Do you ever daydream? I certain do.

In your desires, are you ever the hero in a story of a brand new gold strike or oil gusher? Or the inventor of a brand new cryptocurrency that outpaces Bitcoin? Or a brand new automotive that outperforms Tesla?

A majority of these desires are as outdated as time. They usually’ve motivated the human race to incalculable discoveries and innovations. Many succeed—however numerous folks lose their lives or fortunes yearly searching for journey and treasure in beforehand unknown realms.

I’ve finished it myself. When actual property was on the ropes after 2008, I briefly fell again on my petroleum engineering diploma. A bunch of my buddies and I invested in a high-risk, high-reward hypothesis on a wildcat oil deal in North Dakota. We dropped over 1,000,000 {dollars} on a gap within the floor, anticipating to see a 10x and even 50x ROI.

Our desires got here up dry.

We weren’t alone. However to be clear, some traders struck it wealthy.

However speculations are a roll of the cube. And it’s not the best way I wish to make investments anymore.

A contemporary gold rush

Should you haven’t observed, we’re within the midst of a contemporary gold rush. Many who had by no means invested in actual property are actually in it full-time. And I believe that’s fantastic.

Many who restricted their earlier investments to Wall Avenue’s casinos have found actual property’s joys and wealth-building potential. And lots of who began in residential have migrated to industrial actual property, an area previously reserved for rich insiders. Relaxed crowdfunding guidelines and the explosion of social media and on-line advertising have supplied sensible entry for tens of millions of traders.

However there are darkish clouds on the horizon.

There’s a brand new breed of actual property syndicators who had no actual property expertise earlier than the final crash. There’s nothing improper with that. Many are making tens of millions for themselves and their traders.

However an issue arises when the herd begins overpaying for belongings en masse. And when these people (I name these new gurus Newrus) begin spouting new guidelines, and convincing newbies issues like:

“It’s totally different this time.”

“Individuals at all times want a spot to reside!”

“There’s no finish in sight for this bull actual property market.”

However, my buddies, bushes don’t develop to the sky. And no bull market goes on ceaselessly.

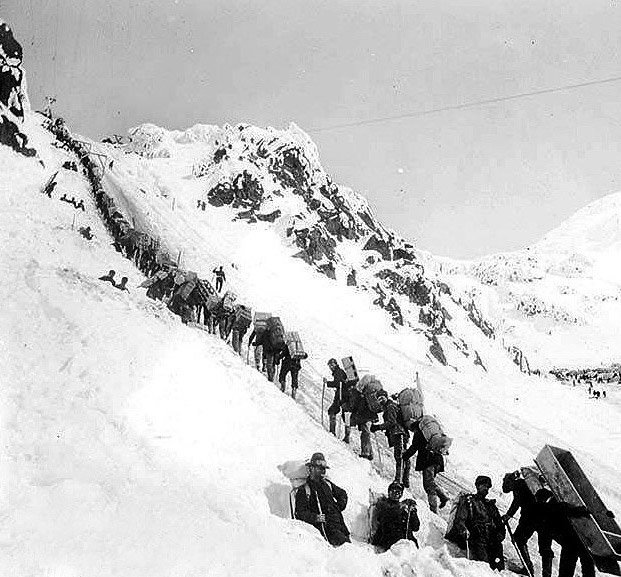

That is the kind of sentiment that brought on beforehand rational folks to go away their properties, their jobs, and their households within the late Nineties to courageous horrific situations whereas crossing the Alaskan tundra on canine sleds to hunt their fortune. Final 12 months, I received to go to an Alaskan metropolis the place many departed however by no means returned.

The Historical past Channel tells us that “solely about 30,000 [of 100,000] weary stampeders lastly arrived in Dawson Metropolis. Most had been gravely dissatisfied to study experiences of obtainable Klondike gold had been drastically exaggerated. For a lot of, ideas of gold and wealth had sustained them throughout their grueling journey. Studying they’d come to date for nothing was an excessive amount of to bear and so they instantly booked passage residence.”

