Finance groups are taking over new challenges and duties in mild of the unsure financial local weather that surfaced within the wake of the worldwide pandemic, provide chain disruptions, value inflation, and the wholesale workforce exodus referred to as the “Nice Resignation.”

Now greater than ever, organizational management is trying to the Workplace of the CFO to be a strategic accomplice in constructing an general enterprise technique. Finance is now tasked with offering well timed planning, forecasting, and reporting that informs enterprise selections within the second.

Contemplating these quickly increasing duties and the duties that accompany them, insightsoftware judged it a wonderful time to test in with finance leaders in North America and EMEA to raised perceive the challenges the Workplace of the CFO is dealing with and the way finance leaders are addressing them.

In partnership with Hanover Analysis, insightsoftware surveyed 514 finance decision-makers throughout a number of industries to get a transparent view of the developments which are shaping finance groups immediately.

That survey led to the publication of our second annual Monetary Crew Traits Report.

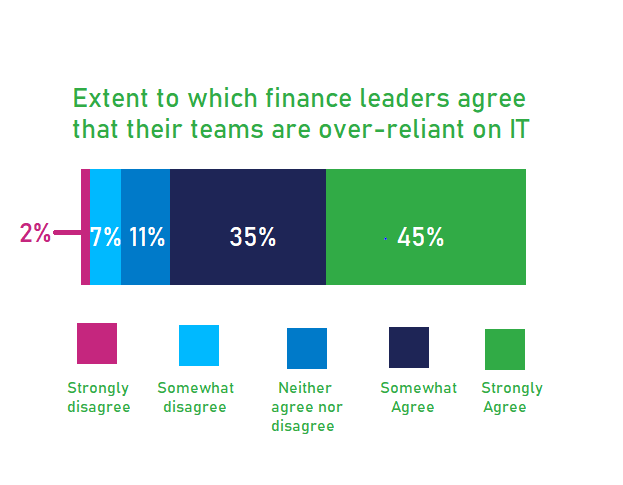

One of the vital findings amongst respondents throughout a number of industries was {that a} overwhelming majority of finance leaders (80 %) really feel that their group is over-reliant on their IT division.

The Relationship Between Finance and IT

That isn’t to say that there’s an adversarial relationship between Finance and IT. Quite the opposite, 88 % of finance leaders are happy with the connection they’ve with IT, understanding that collaboration with IT is critical to leap a few of the hurdles which have been positioned of their path to digital transformation.

Finance leaders recognized a number of challenges that may be conquered with the assistance of IT, akin to:

- Adoption of recent know-how (41 %)

- Information limitations and inaccuracies (33 %)

- Altering reporting standards (35 %)

Collaboration is taken into account a optimistic factor—with just a few caveats. The rationale 80 % of finance leaders imagine they’re over-reliant on IT is that they’re feeling the ache of getting to attend on one other division for the info or customized evaluation they should do their very own jobs successfully and effectively.

When roadblocks occur, the finance group is constrained not solely by their very own deadlines, but additionally by the deadlines of a division over which they’ve little or no management. In brief, over-reliance on IT is an agility killer for Finance.

At a time when agility is a serious precedence for organizations all over the place, over-reliance on IT is a essential weak spot for contemporary finance groups.

Decrease IT Dependence

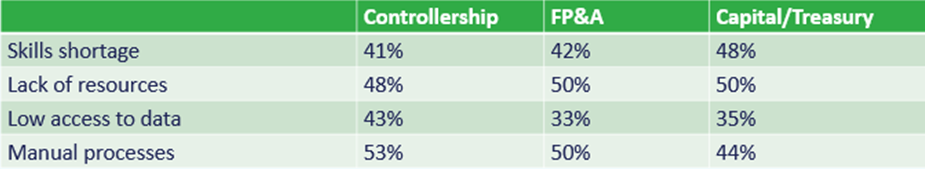

An excessive amount of IT dependence sometimes outcomes from 4 essential root points:

- Abilities scarcity on the finance group

- Lack of assets

- Low entry to information

- Handbook processes

Right here’s a have a look at the proportion of finance leaders who recognized these challenges and their influence on three main areas of duty for the Workplace of the CFO:

To attenuate IT dependence, finance groups should deal with the foundation causes of it head-on. One technique, specifically, stands out as a solution to every of those root causes: automation.

