Momentum Breakout methods are in all probability one of the crucial profitable forms of buying and selling methods. It permits for top yields that might present income which are three to 4 occasions greater than the chance positioned on the cease loss. This kind of technique, if carried out nicely, would offer constant income over the long term.

Sure, Momentum Breakout methods are nice, however the place do we discover them? To know the place to seek out momentum breakouts, we should first perceive the cyclical conduct of the market. The market behaves in two methods, growth and contraction, the distinction would solely be the diploma of the volatility and the timeframe the place the contraction and growth could possibly be noticed.

These two phases would often transfer in cycles. Merchants might count on that the market would develop after a transparent market contraction. However, the market would often contract proper after a robust market growth. The one exception is when there’s a robust reversal transfer that might instantly reverse a previous growth section.

Buying and selling momentum breakouts could be simpler if merchants might establish market contractions as a result of it’s often proper after the market contraction the place a robust momentum breakout happens.

Bollinger Bands Momentum Breakout Foreign exchange Buying and selling Technique is a technique that permits merchants to establish contraction phases which happen previous to a momentum breakout. It additionally permits merchants to systematically establish and make sure a momentum breakout based mostly on two easy technical indicators.

Bollinger Bands

Bollinger Bands might be one of the crucial full technical indicators. It’s primarily a development and momentum indicator, nevertheless it additionally supplies indications for volatility and overbought or oversold markets.

The Bollinger Bands consists of three traces or bands. The center line is a fundamental Easy Transferring Common (SMA) line often set at 20 intervals. The outer traces are customary deviations derived from the center line.

As a result of the center line of the Bollinger Bands is a 20 SMA line, the Bollinger Bands is technically a development indicator. Merchants might establish development path based mostly on the situation of value in relation to its midline, in addition to the slope of the midline.

The outer bands are used for a wide range of functions.

As a momentum indicator, merchants might establish a robust momentum each time value would breakout of the Bollinger Bands and keep near one of many outer bands.

It may be used to establish the precise reverse, which is a possible imply reversal. Costs which are past the outer bands are thought-about overbought or oversold. If value motion reveals indicators of rejection of the outer bands, then value would possibly begin to reverse.

Lastly, it may be used as a volatility indicator. The bands would merely contract throughout a contraction section and develop throughout an growth section.

100 Pips Momentum Indicator

100 Pips Momentum indicator is a customized technical indicator developed to establish robust tendencies and momentum.

It’s composed of two modified transferring common traces. The quicker line is shade blue whereas the slower line is shade crimson. These traces act as a transferring common crossover indicator.

Bullish tendencies are indicated by the blue line being above the crimson line. Inversely, bearish tendencies are indicated by the blue line being beneath the crimson line. As such, crossovers of the 2 traces would point out a possible development reversal.

The traces are characteristically very clean. It doesn’t create sudden spikes and reversals even when value would create some minor spikes. Regardless of its smoothness, it nonetheless could be very responsive to cost actions. This mix of smoothness and responsiveness makes it a wonderful development following indicator.

Buying and selling Technique

Bollinger Bands are top-of-the-line indicators to make use of when buying and selling momentum breakouts. It’s because Bollinger Bands might present info concerning market volatility and momentum.

This buying and selling technique trades on momentum breakouts based mostly on the Bollinger Bands and confirms the momentum breakouts based mostly on the 100 Pips Momentum indicator.

To commerce this technique, merchants ought to await the market to contract which is indicated by a contracted Bollinger Bands. We then await value to develop with robust momentum. That is indicated by a robust momentum candle closing past the Bollinger Bands.

The 100 Pips Momentum indicator must also verify the momentum breakout based mostly on the place of the 2 traces, the slope of the traces and their location in relation to the midline of the Bollinger Bands.

Momentum breakouts utilizing Bollinger Bands needs to be confirmed by value breaching above the breakout candle. Because of this, as soon as the circumstances above are met, we might be utilizing cease entry orders to set off the commerce.

Indicators:

- Bollinger Bands

- 100pips Momentum

Most popular Time Frames: 30-minute, 1-hour, 4-hour and every day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

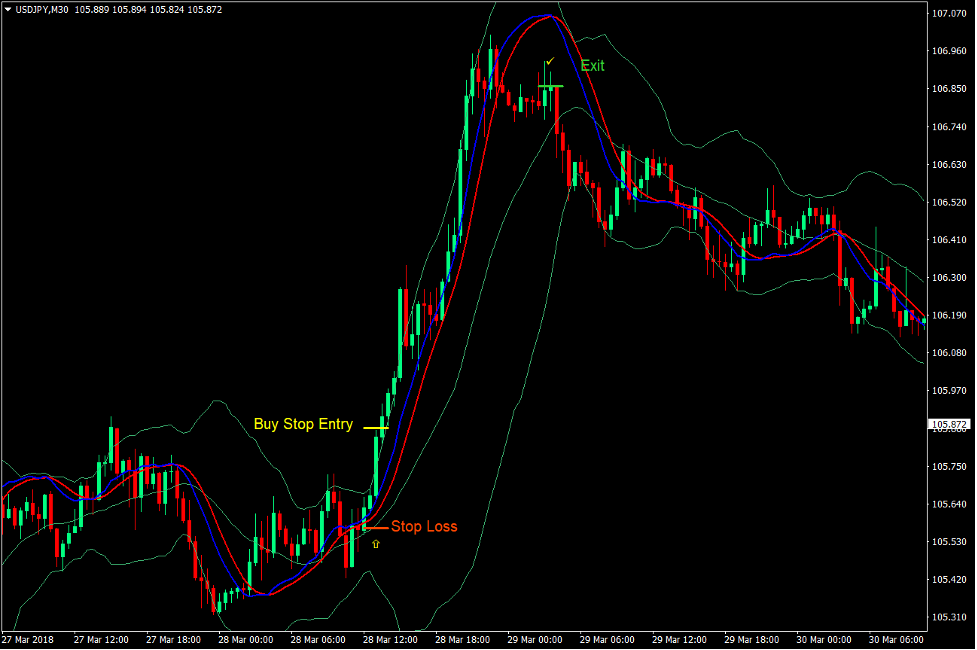

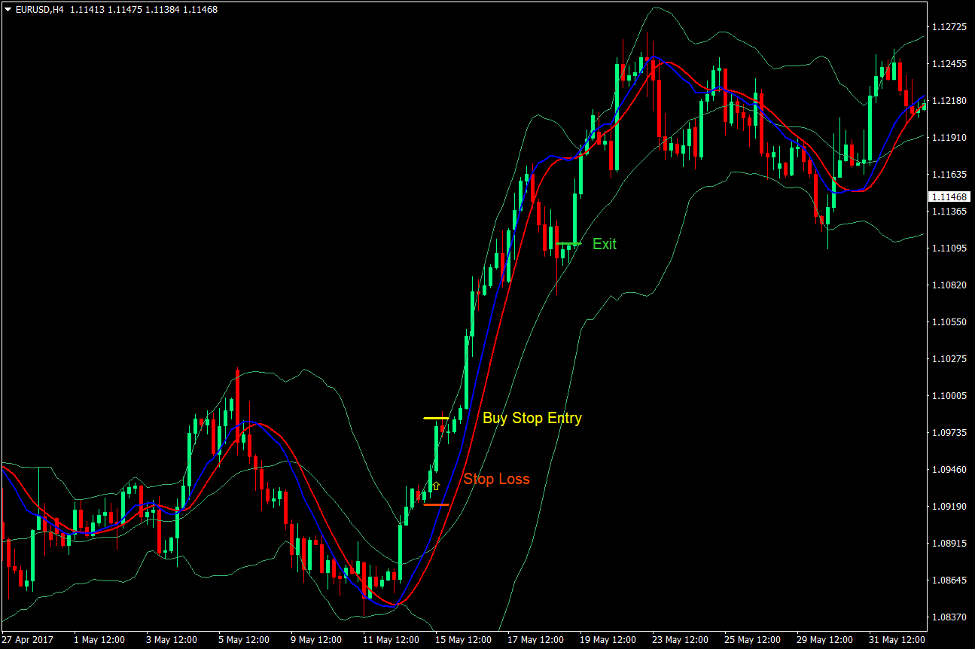

Purchase Commerce Setup

Entry

- The Bollinger Bands needs to be in a contracted section.

- Worth ought to shut above the higher Bollinger Band with robust momentum.

- The Bollinger Bands ought to begin to develop.

- The blue line of the 100 Pips Momentum indicator needs to be above the crimson line.

- Each traces ought to slope up and cross above the midline of the Bollinger Bands.

- Set a purchase cease order above the momentum breakout candle.

Cease Loss

- Set the cease loss on the fractal or congestion beneath the entry candle.

Exit

- Shut the commerce as quickly because the traces of the 100 Pips Momentum indicator flatten out.

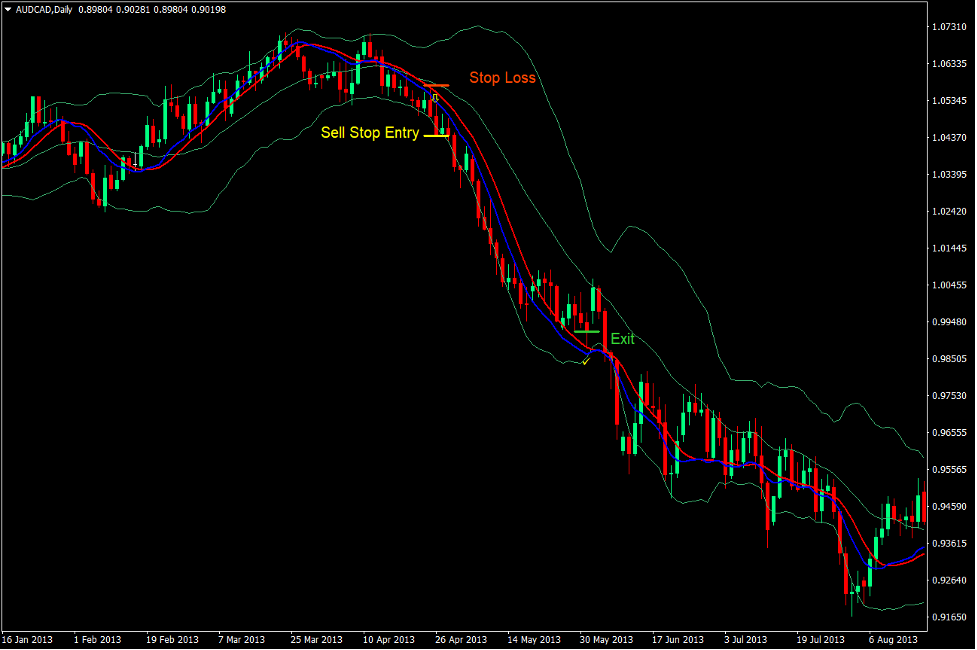

Promote Commerce Setup

Entry

- The Bollinger Bands needs to be in a contracted section.

- Worth ought to shut beneath the decrease Bollinger Band with robust momentum.

- The Bollinger Bands ought to begin to develop.

- The blue line of the 100 Pips Momentum indicator needs to be beneath the crimson line.

- Each traces ought to slope down and cross beneath the midline of the Bollinger Bands.

- Set a promote cease order beneath the momentum breakout candle.

Cease Loss

- Set the cease loss on the fractal or congestion above the entry candle.

Exit

- Shut the commerce as quickly because the traces of the 100 Pips Momentum indicator flatten out.

Conclusion

Momentum breakout methods are inherently excessive threat excessive reward methods. This technique is not any completely different from different momentum breakout methods. It depends on excessive reward-risk ratios whereas permitting some minor losses once in a while. Nevertheless, that is nonetheless very worthwhile as a result of the open ended exit technique permits merchants to capitalize on market runs, which often happen proper after a momentum breakout. These trades would permit merchants to revenue a lot on a single commerce.

Merchants who might grasp figuring out contraction and growth phases utilizing the Bollinger Bands might capitalize on this technique. It additionally requires psychological self-discipline as having some minor losses once in a while might demoralize some merchants. Nevertheless, merchants ought to take into account that so long as they’re able to catch these few good trades, they could possibly be very worthwhile over the long term.

Foreign exchange Buying and selling Methods Set up Directions

Bollinger Bands Momentum Breakout Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past information and buying and selling indicators.

Bollinger Bands Momentum Breakout Foreign exchange Buying and selling Technique supplies a chance to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional value motion and regulate this technique accordingly.

Really helpful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

The best way to set up Bollinger Bands Momentum Breakout Foreign exchange Buying and selling Technique?

- Obtain Bollinger Bands Momentum Breakout Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Bollinger Bands Momentum Breakout Foreign exchange Buying and selling Technique

- You will notice Bollinger Bands Momentum Breakout Foreign exchange Buying and selling Technique is offered in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: