Taking up an impartial contractor is completely different than hiring an worker. There are variations within the types you could collect, wage reporting, and the way you pay contractors vs. workers. So, how do you run contractor payroll if it’s completely different from paying workers? Learn on to study the reply to that query and extra.

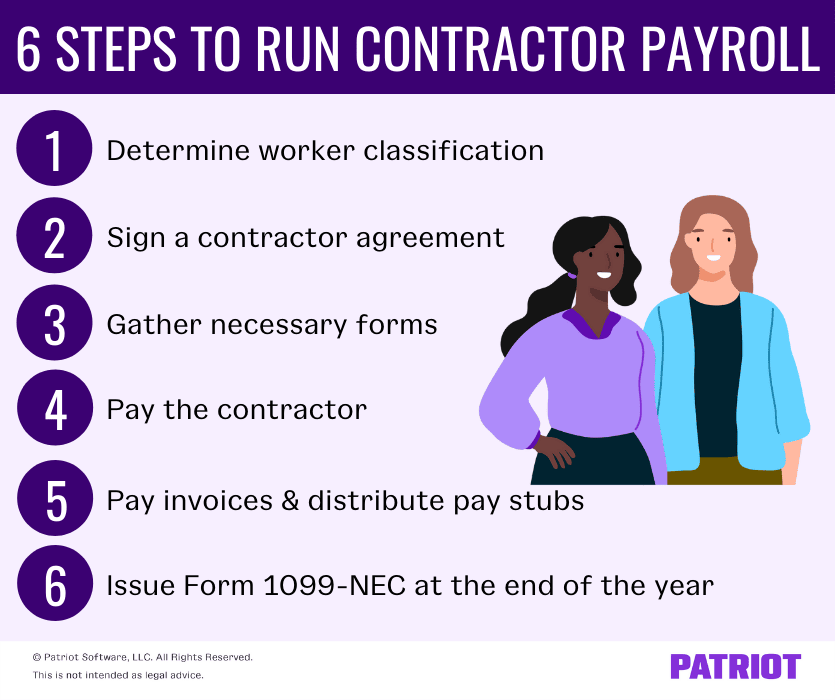

How you can run contractor payroll: 6 Steps

When you have impartial contractors and W-2 workers, it may be a trouble to course of two separate transactions to make sure you pay everybody appropriately. So, paying impartial contractors by payroll (e.g., through software program, utilizing spreadsheets, and many others.) can simplify the method. However whenever you run impartial contractor payroll with W-2 worker payroll, concentrate on the variations in the way you course of the 2. Check out the six steps for working contractor payroll the proper method.

1. Decide if the employee is an worker or a contractor

Employee classification determines your employer duties and the way you might pay staff. To find out in case your employee is an impartial contractor, ask your self:

- Do I management the work they carry out (e.g., when, the place, and the way typically they work)?

- Does my enterprise have monetary management over the employee (e.g., offering obligatory gear)?

- What’s the relationship between my enterprise and the employee (e.g., everlasting, non permanent, advantages offered, and many others.)?

- Does the employee carry out important enterprise duties or supplementary duties?

- Who determines how the work needs to be executed, the employee or the employer?

An impartial contractor dictates their:

- Working hours and availability

- Strategies of performing work

- Sort of apparatus

Unbiased contractors are additionally usually engaged on a brief contract. They don’t obtain worker advantages, resembling medical health insurance or retirement. And, they often settle for work for your online business at a flat payment they decide.

If a employee meets the classification as an impartial contractor, you could deal with and pay them accordingly.

2. Signal an settlement with the contractor

As a result of impartial contractors are usually not workers, they set their very own charges. They might give you a contract or a piece settlement to signal.

Sometimes, a piece settlement particulars:

- Hourly or job charges

- If the contractor requires an upfront deposit

- How you can pay the contractor (e.g., direct deposit or test)

- Timelines for the venture

- Objectives and deliverables

Earlier than signing the settlement, sit down with the contractor to ask any questions or request any modifications you deem obligatory.

3. Collect obligatory types

As soon as you identify {that a} employee is a contractor and signal an settlement, you could obtain Kind W-9, Request for Taxpayer Identification Quantity and Certification. Kind W-9 is much like the worker Kind W-4, Worker’s Withholding Certificates. It gives you with obligatory tax submitting info for the employee to report wages for them.

The W-9 type gives the employee’s:

- Identify

- Enterprise identify, if completely different from their precise identify

- Enterprise entity (sole proprietor, S company, C company, partnership, LLC, and many others.)

- Exemptions

- Handle

- Taxpayer Identification Quantity (Social Safety quantity or Employer Identification Quantity)

- Certification (signature and date)

Hold Kind W-9 in your information. Don’t ship the shape to the IRS. You want this kind to finish Kind 1099 on the finish of the 12 months.

4. Pay the contractor

Once more, paying an impartial contractor is completely different from paying a W-2 worker. When paying contractors, don’t:

- Withhold payroll taxes

- Pay employer taxes (e.g., federal unemployment tax)

As impartial contractors are usually not workers, you don’t withhold any payroll taxes from their checks until you obtain discover from the IRS or state to take action. Don’t withhold:

As a result of you don’t withhold taxes from contractor wages, you additionally don’t contribute to:

- Federal unemployment tax

- Social Safety tax

- Medicare tax

- State unemployment tax

Subsequently, there aren’t any gross wages or internet wages with impartial contractors. As a substitute, the wage quantity within the contractor’s work settlement is the quantity the contractor receives. For instance, you rent a contractor and conform to pay them $2,000 for the work they do for your online business. As a result of you don’t withhold or pay any payroll taxes on their wages, you pay a flat quantity of $2,000.

For those who pay a contractor in payroll and in addition pay workers, withhold and pay taxes for the W-2 workers solely. Utilizing payroll software program? Make sure you appropriately classify contractors within the system earlier than processing payroll. That method, the software program is not going to calculate and withhold any taxes for contractor wages.

5. Pay invoices and distribute contractor pay stubs

Technically, you don’t concern a pay stub for 1099 workers. As a substitute, the impartial contractor pay stub is the bill the contractor sends and also you pay. However if you happen to pay a contractor by payroll, you might be able to obtain a test stub to concern to the contractor with their bill.

There aren’t any federal legal guidelines requiring employers to distribute pay stubs to workers or impartial contractors. And, state legal guidelines could range. Test together with your state for extra info.

Contractors could specify of their contractor work agreements that they need to obtain a pay stub when paid. In that case, concern a stub to the contractor whenever you pay their bill for his or her providers.

6. Challenge Kind 1099-NEC on the finish of the 12 months

On the finish of the 12 months, you could concern the proper Kind 1099 to your contractor. Sometimes, you could give Kind 1099-NEC to your contractors for performing nonemployee work for your online business.

You need to ship copies of Kind 1099-NEC to the contractor by January 31, or the following enterprise day if it falls on a weekend. File Copy A of the shape with the IRS by January 31, too.

Are you able to run payroll for a contractor by software program?

Paying your contractors by payroll software program could prevent time and simplify the method. You possibly can pay contractors and workers in the identical payroll as a substitute of working two whenever you pay contractors utilizing payroll software program.

For those who select to pay contractors by payroll, search for a software program program that permits you to course of each worker and contractor funds in a single payroll. And in case your contractor wish to obtain pay stubs, test to see if you happen to can print contractor pay stubs, too.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.