Runs are the kinds of trades that many merchants would need to make. These markets present merchants the chance to make some huge cash in a really quick interval. Though it isn’t as widespread as a pattern, it shares numerous similarity. In truth, some merchants say {that a} run is a pattern and a pattern is a run, the one distinction is within the timeframe. While you come to consider it, this assertion is true. Robust developments which can be discovered on the decrease timeframe could be a run on the upper timeframe. Lets say that runs are like developments on steroids. If merchants may simply become profitable on developments, then market runs may do the identical for them solely that this time it’s a lot quicker.

Within the real-world market, outdoors of the pc desk, developments might be associated to inflation whereas runs might be associated to hyperinflation, solely that inflation and hyperinflation is a thousand instances extra impactful, whereas developments and runs may happen on a day by day or weekly foundation relying on the timeframe.

Runs carries numerous momentum with it and pushes value at a a lot quicker tempo. Merchants who may systematically commerce attainable market runs because it unfolds may revenue enormously from the market.

Candle Cease Momentum Run Foreign exchange Buying and selling Technique is a momentum buying and selling technique that enables merchants to systematically anticipate possible market runs based mostly on a confluence of indicators.

Oracle Transfer – 100 Pips Momentum

Oracle Transfer, also called 100 Pips Momentum, is a customized technical indicator utilized by merchants to establish momentum and short-term pattern course.

It’s a pattern following indicator based mostly on the crossover of two Hull Shifting Averages (HMA). The blue line represents the quicker shifting common line, whereas the crimson line represents the slower shifting common line.

Developments are based mostly on the positioning of the 2 shifting common traces. If the blue line is above the crimson line, the market is alleged to be bulling. If the blue line is under the crimson line, then the market is alleged to be bearish. Crossovers between the 2 shifting common traces might be thought-about as a attainable pattern reversal sign.

Most shifting common traces are both erratic and prone to uneven markets or are too lagging and produces entry indicators too late. This configuration of shifting averages manages to reduce lag drastically and smoothen out the shifting common line. This creates a shifting common line that may be very responsive to cost actions but is much less prone to false indicators.

Candle Cease Indicator

Candle Cease indicator is a channel or envelope sort of technical indicator. It behaves very like the Keltner Channel or the Donchian Channel indicators.

It plots two dashed traces overlaid on the value chart to point the traditional vary of value motion. These traces are based mostly on the historic actions of value derived from the highs and lows inside a sure interval just a few bars behind.

This creates a channel that ought to envelope value throughout not trending or low volatility markets. Nevertheless, it might additionally point out a possible momentum breakout each time value breaks out strongly on both aspect of the channel.

Buying and selling Technique

This buying and selling technique is an easy momentum breakout technique based mostly on the confluence of indicators coming from the Candles Cease indicator and the Oracle Transfer indicator.

The Oracle Transfer indicator would function an preliminary indication relating to the place the short-term momentum is shifting. Commerce course can be based mostly on how the 2 shifting common traces of the Oracle Transfer indicator are stacked.

We then watch for value to breakout of the channel and shut outdoors of the 2 traces. Value ought to breakout within the course indicated by the Oracle Transfer indicator.

The breakout candle needs to be a momentum candle. It also needs to break the earlier swing low, swing excessive or congestion vary, indicating {that a} momentum breakout state of affairs is in play.

Indicators:

- CandleStop

- 100pips Momentum

Most popular Time Frames: 30-minute, 1-hour, 4-hour and day by day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