Now, this all feels like plenty of enjoyable. Uhhhhhh… NOT!

Critically, this sort of investing can be enjoyable. However don’t overlook the phrases of investor extraordinaire George Soros:

“If investing is entertaining, if you happen to’re having enjoyable, you’re most likely not making any cash. Good investing is boring.”

Many nice traders, like Warren Buffett, share this sentiment.

So, who made financial institution…and in the end had essentially the most enjoyable within the Alaskan and earlier California gold rushes? And what can we study from them?

A handful of speculators received wealthy for certain. Nevertheless it was those that took the boring path who constantly prospered in these conditions.

I can’t think about the boredom of establishing a ironmongery store to promote picks and shovels to hopeful prospectors—or establishing a resort, restaurant, or canine sled operation. However potential miners didn’t have many choices, and these boring traders usually loved the considerable prosperity that eluded most prospectors.

They usually didn’t essentially must danger their lives to get it. Lots of them undoubtedly stayed heat and dry whereas miners endured hardships that I frankly discover unimaginable.

Whereas there are undoubtedly many forgotten exceptions, I believe the proprietors in the end had extra enjoyable on common. Why?

Theoretically, they’d money circulate and financial savings, which supplied the liberty to take holidays and loosen up within the mountains. (Alaska is gorgeous in the summertime!). The identical mountains the place their purchasers sweated and toiled and starved and froze to demise. Their money theoretically supplied the liberty to rent staffers and luxuriate in free time.

Boring ironmongery store homeowners…boring traders…outmaneuvered gold speculators…shiny object chasers…to take pleasure in life and construct multi-generational wealth.

So what does this must do with actual property investing?

I revealed a latest submit with my plea so that you can take into account changing into a boring investor. That is wholly related to this subject of investing throughout a gold rush. And anytime.

Listed below are 4 purposes of the gold rush for actual property traders…

1. Make investments with professionals.

Throughout a gold rush, the 80/20 rule is in full impact. It could be extra like 90/10 (or extra excessive). This implies a small minority of the operators earned the overwhelming majority of the wealth in gold. These had been the professionals. Those that knew what they had been doing and had finished it efficiently for years. I think about those that passively invested of their machines and know-how prospered as nicely.

I’m guessing those that handled it casually, together with many keen newbies, misplaced their fortunes, and infrequently their lives. That was their alternative. However I’d hate to be one among their traders again residence ready for the massive payday that seldom got here. Or one among their relations.

Should you’re going to spend money on actual property, rigorously vet the operator. Don’t toss your capital to anybody and not using a confirmed monitor report, know-how, and crew. Search for operators with the talent to unlock intrinsic worth to create wealth in any economic system.

2. Don’t overpay.

These speculators sacrificed every little thing to chase hope. However hope isn’t normally a superb marketing strategy. They usually undoubtedly overpaid for transportation and tools in restricted provide. One miner reported prices at 10x the traditional costs. After all, the proprietors of those items and companies made enormous income.

Proper now, many actual property traders are betting the farm on hope. Hope that cap charges will proceed to compress. Hope that rates of interest gained’t rise. Hope that inflation will cowl the sins of overpaying in a blazing sizzling market.

I’m in a mastermind with seven high multifamily syndicators. They’re reaping monumental rewards by promoting their overpriced condominium belongings to these clamoring to get a deal at any value. There are traders benefitting in spades. Don’t be a sufferer of this gold rush—and take into account investing with boring traders who make a revenue in any economic system.

3. Don’t chase shiny objects.

I hosted a podcast referred to as Find out how to Lose Cash for 4 years. We interviewed 238 profitable entrepreneurs and traders who misplaced cash on their option to success. One of many massive blunders we heard again and again concerned chasing shiny objects. I used to be actually responsible of this in earlier a long time myself.

To be clear, a number of the best corporations and innovations on this planet had been as soon as somebody’s shiny objects. However funding success on this area is extra the exception than the rule. I like to recommend you dial in on a selected technique and say no to a thousand distractions in your journey.

4. Search for hidden worth in undervalued belongings.

Billionaire Howard Marks is a superb investor and instructor. Warren Buffett reads every little thing Marks writes. His epic guide, Mastering the Market Cycle, warns towards market timing. He tells us to overlook about precisely predicting market cycles—and to give attention to appearing appropriately for the place we’re within the cycle as an alternative.

As we mentioned, there’s a gold rush mentality in the true property funding realm right now. This isn’t a time to pay high greenback for already-stabilized belongings. Howard Marks tells us it is mindless to overpay for the bottom margin offers at a time when the market may flip downward. Positive, inflation may prevent as revenues outpace your mounted debt. However do you actually wish to depend upon that to keep away from damage? Is that honest to your passive traders?

There are confirmed methods to amass undervalued belongings that thrive in any economic system. You don’t must hit gold to make a revenue. I’ve written about this extensively—that is some of the latest posts.

A shock ending to my gold rush story

I informed you about my gold rush story within the Bakken oil growth in a previous decade. We misplaced some huge cash on a gap within the floor.

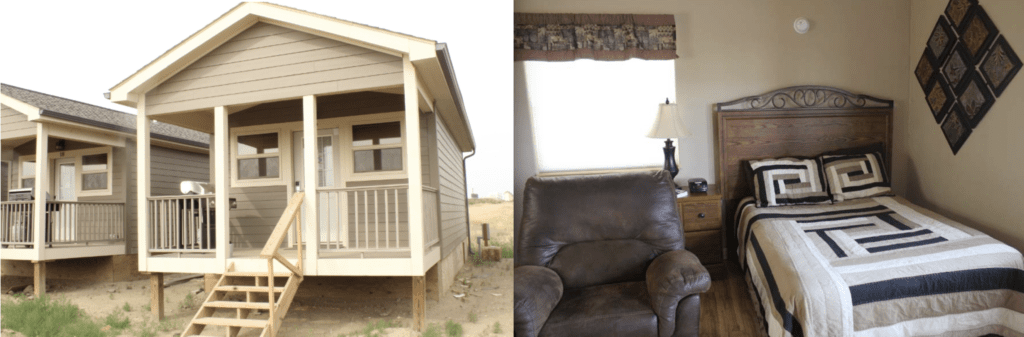

However in our due diligence travels to North Dakota, we observed working pickup vans, automobiles, and semis parked in a single day all around the space—and we couldn’t discover a resort room at any value. My enterprise accomplice had a small jet, and he needed to fly again to a neighboring state or go residence at evening after a go to. The tiny city of Watford Metropolis couldn’t home hundreds of staff who had descended on it.

An thought took form. We determined to promote picks and shovels to miners.

Nicely, not likely. However we had been each in actual property, and we had time and capital obtainable. We determined to construct a multifamily property to run as an prolonged keep resort. This facility would serve all kinds of workers and contractors working in and visiting the burgeoning Bakken oil fields.

We rapidly acquired land and introduced in modular buildings. We employed a supervisor and constructed a web site. We stuffed up each suite and developed a ready listing in a single day.

Fundamental space resort rooms (when obtainable) had been working between $300 to $500 per evening. Residences may run as excessive as a couple of thousand {dollars} month-to-month. We priced our 300 sq. foot superbly furnished suites at $4,000 month-to-month—or $129 per evening.

We stayed primarily full whereas oil costs remained excessive. We made way more revenue serving the oilfields than we misplaced investing by drilling for oil. We ultimately offered to an institutional purchaser with deep pockets.

Extra importantly for me, I efficiently transitioned from residential to industrial actual property. That is one thing that intrigued me for years. However I didn’t know the place the onramp was—not till I rethought find out how to revenue from a gold rush.

So how are you investing throughout the true property gold rush? Or do you suppose there’s one in any respect?