The inventory market by no means works the way in which we expect it ought to. When the information tales are bleak, we are inclined to assume the inventory market should react negatively. However that is not the way in which issues work. Most occasions, the inventory market bottoms LONG BEFORE we see any constructive developments within the fundamentals. Let me provide you with an ideal instance and one which jogs my memory a LOT of as we speak’s market motion:

1990-1991 Persian Gulf Battle

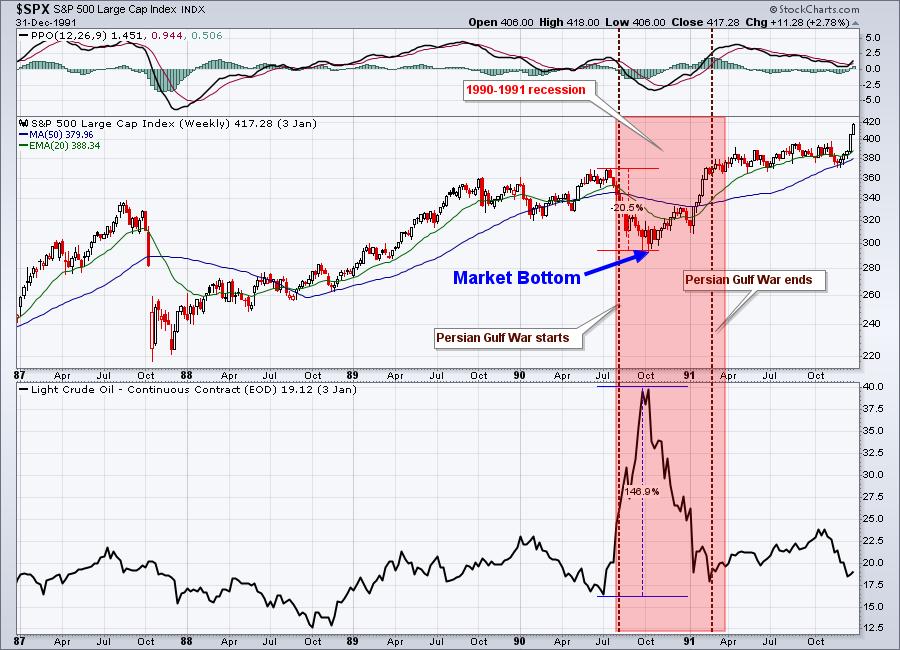

The Persian Gulf Battle was simply one in every of a variety of issues throughout that point interval. Just like as we speak, crude oil costs ($WTIC) soared 147% from $17 per barrel to $42 per barrel in a really quick time period – from July by September 1990. There was additionally a recession that lasted from July 1990 by March 1991, principally as the results of restrictive Federal Reserve coverage in 1989 and 1990 to struggle inflation. Oh, and we had simply recovered over the prior 2-3 years from a dramatic market drop – the 1987 market crash.

Does this all sound acquainted?

In the course of the third quarter of 1990, the S&P 500 fell simply over 20%, leading to a cyclical bear market. However whereas the struggle and the recession lasted properly into 1991, the inventory market bottomed lengthy earlier than in early-October 1990:

The red-shaded space represents the timing of 1990-1991 recession. The dotted vertical traces mark the start and finish of the Persian Gulf Battle. Notice when the market backside occurred – properly earlier than both of the opposite two ended. So when you ever surprise, “how can the inventory market transfer increased with a lot dangerous information on the market?”, simply do not forget that the inventory market seems forward. Wall Road sees issues that we won’t see. It seems past the present troubles, lots of which can go away over time.

At present, we see crude oil hovering, a serious battle in Jap Europe, and a decided Fed that is begun its struggle in opposition to inflation and plans to proceed mountaineering rates of interest all through 2022 and into 2023. It is all occurring inside 2 years of a serious market decline that resulted from the 2020 pandemic. It sounds quite a bit like 1990, would not it? So how might the inventory market probably have bottomed with its February low? Whereas I am not satisfied it has, I definitely notice that it is fairly potential, as a result of that is how the inventory market works. Bottoms don’t happen when media shops begin reporting excellent news. Initially, they do not report excellent news as their viewers/readers will drop by a half to two-thirds. Dangerous information sells, so we’ll proceed seeing terribly detrimental headlines. If you wish to see or anticipate the underside, follow the charts.

In tomorrow morning’s EB Digest, our FREE publication, I am offering an S&P 500 chart to assist illustrate what I consider goes to occur within the coming days and weeks based mostly on key technical value ranges. If you would like to affix our rising EB group and obtain this S&P 500 chart tomorrow, merely present your title and e-mail deal with HERE. There isn’t any bank card required and it’s possible you’ll unsubscribe at any time. We’ll hold your data personal as properly, by no means offering your data to 3rd events.

Glad buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Each day Market Report (DMR), offering steering to EB.com members on daily basis that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as properly, mixing a singular ability set to strategy the U.S. inventory market.