Options:

Discover these engulfing patterns:

- Easy Engulf

- Stick Sandwich Engulf

- Three Line Strike

- Rising Three

- Morning Star Doji

Scanner is helpful to make your technique higher. Do not at all times go by Win/Loss share. As a result of this device shouldn’t be primarily based on previous outcomes.

Scanner accessible right here:

https://abiroid.com/product/engulfing-candles-price-action

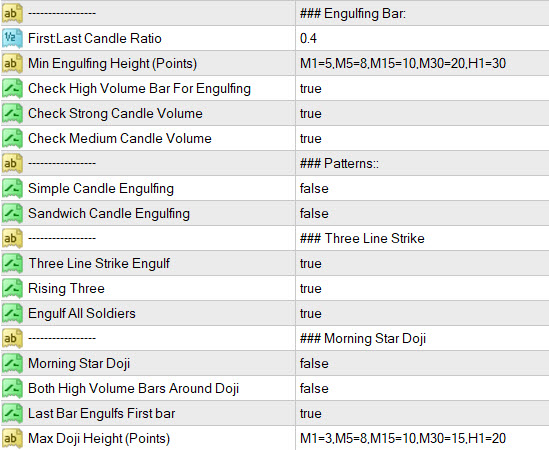

Primary Settings:

For All Patterns You may set:

This can make it possible for the sooner reverse candle is at the very least this given ratio in top as in comparison with the engulfing candle. This isn’t checked for Three Line Strike or Rising/Falling Three.

E.g.: 0.8 worth

Suppose for “Bullish Stick sandwich”, If Bullish engulfing candle is 100 factors in top, then the center Bearish candle ought to be at the very least 80 factors in top.

Hold it 0 for no verify.

Min Engulfing Top (Factors)

Minimal top in factors for the engulfing candle primarily based on timeframe.

Calculate all Min/Max Values utilizing Cross Hair Device:

e.g.: M1=5,M5=8,M15=10,M30=20,H1=30

Means for H1, the engulfing candle ought to be 30 or extra in factors.

Examine Excessive Quantity Bar For Engulfing: true

The engulfing candle ought to be at the very least medium (if medium true) or sturdy excessive Quantity Candle

Sample Settings:

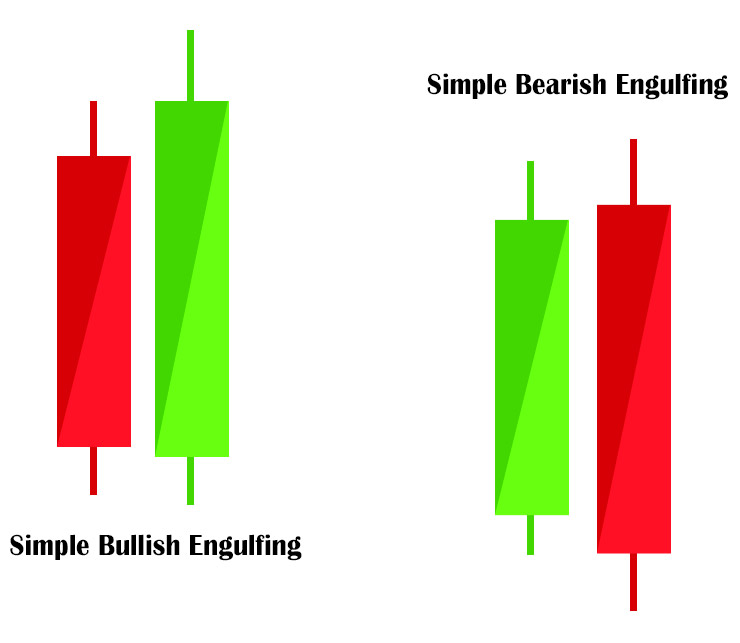

1. Easy Engulfing Sample:

Sample detected when a bullish candle engulfs a bearish candle.

Suppose ” First:Final Candle Ratio” is 0.8

And that 1st bearish candle top is at the very least 0.8 ratio of the longer bullish candle. If this ratio is excessive, it should give fewer alerts.

Holding it low like 0.4 will give extra alerts.

Identical, however vice versa for bearish engulfing.

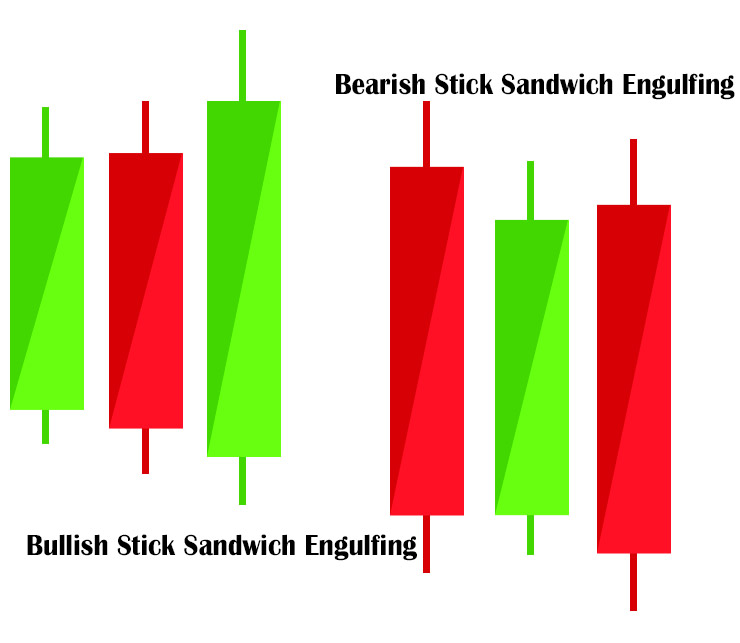

2. Sandwich Engulfing Sample:

Much like above sample.

Bullish:the beginning candle ought to be Bullish, then bearish. Then once more an engulfing bullish.

Right here, the First candle ratio can be checked between the center bearish and final engulfing bullish candle.

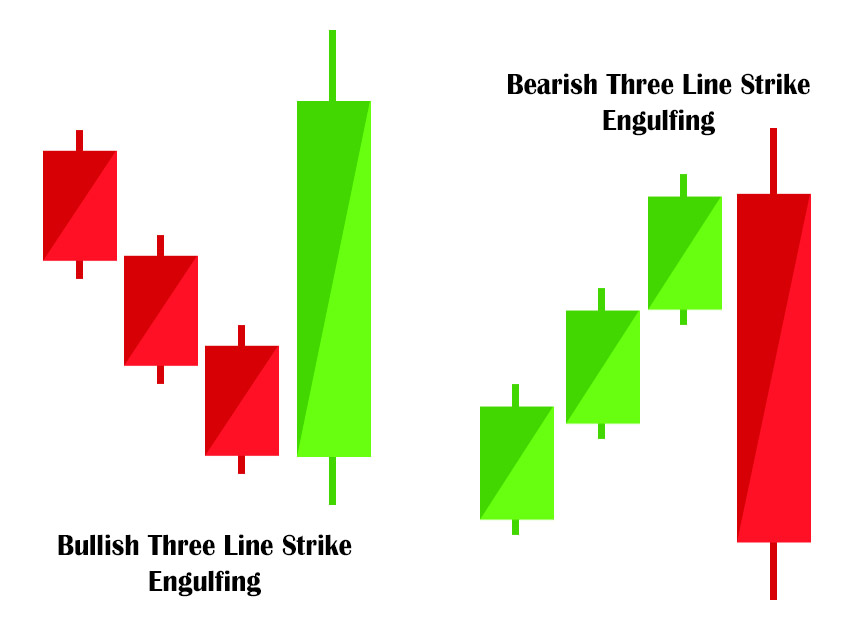

3. Three Line Strike Engulfing Sample:

Bullish:This sample will search for 3 steady bearish candles after which one Bullish candle.

Identical for bearish, it should search for 3 steady bullish candles (known as 3 troopers). After which one bearish candle.

If “Engulf All Troopers”is true, then the final candle ought to engulf all of the earlier 3 reverse candles.

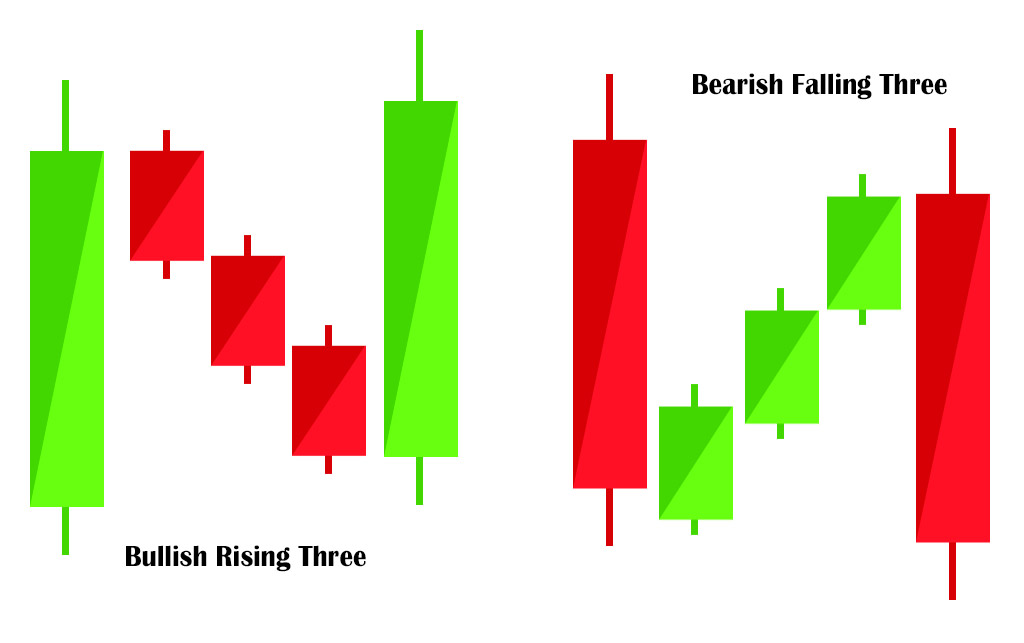

If “Rising Three”is true, then it should verify for a bullish bar first, then 3 bearish bars, then lastly a bullish engulfing bar once more like this:

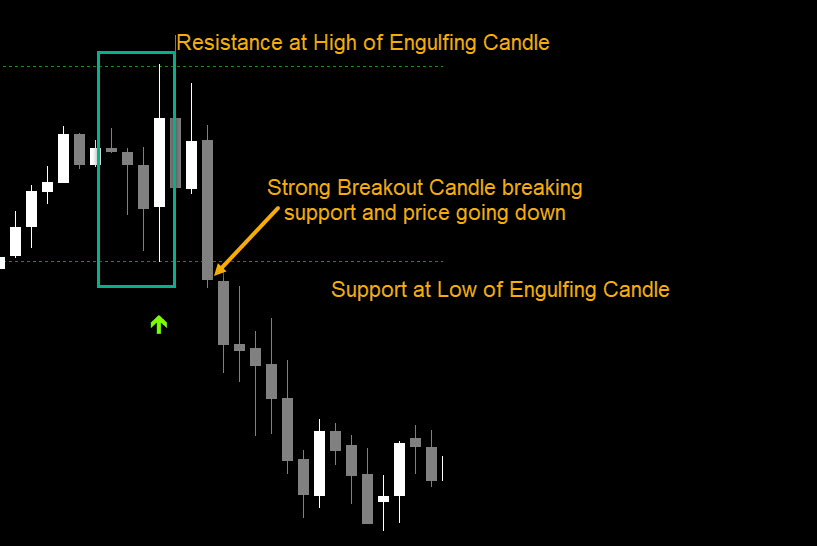

The three-line strike sample, solely reveals doable S/R areas.

After which it’s best to attend to see if value crosses the 3-line strike engulfing bar above/beneath:

As a result of generally, after a Bullish 3 line strike, value would possibly breakout and go down as an alternative of up.

So, watch out and await a strong breakout after this sample. Ideally with a robust quantity candle breaking out.

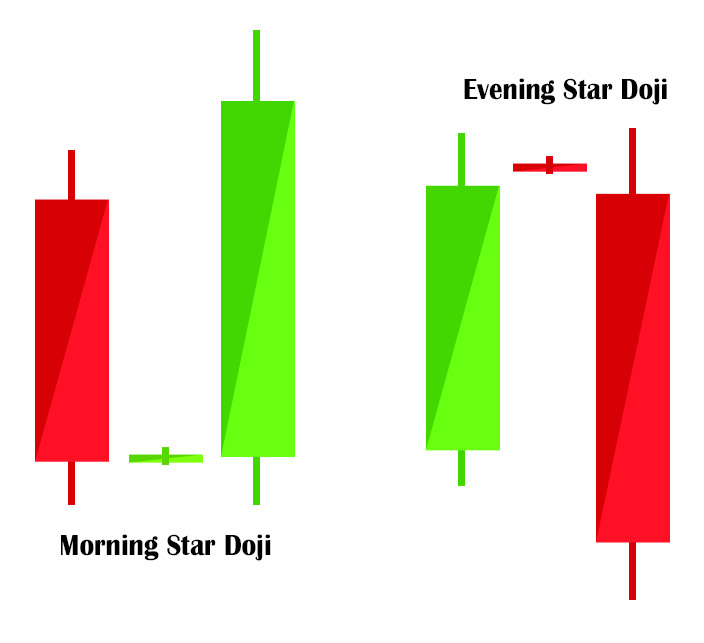

4. Morning/Night Star Doji Sample:

It is fairly clear from picture above. Bearish candle, then doji after which bullish engulfing candle.

Doji could be bullish or bearish. Nevertheless it’s top ought to be lower than “Max Doji Top”outlined in factors.

Use cross hair device to seek out finest Min/Max heights for all totally different timeframes:

https://www.mql5.com/en/blogs/submit/747462

If “Each Excessive Quantity Bars Round Doji”is true, it should verify each bars to be excessive/medium quantity bars. Medium verify provided that medium is true in earlier Quantity Setting.

And if “Final Bar Engulfs First Bar”is true, it should verify if remaining bar engulfs the primary reverse bar. Doji could be barely above/beneath each bars as nicely.

Forming an deserted child sample. However this sample shouldn’t be particularly checked for.

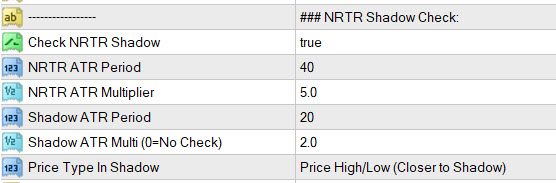

Assist/Resistance with NRTR:

Engulfing patterns seem rather a lot, and so they do not at all times sign reversal.

Which is why, if we use these patterns with SR Areas, they provide a better likelihood of being higher reversal areas.

This indicator makes use of NRTR Shadow. Learn extra about NRTR:

https://abiroid.com/defined/nrtr-explained

NRTR will restrict the alerts rather a lot. And provides fewer however very dependable alerts. Hold NRTR Shadow multiplier greater. Like 2, to get extra alerts.

On decrease timeframes watch out and maintain it decrease. In any other case you would possibly get unpredictable alerts, as value ATR can be greater when volatility could be very excessive.

And timeframes like M1,M5 is not going to give good outcomes. So keep away from these.

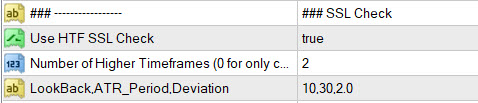

Larger Timeframe Development (utilizing SSL):

For Present and better timeframes development verify, it makes use of SSL development verify: “SSL quick nrp atr bands.ex4”

Variety of Larger TF:In case you specify 0, it should solely verify present timeframe.

Or else suppose present is M30 and quantity is 2. It’s going to verify SSL Development on present M30 and better H1 and H4.

Holding extra HTF timeframes will restrict alerts much more.

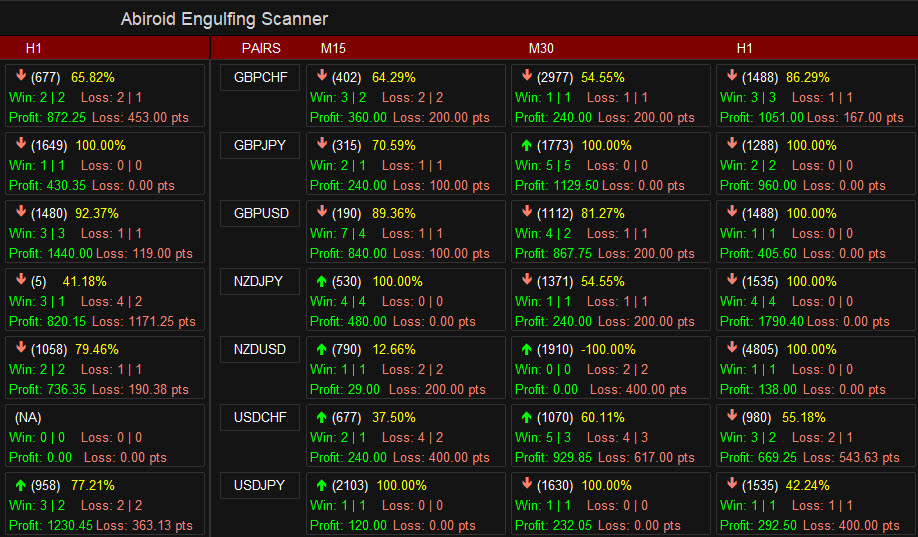

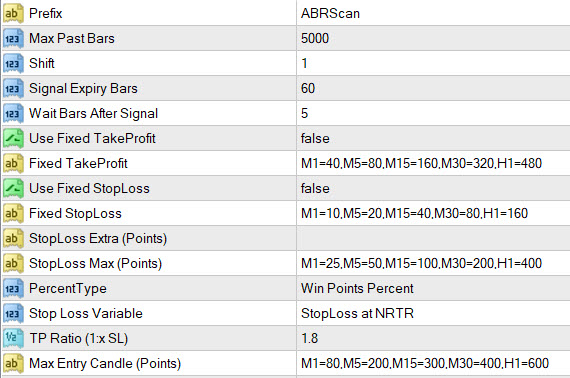

Win Fee Calculations:

Try this submit to learn extra about Win Fee and different frequent Scalper settings:

https://www.mql5.com/en/blogs/submit/748037

This indicator has variable SL at NRTR. And variable TP utilizing TP_Ratio. Which is ratio of StopLoss. Learn above submit for extra particulars.

Mounted SL/TP can be given desire whether it is true.

Greatest Trades:

Commerce on M15+

H1 will give finest trades. Constructed for MT4 (Metatrader 4)

Solely commerce throughout good volatility. However do not use throughout unpredictable, whipsawing markets.

SSL checks could be heavy, particularly if a number of greater timeframes are there. So do not use too many pairs if scanner appears to be slowing down.