GBPUSD continued to put up barely increased right this moment, persevering with Friday’s bullish momentum after the large 6-day fall that pushed the pair to 1.2154, its lowest stage since Could 2020. It’s now buying and selling near the 1.2480 highs.

The excessive demand for the USD and the issues of traders inflicting risk-off sentiment available in the market are clearly placing stress on the GBP. This week, the GBP boosted by politics and at the moment by the labor sector information. UK wage development tops forecast as labour market tightens. The ILO unemployment price unexpectedly declined to three.7% within the the three months to March, from 3.8% within the earlier three months interval. Earnings development jumped to 7.0% in that point, whereas the earlier quantity was revised as much as 5.6% from 5.4%. Excluding bonuses the three months price reached 4.2%. All increased than anticipated numbers and the extra updated claimant depend price dropped again to 4.2% in April, whereas the March studying was revised all the way down to 4.2% from 4.3%. Jobless claims continued to say no as a quick tempo and the variety of payrolled workers jumped 121K in April, probably pushed by the re-opening of the companies sector that got here in time for the Easter vacation interval. Very sturdy numbers that may again the arguments for added tightening from the BoE, which has already delivered a collection of hikes now, in a bid to maintain a lid on inflation that’s now anticipated to peak above 10% later within the 12 months.

Though usually a rise in inflation is seen as optimistic for a foreign money, giving a sign of the opportunity of a rise in rates of interest, excessively excessive inflation can exacerbate current price of residing pressures, as seen within the UK and its part of stagnant development. UK GDP information for March reported a contraction of -0.1%. That is in keeping with an earlier Financial institution of England (BoE) assertion warning that the UK is prone to expertise an financial recession this 12 months. The mixture of low financial development and speedy rise in inflation is one thing that’s not good for the GBP.

In a press release to the UK parliamentary finance committee (Home of Commons) on Monday, BoE Governor Andrew Bailey pressured that they had been sad with the present inflation scenario the place the reason for rising inflation was on account of rising vitality costs and tradeable items. He was additionally quoted as saying they had been involved in regards to the shock within the world economic system as may be seen within the weak point of China’s financial information. If inflation information is increased or in keeping with expectations, the GBP is predicted to depress once more. Nonetheless, right this moment’s labour market information already confirmed increased than anticipated wage development and an more and more tight jobs market, which is able to solely add to the arguments in favor of much more hikes from the central financial institution, which has already hiked charges successively since final December to at the moment 1%.

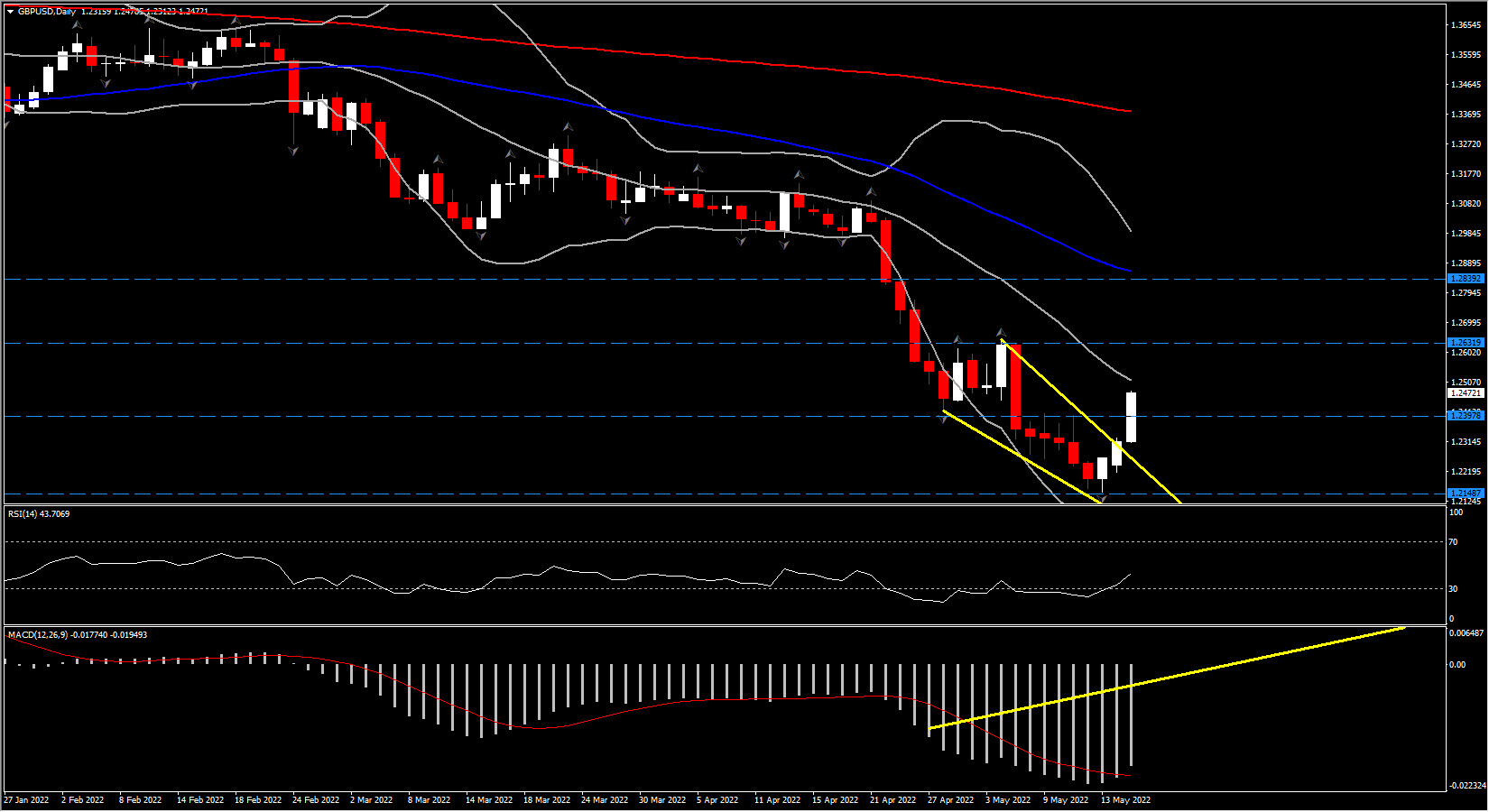

Total the mixture of the strengthening USD and the weak point of the GBP has brought on GBPUSD to say no greater than 10% from the January 2022 excessive of 1.3750 to as little as 1.2154 in Could 2022. Nonetheless Cable bounce considerably the previous 3 days to 1.2480 stage , breaking the important thing 1.2400 Resistance space and turning nearer to 20-day SMA. Intraday, the asset handle to interrupt 3-week descending triangle whereas the momentum has turned optimistic, signalling a possible reversal sign. If the GBP continues to be supported by traders and registers vital positive aspects, the resistance stage within the necessary cluster 1.2630, which is the Could excessive. A breach and break of it may open the doorways to 1.2970 (2-year help space). Within the Day by day chart, the MACD indicator continues to be nicely beneath the 0 stage, however the each day RSI-14 stage has risen barely from the oversold stage, nevertheless the momentum continues to be sturdy downwards general.

Click on right here to entry our Financial Calendar

Tunku Ishak

Market Analyst – HF Training Workplace – Malaysia

Disclaimer: This materials is supplied as a common advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distribution.