Automation makes it attainable to:

1. Dig Out of the Handbook Course of Gap

For a big variety of finance groups, handbook processes are sucking up time that may very well be higher spent on value-added evaluation.

Ahead-thinking finance leaders are on the lookout for methods to hurry their digital transformation, automating processes when attainable to recoup time and assets. Why are you hiring educated monetary professionals to crunch information? It’s 2022; let the computer systems do it for them. You will notice a drastic improve in your group’s engagement as they leverage the evaluation expertise they spent years growing.

2. Optimize Useful resource Utilization

Automation additionally alleviates a few of the weight of restricted assets. For instance, automating time-consuming duties akin to monetary planning and evaluation allows finance leaders to reallocate duties and duties to optimize workers scheduling. That’s particularly useful for the 17 % of finance leaders who anticipate to see workers reductions within the coming two years.

Nevertheless, even when your group is planning to develop within the subsequent two years, like 72 % of survey respondents, optimizing the way in which you devour assets by automating in each side of your division continues to be the correct transfer to make with the added duties your group will probably be shouldering.

3. Allow Self-Service Reporting and Evaluation With Actual-Time Information

Leveraging tech instruments that allow enterprise customers to generate stories utilizing real-time information pulled from a number of present methods helps to cut back reliance on IT. Search for instruments that don’t require intensive customization. Instruments with a well-recognized interface are additionally a good suggestion if you wish to empower your finance group to create their very own stories by way of superior tech.

Automation represents a big step towards the last word aim of self-service reporting for finance groups. Automation makes wonderful use of generally restricted assets, alleviates a lot of the ache that comes with workers shortages, and eliminates tedious handbook duties.

Case examine: kolb Automates Monetary Processes to Cut back Load on IT

kolb Cleansing Expertise prides itself on quick supply instances. As a worldwide chief within the cleansing equipment manufacturing market with 50 staff, the enterprise has a popularity for appearing shortly and effectively. The place opponents preserve a 20-30 week lead time, kolb can ship in six to eight weeks whereas producing a high-quality consequence.

Nevertheless, the corporate beforehand relied on handbook processes throughout month-end and year-end shut. Along with being time-consuming for the monetary group, the enterprise relied on IT to customise and generate ad hoc stories. As a result of its IT workers had been tasked with different essential duties, they had been unable to prioritize finance wants, inflicting appreciable delays to the shut course of.

“We didn’t have an information tradition earlier than Jet Stories,” Christian Ortmann, CEO of kolb Cleansing Expertise mentioned. “Previously, the IT division was liable for information administration. On the time, we needed to go to IT and clarify what we would have liked and why we would have liked it. IT usually didn’t have time to run the stories shortly.”

Jet Stories helped relieve the corporate’s overtaxed IT division whereas placing the ability to run stories into the palms of those that wanted them most.

“We now have extra folks feeling snug designing in Jet Stories,” defined Ortmann. “And it’s not IT folks; it’s folks in finance, engineering, and gross sales. There aren’t any IT individuals who program now. As a substitute, Jet designers in our firm run stories as a result of they know exactly what they want. Jet Stories generates correct numbers for them.”

kolb makes use of Jet Hub to schedule stories mechanically. Total, the enterprise saves a full day each week on scheduling and administrative duties with the answer’s automation capabilities.

“We now have numerous advanced stories that take 45 minutes to an hour to generate,” mentioned Ortmann. “Once you report manually, you deal with duties to folks, however you additionally should test the report on the proper time as a result of some stories, like stock, have to be generated on the proper time. With Jet Hub, listed below are numerous issues we don’t have to consider now. It saves us a minimal 1.5 days per week. You don’t should be reminded of which stories to run on the proper time as a result of Jet Hub automates that course of.”

Learn the Full Kolb Case Research

Break Free from IT Over-Dependence With insightsoftware

insightsoftware works with hundreds of finance groups throughout a number of industries to supply the instruments and help they should execute towards all their rising duties. insightsoftware merchandise join on to your ERP for stay information evaluation via an easy-to-understand interface. Our merchandise come geared up with a collection of pre-built content material to make sure finance groups are in a position to hit the bottom working.

Be taught extra about present finance group developments and the way insightsoftware helps the Workplace of Finance to handle the present panorama and plan for the longer term while you obtain “2022 Finance Groups Traits Report”.