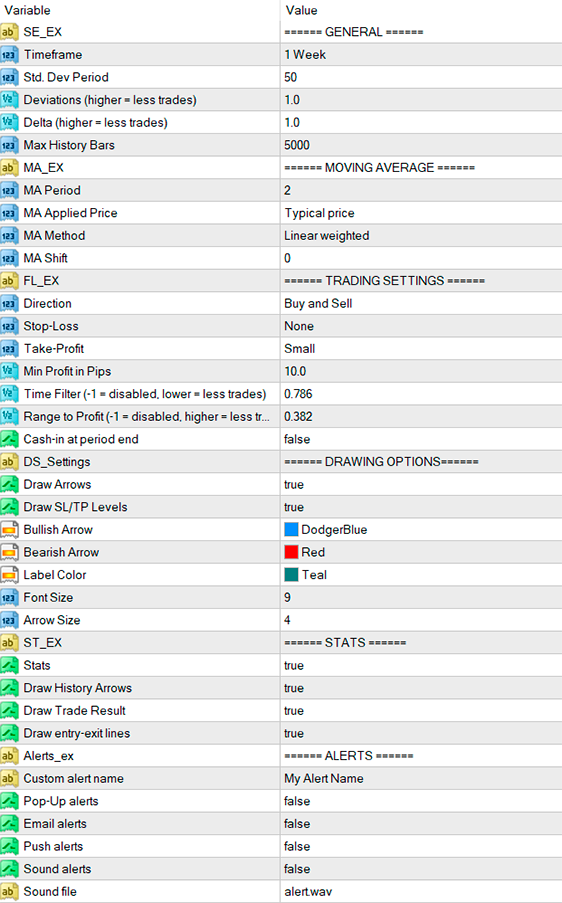

- Timeframe: The timeframe from which the transferring common (imply) is calculated. It have to be the next timeframe from the present chart.

- Std. Dev Interval: The commonplace deviation interval to calculate the standard worth band across the imply.

- Deviations: The multiplier of the standard worth band. The next worth will create a wider worth band and reduce the buying and selling frequency. In some circumstances, it will probably make sense to lower it, as an illustration, if you’re buying and selling lengthy trades solely in opposition to a transferring common calculated utilizing low costs solely.

- Delta: Represents the multiplier for the pattern channel calculated from the next timeframe. A decrease worth will improve the buying and selling frequency.

- Max Historical past Bars: The quantity of previous bars analyzed when the indicator hundreds. A decrease worth will lower the load time.

- MA Interval: The transferring common interval used to calculate the imply.

- MA Utilized Value: The value utilized for the transferring common.

- MA Methodology: The transferring common methodology used for the transferring common.

- MA Shift: The shift of the transferring common used as a imply.

- Course: This parameter lets you discover solely lengthy trades, quick trades or each. This may be helpful relying in your market evaluation or the transferring common utilized worth chosen. As an example, you may commerce purchase solely in opposition to a transferring common calculated utilizing low costs, or promote solely in opposition to a transferring common calculated utilizing excessive costs solely.

- Cease-Loss: The indicator can plot an elective stop-loss, which may be “tight” or “regular”. For imply reversion, stop-losses are often not used and as a substitute, losses are accepted when the value returns to the standard worth band or the imply.

- Take-Revenue: The indicator plots a take-profit, which may be “small”, “common” or “giant”. Every represents a distinct worth level of the standard worth band.

- Min Revenue in Pips: The indicator will filter out any trades that provide a revenue in pips under this worth. Helpful for buying and selling small timeframes.

- Time Filter: The indicator can filter out trades that haven’t any or little likelihood of reverting to the imply through the subsequent few bars. It does so by calculating the standard worth motion per bar within the reference interval. The next worth will produce extra trades and a decrease worth will discard extra trades. To disable this characteristic, enter “-1”.

- Vary to Revenue: The vary to revenue ratio compares the revenue goal of a a possible commerce in opposition to the distante to the best/lowest of the day. The next worth will produce much less however extra worthwhile trades. If the stop-loss characteristic just isn’t in use, it is sensible to disable this filter by typing “-1” as its worth.

- Money-in at interval finish: The indicator can shut trades, at any revenue, earlier than the interval ends. If enabled, this characteristic will lower the variance within the buying and selling outcomes.

- Draw Arrows: Allow or disable the sign arrows within the chart.

- Draw SL/TP Ranges: Show or disguise the SL and TP ranges within the chart.

- Stats: Carry out and fisplay self-analyzing statistics on the chart.

- Draw Historical past Arrows: Show tester-like entry-exit arrows within the chart. Seen solely in bar charts.

- Draw Commerce Outcomes: Show commerce end in pips for all previous alerts.

- Draw Entry-Exit Strains: Join entry-exit factors with strains, tester-like.

- Alerts: Allow or disable alerts of every kind.