The Financial institution of England has warned that the UK economic system will slide into recession this yr as increased vitality costs push inflation above 10 per cent, a forecast that pushed sterling to a two-year low.

Regardless of forecasting a extreme fall in family incomes, the financial institution’s Financial Coverage Committee voted on Thursday to squeeze them additional, elevating the primary rate of interest by a quarter-point to 1 per cent, its highest stage since February 2009.

Three of the 9 MPC members voted for a half-point charge improve.

The grim financial forecast took its toll on sterling. The pound was down virtually 2 per cent towards the greenback at $1.2383 in early afternoon buying and selling. And with rates of interest not anticipated to rise as quick as beforehand, the federal government’s value of borrowing over two years, a value that’s extremely delicate to financial coverage expectations, tumbled 0.25 share factors to 1.37 per cent.

The MPC stated it was “unable to forestall” UK households from changing into worse off and its position was to make sure inflation got here all the way down to its 2 per cent goal sustainably within the medium time period.

Andrew Bailey, BoE governor, stated there can be a “very sharp slowdown” and he understood that increased vitality costs and borrowing prices would damage. “I recognise the hardship that this may trigger,” he stated, blaming many of the ache on vitality costs slightly than increased borrowing prices.

The message from the central financial institution was much less aggressive on future rate of interest rises than monetary markets had anticipated.

Seven MPC members signed as much as a press release that stated: “A point of additional tightening in financial coverage may nonetheless be applicable within the coming months.” Two members of the committee thought the approaching financial difficulties can be ample to drive out inflation and this steerage that rates of interest wanted to rise additional “was not applicable”.

The committee additionally determined to not begin month-to-month gross sales of the £875bn of property that the BoE constructed up below its quantitative easing programmes since 2009, preferring as a substitute to “work on a method for UK authorities bond gross sales” that may begin on the earliest after August.

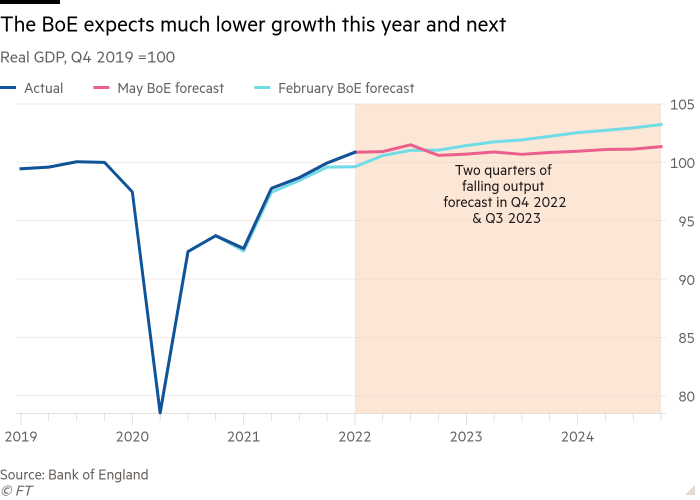

In contrast to the US Federal Reserve, the BoE was not assured it might engineer a comfortable touchdown for the economic system. As an alternative, unusually gloomy BoE forecasts predicted the economic system would contract 1 per cent within the fourth quarter of this yr after fuel and electrical energy prices rose one other 40 per cent in October.

It stated these rises in vitality payments had been more likely to push inflation as much as 10.2 per cent within the fourth quarter of 2022, the best in 40 years and slash actual family incomes as a result of wages wouldn’t hold tempo.

One other dip in GDP was probably within the third quarter of 2023, the BoE added, when the federal government’s momentary incentives for enterprise funding ended, leaving the economic system 0.8 per cent smaller than in the summertime of 2022.

Unemployment, it stated, would rise from 3.8 per cent to five.5 per cent by 2025 and this might assist reasonable wage claims and convey down inflation.

Thereafter, the MPC now expects the UK economic system to get well solely weakly from the approaching recession, suggesting that the economic system couldn’t face up to progress of rather more than 0.6 per cent a yr with out inflation taking off once more.

The three dissenting MPC members — Jonathan Haskel, Catherine Mann and Michael Saunders — fearful that persistent excessive inflation can be troublesome to eradicate. Within the minutes, they known as for a half level rate of interest rise to forestall “latest traits in pay progress, companies’ pricing methods and inflation expectations within the economic system extra extensively [becoming] extra firmly embedded”.

Karen Ward, a markets strategist at JPMorgan Asset Administration, stated that general the BoE had confronted a troublesome resolution and had revealed a transparent intent to drive down inflation regardless of its depressing forecast.

“Immediately’s unanimous vote to boost rates of interest suggests inflation issues dominated the assembly and certainly three members voted for a bigger half level hike,” she stated.

“The mix of the pandemic and Brexit has modified the basics of the UK economic system — notably its potential to generate persistent inflation. The financial institution should hold elevating charges to deliver inflation down, however a gradual method, as taken right this moment, is comprehensible,” Ward added.

Extra reporting by Tommy Stubbington