EUR/USD: Forward of the US Federal Reserve FOMC Assembly

● The World Financial institution stated final week that dangers of a recession in 2023 are rising amid simultaneous tightening of financial coverage by the world’s main Central banks and the power disaster in Europe. In line with Citigroup strategists, the greenback stays the one protected haven for buyers to hedge in opposition to the chance of drawdown in funding portfolios.

World inventory markets have misplaced $23 trillion because the early 2022, and bond costs have additionally declined. As for the US forex, it continues to develop, not like shares and different dangerous belongings. In line with specialists’ forecasts, the DXY Greenback Index might come near 112.00 factors over the subsequent three months, renewing a 20-year excessive. Buyers’ perception that the US financial system will cope higher with the approaching international recession than the economies of different international locations and areas strengthens the greenback as properly.

● Markets at the moment are targeted on the subsequent FOMC assembly of the US Federal Reserve, which might be held on Wednesday, September 21. The important thing parameters that decide the financial coverage of the Central Financial institution at present stage are inflation and the state of the labor market. Vital statistics have been launched final week, together with retail gross sales and unemployment claims within the US. This knowledge strengthened buyers within the opinion that the Fed will proceed the coverage of quantitative tightening (QT). In line with the CME Group, the likelihood of one other charge improve by 75 foundation factors (bp) is estimated at 74%, and by 100 bps at 26%. As well as, Wells Fargo analysts consider that the speed hike might be supplemented by an acceleration within the charge of steadiness sheet discount.

The Fed’s forecast for a impartial degree of rates of interest might be up to date at this assembly as properly. The median forecast for the federal funds charge in 2022 is predicted to be revised to three.875%, up from 3.375% within the June forecast.

● All the above steps might result in additional strengthening of the greenback and the autumn of the inventory market. The reverse situation might be doable provided that the introduced plans are abruptly deserted. Nevertheless, this will solely occur with a pointy decline in GDP, rising unemployment and a convincing victory over inflation. Neither one, nor the opposite, nor the third has but been noticed in america.

The Client Worth Index (CPI), revealed on September 13, fell from 8.5% to eight.3% over the month. Nevertheless, the forecast assumed a stronger fall, to eight.1%. An extra unfavourable was the rise in core inflation to six.3% y/y, which is the very best since March and greater than 3 times greater than the Central Financial institution’s goal of two%. However the labor market, quite the opposite, is doing fairly properly, which helps forecasts for an increase in rates of interest. Employment development over the previous two months has been sturdy, averaging 421K new jobs.

● As for the Eurozone, inflation accelerated to 9.1% in August. Primarily based on this, some analysts consider that the ECB may proceed to lift the speed in 0.75% increments. Nevertheless, the subsequent assembly of this regulator just isn’t but quickly, on October 27. So it lags far behind in tightening (QT) from its abroad counterpart. On the similar time, in response to Rabobank strategists, the unstable scenario within the area might imply that “elevating charges is not going to considerably strengthen the euro.” Given the energy of the US greenback, specialists consider that the EUR/USD pair might fall to 0.9500 within the coming weeks.

● The EUR/USD ended the week at 1.0013. On the time of scripting this evaluation, on the night of Friday, September 16, the votes of the specialists are distributed as follows. 75% of analysts say that the pair will proceed shifting south within the close to future, one other 25% vote for the continuation of the facet development alongside Pivot Level 1.0000. There may be not a single vote on the facet of the bulls.

Among the many development indicators on D1, 65% are pink, 35% are inexperienced. Among the many oscillators, 25% are on the inexperienced facet, the identical 25% on the pink facet, and 50% are coloured impartial grey.

The pair has been shifting alongside the parity line for the previous 4 weeks. The principle buying and selling vary was inside 0.9900-1.0050. Considering breakdowns in each instructions, it’s considerably wider: 0.9863-1.0197. The following robust help after the 0.9860 zone is situated round 0.9685, the bears’ goal, as talked about above, is 0.9500. The resistance ranges and targets of the bulls seem like this: 1.0050, 1.0080, 1.0130, then 1.0200 and 1.0254, the subsequent goal space is 1.0370-1.0470.

