Gold continued to ascend this week, registering an eight month excessive of US$1,910.50 per ounce by noon on Wednesday (February 23). The February rally has come amid rising tensions on the Ukraine border.

As Russia’s army presence intensifies within the area, Ukraine’s authorities introduced on Wednesday a 30 day state of emergency throughout the nation, except Donetsk and Luhansk. The worldwide group adopted with hardline warnings to the Kremlin to de-escalate tensions and withdraw from the world.

Russian President Vladimir Putin responded in a video message saying the nation’s pursuits and safety are non-negotiable; nevertheless, he went on to say he’s open to diplomatic dialogue.

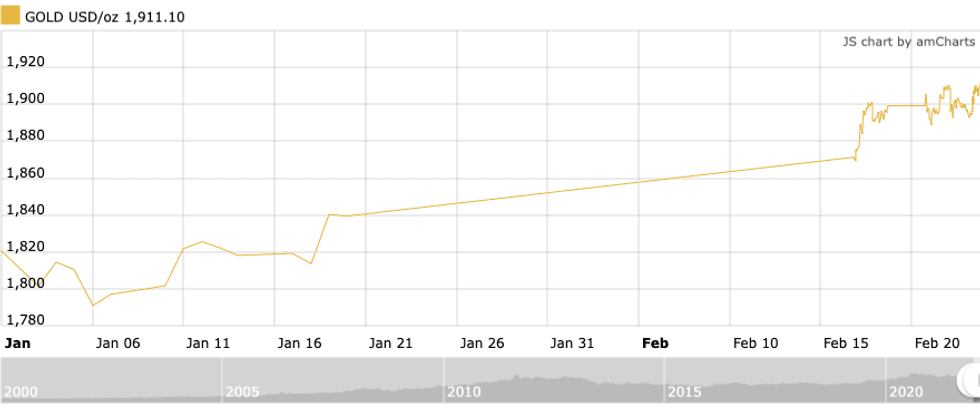

The geopolitical uncertainty has left fairness markets in North America within the crimson for a lot of the month, with traders gravitating towards the golden safe-haven asset. Since January, the gold worth has climbed by US$108 — equal to a rise of 6.03 % — following a 12 months of flat worth motion.

12 months-to-date gold efficiency.

Chart through Kitco.

“Gold performs properly throughout instances of financial, geopolitical and well being crises as there are elevated dangers and uncertainties related to such occasions,” stated Sagar Kalra, senior analyst at Wooden Mackenzie.

“These typically result in unfavorable macroeconomic situations like excessive ranges of inflation, provide chain hurdles, and many others. and traders enhance publicity to gold to guard their wealth,” he defined to the Investing Information Community (INN) final week. “The present battle between Russia and Ukraine has offered assist to the worth in latest months and it has reached its highest since July 2021 through the week.”

Along with safe-haven attraction, gold presents liquidity, which can also be fascinating in instances of rampant volatility.

“Gold is a extremely liquid asset, and central banks maintain it as part of their overseas reserves to make sure satisfactory liquidity,” Kalra stated. “An identical logic can also be employed by traders.”

Traditionally gold has carried out properly in instances of battle and disaster, however Kalra stated the present circumstances are considerably totally different given the lingering affect of the pandemic, surging inflation and international debt.

“With inflation at document ranges in elements of the world, we anticipate central banks to undertake a extra hawkish stance and lift rates of interest, which might create headwinds for gold. Concurrently, geopolitical tensions, excessive inflation and menace of vaccine-resistant COVID-19 variants would offer assist, and we anticipate worth volatility to be a function of 2022 as properly,” he stated, becoming a member of different specialists who anticipate tumultuous instances for the yellow metallic.

In response to Russia’s mounting aggression and fortification at Ukraine’s borders, the UK, US and Canada have applied sanctions concentrating on Russia’s funds. These strategic sanctions are supposed to minimize Russian state banks off from accessing US {dollars}. Different measures embrace sanctions on Russia’s overseas debt, that are geared toward impeding the nation’s potential to lift cash from western banking establishments.

These punitive measures may power Russia to extend its reliance on gold, however because the third largest gold producer when it comes to annual output, Russia additionally stands to profit from greater gold values.

“This may additional immediate Russia to rely extra on gold than US {dollars} as a part of its worldwide reserves, which might in flip result in greater demand for Russian gold,” Kalra stated. “Over the course of 2020, Russia elevated the portion of gold in its worldwide reserves to 23.3 % from 19.5 % within the earlier 12 months.”

Gold was priced simply above US$1,910 on the finish of Wednesday.

Don’t neglect to observe us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t replicate the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Internet