The battle of Twitter vs. Elon Musk wages onward following the billionaire’s bid to buy the corporate for $43 billion final week.

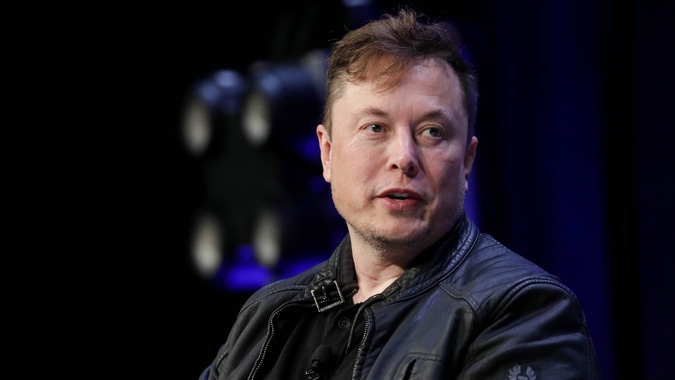

Anadolu Company | Getty Photographs

Twitter staff and shareholders have reportedly been burdened and disgruntled since Musk acquired almost 10% of the corporate’s shares, fearing inner change and shifts that they aren’t precisely on board with.

Musk’s newest proclamation through the social media platform is direct proof of that.

On Monday, Musk responded to a Tweet from Gary Black, a managing associate at Future Fund, and identified that if Twitter had been to turn into a personal firm beneath Musk’s possession, members of the board would not be paid.

At present they’re paid between $250,000 to $300,000 yearly, which totals round $3 million per 12 months.

Associated: Elon Musk Will No Longer Be part of Twitter Board

“The board serves to signify shareholders,” Black wrote. “In the event that they refuse to behave in the perfect curiosity of SHs, they need to be eliminated and changed by new board members who perceive their fiduciary obligations.”

Musk replied and added to Black’s assertion.

“Board wage will likely be $0 if my bid succeeds, in order that’s ~$3M/12 months saved proper there,” the Tesla CEO wrote.

Board wage will likely be $0 if my bid succeeds, in order that’s ~$3M/12 months saved proper there

— Elon Musk (@elonmusk) April 18, 2022

This follows Musk’s response to a Tweet over the weekend in which he claimed that the “financial pursuits” of the Twitter board “are merely not aligned with shareholders” by mentioning that members of the Twitter board personal minimal firm shares.

Musk remains to be the biggest particular person shareholder of Twitter, although funding agency Vanguard is now the total largest shareholder of the corporate, proudly owning about 10.3% of Twitter shares.

The billionaire was requested to hitch the Twitter board earlier than declining on what would have been his official first day, April 9.

“Elon shared that very same morning that he’ll not be becoming a member of the Board. I consider that is for the perfect,” Twitter CEO Parag Agrawal mentioned on the time. “We have now and all the time will worth enter from our shareholders whether or not they’re on our Board or not. Elon is our largest shareholder and we are going to stay open to his enter.”

Final week, Musk proposed taking Twitter non-public at $54.20 per share in money, a 54% premium from the day earlier than he started shopping for Twitter inventory.

Nevertheless, Musk’s proposition is more likely to be blocked by shareholders who should not eager on his takeover.

CNBC has additionally reported that personal fairness agency Apollo International Administration has been in talks to purchase Twitter earlier than Musk does in what can be a “most popular fairness” kind plan, although the agency has not publicly commented on or confirmed the rumors.

Twitter was down simply shy of 30% as of Tuesday afternoon.