● Along with the FOMC (Federal Open Market Committee) assembly and subsequent forecasts and feedback, we count on recent knowledge on unemployment within the US subsequent week. Will probably be revealed on Thursday September 23. And enterprise exercise indicators (PMI) in Germany and within the Eurozone as a complete will turn into recognized on the finish of the working week, on Friday, September 23.

GBP/USD: Forward of the Financial institution of England Assembly

● The British forex has set one other anti-record. Having risen to 1.1737 firstly of the week, GBP/USD then rotated and flew down quickly. Wednesday introduced slightly respite, after which the flight continued. The touchdown occurred on Friday 16 September at 1.1350. The pair was this low 37 years in the past, in 1985. The final chord of the week sounded 75 factors greater, at 1.1425.

Aside from the strengthening of the greenback on expectations of a charge hike by the Fed, further strain on the British forex was exerted by a drop in retail gross sales in the UK. They fell 1.6% m/m in August, greater than 3 times the 0.5% forecast.

● In line with analysts, a powerful technical correction can cease the collapse. And that is just for some time. Strategists from MUFG Financial institution consider that the downtrend of GBP/USD might proceed to a historic low of 1.0520. “With the UK price range and present account deficits mixed to succeed in a formidable 15% of GDP, downward strain on the GBP will proceed,” they write.

● The Financial institution of England may also announce its rate of interest determination the subsequent day after the FOMC assembly, on Thursday, September 22. The principle forecast means that it could rise by 50 bp, from 1.75% to 2.25%. Nevertheless, it’s doable that the regulator will instantly elevate the speed to 2.50%, which can help the British forex for a while.

Nevertheless, this can be a double-edged sword. If the speed improve forecast comes true, this can create a fair higher burden on the nation’s financial system, whose well being is already inflicting severe concern. We beforehand wrote that, in response to the estimates of the British Chamber of Commerce (BCC), the UK is already within the midst of a recession, and inflation will attain 14% this 12 months. And in response to Goldman Sachs, it might attain 22% by the top of 2023, which can provoke a protracted financial downturn and a contraction of the financial system by greater than 3.5%. British power regulator Ofgem has already introduced that common annual electrical energy payments for UK households will rise by 80% from October. And in response to the Monetary Instances, the variety of fuel-poor households will greater than double in January to 12 million.

● Forward of the Fed and Financial institution of England conferences, the median outlook for subsequent week seems impartial. A 3rd of the analysts facet with the greenback, one other third – with the pound, and one other third have taken a impartial place. The readings of the symptoms on D1 are nearly all pink once more. These are 100% among the many development indicators. For oscillators, 85% level south and 15% level east. No oscillators are pointing north.

As for the bulls, they’ll meet resistance within the zones and on the ranges of 1.1475, 1.1535, 1.1600, 1.1650, 1.1710-1.1740, 1.1800, 1.1865-1.1900, 1.2000. The closest help is within the 1.1400-1.1415 zone, adopted by the September 16 low at 1.1350. One can solely guess to what ranges, given the elevated volatility, the pair might fall additional. Allow us to solely repeat that the 1985 historic low is at 1.0520.

● Among the many occasions of the approaching week, apart from the Financial institution of England assembly, the calendar consists of Friday, September 23, when knowledge on enterprise exercise (PMI) within the UK might be revealed. It must also be famous that the nation has a financial institution vacation on Monday, September 19.

USD/JPY: Forward of the Financial institution of Japan Assembly

● Along with the Fed and Financial institution of England conferences, the Financial institution of Japan (BOJ) may also meet subsequent week. In line with forecasts, the Japanese regulator will proceed to stick to the ultra-soft financial coverage and maintain the unfavourable rate of interest (-0.1%) unchanged.

A miracle can occur after all, however its likelihood is near 0. On the similar time, the BOJ’s unilateral actions, in response to economists from Societe Generale, will solely be sufficient to cease the weakening of the yen. However they won’t be sufficient to reverse the USD/JPY downtrend. Societe Generale calls a recession within the US, which can result in a drop within the yield of US Treasury obligations, as one other prerequisite.

● USD/JPY ended the buying and selling session final week at 142.90, failing to succeed in the 145.00 excessive. Nevertheless, in response to Financial institution of America analysts, the pair’s bullish sentiment stays, and it’s nonetheless geared toward shifting in direction of 150.00. On the similar time, financial institution specialists word the next three ranges: Fibo 38.2% correction (head and shoulders) at 145.18, the height of 1999 at 147.00, and the goal A=C at 149.53.

● The closest resistance for the pair, identical to per week in the past, is 143.75. The bulls’ process No. 1 is to achieve a foothold above 145.00. Again within the spring, when analyzing the speed of the pair’s rise, we made a forecast in response to which it might attain a peak of 150.00 in September. And it could come true in opposition to the background of an increase within the Fed’s rate of interest. Helps for the pair are situated on the ranges and within the zones 142.00-142.20, 140.60, 140.00, 138.35-139.05, 137.50, 135.60-136.00, 134.40, 132.80, 131.70.

The opinion of Financial institution of America analysts is supported by 65% of specialists, 25% have taken the alternative place, the remaining 10% stay impartial. Oscillators on D1 are 100% on the inexperienced facet, though 10% of them sign being overbought. Amongst development indicators, 75% are inexperienced and 25% are pink.

● Aside from the BOJ assembly, no vital macro knowledge on the Japanese financial system is predicted to be launched this week. Merchants must also word that Monday, September 19 and Friday, September 23 are non-working days in Japan.

CRYPTOCURRENCIES: ETH After the Merge: Fall As a substitute of Progress

● We often begin our evaluation with the primary cryptocurrency, bitcoin. However this time, let’s deviate from the foundations and provides the palm to the primary altcoin, Ethereum. This is because of an occasion that will turn into an important for the crypto trade in 2022. On September 15, the ETH community hosted the worldwide replace The Merge, which includes the transition of the altcoin from the Proof-of-Work protocol to Proof-of-Stake (PoS). Because of this now the safety of the blockchain might be ensured not by miners, however by validators: customers who’ve deposited and blocked their share of cash (staking).

Now, as an alternative of working massive networks of computer systems, validators will use their Ethereum cache as a method of validating transactions and mining new tokens. This could enhance the pace and effectivity of the community in order that it could possibly course of extra transactions and resolve the issue of person development. The builders declare that the replace will make the community that hosts the ecosystem of cryptocurrency exchanges, lending corporations, non-playable token (NFT) markets and different functions safer and scalable. As well as, cryptocurrencies have been always criticized for his or her enormous power consumption. Ethereum will now devour 99.9% much less of it.

● Lovers consider that this merge will revolutionize the trade and permit Ethereum to overhaul bitcoin in capitalization and worth. Nevertheless, many authoritative voices sound a lot calmer. For instance, Financial institution of America (BofA) believes that this difficult fork is not going to resolve the issue of scalability or excessive charges however might result in wider institutional adoption. The notable lower in energy consumption after The Merge will enable some buyers to buy this altcoin for the primary time. “The power to put ETH and generate greater high quality returns (decrease credit score and liquidity threat) as a validator or by staking might additionally drive institutional adoption,” BofA admitted.

● CoinShares Chief Technique Officer Meltem Demirors seems extra pessimistic. He believes that buyers are ignoring the general market scenario within the hype across the Merge. And it’s not sure that this occasion will entice vital funding capital: “The truth is extra prosaic,” says the CoinShares strategist. “On the international degree, buyers are involved about charges and macro indicators. And I do not consider that vital quantities of recent capital are more likely to enter ETH.”

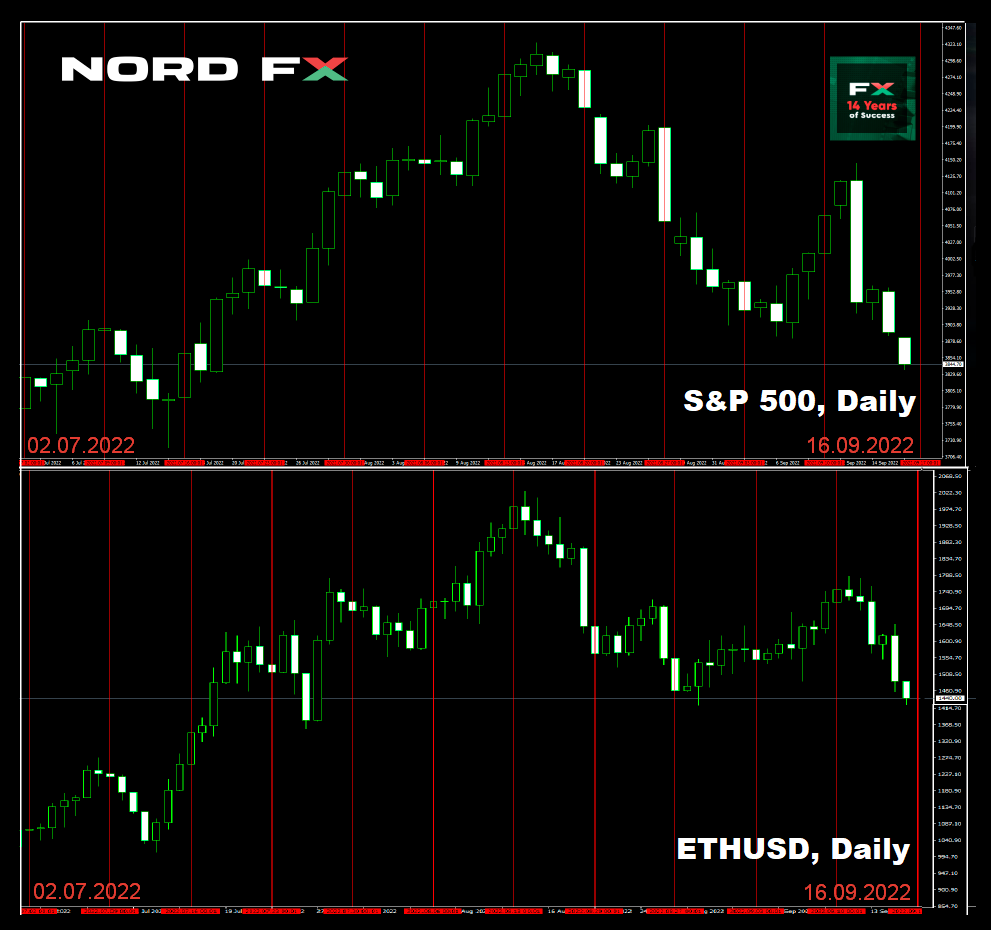

● Time will inform how the market will finally react to the Merge. Within the meantime, as an alternative of development, there was a fall. The set off was the collapse of inventory indices (S&P500, Dow Jones and Nasdaq), which was provoked by US inflation knowledge for August. Market members determined that in such a scenario the Fed would tighten its financial coverage extra actively and lift rates of interest. It’s anticipated that the speed will rise by one other 0.75% and even 1.0% subsequent week. Because of this, the greenback started to rise sharply, whereas dangerous belongings, together with bitcoin and Ethereum, fell. BTC fell to $19,341 by Friday night, having misplaced 15% of its worth over the week, ETH fell to $1,403, “shrinking” by 20%.

● In line with many specialists, because of the hawkish place of the Fed and the ECB, the dynamics of the crypto market will stay unfavourable a minimum of till the top of the 12 months. Towards the backdrop of a discount in market threat urge for food, it is going to be tough for bitcoin to remain above not solely the psychologically vital degree of $20,000, but additionally above the June 18 low of $17,600. The latter threatens an additional collapse.

● A dealer and analyst beneath the nickname filbfilb allowed in an interview with Cointelegraph the bitcoin to fall from present ranges to $10,000-11,000. In line with the specialist, bitcoin has turn into extremely correlated with the US inventory market, which is beneath monumental strain because of the Fed’s insurance policies. The primary cryptocurrency behaves as a dangerous asset, not as inflation insurance coverage.

The skilled famous that the upcoming winter might be a severe check for residents and politicians of the European Union, the implications of which can have a unfavourable influence on hodlers. The vital factor might be how the international locations of the Outdated World will deal with the power disaster. In line with him, every little thing is within the fingers of diplomats who’re in a position to forestall an emergency. In any other case, dangerous belongings will face a tough future. “The dialogue between Russia and NATO is vital: the earlier it begins, the upper the bitcoin low might be”, filbfilb emphasised.

● It must be famous right here that the dependence of BTC on the US inventory market weakened sharply in August and was on the annual low. Nevertheless, it has begun to develop once more and, in response to the TradingView service, the correlation between bitcoin and the S&P 500 index has reached 0.59. The scenario is comparable with the Nasdaq. The correlation with it fell to 0.31 in August, and it rose to 0.62 in September. Analysts remind that the dependence of the crypto sphere on the inventory market turns into robust after the correlation index rises above 0.5. When 0.7 is reached, the dependence turns into ideally suited.

● Nevertheless, regardless of the unfavourable sentiments, there’s nonetheless hope to see gentle on the finish of the tunnel. The aforementioned filbfilb referred to as bitcoin’s Q1 2023 rally “apparent”. The skilled sees two causes for this. The primary is the seasonal issue. Downtrends finish 1000 days after the halving (which might be early subsequent 12 months. The second is a change in sentiments to optimistic ones, primarily based on sport concept. With a likelihood of two/3, the skilled prompt that Europe will survive the approaching winter. But when issues go badly, it can improve the probability of a dialogue with Russia that can convey stability within the quick time period.

● Cryptocurrency analyst with the nickname Rager doesn’t consider within the decline of BTC to $12,000. He agreed that there aren’t any ensures when coping with bitcoin. However, in his opinion, it is vitally doubtless that the asset is forming a bear market backside above $19,000. One other analyst and dealer with the nickname Rekt Capital believes that every little thing is shifting in direction of the ultimate part of bitcoin’s decline. “A major a part of the BTC bear market is behind us, and the complete bull market is forward. The underside of the bear market might be in November, December or the start of the Q1 2023.”

Rekt Capital famous that the info sign a doable rise in BTC by 200%, however there’s one caveat: Bitcoin might fall much more earlier than it goes up. “After all, within the quick time period, the BTC value might fall by 5%-10%,” Rekt Capital writes. “However in the long run, a rally of greater than 200% may be very doubtless.”

● Regardless of the depreciation of BTC, Michael Saylor, the founding father of MicroStrategy, hopes for the perfect. His firm intends to proceed with the acquisition of this asset. It can reportedly promote $500 million value of its personal shares. The proceeds from these gross sales might be used, amongst different issues, to replenish the cryptocurrency shares. Be aware that MicroStrategy is the biggest company bitcoin holder. It owns 129,699 cash bought at a mean trade charge of $30,664. The final buy (480 BTC) was made in June.

● On the time of writing (Friday night, September 16), this MicroStrategy funding is deeply unprofitable, as BTC/USD is buying and selling at $19,730 (ETH/USD – $1,435). The whole capitalization of the crypto market has once more fallen under the psychologically vital degree of $1 trillion and is $0.959 trillion ($1.042 trillion per week in the past). The Crypto Worry & Greed Index fell 2 factors in seven days from 22 to twenty and remains to be within the Excessive Worry zone.

NordFX Analytical Group

Discover: These supplies will not be funding suggestions or pointers for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx