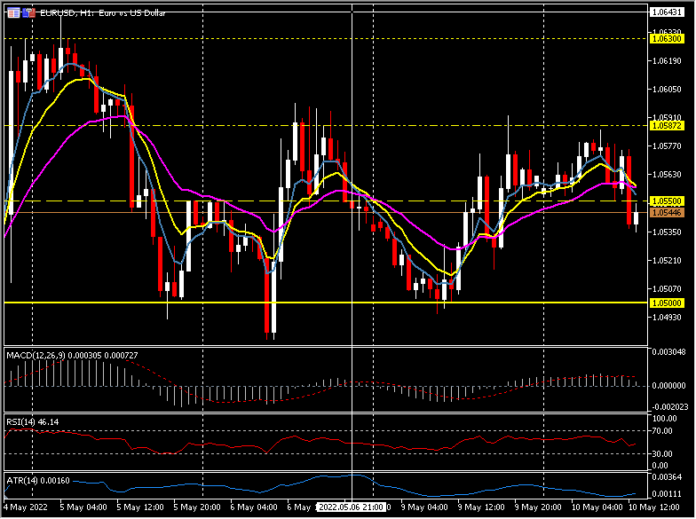

EURUSD, H1

The Could German ZEW Investor Sentiment expectations quantity lifted to -34.3 from -41.0 in April. The present situations indicator got here in weaker than anticipated at -36.5, down from -30.8 within the earlier month, however the enchancment within the headline remains to be a constructive shock, even when the unfavourable studying nonetheless flags that pessimists clearly outnumber optimists. Nonetheless, that is the primary enchancment since February, i.e. the primary enchancment because the begin of the Ukraine struggle and the information means that traders are slowly adjusting to the “new regular”. Readings for brief time period rates of interest within the Eurozone have risen sharply, however respondents appear considerably extra optimistic on the outlook for native inventory markets. Hardly a superb report, however one that means confidence could have handed the nadir – no less than for now. Certainly, the ZEW headline studying for the Eurozone additionally rose sharply to -29.5 in Could of 2022, from the greater than two-year low of -43.0 in April. Nothing that can actually ease concern that the fallout from the Ukraine struggle is leaving the Eurozone heading for recession as soon as once more, however possibly extra ammunition for the hawks on the ECB, who’re pushing for an early charge hike in July.

The restoration of EURUSD from 1.0500 yesterday held over 1.0550 in the course of the Asian and early European session as we speak forward of the ZEW knowledge, earlier than dipping. EURGBP pivots round 0.8550 and holds the break of 0.8500 from Thursday, while EURJPY holds over 137.00 however once more, has not been capable of break and maintain 138.00, copying strikes on each Friday and yesterday.

Click on right here to entry our Financial Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distribution.