If you happen to would take a look at the various kinds of buying and selling methods, you’ll discover that there two frequent themes amongst these methods. Methods are both reversal methods or continuation methods. Most methods fall into both of these classifications. Some fall on one finish of the spectrum and a few on the opposite finish of the spectrum. Both kind of technique may work very nicely when used correctly in the fitting market situation.

Totally different merchants take a look at the market in a different way. One dealer would possibly use a reversal kind of technique, whereas one other dealer might take a look at it as a possibility for a continuation kind of technique. This battle between merchants who’ve positioned their trades for a reversal and merchants who’ve positioned their trades for a continuation trigger value to maneuver in both route. The market strikes within the route the place most merchants place their bets on. Place your commerce in opposition to the majority of the market and you’ll be on the dropping finish of the market.

Nevertheless, there’s a technique to place your self proper in the midst of each camps. Merchants can commerce a method which is each a continuation alternative and a reversal alternative. The market may be a possibility for a development continuation technique on the long-term and in addition be a imply reversal technique on the short-term. Buying and selling on this method permits merchants to commerce with the majority of the market, which considerably will increase the win chance of every commerce.

Carter MA

Carter MA is a customized development following technical indicator which is predicated on transferring averages. Actually, this indicator consists of a set of transferring averages that are set at completely different interval lengths.

This indicator plots a number of transferring averages in an effort to assist merchants see the massive image when it comes to development route. The completely different transferring averages have completely different interval lengths which it derives it figures from in an effort to characterize the various tendencies from short-term to long-term.

The stable purple line is predicated on a 200-period transferring common, which is usually used as a long-term development indicator. The dotted purple line is predicated on a 100-period transferring common, which represents the mid-long-term development. The blue line is predicated on a 50-period transferring common, which is broadly used as a mid-term development indicator. The inexperienced line is predicated on a 21-period transferring common, which represents a mid-short-term development. The sienna line is predicated on an 8-period transferring common, which represents the short-term development.

Development route may be recognized based mostly on how the transferring common traces are stacked. Having the shorter-term transferring averages above the longer-term transferring averages point out a bullish development bias. Having the shorter-term transferring averages beneath the longer-term transferring averages point out a bearish development bias. Shifting averages which might be crossing over one another point out that the market might be reversing. Shifting averages that aren’t clearly stacked point out a market that’s ranging or a market that’s transferring erratically.

Stochastic Cross Alert

The usual Stochastic Oscillator is a well-liked momentum indicator which plots two traces that oscillate from 0 to 100. Momentum route is recognized based mostly on how the 2 traces overlap. A bullish momentum is recognized if the quicker line is above the slower line. Inversely, a bearish momentum is recognized if the quicker line is beneath the slower line. Crossovers between the 2 traces are then interpreted as momentum reversal alerts.

The vary of the Stochastic Oscillator additionally usually has markers at stage 20 and 80. Strains dropping beneath 20 point out an oversold market, whereas traces breaching above 80 point out an overbought market. Each circumstances are prime for imply reversals. Crossovers occurring on these areas are excessive chance imply reversal alerts.

The Stochastic Cross Alert indicator is a sign indicator based mostly on the imply reversal idea of the Stochastic Oscillator. It identifies imply reversal alerts based mostly on crossovers occurring beneath 20 or above 80. It then plots an arrow pointing the route of the imply reversal, which merchants can use as a imply reversal setup entry sign.

Buying and selling Technique

Carter MA Foreign exchange Buying and selling Technique is a mixture of a development following technique and a imply reversal technique.

On this technique, development route is recognized based mostly on how the transferring averages are stacked. Shifting averages must also begin to fan out indicating that the development is strengthening.

Then, we watch for value pullbacks.

Worth pullbacks may cause the sienna line to quickly cross over the inexperienced line. Nevertheless, the worth motion ought to respect the blue line as a dynamic assist or resistance.

The pullback ought to then trigger the Stochastic Oscillator to be overbought or oversold. Trades are confirmed as quickly because the Stochastic Cross Alert indicator plots an arrow indicating the resumption of the development.

Indicators:

- Carter_MA

- Stochastic_Cross_Alert

Most well-liked Time Frames: 30-minute, 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

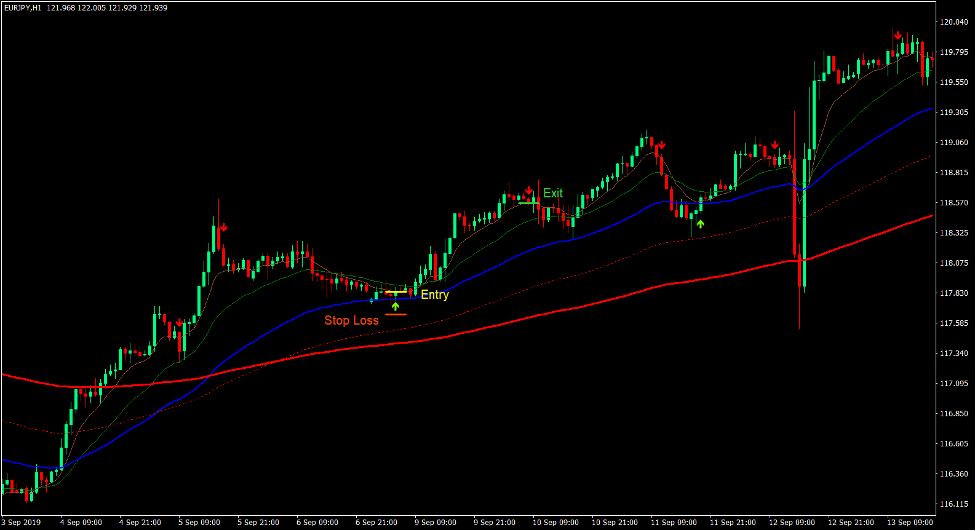

Purchase Commerce Setup

Entry

- The shorter-term transferring common traces of the Carter MA needs to be above the longer-term transferring common traces.

- Worth motion needs to be above the blue transferring common line.

- Worth ought to pullback in direction of the realm of the blue transferring common line.

- Enter a purchase order as quickly because the Stochastic Cross Alert indicator plots an arrow pointing up.

Cease Loss

- Set the cease loss beneath the arrow.

Exit

- Shut the commerce as quickly because the Stochastic Cross Alert indicator plots an arrow pointing down.

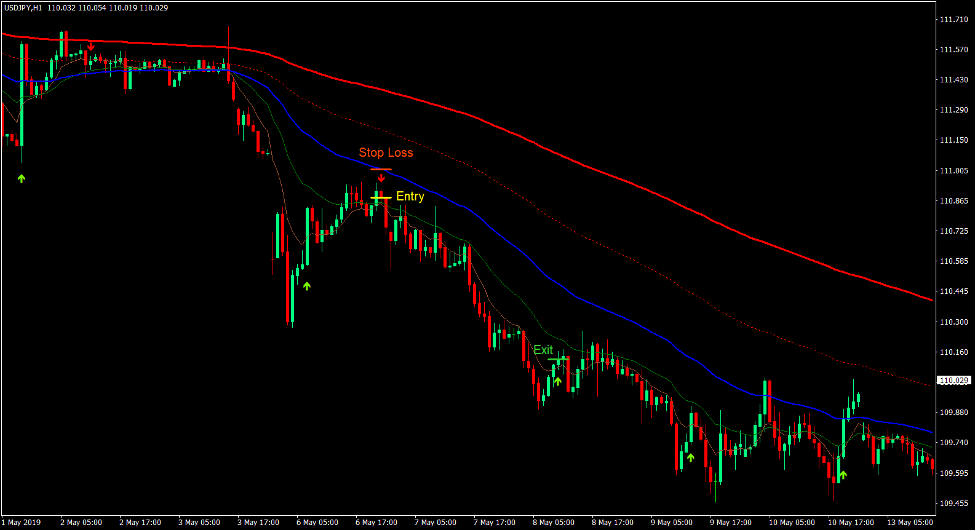

Promote Commerce Setup

Entry

- The shorter-term transferring common traces of the Carter MA needs to be beneath the longer-term transferring common traces.

- Worth motion needs to be beneath the blue transferring common line.

- Worth ought to pullback in direction of the realm of the blue transferring common line.

- Enter a promote order as quickly because the Stochastic Cross Alert indicator plots an arrow pointing down.

Cease Loss

- Set the cease loss above the arrow.

Exit

- Shut the commerce as quickly because the Stochastic Cross Alert indicator plots an arrow pointing up.

Conclusion

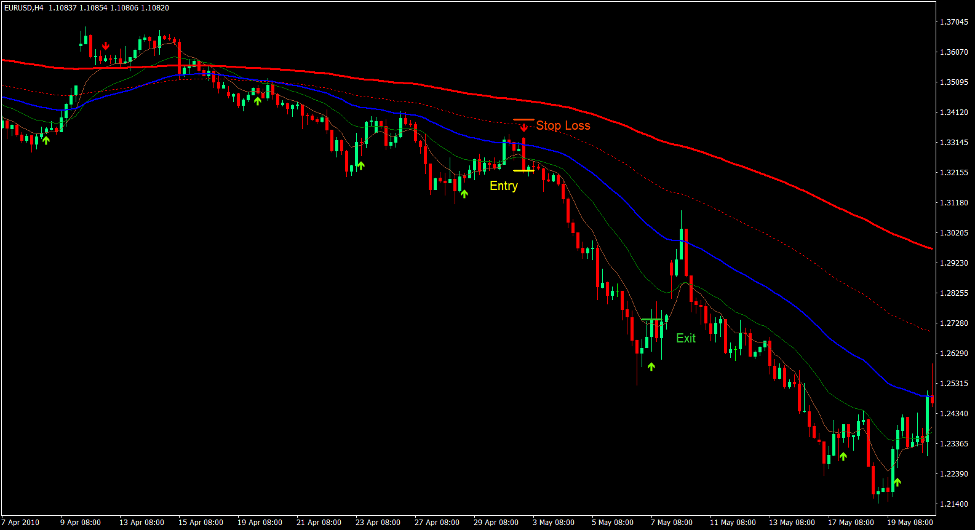

This buying and selling technique is a wonderful buying and selling technique as a result of it combines each a development following technique and a imply reversal technique.

This buying and selling technique needs to be utilized in a market that trending strongly on the long-term. Worth must also respect the 50-period transferring common line to verify that the market remains to be trending and isn’t due for a deep reversal.

Commerce setups ought to happen close to the realm between the inexperienced and blue traces as this space ought to act as an space of dynamic assist or resistance.

If utilized in the fitting market situation, this technique has the potential to supply constant income over the long term.

Foreign exchange Buying and selling Methods Set up Directions

Carter MA Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past knowledge and buying and selling alerts.

Carter MA Foreign exchange Buying and selling Technique gives a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional value motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Methods to set up Carter MA Foreign exchange Buying and selling Technique?

- Obtain Carter MA Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Carter MA Foreign exchange Buying and selling Technique

- You will note Carter MA Foreign exchange Buying and selling Technique is obtainable in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: