EUR/USD: Euro Updates 5-12 months Low, We Are Ready for the Fed (FOMC) Assembly

● The DXY index that measures the US greenback in opposition to a basket of six different main currencies up to date its 20-year excessive on Thursday, April 28. The explanation for this progress remains to be the identical, and we have now repeatedly written about it: the Fed started to tighten its financial coverage sooner than different main central banks. It’s anticipated that the FOMC (Federal Open Market Committee) could increase the important thing rate of interest by 0.5% on the subsequent assembly on Might 4. That is the minimal. For instance, James Bullard, the top of the Federal Reserve Financial institution of St. Louis, didn’t rule out that the speed may very well be raised by 0.75% immediately.

● Different nationwide regulators are shifting rather more slowly (or by no means) amid the US Fed’s hawkish exercise. Their economies are displaying weaker restoration from the disaster brought on by the COVID-19 pandemic, and this doesn’t permit central banks to shortly curtail financial packages incentives (QE) and improve borrowing prices.

After all, this is applicable to the European Union as effectively, which additionally suffers further financial losses brought on by the sanctions imposed on Russia because of the army invasion of Ukraine. Recall that the dependence of the EU international locations on Russian power sources may be very excessive.

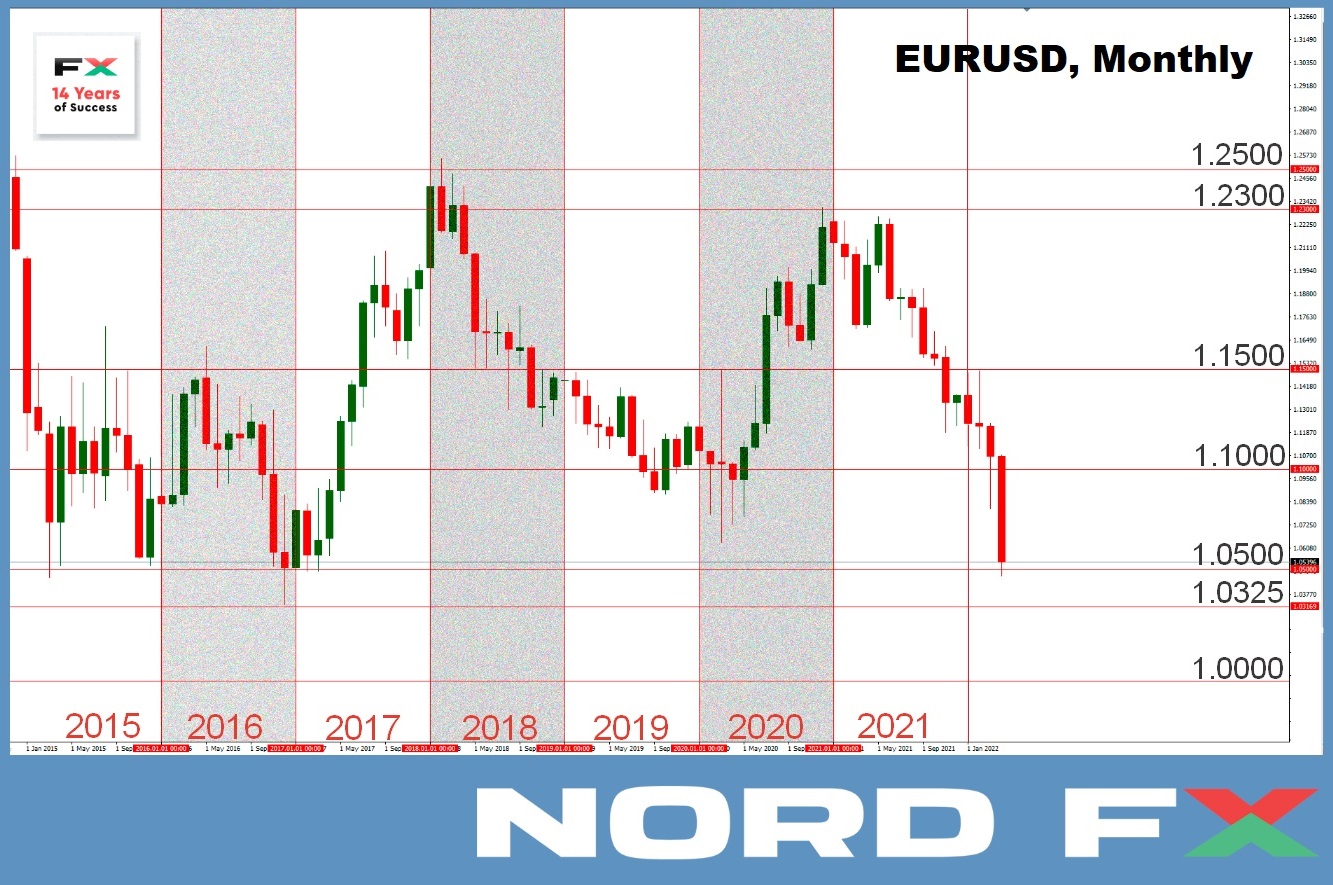

In opposition to this background, the greenback continued to push the European forex, and the EUR/USD pair rewrote the five-year low, falling to 1.0470 on April 28. Thus, the losses of the European forex has exceeded 700 factors in April alone. There was a slight rebound on the very finish of the five-day interval and a end on the degree of 1.0545.

● The extent of 1.0500 performs the function of a help, which can result in a discount within the quantity of quick positions and, in consequence, to a reasonably sturdy correction to the north. If this doesn’t occur, then the subsequent goal for the bears would be the 2016 low of 1.0325. It’s doable that we are going to see the parity of the euro and the greenback 1:1 quickly. Nevertheless, a lot is dependent upon what occurs to the rate of interest on the US Federal Reserve assembly on Might 4, and what will probably be mentioned by the administration of this regulator on the subsequent press convention.

● On the time of writing, analysts’ votes are virtually evenly divided. 35% are assured that the greenback will proceed to strengthen, 30% have the other opinion, the remaining 35% have taken a wait-and-see angle. Not surprisingly, with the present dynamics of the pair, 100% of the development indicators and oscillators on D1 are coloured crimson, though 25% of the latter give indicators of the pair being oversold. The closest help is situated at 1.0500, adopted by the April 28 low of 1.0470, and the bears’ additional objectives for EUR/USD are described above. The closest resistance zone is 1.0550-1.0600, 1.0750-1.0800, 1.0830-1.0860, 1.0900-1.0935 and 1.1000.

● As for the approaching week, along with occasion No. 1, the Fed assembly, the calendar consists of the discharge of knowledge on retail gross sales in Germany and enterprise exercise in US manufacturing sector (ISM) on Monday, Might 02. ECB President Christine Lagarde is anticipated to talk the subsequent day. We’ll discover out the amount of retail gross sales within the European Union as an entire on Wednesday, Might 04. The ADP report on US non-public sector employment will probably be printed on today as effectively. One other portion of knowledge from the US labor market will arrive on Friday, Might 06, together with such an necessary indicator because the variety of new jobs exterior the agricultural sector (NFP).

GBP/USD: The Pound Updates its Two-12 months Low, We Are Ready for the Assembly of the Financial institution of England

● We said within the earlier overview that the bulls’ battle for 1.3000 is misplaced. Answering the query whether or not there will probably be a counteroffensive, nearly all of consultants (65%) answered that no, there will not be, and the pound will proceed to fall. This forecast turned out to be completely appropriate, and regardless of the oversold indicators, the GBP/USD pair reached an area backside at 1.2410 on Thursday, April 28. The final time it was at this degree was in June 2020. As for the final chord of the week, it sounded within the 1.2575 zone.

● Subsequent week will see not solely the assembly of the US Federal Reserve, but additionally that of the Financial institution of England. In keeping with forecasts, the regulator of the UK could increase the rate of interest from 0.75% to 1.0%. Nevertheless, since its assembly will probably be held on Might 5, that’s, a day later than the Fed, the 9 members of the MPC (Financial Coverage Committee) of the Financial institution could have time to regulate their place relying on the choice of their abroad colleagues.

● Within the meantime, the overwhelming majority of consultants (70%) stay impartial forward of each conferences. 15% of them have taken the freedom of predicting an additional weakening of the British pound, the identical quantity expects the pair to appropriate to the north. There’s nonetheless a complete benefit of the crimson ones among the many indicators on D1: 100% amongst each development indicators and oscillators. The quick goal of the bears is to beat the help at 1.2500, additional targets for the pair’s decline are situated on the ranges of 1.2400, 1.2250, 1.2075 and 1.2000. As for the bulls, in the event that they handle to grab the initiative, they’ll face resistance within the zones of 1.2600, 1.2700-1.2750, 1.2800-1.2835 and 1.2975-1.3000.

● Relating to the discharge of statistics on the financial system of the UK, the PMI (Buying Managers Index) within the manufacturing sector will probably be printed on Tuesday, Might 3. The Composite PMI and the PMI within the providers sector will probably be introduced the subsequent day, somewhat forward of the Financial institution of England assembly. The publication of PMI within the UK building sector on Friday 06 Might will full the image of enterprise exercise.

USD/JPY: The Yen Updates a 20-12 months low. What else to anticipate?

● A brand new anti-record for the Japanese forex was mounted at 131.25 yen per greenback. The USD/JPY pair made a correction to the south within the first half of the week: as much as the extent of 126.92. However then, following the assembly of the Financial institution of Japan, we witnessed a brand new rally of 433 factors. This was adopted by a somewhat highly effective bounce by 190 factors and a end at 129.75.

● Some consultants anticipated that the Japanese regulator may step again a bit from its ultra-soft financial coverage. Furthermore, earlier than that, varied authorities officers had talked quite a bit about the truth that Japanese households are sad with the surge in inflation, and that, given the actions of the US Federal Reserve, it will be time to regulate their financial coverage. However the Financial institution of Japan remained true to itself, leaving the destructive rate of interest (-0.1%) unchanged and declaring its readiness to purchase a vast variety of bonds every session as wanted.

In keeping with many analysts, the Central Financial institution will preserve its comfortable financial coverage unchanged all through 2022, and also will preserve large incentives, maybe a minimum of till fiscal 12 months 2023.

● The yen was additional hit by rising US 10-year Treasury yields, which rose 48 bp to 2.83% in April alone, widening the hole with comparable Japanese securities. And right here is the end result: if the pound fell to a two-year low, the euro – to a five-year low, the yen fell to the bottom values within the final twenty years!

● 35% of consultants vote for the truth that the bulls will storm new heights, 50% have taken the other place. The remaining 15% are impartial, ready for the Might assembly of the Fed. Amongst development indicators and oscillators on D1, 100% are wanting north, however amongst oscillators, 15% sign that the pair is overbought.

The closest help is situated at 129.00-129.40, adopted by 127.80-128.00, 127.45, 126.30-126.75 zone and ranges 126.00 and 125.00. Resistances are situated on the ranges of 130.00-130.35 and 131.00-131.25. An try to designate the following targets of the bulls will somewhat be like fortune telling. The one factor that may be assumed is that they’ll set the January 01, 2002 excessive of 135.19 as their objective. If the pair’s progress charge is maintained, it might attain this top as early as in June.

● No necessary data relating to the state of the Japanese financial system is anticipated to be launched this week. Merchants additionally want to bear in mind the 2 upcoming holidays: Japan celebrates Structure Day on Tuesday, Might 03, and the Greenery Day on Wednesday Might 04.

CRYPTOCURRENCIES: Tendencies, Forecasts and Hollywood

● Bitcoin has been shifting alongside the Pivot Level round $40,000 all through 2022, attempting to both attain $50,000 or fall to $30,000. The struggle between bulls and bears continued final week as effectively. Wanting on the chart of the BTC/USD pair, it’s clear that the bears have had a transparent benefit over the previous 5 weeks. Bulls, after all, are making makes an attempt to show the tide, however no success is but to be seen.

● On the time of writing, Friday night, April 29, the full crypto market capitalization remains to be under the necessary psychological degree of $2 trillion: at $1.752 trillion ($1.850 trillion per week in the past). The Crypto Concern & Greed Index has barely worsened its readings: it has dropped from 26 to 23 factors and has returned from the Concern zone to the Excessive Concern zone. The BTC/USD pair is buying and selling round $38,700.

● The correlation of the flagship cryptocurrency with inventory indices such because the S&P500 and Nasdaq Composite remains to be very sturdy. The correction in US tech corporations started late final 12 months, and most of the business’s shares are presently buying and selling 50-70% under their highs. Buyers, anticipating a pointy rise in rates of interest by the Fed, switched to the US greenback, shedding their urge for food for threat belongings, which hit the inventory and cryptocurrency markets. The excessive threat of stagflation in lots of developed international locations, the brand new coronavirus outbreak in China, the escalation of the armed battle between Russia and Ukraine, and different processes affecting the worldwide financial system don’t add optimism. So, there are lots of possibilities for bitcoin to go all the way down to $30,000 per coin.

● In keeping with dealer and analyst Tony Weiss, the principle cryptocurrency has damaged help ranges, so the dangers of one other large fall are excessive. The coin wants to carry round $39,500 for this to not occur.

Cryptocurrency dealer nicknamed Kaleo additionally believes that bitcoin has not but reached the extent that may be thought of a backside with confidence. In keeping with him, the cryptocurrency is getting ready to retest the lows final seen in mid-2021. (Recall that the BTC/USD pair discovered a backside at $29.066 on June 22, 2021). Bitcoin is presently inside an enormous wedge sample and in response to Kaleo, it will likely be damaged within the coming weeks, with the asset itself anticipated to fall by about 28%. As well as, the knowledgeable warned that even when we see a bounce above $41,000, it won’t change the state of affairs a lot.

● Analyst Kevin Swenson has urged a solution to precisely predict development reversals. In keeping with him, it’s crucial to observe the weekly quantity of bitcoins on the Coinbase crypto change. This indicator has appropriately pointed for Swenson to the value peaks and backside of bitcoin since 2017. Swenson famous that traders must see a big improve in quantity after the correction to be fully certain of a backside: “There’s a small probability that giant volumes will probably be noticed when the speed bounces. It takes time to kind a bullish development. The bulls work collectively to lift the value, whereas the bear is normally alone.”

● However, regardless of the present bearish development, not all the pieces is so unhappy. The worth of bitcoin could attain $65,185 by the top of 2022. This forecast was given by monetary consultants interviewed by Finder. In keeping with them, bitcoin will price $179,280 on December 31, 2025, and $420,240 on the finish of 2030. Greater than two-thirds of these surveyed imagine that now could be the time to purchase the primary cryptocurrency. Solely 9% have been in favor of exiting the asset.

87% of respondents included ethereum within the record of the best cryptocurrencies. Bitcoin was in second place with 71%. Half of the consultants imagine that bitcoin will probably be finally displaced from the place of the preferred cryptocurrency by a extra superior blockchain, 38% are certain that digital gold will keep on the throne.

● Recall that giving a long-term forecast, the top of ARK Make investments, Katherine Wooden, and CEO of MicroStrategy, Michael Saylor, expressed the opinion that the flagship cryptocurrency will certainly attain the value mark of $1 million. In keeping with them, this can occur nearer to 2030.

The identical determine of $1 million was voiced by one other specialist, Jason Pizzino final week, who defined underneath what circumstances the coin will attain this mark. To do that, firstly, the flagship cryptocurrency must get rid from the dependence on the Nasdaq index. If this dependence continues, bitcoin and ethereum will lose worth. As well as, it is vital for bitcoin to cease associating itself with the blockchain. This cryptocurrency have to be extra like gold than a part of the know-how sector with the intention to turn into a world reserve asset.

Pizzino emphasised that the expansion within the worth of the flagship cryptocurrency by 25 occasions appears improbable in the meanwhile. Nevertheless, the asset value elevated 22 occasions between December 2018 and November 2021, so nothing is inconceivable in such a rally.

● Chainalysis consultants not directly confirmed Jason Pizzino’s bullish sentiment. In keeping with them, crypto traders earned $162.7 billion in 2021, which is 400% greater than within the earlier 12 months, 2020 ($32.5 billion). This occurred as a result of the costs of the 2 essential cryptocurrencies, bitcoin and ethereum, rose to report ranges. At $76.3 billion, ethereum outperformed bitcoin, which introduced in $74.7 billion to traders. American traders earned essentially the most, making a revenue of $47 billion, which is greater than their colleagues from the UK, Germany, Japan and China. By comparability, British savers earned “solely” $8.2 billion.

● And on the finish of the overview, some information from the world … of books and flicks. Firstly, the movie firm Scott Free Productions intends to movie the e book The Infinite Machine, devoted to ethereum and Vitalik Buterin. It was written by Camilla Russo, a widely known journalist within the crypto business. The film will probably be co-produced by such a Hollywood luminary as Ridley Scott, identified for his work on the blockbusters Alien, Gladiator, Blade Runner and The Martian.

One other newsmaker of the week was former stockbroker Jordan Belfort. Recall that this American entrepreneur pleaded responsible to inventory market fraud and inventory scams in 1999, for which he served 22 months in jail. He printed a memoir in 2007, The Wolf of Wall Road, which was tailored into a movie of the identical identify in 2013. And now this monetary “wolf” admitted that he himself was lately robbed of about $300,000 price of crypto belongings. He noticed the switch of funds, however couldn’t cancel the transaction. The irony of destiny…

NordFX Analytical Group

Discover: These supplies are usually not funding suggestions or pointers for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx