I want so as to add a brand new phrase to my buying and selling vocabulary. I feel each presentation at this 12 months’s CMT Affiliation Symposium has used “regime change” to outline the shift from one main sector to a different main sector. This verbiage can be utilized in discussions for the “regime change” from development to worth. How about from tech- to commodity-centric? These are all regime adjustments, and this phrase does assist to disrupt our historic pondering of tech or development as one of the best sector.

The phrase is essential as a result of it highlights how important the change is. This isn’t only a month-to-month focus. The consideration of a regime change highlights that we’re at a way more important place in historical past. Utilizing this macro terminology, let us take a look at among the totally different market areas.

Nasdaq 100

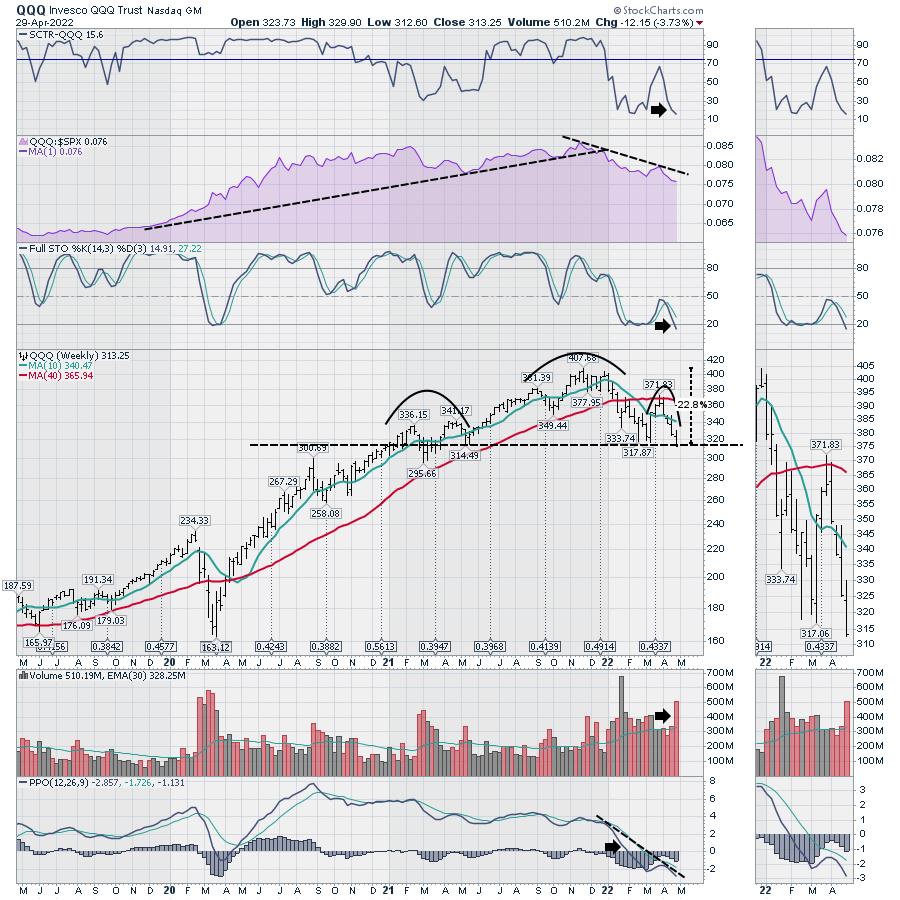

The markets have been breaking down for months and, as we roll out of April, the QQQ hangs across the neckline of the traditional head/shoulders sample.

Once we place the thought sample of a regime change, the chart under holds some technical alerts that chartists discuss. Initially, the QQQ SCTR is right down to 23%. That signifies that 77% of the ETF’s have higher value motion than the QQQ’s proper now. The query needs to be “Is that this a bounce degree?”

The relative power in purple compares the chart to the $SPX. The Nasdaq was outperforming the $SPX for years, and now it’s not. Till that 3-month down pattern adjustments, we will look elsewhere. The straightforward pattern line change can inform us a regime change could also be taking place, after we are evaluating large macro environments. It was an incredible clue at 12 months finish.

The complete stochastic is close to the underside of the vary. This could keep close to the underside of the vary for some time. The best way a full stochastic is calculated tells us the place the worth is in comparison with the current value motion. Unhealthy markets keep close to the underside, good markets keep close to the highest. There isn’t a information that that is bettering but.

Once we take a look at value, the chart has clearly made a decrease excessive not too long ago on the finish of March. However it’s making an attempt to bounce off assist.

The quantity on this chart reveals this week as one of many highest quantity weeks in 2022. It was additionally the earnings week for the biggest tech corporations. The quantity displays one thing essential right here: it was both managers promoting into any earnings rally, or it was managers shopping for the bounce. We can’t know but, however there’s a particular degree of curiosity proper right here.

Lastly, the PPO is my favourite indicator, and it’s nonetheless pointing down. The slotted black pattern line is an actual resistance line. For me, except we will break this momentum downtrend, this chart continues to be heading decrease. If this chart breaks decrease, I might counsel a bigger cycle regime change is formally right here because it breaks assist.

Vitality

I do have a chart that may be a commodity-related chart. With out going by means of all the symptoms, it is fairly apparent this has been outperforming.

The actual query for me is that if the purple uptrend on the XOP chart will proceed to outperform. The PPO is rolling over to finish the month of April. We’ll see if this chart can proceed larger, however, proper now, it’s significantly better than the remainder of the market.

If the concept of a regime change is worrying to you, we’re about to see if the change from tech to vitality is a bigger cycle regime change. To me, the regime change began in January 2022, when the QQQ began to underperform the $SPX.

The CMT Symposium is utilizing the regime change verbiage throughout most shows. Whereas the elemental buyers are pondering it is a nice time to step in as a price funding, the technical view suggests the regime change is essential. For me, we stand at a vital juncture.

Keep tuned.

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Based mostly in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an energetic member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).