Canadian Imperial Financial institution of Commerce is managing a scarcity of tech staff by coaching its builders in high-demand applied sciences together with blockchain and Microsoft Azure, betting that such progress alternatives will assist the lender retain present staff and appeal to outdoors expertise.

With tech changing into more and more vital within the finance world, Canada’s banks are looking for to rent extra builders, however they’re dealing with elevated competitors from startups and different corporations. That’s leading to hovering salaries and rising turnover charges, prompting Royal Financial institution of Canada Chief Govt Officer David McKay to record the battle for expertise as considered one of his high considerations for this 12 months.

“It’s in all probability probably the most aggressive setting I’ve ever skilled in my 30 years in IT,” CIBC Chief Info Officer Richard Jardim stated in an interview. “We used to compete towards the banks and perhaps some huge tech — now it’s like we’re competing with everybody.”

To deal with the problem, Toronto-based CIBC is specializing in offering present builders with new expertise relatively than trying externally for expertise with the identical capabilities. For instance, the corporate has educated 2,000 staff — about two-thirds of its builders — on Microsoft Azure since CIBC struck a multiyear settlement in July to make this system its major cloud platform.

Of these workers, about 350 have taken exams to obtain full Azure certification, a fascinating credential within the information-technology world that may price as a lot as C$5,000 ($4,000) to obtain, Jardim stated.

The financial institution additionally partnered with Ethereum software program firm ConsenSys to coach 450 tech staff in blockchain expertise and take part in a hackathon to construct merchandise utilizing these expertise. The financial institution is engaged on the same program in quantum computing for subsequent 12 months, Jardim stated.

“These are the brand new, sizzling expertise and rising applied sciences,” Jardim stated. “Once we spend money on that with of us, it positively appears to retain expertise, and it additionally attracts new expertise to know that we’re specializing in these items.”

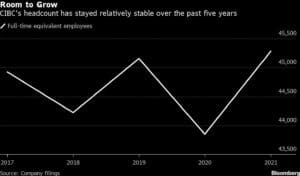

CIBC CEO Victor Dodig has signaled that his firm is in progress mode and will likely be investing in tech workers and front-line, revenue-generating staff. The financial institution is seeking to rent 700 to 900 technologists this 12 months, Jardim stated.

Nonetheless, CIBC’s turnover price amongst tech staff is rising, as it’s throughout the banking trade, Jardim stated, declining to offer particular figures.

CIBC is seeing salaries for tech staff rising from 10% to as a lot as 40% for these with sure expertise, Jardim stated. Among the many specialties most in demand are cloud engineering, synthetic intelligence, automation and course of engineering, together with experience in applied sciences corresponding to Salesforce.com Inc.’s Pega platform, he stated. There have additionally been uncommon, excessive circumstances through which staff in sure niches are looking for to double their pay, he stated.

The scarcity of tech expertise is more likely to ultimately attain a “settlement level,” although it’s laborious to pinpoint precisely when that will occur, Jardim stated.

“Individuals might begin to scale back a few of their investments,” he stated. “Then the market will right.”

— By Kevin Orland (Bloomberg Mercury)