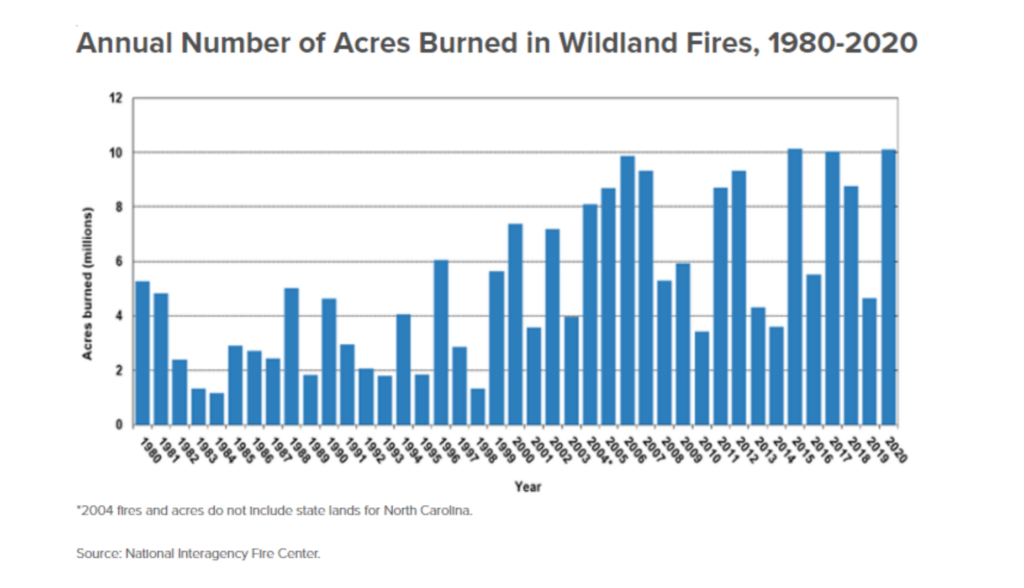

The world is getting hotter and drier, making the incidence of wildfires extra frequent. In accordance with the Insurance coverage Data Institute, the annual variety of acres burned in wildland fires has greater than doubled within the final 20 years.

Different vital components reminiscent of inhabitants development on the wildland-urban interface and inadequate or inappropriate administration of state, federal and privately owned forests exacerbate the rising danger.

Because the state of affairs worsens, insurance coverage premiums will are likely to rise to some extent the place they may not be inexpensive. In some areas, protection is perhaps pulled altogether. It will widen a “safety hole” of uninsured disaster losses that Swiss Re at present estimates at $1.2 trillion (about 75 % of complete financial losses).

Some companies are being particularly affected. Ski resorts and wineries, for example, are sometimes surrounded by bushes and crops, and are notably susceptible to direct and oblique impacts of wildfire.

Though there is no such thing as a easy resolution, innovation within the type of parametric danger switch helps the private and non-private sector discover new choices to enhance their conventional indemnity protection within the face of an evolving local weather.

Why parametric danger switch is an effective choice for wildfire protection

Parametric options depend on measurements of the occasion’s depth and site as a way to decide payouts. A coverage will be designed, for example, in order that it pays a pre-agreed quantity relying on the wildfire footprint reaching sure areas.

Whereas injury from a tropical cyclone can fluctuate dramatically from slight to finish relying on myriad components, injury from wildfire tends to be binary: If the fireplace footprint reaches a selected asset, the asset will doubtless be fully misplaced. Due to this fact, wildfire lends itself properly to parametric therapy because the hazard location largely determines the loss end result.

Distant sensing approaches to offer the sort of data have superior considerably over the last many years due to extra quite a few satellites and higher instrumentation. With these capabilities inside attain, (re)insurance coverage firms are growing parametric contracts that depend on measurements which might be usually public, free and made accessible in near-real time, reminiscent of these offered by NASA’s Fireplace Data for Useful resource Administration System.

Susceptible infrastructure reminiscent of highways, entry factors and even parts of the forest itself will be protected through a parametric coverage.

Most of the time, direct damages are much less regarding than monetary damages incurred by the interruption of operations. Mountain resorts and resorts are a working example. Parametric insurance coverage can be utilized by these companies to enhance their conventional protection with a software akin to a hedge. Susceptible infrastructure reminiscent of highways, entry factors and even parts of the forest itself will be protected through a parametric coverage that responds promptly if a wildfire impacts them, inflicting direct or oblique monetary loss to the corporate.

Parametric innovation brings extra capability

Longstanding and well-established insurance coverage carriers in addition to new (re)insurance coverage firms and capital markets can provide protection on a parametric foundation enlarging the full capability accessible. Differentiation in pricing and danger urge for food is pushed primarily by the capital suppliers’ view of the frequency of wildfire at a selected location.

Lately, we have now seen the looks of fashions that use quite a lot of information sources and strategies that classical approaches ignore. New fashions account for burned areas with replace cycles which might be rather more frequent than the multi-year mannequin launch schedule we usually see within the business. This permits for extra correct and dynamic pricing of parametric options.

Differentiation of markets that use these new modeling capabilities resides in having the ability to establish areas the place their perceived danger is decrease than what the broader market suggests. Their worth proposition consists of “carving out” swathes of exposures or zones that almost all insurance coverage carriers would possibly discard however that they imagine they will underwrite at an inexpensive premium.

As parametric options don’t require complicated and expensive loss adjustment operations, the barrier to entry is decrease for newcomers to the area. Decrease prices, coupled with improvements in distant sensing and modeling, may have the impact of bringing new capability to enhance current conventional insurance coverage availability.

A endless season of smoke

Companies and communities have lately woke up to the exacerbated menace of direct lack of property attributable to wildfires. Whereas the direct hearth injury stays a problem of quick concern, yet one more peril looms on the horizon: that of elevated direct and oblique losses attributable to wildfire smoke.

The U.S. West Coast used to expertise smoke within the air from October to Could attributable to residential wooden stoves within the winter, burning of wooden particles within the fall and spring and different agricultural or prescribed fires. Industrial operations had been the only vital supply of smoke that continued all year long. Nonetheless, these days, frequent wildfires have added a second supply of smoke throughout an more and more lengthy summer time season compounding what one may name a endless season of smoke, which extends from January to December.

Simply as we’re seeing for direct wildfire danger, the necessity for capability to cowl smoke-related damages will enhance.

The air we breathe accommodates particles reminiscent of mud, pollen and mildew, known as PM10 or particulate matter of 10 microns or much less in diameter. The unfinished combustion of natural compounds that happens throughout wildfires provides to the air tinier PM2.5 particles of two.5 microns in diameter or much less. Being smaller and lighter, these particles journey additional, affecting a higher swath of the inhabitants. They’re of most concern from a well being perspective as a result of their measurement permits them to enter our respiratory tract deep into our lungs, the place they will trigger a spread of medical circumstances, from decreased lung perform to cardiac arrhythmias or coronary heart assaults.

Winegrowers in wildfire-prone areas have needed to take care of the elevated potential of seeing their vineyards and amenities burn however have additionally wrestled with smoke affecting the standard of their grapes. Possibly extra far reaching is the potential affect to employees compensation schemes for firms whose operations naturally expose employees to extra hours open air.

Simply as we’re seeing for direct wildfire danger, the necessity for capability to cowl smoke-related damages will enhance. Parametric options are poised to emerge as choices to offer further protection options on this realm, presumably utilizing instrumental networks just like these already current within the citizen scientist group.

Parametric options and community-based insurance coverage

Whereas a altering local weather continues to current insurance coverage protection challenges, Man Carpenter is advancing the idea of “Neighborhood-Primarily based Disaster Insurance coverage,” an instance of public-private partnership to draw insurers to supply inexpensive safety for communities in danger. A mechanism offering credit for no- or low-losses creates an incentive for mitigation adoption. Mitigation measures, in flip, will be well-accommodated by parametric options, for example, by excluding buffer zones with low danger of wildfire, which additional reduces the premium.

As communities and companies advance of their efforts to guard themselves, parametric choices that pay quick and assist offset any sources of loss will more and more provide extra choices to enhance conventional insurance coverage options.