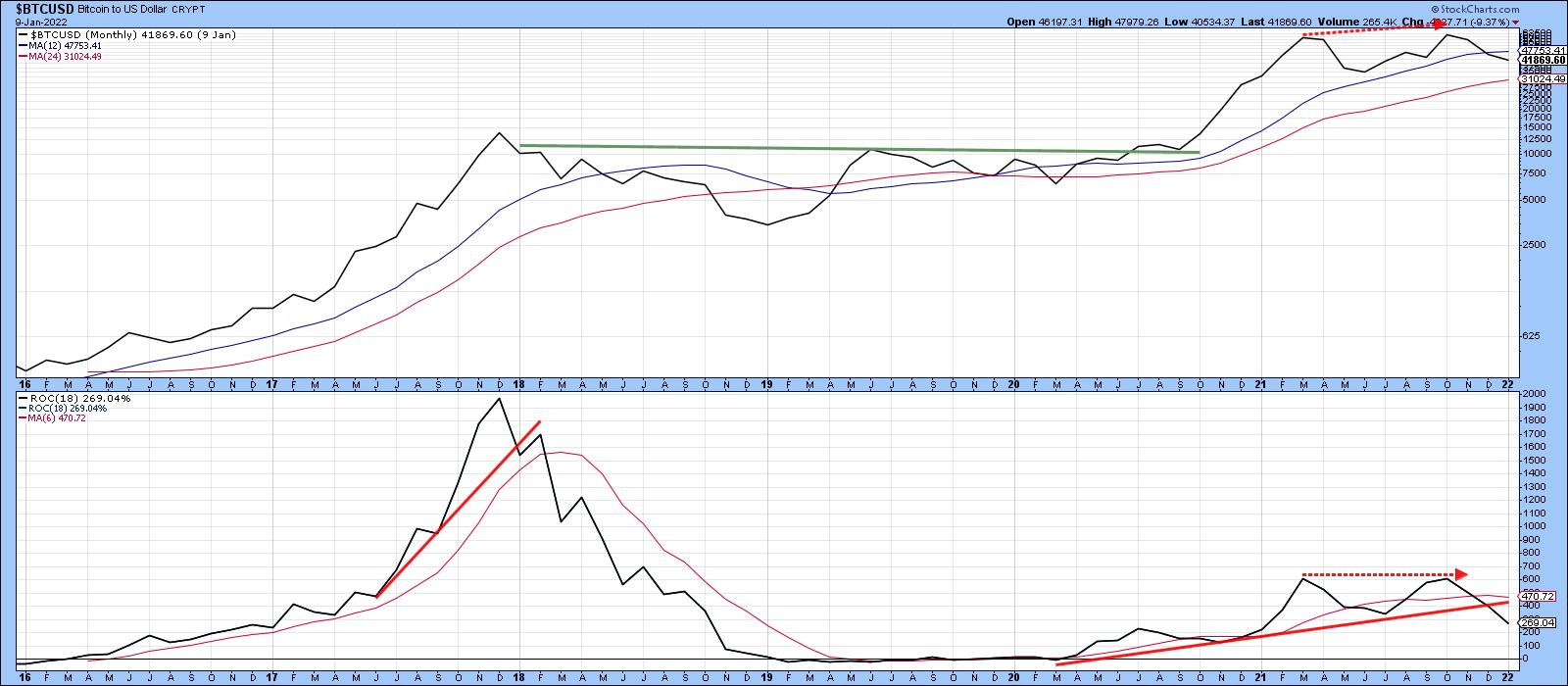

One of many strategies for calling a bubble prime is to look at an 18-month ROC and see when, following a prolonged advance, it reaches the 200% degree after which reverses. A studying north of 200% is necessary as a result of it signifies a doubling in worth over a interval of a year-and-a-half. Analysis exhibits that it is a very uncommon prevalence. For instance, the very risky copper worth has solely achieved it as soon as, within the late Seventies. The S&P has by no means touched 200%, not even in 1929. The best peak for any commodity, foreign money or inventory market (not shares), that I’ve ever noticed was 500% for silver in 1980. My research, overlaying 30+ examples unfold over centuries of knowledge, point out that after the ROC peaks above 200%, it has taken a mean of 15 years to regain the bubble excessive.

The rationale I carry this up is that, in 2017, the ROC for Bitcoin topped out at an unprecedented 2000% and took solely 3 years to recapture its losses, manner shorter than the common restoration interval. Chart 1 exhibits that the ROC has been in an uptrend since its 2020 low. The 2 2021 highs clocked in at a outstanding 600%. It solely seems low within the chart due to the remarkably excessive 2017 studying. The ROC has now arrange a adverse divergence with the value, as a result of the November 2021 excessive surpassed that established earlier within the 12 months. Be aware additionally that each sequence are under their respective MAs. Extra necessary is the truth that the ROC has not too long ago dropped under its up trendline, thereby confirming that, so far as momentum is anxious, a reversal has taken place.

Chart 1

Chart 1

A lack of upside momentum can be seen from Chart 2, the place it’s evident that the value is as soon as once more struggling in its battle to stay above its secular up trendline, in addition to its 40- and 65-week MAs.

Chart 2

Chart 2

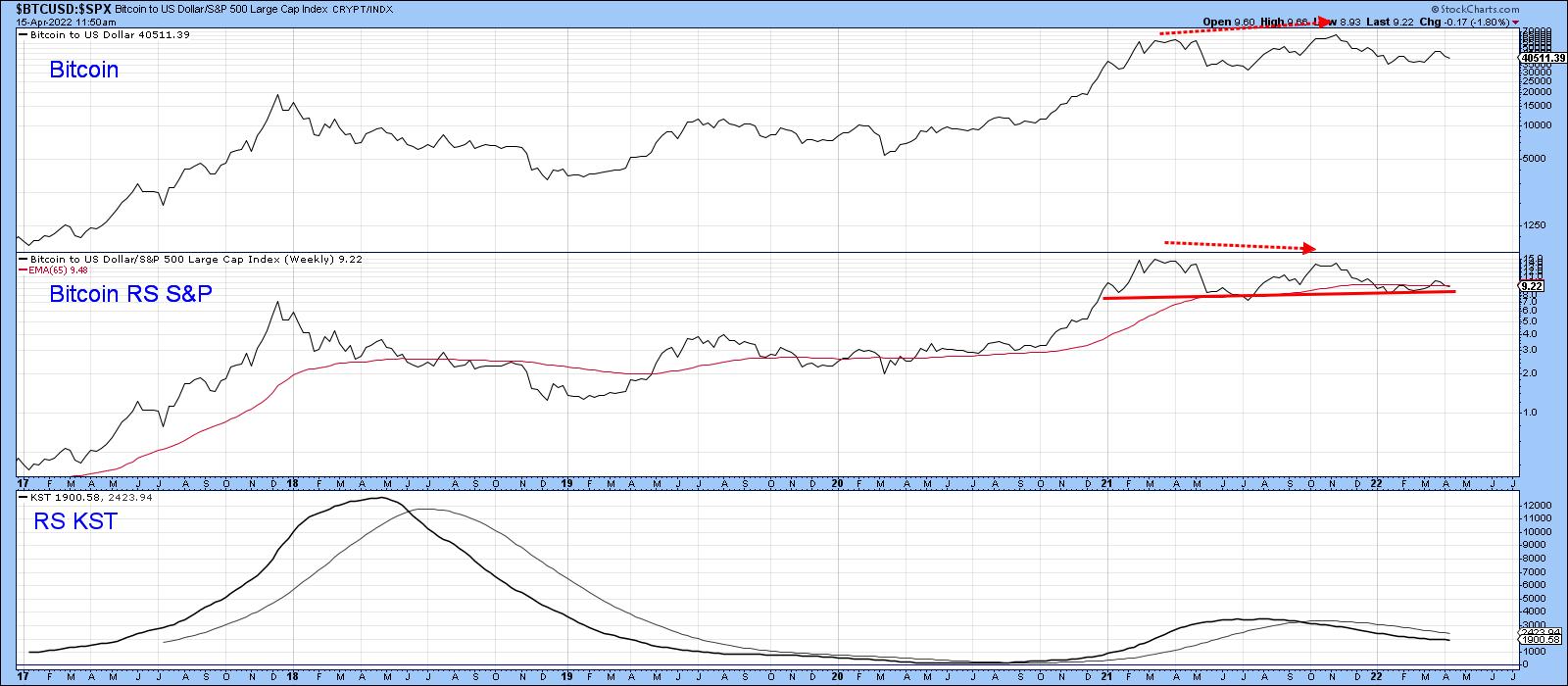

Relative Motion can be Slipping

Chart 3 exhibits that, between 2017 and early 2021, Bitcoin was confirming each new excessive with the same new excessive in its relative line with the S&P. The 2 dashed arrows point out that was not the case in November 2021, when the value touched an unconfirmed new excessive, however the RS line made a decrease one. It’s now resting precariously on its 2021-22 help trendline. The declining KST for relative motion means that help will quickly give manner.

Chart 3

Chart 3

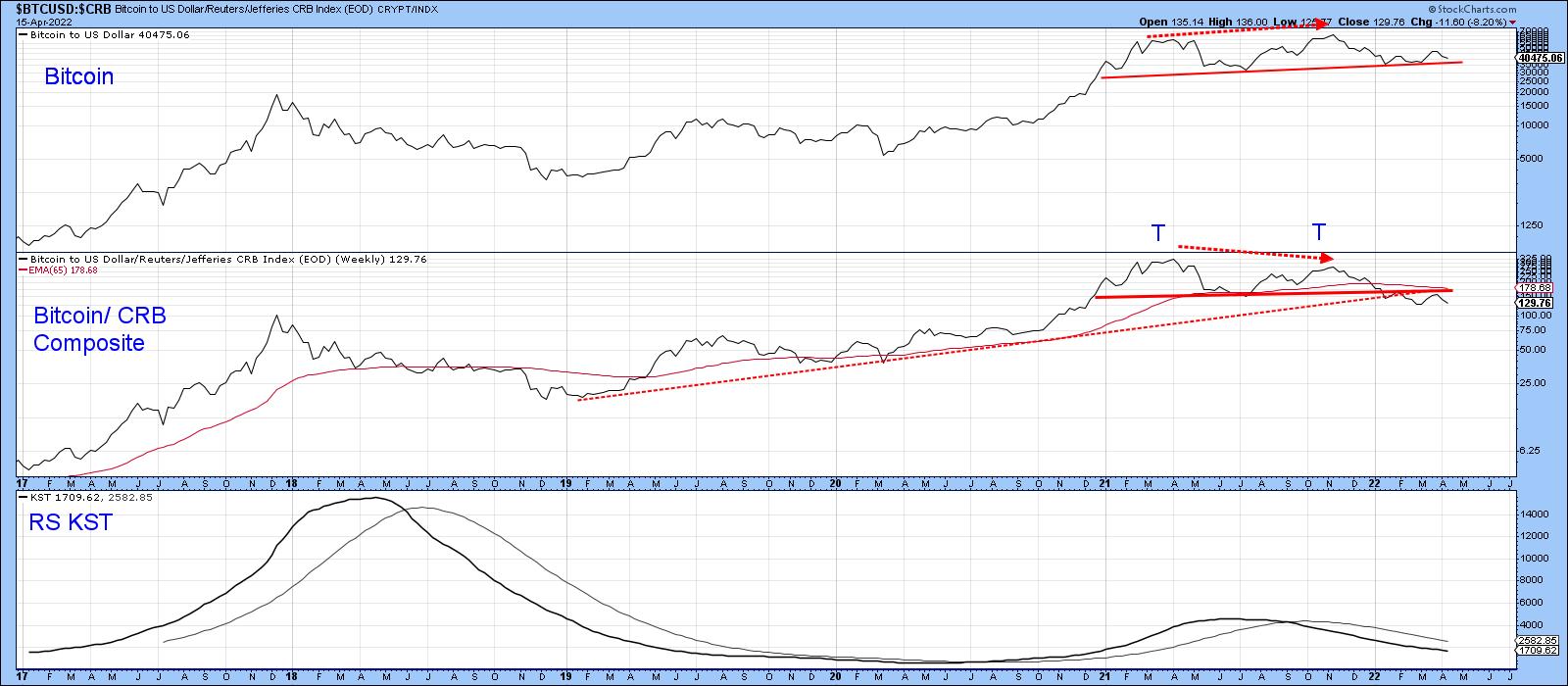

Bitcoin has additionally misplaced its mojo in opposition to commodity costs, within the type of the CRB Composite, as seen in Chart 4. On this occasion, the RS line has not solely diverged negatively, however has violated its (dashed) 2019-2022 up trendline and 65-week EMA. Most severe of all is the completion of a double prime formation.

Chart 4

Chart 4

Worth Motion Appears to be like Toppy

A primary true and examined device within the technical arsenal is supplied by peak-and-trough evaluation. In that respect, Chart 5 flags the main rallies and reactions since 2019. All through the entire interval, the sequence of rising peaks and troughs has been intact. That mentioned, the latest 2022 advance has up to now didn’t take out the earlier peak set final November. It might properly achieve this. All we all know on that entrance is that the January-March rally retraced at 38% of the earlier decline. That is sufficient to qualify the January low and March highs as authentic benchmarks for peak-trough evaluation.

Chart 5

Chart 5

Drilling down on the rally, we see quite a bit to be involved about in Chart 6. One of many traits of a bear market advance is a false breakout from a worth sample. That is precisely what occurred in late March. False breakouts are sometimes adopted by above-average strikes in the wrong way to the breakout as merchants scramble to get again on the correct aspect of the development, which is what seems to have been taking place within the final couple of weeks. Failure of the value to clear its 200-day MA is one other signal of the bear.

The extent to look at now on a day by day shut foundation is $35,000, since that marks the place to begin of the 2022 rally. If that’s taken out, the upward peak trough development might be reversed, which, in all chance, will point out that the November 2021 was a bubble-bursting occasion.

Chart 6

Chart 6

Lastly, Chart 7, based mostly on weekly information, exhibits the potential for a giant head-and-shoulders prime. Be aware that the latest rally failed to interrupt above the 52-week MA. The highest has not but been accomplished, as that can require a Friday shut beneath the neckline and, to be secure, an in depth beneath the January Friday shut low of $35,280.

Chart 7

Chart 7

Conclusion

Bitcoin continues to expertise a gradual technical deterioration, however this has not but been confirmed with the completion of a prime. When any market rises quickly over an prolonged interval, seemingly by no means to go down once more, confidence naturally builds up a head of steam. That optimism leads to complacency and careless choices. With rates of interest rising quickly, probably affecting margin accounts, now could possibly be nearly as good a time as any for beginning to take some bets off the desk.

This text is an up to date model of an article beforehand printed on Monday, April 11 at 7:09pm ET within the member-exclusive weblog Martin Pring’s Market Roundup.

Good luck and good charting,

Martin J. Pring

The views expressed on this article are these of the writer and don’t essentially mirror the place or opinion of Pring Turner Capital Group of Walnut Creek or its associates.

Martin Pring is likely one of the most outstanding names within the trade. A grasp technical analyst and educator extraordinaire, he’s the award-winning writer of quite a few books on Technical Evaluation, together with Introduction to Technical Evaluation and Technical Evaluation Defined. The latter is now utilized by a number of worldwide technical societies for coaching and for a number of many years was one of many three core books for Stage 1 CMT certification with the Market Technicians Affiliation. Translated into over 7 languages, the e-book is, as quoted by Forbes, “broadly considered the usual work for this era of chartists”.

Be taught Extra