America goes by means of its worst child formulation scarcity in many years. Moreover the overall provide chain points, the shutdown of the manufacturing plant of the largest provider within the nation, Abbott Laboratories, (the corporate additionally recalled a number of manufacturers of powdered formulation) following experiences of toddler bacterial an infection has worsened the state of affairs. In line with Datasembly, the typical out-of-stock price for child milk formulation in April was 43%.

Fig. 1: International Manufacturing and the High 6 Exporters of Toddler Components by Area. Supply: Gira.

Clearly, restarting manufacturing of Abbott Laboratories shouldn’t be an efficient resolution. To additional alleviate the issue, the US authorities is contemplating rising child formulation imports. Such motion could profit Danone, which relies in Eire, because the EU has turn out to be the largest provider and exporter of toddler formulation of the previous few years, with European formulation topping the rating presumably because of the notion that they’re of greater high quality and safer to devour on account of stricter regulation.

Fig.2: Gross sales of Danone Worldwide in 2021, by Division. Supply: Statista.

Essentially, Danone leads the market in each dairy and plant-based product classes. It additionally operates different companies in waters, toddler and grownup diet. As well as, it had a robust end to FY 2021, with internet gross sales up roughly 3%, at €24,281m. It returned worthwhile development within the latter half of the yr following its capability to cut back its recurring working margin by 0.3% (y/y). Though recurring EPS was down -1.1% in comparison with the identical interval within the earlier yr, the general monetary situation of the corporate stays wholesome with €2.5b free cash-flow, up greater than 20% (y/y).

Fig 3: Bridge from Reported Information to Like-For-Like Information. Supply: Danone Q1/22 Press Releases.

The corporate continued to ship passable Q1/2022 outcomes in April. Internet gross sales had been up +7.1% on a like-for-like (LFL) foundation to €6236m, benefiting from constructive foreign exchange affect and natural contribution of hyperinflation geographies to development. By area, gross sales had been probably the most in China, North Asia and Oceania, at +15.3%. The administration additionally stays constructive in its steerage for FY 2022, with gross sales development focused between +3% to +5%, and recurring working revenue over gross sales ratio above 12%.

Technical Overview:

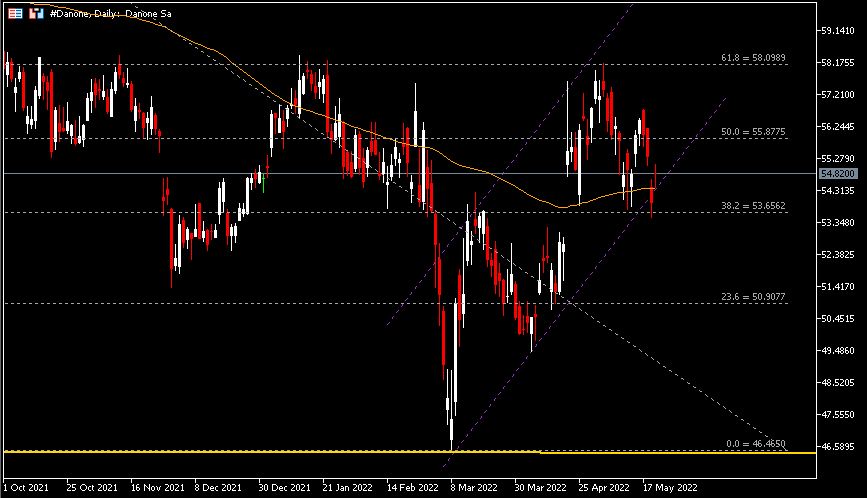

Technically, the weekly chart exhibits that the #Danone share worth stays vary sure, throughout the decrease stage €46.4658 and the higher stage €65.2900. It has rebounded for the second time from the decrease stage since early January this yr. If the bullish momentum persists, #Danone could prolong greater and full the W-shape sample, with the higher stage €65.2900 serving as an essential neckline (resistance) within the longer time-frame.

Then again, the every day chart exhibits that the #Danone share worth stays supported above €53.65, the 100-day SMA and the decrease line of the ascending channel. Collectively they type a robust confluence zone. So long as the corporate’s share worth stays above this confluence zone, there may be chance for the consumers to push the value greater in direction of testing the subsequent resistance at €55.88 (or FR 50.0% prolonged from the higher stage and decrease stage of the Weekly vary), adopted by €58.10 (FR 61.8%) and €61.26 (FR 78.6%).In any other case, if the value breaks the stated assist zone, the subsequent ranges to look at are €50.91 (FR 23.6%), the low level of the primary retrace throughout the channel €49.45, and the decrease stage of the vary at €46.4658.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst – HF Academic Workplace – Malaysia

Disclaimer: This materials is supplied as a basic advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distribution.