Welcome to the thrilling world of the gig financial system, the place flexibility meets alternative — and extra tax obligations.

The gig financial system has exploded lately, with extra taxpayers choosing the liberty and autonomy of self-employment. Whether or not you’re a rideshare driver, content material creator, Etsy® or eBay® vendor, or working odd jobs, understanding your gig financial system tax obligations is crucial.

This information will stroll you thru every little thing it’s essential to know to navigate the tax submitting course of as a gig financial system employee. From tax guidelines on estimated tax funds to deductions and self-employment tax, we’ve received you lined. Plus, we’ll hyperlink you to detailed guides tailor-made to particular gig jobs to make tax season as painless as potential. Let’s dive in!

Getting began with gig taxes

Let’s clear up a standard false impression: Simply since you’re not a conventional Kind W-2 worker doesn’t imply you’re off the hook in relation to taxes. The IRS considers most gig staff as self-employed individuals, that means you’re chargeable for reporting your aspect earnings and paying taxes on gig earnings.

Right here’s what meaning for you:

- You may deduct enterprise bills to decrease your taxable earnings.

- You need to report all earnings from gig work.

- Should you count on to owe not less than $1,000 in taxes for the yr, you could have to make estimated tax funds.

- Should you made not less than $400 in self-employment earnings, you have to pay self-employment tax (15.3%) to cowl Social Safety and Medicare.

Self-employed tax kinds for gig staff

Should you’re self-employed, you’ll seemingly cope with the next tax kinds:

| Kind | Goal |

| Schedule C (Kind 1040) | Studies self-employment earnings and bills. |

| Kind 1099-NEC | Studies nonemployee compensation ($600+) from shoppers. |

| Kind 1099-Ok | Studies funds processed by way of third-party platforms. |

| Schedule SE | Calculates self-employment tax (Social Safety & Medicare). |

| Kind 1040-ES | Used to make estimated tax funds. |

For a deeper dive into the self-employed tax kinds above, take a look at our Information to Self-Employed Tax Kinds.

Methods to file taxes as a gig employee

Submitting taxes as a gig employee could seem advanced, however it doesn’t must be. Let’s begin by breaking every little thing down into manageable steps.

1. Decide your tax standing.

Earlier than submitting, it’s essential to perceive how the IRS classifies your gig work. Most gig staff fall into one of many following classes:

- Unbiased contractor or freelancer – You present providers to shoppers however don’t obtain worker advantages.

- Sole proprietor – You use a enterprise below your personal identify with out forming a separate authorized entity.

- Restricted legal responsibility firm (LLC) – You may have registered a enterprise to separate private and enterprise legal responsibility.

For tax functions, the IRS considers unbiased contractors, sole proprietors, and single-member LLCs as self-employed, that means you’ll file Schedule C together with your Kind 1040 earnings tax return.

Should you’re uncertain whether or not your gig is a passion or a enterprise, ask your self:

- Do I repeatedly earn earnings from this exercise?

- Do I intend to make a revenue?

- Do I put effort and time into rising my gig work?

If the reply is sure to the above, the IRS will seemingly classify your gig as a enterprise. Congrats! This implies you may declare deductions to decrease your tax invoice.

2. Preserve monitor of earnings from all sources.

In contrast to conventional W-2 staff, gig staff don’t have taxes withheld from their paychecks, so you have to monitor your personal earnings.

Widespread methods gig staff obtain earnings:

- Direct funds – Financial institution transfers, Venmo®, PayPal®, or Money App®.

- Platform-based earnings – Uber®, Lyft®, Etsy, eBay, YouTube®, TikTok®, and so forth.

- Freelance work – Funds from shoppers, model partnerships, or content material sponsorships.

Understanding tax kinds for gig staff:

- Kind 1099-NEC – Issued by shoppers who paid you $600 or extra in nonemployee compensation (beforehand reported on Kind 1099-MISC).

- Kind 1099-Ok – Issued by third-party cost processors (e.g., PayPal, Venmo, eBay, Etsy) if funds exceed $5,000 in tax yr 2024 ($2,500 in 2025, $600 in 2026).

- No tax kind? – Even in the event you don’t obtain a 1099, you have to nonetheless report all earnings in your tax return.

Tax Tip: Preserve a spreadsheet or use accounting software program to trace your earnings all year long to keep away from scrambling at tax time.

3. Monitor deductible bills to decrease your taxable earnings.

One of many largest tax advantages of gig work is deducting enterprise bills to cut back your taxable earnings. To qualify, bills have to be:

- Unusual – Widespread in your trade (e.g., mileage for a rideshare driver).

- Crucial – Important for working your gig work.

Widespread gig employee tax deductions:

Gig work typically comes with distinctive bills. Should you’re in search of to maximise your tax financial savings, it helps to learn about tax deductions out there for freelancers and gig staff. Some frequent ones that may apply to you embody:

- Self-employment tax deduction – You may deduct 50% of your self-employment tax (the portion that an employer would sometimes cowl).

- House workplace deduction – When you’ve got an area used solely and repeatedly for enterprise, you may deduct a portion of your hire, utilities, and web.

- Medical insurance premiums – These are solely deductible in the event you pay in your personal protection and are usually not eligible for an employer-sponsored plan (contains medical, dental, imaginative and prescient, and even qualifying long-term care insurance coverage).

- Cellphone and web payments – You may deduct solely the share of your cellphone utilization for enterprise, or 100% if in case you have a devoted enterprise cellphone line.

- Workplace provides & tools – Consists of laptops, printers, software program, enterprise subscriptions, and so forth.

- Promoting & advertising and marketing – Web site internet hosting, paid social advertisements, enterprise playing cards, and so forth., could be deductible when used for enterprise functions.

Tax Tip: At all times use detailed record-keeping, receipts, and mileage logs — these could make or break your deductions within the occasion of an IRS audit. Utilizing a separate checking account or bank card for your online business can assist you monitor bills extra simply.

4. File the proper tax kinds.

Since gig staff don’t obtain a W-2, you’ll have to file extra tax kinds:

- Schedule C (Kind 1040) – Studies gig earnings and deductible bills.

- Schedule SE (Self-Employment Tax) – Calculates Social Safety & Medicare taxes.

- Kind 1040-ES – Used to make quarterly estimated tax funds in the event you count on to owe over $1,000 in taxes for the yr.

TaxAct Self-Employed makes submitting these tax paperwork a breeze. Our user-friendly tax preparation software program walks you thru reporting your self-employment earnings and enterprise bills.

Tax Tip: Should you fashioned an LLC or S Corp, you could have to file extra kinds, similar to Kind 1065 for partnerships or Kind 1120-S for S firms. Don’t fear, although — TaxAct Enterprise can assist you with these.

5. Pay estimated taxes to keep away from IRS penalties.

Since no employer withholds taxes out of your gig earnings, you’re chargeable for paying taxes your self all year long. You need to pay estimated taxes quarterly in the event you count on to owe $1,000 or extra in the course of the yr.

Quarterly estimated tax due dates:

- April 15 – For earnings earned January by way of March

- June 15 – For earnings earned April by way of Might

- Sept. 15 – For earnings earned June by way of August

- Jan. 15 (following yr) – For earnings earned September by way of December

If any of the above dates fall on a weekend or vacation, the due date turns into the subsequent enterprise day.

Methods to calculate estimated taxes:

- Add up your whole anticipated gig earnings for the yr.

- Subtract your estimated deductions to search out your taxable earnings.

- Calculate self-employment tax (15.3% ) + earnings tax (tax charge is predicated in your tax bracket).

- Pay 25-30% of your internet earnings in quarterly tax funds.

Need assistance together with your tax calculations? Check out our Revenue Tax Calculator and Self-Employment Tax Calculator.

Methods to make funds:

Tax Tip: Should you even have a W-2 job, you may improve your tax withholding to cowl gig work taxes as a substitute of paying estimated taxes individually. Some individuals discover this simpler!

6. Use tax software program to simplify the method.

A simple option to file gig employee taxes is by utilizing TaxAct Self-Employed. Our product walks you thru:

- Coming into gig earnings from Kind 1099-NEC, Kind 1099-Ok, or guide entries.

- Claiming enterprise deductions to decrease your tax invoice.

- Calculating estimated taxes for subsequent yr.

- E-filing your return on to the IRS.

Methods to file gig employee taxes with TaxAct

Utilizing TaxAct makes submitting self-employment taxes a breeze. Right here’s find out how to enter your Schedule C info:

- Log in to TaxAct (On-line or Desktop).

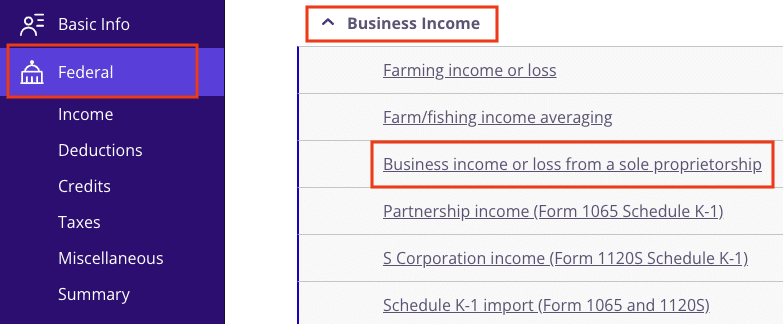

- Click on Federal > Enterprise Revenue > Enterprise Revenue or Loss from a Sole Proprietorship, as proven beneath.

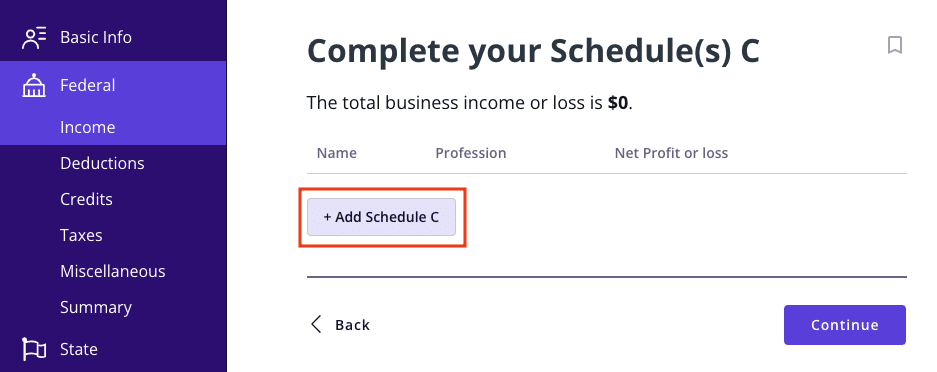

- Click on + Add Schedule C, as proven beneath, to create a brand new copy of the shape, or click on Edit to edit a kind already created. (Desktop program: click on Evaluate as a substitute of Edit.)

- Proceed with the interview course of to enter your info.

Tax Tip: Should you’re apprehensive about lacking deductions, TaxAct’s Deduction Maximizer1 will flag potential missed financial savings earlier than you file.

Gig employee tax guides by occupation

Every sort of gig work comes with some distinctive tax concerns. Whether or not you’re promoting on an internet market, driving for Uber, creating digital content material, streaming on Twitch®, and even promoting toes pics, it’s essential to know find out how to report your earnings and maximize deductions. Under, we’ve damaged down the necessities for every gig occupation, full with hyperlinks to in-depth guides that will help you file confidently.

eBay vendor taxes: Understanding 1099-Ok reporting and deductions

Learn our full eBay tax information right here.

Should you’re promoting on eBay, whether or not as a passion or full-time small enterprise proprietor, your earnings could also be taxable. The IRS distinguishes between private gross sales and enterprise gross sales, and realizing the place you fall is vital.

- Do eBay sellers have to pay taxes?

- Promoting used private gadgets at a loss? No tax owed.

- Promoting for a revenue? You owe taxes on the achieve.

- Recurrently reselling for revenue? You’re a enterprise and should report all earnings.

- Widespread tax deductions for eBay enterprise sellers:

- Delivery prices and packaging supplies

- Transaction and platform charges

- Value of products offered (COGS)

- Storage and stock monitoring methods

- Methods to report eBay earnings:

- Enterprise sellers report earnings on Schedule C and should owe self-employment tax.

Etsy vendor taxes: Reporting on-line craft gross sales to the IRS

Learn our full Etsy tax information right here.

Do you promote handmade items, digital merchandise, or classic gadgets on Etsy? If that’s the case, your earnings are self-employment earnings and have to be reported in your tax return.

- Key tax obligations for Etsy sellers:

- You need to file a tax return in the event you earn $400+ in internet self-employment earnings.

- Self-employment tax (15.3%) and earnings tax applies to internet earnings.

- Some important deductions for Etsy sellers:

- Provides

- Etsy charges

- Promoting

- Delivery supplies

- House workplace bills

- Methods to file Etsy earnings:

- Use Schedule C to report earnings and declare bills.

Odd jobs and peculiar gigs: Reporting aspect hustle earnings

Learn our full odd job tax information right here.

This information is a superb catch-all for many who are juggling a couple of random gigs or making an attempt one thing new — and it’s filled with actual examples that will help you get it proper throughout tax season.

Whether or not you’re earning money from Twitch streaming, strolling canines, babysitting, freelancing on Fiverr®, and even promoting toes pics on-line (sure, actually) you’re most likely incomes taxable self-employment earnings.

Right here’s what it’s essential to know in case your aspect hustle doesn’t fairly slot in a field:

- Each greenback counts: Even in the event you don’t obtain a Kind 1099, the IRS expects you to report all earnings.

- Self-employment tax: Should you earn over $400 throughout all aspect hustles, you owe self-employment tax to cowl Social Safety and Medicare taxes.

- Sure, canine strolling counts: Earnings from platforms like Rover® or direct shoppers have to be reported and should set off self-employment tax.

- Streaming is a enterprise: Twitch earnings from Bits, advert income, or donations is self-employment earnings and will go on Schedule C.

- Money jobs are nonetheless taxable: Babysitting, tutoring, or mowing lawns? If somebody pays you, that’s earnings, even in the event you’re paid in money “below the desk.”

- Declare your write-offs: Relying on the job, you could possibly deduct platform charges, provides, pet gear, advertising and marketing, grooming, or software program subscriptions.

- Don’t skip quarterly funds: You might have to pay estimated taxes each quarter to keep away from underpayment penalties.

Lyft and Uber driver taxes: Maximizing deductions for rideshare drivers

Learn our full Uber and Lyft tax information right here.

As an unbiased contractor for Uber, Lyft, or a meals supply service like DoorDash®, you’re chargeable for monitoring your earnings and paying your personal taxes.

- Do Uber and Lyft take out taxes?

- No. Drivers should put aside cash for earnings and self-employment taxes.

- Should you count on to owe $1,000+ in taxes, you must make estimated quarterly tax funds.

- Understanding Kind 1099-Ok and 1099-NEC:

- 1099-Ok experiences gross journey earnings.

- 1099-NEC is issued in the event you earn $600+ in non-driving earnings (bonuses, incentives, referral funds, and so forth.).

- Maximizing tax deductions:

- You may take the usual mileage deduction or deduct precise automobile bills (gas, upkeep, insurance coverage, and so forth.)

- Parking charges and tolls throughout work

- Automotive mortgage curiosity

- Tools and passenger facilities like cellphone mounts, chargers, and streaming subscriptions

- Methods to file Uber & Lyft taxes:

- Report earnings and business-related bills on Schedule C and pay self-employment tax.

Content material creator taxes: Submitting taxes as a YouTuber, influencer, or social media star

Learn our full content material creator tax information right here.

Should you earn cash from YouTube, Instagram®, TikTok, or model sponsorships, you have to report all earnings to the IRS.

- Do content material creators pay self-employment tax?

- Sure, in the event you earn $400+ in internet self-employment earnings, you owe self-employment tax (15.3%).

- You need to pay estimated taxes quarterly in the event you count on to owe $1,000+ in taxes.

- Understanding 1099-NEC and taxable free merchandise:

- If a model pays you $600+, they have to concern Kind 1099-NEC.

- Free merchandise value $100+ could also be taxable if obtained in alternate for promotions.

- Tax deductions for influencers:

- House workplace bills

- Images & video tools (cameras, ring lights, tripods)

- Advertising and marketing & promoting, like paid social media promotions

- Enterprise journey bills

- Methods to file as a content material creator:

- Report earnings and bills on Schedule C with Kind 1040.

FAQs about gig employee taxes

Do I have to pay taxes if I don’t get a 1099?

Sure, the IRS requires you to report all earnings, even in the event you don’t obtain Kind 1099-NEC or 1099-Ok. Ensure to trace all earnings and preserve good enterprise information to reduce complications when tax season rolls round.

How do I inform if I’m self-employed?

The IRS typically considers you to be a self-employed particular person in the event you match into any of the next classes:

- Unbiased contractor or freelancer

- Sole proprietor

- Restricted legal responsibility firm (LLC)

- Member of a partnership

Even in the event you work part-time for one employer whereas freelancing for varied shoppers, you continue to fall below the self-employed class.

Nonetheless unsure? Try Methods to Inform If You Are Self-Employed.

How do I calculate self-employment tax?

Self-employment tax is 15.3% of your internet earnings (12.4% for Social Safety and a couple of.9% for Medicare). You may deduct half of this tax in your federal tax return.

Is passion earnings totally different from gig earnings?

Sure! Tax implications differ relying on whether or not your aspect gig is a passion or a enterprise.

Right here’s the gist: In case your aspect gig is a enterprise, you may declare tax deductions for issues like startup prices, journey, and web payments. But when your aspect gig is only a passion, you gained’t be capable of declare tax deductions to offset related prices.

The IRS sometimes considers you a enterprise in the event you’re making a revenue repeatedly.

How can I decrease my tax invoice as a gig employee?

To save lots of on taxes, do your greatest to maximise your deductions, contribute to a self-employed retirement plan in the event you qualify, and preserve correct information to make sure you declare each eligible tax break.

What occurs if I don’t pay estimated taxes?

You may face IRS penalties for underpayment in the event you don’t pay estimated taxes by the deadline each quarter. To keep away from this, make quarterly estimated tax funds in the event you count on to owe not less than $1,000 in taxes in the course of the yr.

Should you work full-time, take into account asking your employer to withhold extra taxes out of your paychecks to cowl your aspect gig taxes, if that’s your choice.

How a lot ought to I put aside for estimated tax funds?

Setting apart 25-30% of your self-employment earnings is mostly advisable to cowl your tax obligations.

The underside line

Submitting taxes as a gig employee doesn’t must be scary. By understanding your tax obligations, holding detailed information, and claiming out there deductions, you’ll be breezing by way of tax season with confidence.

Should you need assistance submitting, TaxAct Self-Employed guides you thru the method step-by-step, making certain you declare each deduction you’re entitled to. Able to knock out your gig employee taxes? Let’s begin submitting.