The euro continues to please its consumers at this time, having strengthened once more at first of at this time’s European session, which can’t be mentioned in regards to the pound. Quite the opposite, it fell sharply after the publication (at 08:30 GMT) of the Buying Managers’ Index (PMI). In keeping with the Royal Institute of Buying and Provide, manufacturing PMI (from Markit Economics) fell to 54.6 in Might from 55.8 in April. The PMI index for the companies sector fell to 51.8 in Might from 58.9 in April. The forecasts have been 55.1 and 57.0, respectively.

Values above 50 point out a rise in exercise. Nonetheless, the relative decline in efficiency turned out to be a unfavorable issue for the pound. The revealed knowledge “recommend that the financial system is slowing down as inflationary pressures have risen to unprecedented ranges,” S&P economists mentioned.

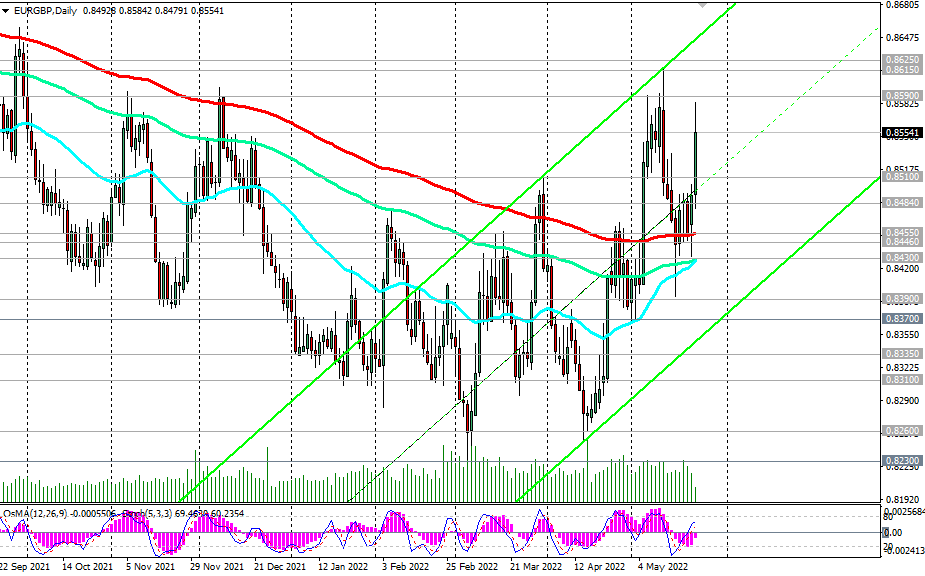

On account of the coincidence of overlapping components, EUR/GBP rose sharply at this time at first of the European session, reaching 0.8584, which is 91 factors increased than the opening worth of at this time’s buying and selling day (we wrote in regards to the options of buying and selling this forex pair in our evaluation for 04/20/2022), once more heading in direction of the important thing resistance degree 0.8625, separating the long-term bull market from the bear market (for extra particulars, see “EUR / GBP: technical evaluation and buying and selling suggestions for 05/24/2022“).

Christine Lagarde will ship her speech once more at this time at 18:00 (GMT) as a part of occasions associated to the Worldwide Financial Discussion board in Davos. Throughout the speech of the pinnacle of the ECB, the volatility of buying and selling will increase not solely within the euro and European inventory indices, but additionally in your complete monetary market, particularly if Christine Lagarde touches with reference to the financial coverage of the Central Financial institution. New statements on the subject of curbing the QE program and elevating charges within the Eurozone might trigger a brand new development of the euro. If Christine Lagarde doesn’t contact with reference to the ECB’s financial coverage, then the response to her speech will probably be weak.

Help ranges: 0.8550 0.8510 0.8484 0.8455 0.8446 0.8430 0.8400 0.8390 0.8370 0.8335 0.8310 0.8260 0.8230 0.8200 0.8145

Resistance ranges: 0.8585, 0.8590, 0.8600, 0.8615, 0.8625

**) Get no deposit StartUp bonus as much as 1500.00 USD

Supply: InstaForex