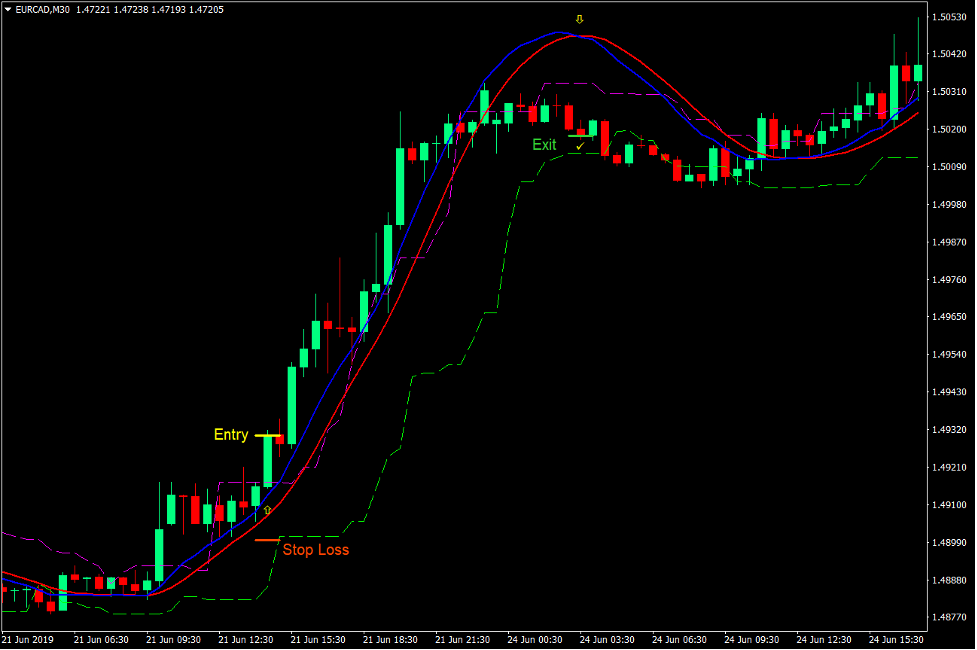

Purchase Commerce Setup

Entry

- The blue line of the Oracle Transfer indicator needs to be above the crimson line.

- A bullish momentum candle ought to break above the magenta line of the Candle Cease indicator.

- The breakout candle ought to shut above the current swing excessive or congestion space.

- Enter a purchase order on the affirmation of the situations above.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Shut the commerce as quickly because the blue line of the Oracle Transfer indicator crosses under the crimson line.

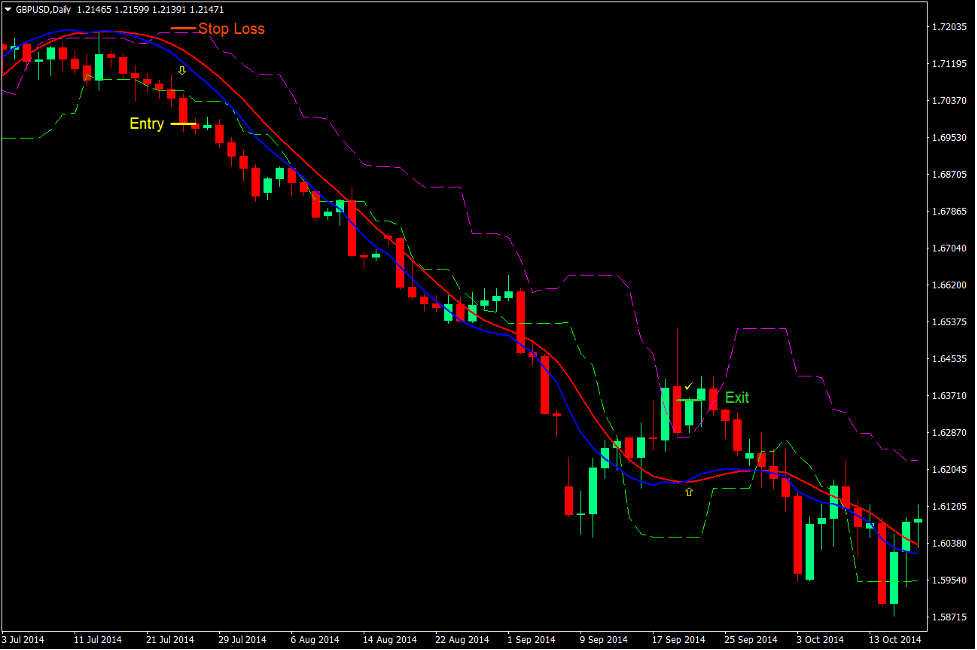

Promote Commerce Setup

Entry

- The blue line of the Oracle Transfer indicator needs to be under the crimson line.

- A bearish momentum candle ought to break under the lime line of the Candle Cease indicator.

- The breakout candle ought to shut under the current swing low or congestion space.

- Enter a promote order on the affirmation of the situations above.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly because the blue line of the Oracle Transfer indicator crosses above the crimson line.

Conclusion

This momentum breakout technique is a working buying and selling technique. It supplies commerce entries which have a comparatively excessive likelihood and an excellent increased potential reward-risk ratio.

Conventional breakout methods work in virtually the identical method. The distinction is that this technique relies on the current highs and lows of value, that are the areas the place value ought to breach so as to affirm a breakout.

It additionally permits value to run, which capitalizes on momentum breakout’s predominant energy, which is excessive reward-risk ratios resulting from market runs.

The important thing to buying and selling this technique efficiently is in figuring out viable congestion or breakout areas and momentum breakout candles. The symptoms used serve simply as a affirmation to the setup. It additionally permits merchants to see potential commerce setups with extra readability, which have in any other case been missed if with out the indications.

Foreign exchange Buying and selling Methods Set up Directions

Candle Cease Momentum Run Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past knowledge and buying and selling indicators.

Candle Cease Momentum Run Foreign exchange Buying and selling Technique supplies a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional value motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Advisable Choices Buying and selling Platform

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 General Score!

- Mechanically Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

The way to set up Candle Cease Momentum Run Foreign exchange Buying and selling Technique?

- Obtain Candle Cease Momentum Run Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Candle Cease Momentum Run Foreign exchange Buying and selling Technique

- You will notice Candle Cease Momentum Run Foreign exchange Buying and selling Technique is obtainable in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: