Worth actions in a worth chart is the results of what thousands and thousands of merchants all over the world consider the honest worth of a buying and selling instrument is. Some merchants consider that worth is low and must be going up, then they’d hit the purchase button. Others see worth being to excessive and will go down, then they’d provoke a protracted commerce. All these cumulative actions coming from thousands and thousands of merchants and market contributors trigger worth to maneuver. When summed up collectively, it turns into the present worth of a buying and selling instrument. Within the case of foreign exchange currencies, it turns into the present alternate fee of a foreign exchange pair.

As a result of merchants have the facility to both purchase or promote a forex, some merchants would attempt to predict worth actions. As quickly as they hit that purchase or promote button, some would suppose that they might will worth to maneuver in a sure route based mostly on their assumptions. Nevertheless, that isn’t the case in foreign currency trading. The market is simply too huge to be moved by a single dealer. One lot measurement couldn’t transfer a market sufficient to create an impression. Retail merchants don’t have any energy to maneuver the market.

As a substitute of hoping to maneuver the market, we should always glide based mostly on what the market needs to do. We observe a chart, create assumptions of the place worth goes, and glide.

Fisher Momentum Shift Foreign exchange Buying and selling Technique systematically permits merchants to enter a commerce based mostly on the place the market is shifting. It permits merchants to comply with worth actions based mostly on worth motion and with the affirmation of indicators.

Fisher Indicator

The Fisher indicator is a development following technical indicator developed to assist merchants anticipate the route of worth actions. It helps merchants establish development route bias and attainable development reversal factors.

The Fisher indicator is an oscillating indicator that converts historic worth knowledge right into a Gaussian regular distribution. This permits merchants to establish excessive worth actions which have a excessive chance to reverse based mostly on a traditional distribution of worth fluctuations. It helps merchants establish potential development reversal factors because the Fisher indicator additionally tends to indicate attainable development reversals as worth strikes to an excessive level.

This model of the Fisher indicator is plotted as histogram bars. Constructive lime bars point out a bullish development bias, whereas damaging pink bars point out a bearish development bias. This permits merchants to establish attainable development reversals which they might use as an entry sign. Sections on the Fisher indicator window with lengthy streaks of bullish or bearish bars is also used to establish a development bias. Merchants may use this info to filter out trades that aren’t consistent with the development.

Exponential Transferring Common

Transferring averages are a staple technical indicator that many merchants use in a buying and selling technique. It is because shifting averages are likely to work extraordinarily nicely in figuring out development route.

Transferring averages can be utilized in numerous methods. Merchants may establish development route based mostly on the slope of the shifting common line or the situation of worth motion in relation to the shifting common line. Merchants may establish attainable development reversals based mostly on crossovers of shifting averages or a shifting common and worth. Some merchants additionally use shifting averages as a foundation for imply reversal trades, taking entries every time worth is simply too removed from a shifting common.

Though shifting averages are glorious instruments for buying and selling, it has its setbacks. Most shifting averages are both too lagging or too susceptible to risky uneven markets.

The Exponential Transferring Common (EMA) was developed with a purpose to deal with this. It’s computed by incorporating the earlier EMA with a purpose to smoothen out the shifting common line. The result’s a shifting common line that may be very responsive to cost actions and can also be smoothened out making it much less vulnerable to market noise.

Buying and selling Technique

This buying and selling technique is a development reversal technique based mostly on the crossover of worth and a 20-period Exponential Transferring Common (EMA). Nevertheless, it shouldn’t be used as a standalone entry sign with out confluence with different elements.

Commerce indicators must be filtered based mostly on the development bias coming from the Fisher indicator. The Fisher indicator would normally reverse forward of a legitimate commerce sign if worth has been in an excessive situation previous to the reversal.

Worth motion and candlestick patterns must also be thought of previous to taking a commerce. This might both be congestions or reversal patterns. Lastly, a momentum candle indicating the route of the development reversal ought to affirm the commerce setup.

Indicators:

Most popular Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and every day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

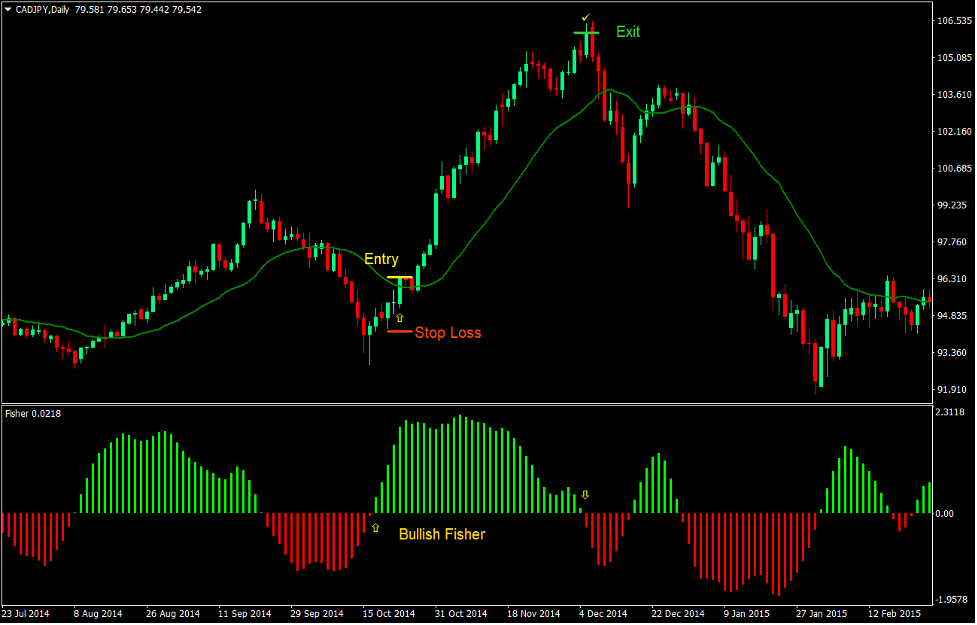

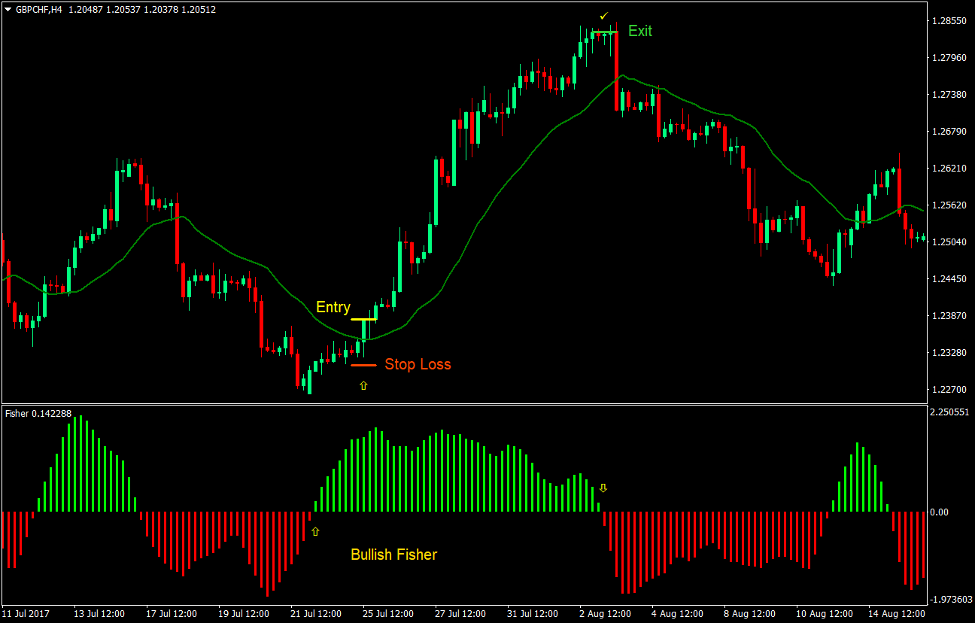

Purchase Commerce Setup

Entry

- Worth ought to create a bullish reversal patterns or must be in a market congestion section.

- The Fisher indicator ought to shift to constructive lime bars.

- A bullish momentum candle ought to cross and shut strongly above the 20 EMA line.

- Enter a purchase order upon the affirmation of the situations above.

Cease Loss

- Set the cease loss on the fractal beneath the entry candle.

Exit

- Shut the commerce as quickly because the Fisher indicator shifts to damaging pink.

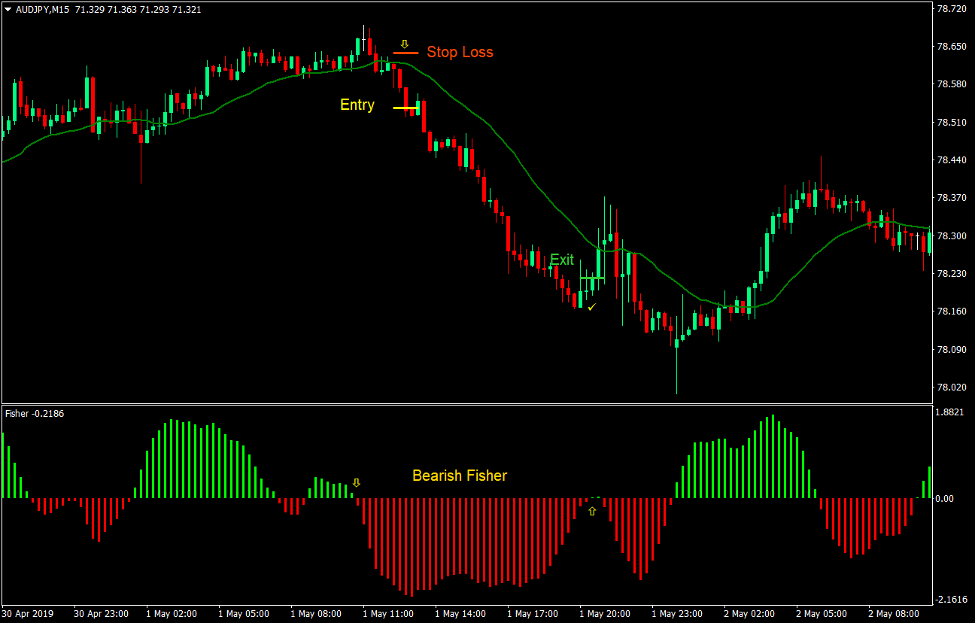

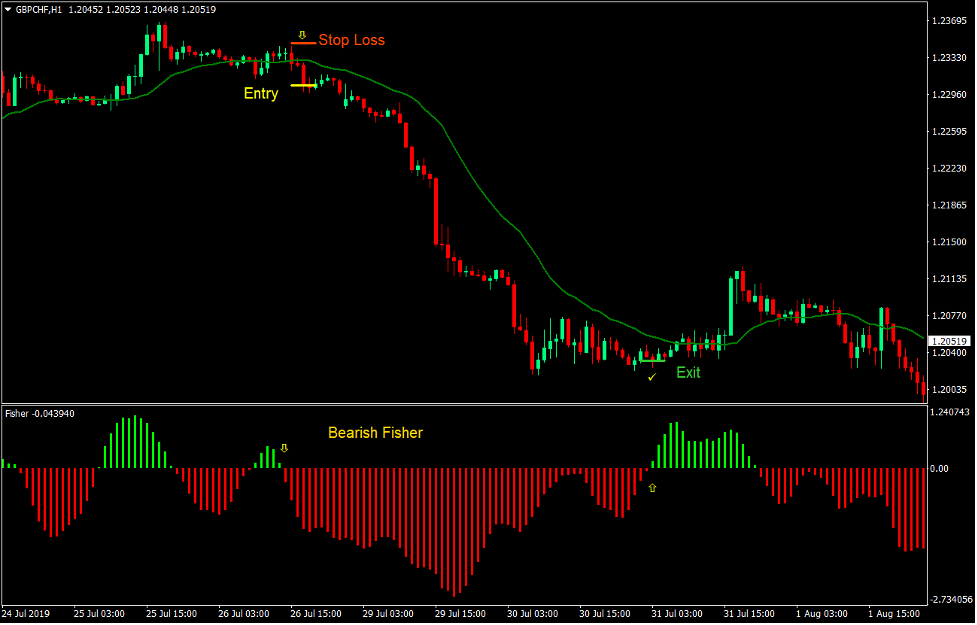

Promote Commerce Setup

Entry

- Worth ought to create a bearish reversal patterns or must be in a market congestion section.

- The Fisher indicator ought to shift to damaging pink bars.

- A bearish momentum candle ought to cross and shut strongly beneath the 20 EMA line.

- Enter a promote order upon the affirmation of the situations above.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly because the Fisher indicator shifts to constructive lime.

Conclusion

This buying and selling technique is a working buying and selling technique that ought to enable merchants to persistently revenue from the foreign exchange market. Nevertheless, it must also not be used blindly taking any sign that crosses over. As a substitute, merchants ought to use this to substantiate a development reversal coming from an space the place worth may attainable reverse. Merchants must also take into account worth motion patterns when getting into commerce setups.

Foreign exchange Buying and selling Methods Set up Directions

Fisher Momentum Shift Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the accrued historical past knowledge and buying and selling indicators.

Fisher Momentum Shift Foreign exchange Buying and selling Technique offers a chance to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and regulate this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

How one can set up Fisher Momentum Shift Foreign exchange Buying and selling Technique?

- Obtain Fisher Momentum Shift Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Fisher Momentum Shift Foreign exchange Buying and selling Technique

- You will note Fisher Momentum Shift Foreign exchange Buying and selling Technique is obtainable in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: