Run Lola Run! It is Groundhogs’ Day All Over Once more

For the second week in a row, the main U.S. inventory indexes gave the impression to be on the verge of an total acquire at midweek, solely to finish up unfavorable after declining on Thursday and Friday. Indexes fell practically 2%, as traders learn infinite evaluation on the constructing pressure on the Russia-Ukraine border.

In case you are feeling like Franka Potente making an attempt to outrun the mob, or Tom Cruise in Dwell. Die. Repeat. battling alien invaders every week, there’s excellent news… this is not a lesson in metaphysical time loop sci-fi, it is simply investing! You might be accountable for your portfolio, and you may take motion to alleviate this irritating cycle.

GoNoGo Charts have highlighted the S&P 500 in a “NoGo” development for many of 2022. Right this moment’s problem of Flight Path from GoNoGo Analysis will cowl a number of various funding arenas to think about.

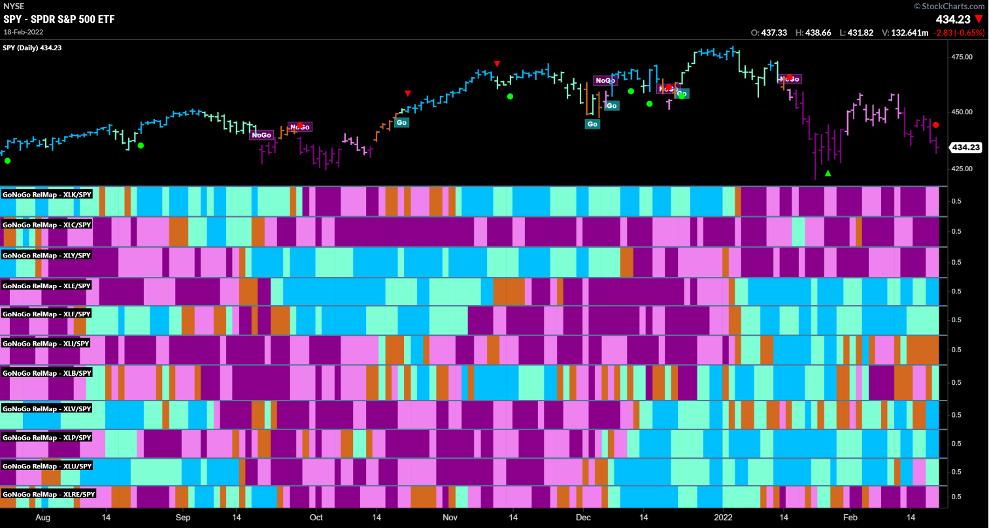

GoNoGo RelMap: S&P Sector Relative Efficiency

Ten of the 11 S&P 500 sectors ended final week in unfavorable territory. The sometimes defensive Shopper Staples sector, $XLP, outperformed throughout the S&P 500 Index. Gaining over 1% final week, the sector was fueled by features in Walmart $WMT and Procter & Gamble $PG – each countertrend rallies inside “NoGo” situations. A steep decline in Meta Platforms $FB (Fb) weighed closely on the Communication Providers sector.

- 6 sectors outperformed the broad S&P 500 Index to finish this week

- Power $XLE, Financials $XLF, and Shopper Staples $XLP maintained their constant “Go” tendencies

- Supplies $XLB, Healthcare $XLV, and Utilities $XLU gained “Go” development situations relative to the S&P 500 final week

- Your prime three panels: Know-how $XLK, Communications $XLC, and Shopper Discretionary $XLY all stay in “NoGo” tendencies

- The Power sector $XLE, whereas nonetheless in a “Go” development was the laggard final week with a -3.7% decline. Oil costs briefly fell beneath $90 per barrel dropping 2% final week amid stories indicating {that a} nuclear settlement with Iran was inside attain: doubtlessly resulting in a rise in international provide.

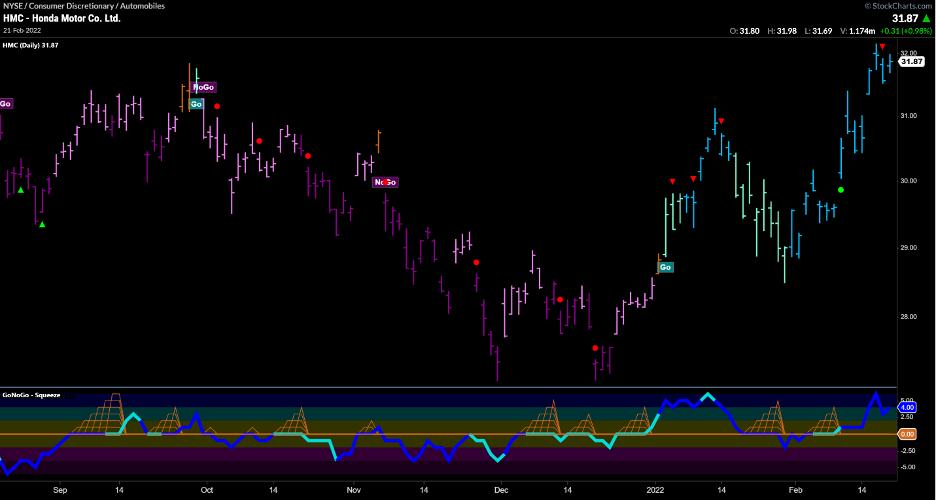

Work from Dwelling, Store from Dwelling

On Wednesday, U.S. retail gross sales knowledge for January got here in effectively forward of expectations, regardless of omicron worries. The headline determine was up 3.8% month-over-month; outpacing consensus forecasts of 1.9% and sharply above final month’s studying of -2.5%. The features have been pushed by notable will increase in on-line gross sales (non-store), furnishings gross sales and a rebound in auto gross sales, which have been up probably the most in 10 months.

Under is a chart of Honda Motor Firm $HMC in a robust “Go” development. Discover that GoNoGo Oscillator confirms the value rally with optimistic momentum on heavy relative quantity:

This strong retail gross sales report displays a comparatively wholesome U.S. client and, maybe, some waning impacts from the omicron variant in direction of the tip of the month. Wall St. analysts see potential for reopening demand to stay strong within the spring and summer season months forward, significantly if virus tendencies proceed to enhance.

A Pause within the Gushing Oil Rally

An eight-week rally that pushed U.S. crude oil costs from round $70 per barrel to as excessive as $95 light barely final week, as the value retreated to round $92 on Friday. The potential for added oil exports from Iran helped to offset issues associated to produce disruptions stemming from the persevering with Russia-Ukraine battle. The day by day chart of $USO beneath suggests this development has the potential to proceed, because it stays in a “Go” development on weaker aqua bars. The countertrend correction arrow signaled the waning momentum proven in GoNoGo Oscillator, which fell from excessive overbought to the zero-line. We’ll watch this week to see if the oscillator finds help at impartial or breaks all the way down to oversold ranges.

Energizer Commerce – Lithium

Sociedad Química y Minera de Chile $SQM is a Chilean chemical firm and a provider of plant vitamins, iodine, lithium and industrial chemical compounds. It’s the world’s largest lithium producer. SQM’s pure assets and its essential manufacturing services are situated within the Atacama Desert within the Tarapacá area. Take a look at this quarterly chart of $SQM going again to the mid-Nineties:

What’s fascinating about these shares is that on each timeframe – quarterly, month-to-month, weekly and day by day – the inventory is in a “Go” development. Notably, the quarterly and month-to-month charts are poised to lock in all-time closing highs. That’s bullish.

In the event you watched the Tremendous Bowl, primarily for the artistic genius within the commercials (as we did), you will have seen each main auto producer is releasing new electrical automobiles. The demand for lithium in every of these batteries might drive worth motion for lithium miners quicker than Arnold might drive that new electrical truck!

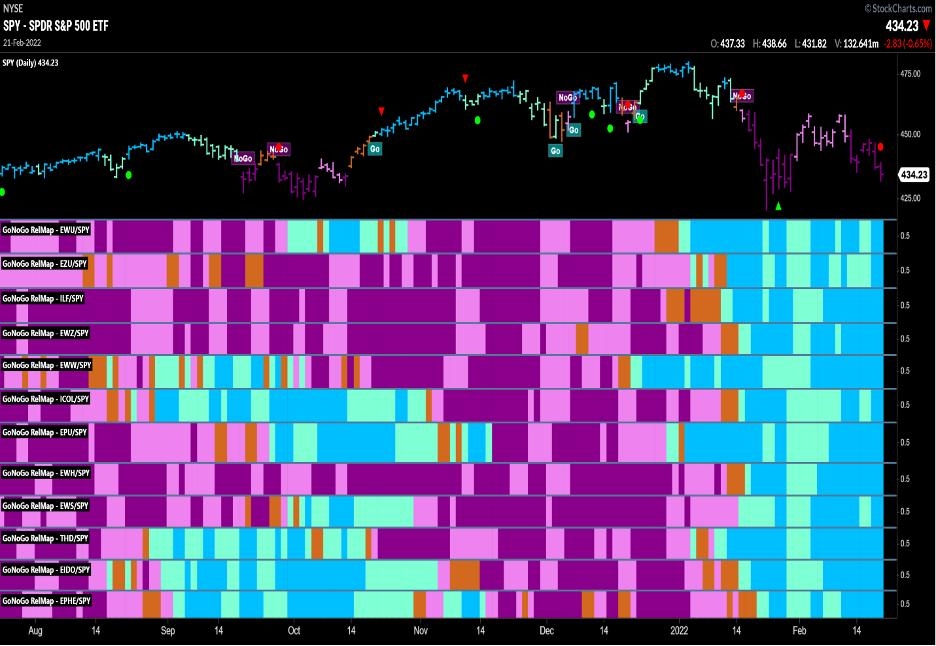

Rising Markets (simply not China)

Behavioral economists have studied how traders over-allocate to their native inventory market. For Canadians, that is understanding nice, eh? However American traders have been rewarded so closely for his or her home-country bias all through this cycle that we might have forgotten the extensive world of equities on distant shores. Because the charts beneath will present, relative and absolute alternatives exist for tendencies in international equities. Think about this weekly relative ratio chart of Rising Markets (excluding China) vs the S&P. The numerous downtrend for the reason that begin of 2021 has made this house undesirable, however, as development followers, we should see the break of trendline resistance in 2022. GoNoGo Pattern has shifted from a weak “NoGo” to impartial amber final week because the GoNoGo Oscillator broke optimistic for the primary time in a yr on heavy quantity:

Under is one other approach to have a look at relative energy throughout international fairness markets. A GoNoGo RelMap of ETFs in opposition to the S&P 500 reveals that the U.Okay, the Eurozone, Latin America’s prime 40, Brasil, Mexico, Colombia, Peru, Hong Kong, Singapore, Thailand, Indonesia and the Philippines are all outperforming the US Fairness market on a day by day development foundation. Much more importantly, these relative tendencies have strengthened throughout the board into the extra bullish blue “Go” situations.

US markets have been closed in observance of Presidents Day at this time, February twenty first. Think about a substitute for waking up tomorrow and repeating the cycle of the final two weeks. As development followers, we wish to “fish the place the fish are.” Proper now, each absolute and relative tendencies counsel that the grass may very well be greener in different pastures.

Alex Cole & Tyler Wooden

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and knowledge visualization groups, directing each enterprise technique and product growth of analytics instruments for funding professionals. Alex has created and carried out coaching packages for giant companies and for personal shoppers. His educating covers a large breadth of Technical Evaluation topics from introductory to superior buying and selling methods.

Be taught Extra

Tyler Wooden is the Chief Working Officer of GoNoGo Charts and a seasoned enterprise govt who has led the operational and enterprise growth actions of groups massive and small. As an govt supervisor over the previous 20 years, he constructed and introduced merchandise to market within the academic know-how house and monetary companies business. Because the Managing Director of the CMT Affiliation for over a decade, Tyler has offered the instruments of technical evaluation all over the world to funding corporations, regulators, exchanges, and broker-dealers. Galvanizing distributors, volunteers, and demanding stakeholders round a typical imaginative and prescient, Tyler designed and carried out insurance policies and programming that raised the requirements for skilled technical evaluation worldwide.

Be taught Extra