Oil costs stay supported in tight markets, and whereas European fuel costs corrected final week, Russia’s choice to chop provides to Finland highlights the continuing threat of a wider stoppage of Russian fuel deliveries to the EU. Gold in the meantime has discovered a footing and bullion lastly ended the run of weekly losses, whereas the chance of a worldwide meals disaster is wanting more and more actual.

Oil costs are somewhat firmer, and stay supported in tight markets. USOIL has edged marginally greater to $111, although it’s across the center of the slender $111.94 to $109.51 vary. There stays one thing of a tug-of-war between expectations for a moderately resilient US financial system this yr, versus China’s ongoing covid issues and uncertainties over the EU’s insurance policies relating to Russian imports.

On the supportive aspect, the PBoC’s charge lower final week has supplied some underpinning to grease, as properly expectations for Shanghai to reopen on June 1. Additionally, US gasoline and diesel costs stay at or close to report highs and the arrival of the height driving season within the US and Europe is prone to hold markets tight and costs excessive. The IEA’s Fatih Birol instructed Bloomberg that oil costs might rise additional and referred to as on oil producers to behave responsibly to assist comprise costs. And he warned “we might even see costs even going greater, being rather more unstable and turning into a serious threat for recession for the worldwide financial system,” including that “If Europe reduces oil imports from Russia, it is not going to be straightforward for the worldwide oil markets.”

The EU has to this point didn’t agree on a ban of Russian oil imports although, largely due to resistance for Hungary’s Orban, who continues to demand extensive ranging exceptions. In the meantime the previous head of Russia’s second largest oil group instructed the FT {that a} ban on Russia’s “not possible to exchange” crude could be the “most unfavourable situation” for all events and a “shock for everybody”. Regardless of resistance from Hungary, most EU leaders stay dedicated to hitch the ban of Russian oil imports, however for now the failure to achieve an settlement is capping the upside for oil. In the meantime there have been reviews as we speak that the White Home is weighing an emergency launch of diesel from a hardly ever used stockpile to ease the tightness in provides.

European fuel costs have dropped greater than -10% over the previous week, and US costs are additionally barely down in comparison with final Monday, even supposing Russia added Finland to the listing of European international locations that that should stay with out Russian provides. Flows on the primary pipeline have been halted early on Saturday, in response to Finnish importer Gasum Oy, though the state owned vitality agency additionally mentioned in an announcement that it had fastidiously ready for this example and that “supplied that there will likely be no disruptions within the fuel transmission community, we will provide all our clients with fuel within the coming months”. Provides to Finland proceed through the Balticconnector pipeline from Estonia, and Finland’s fuel imports from Russia account for a small share of the nation’s vitality imports. For now the transfer is principally simply signalling, however because the dispute over fee modalities just isn’t over but, and if Russia cuts off Germany or the entire of the EU, the financial implications near-term could be appreciable.

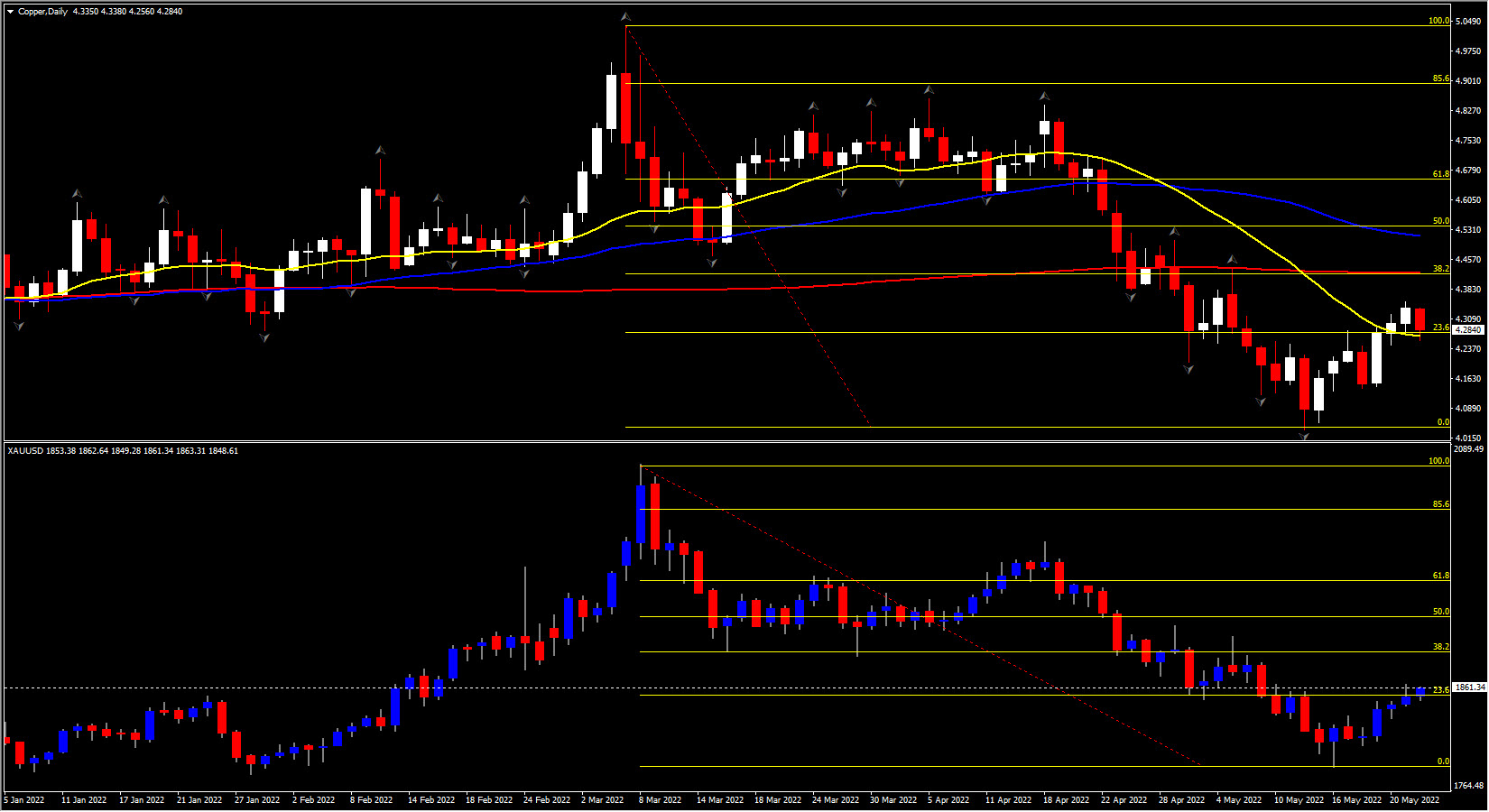

Gold lastly ended its run of weekly losses final week and managed to rise 1.9%. Gold stays supported as we speak and bullion is up on yesterday’s shut as threat aversion picks up, at $1862.77, breaking the 20- and 200-day SMA. The 1870 deal with (38.2% Fib. degree) stays key. Gold has regained a few of its secure haven standing as concern that aggressive Fed motion will undermine the US restoration appears to have dented the greenback’s haven standing and Yen and Gold appear to be again in favor as a hedge in opposition to progress dangers.

Agricultural commodity costs in the meantime largely stay sharply greater than a yr in the past, as concern deepens that the fallout from the Ukraine struggle and sanctions on Russia will set off a world meals disaster. The drought in India just isn’t serving to in fact, and wheat costs specifically have pushed greater, prompting BoE head Bailey to warn of an “apocalyptic” rise in meals costs. The World Financial institution in the meantime introduced a $30 bln motion plan to finance a “world response to the continuing meals safety disaster” final week. World Financial institution Group President David Malpass mentioned that “to tell and stabilize markets, it’s essential that international locations clarify statements now of future output will increase in response to Russia’s invasion of Ukraine. Nations ought to make concerted efforts to extend the availability of vitality and fertilizer, assist farmers improve plantings and crop yields, and take away insurance policies that block exports and imports, divert meals to biofuel, or encourage pointless storage.”

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distribution.