Because the US is engulfed in inflation whereas The Federal Reserve is engaged in attempting to struggle inflation (effectively, type of), we’re seeing markets taking a shellacking, notably commodities.

One indicator of a slowdown is declining commodity costs. Crude oil futures are down round -2.5%. Iron Ore is down -5% and metal rebar is down -3.21%.

Inflation numbers are due out Wednesday and are forecast to be 8.1% YoY (primarily based on headline CPI). However mixed with a slowing world economic system, we get the dreaded “STAGFLATION.”

In the meantime, the S&P 500 index futures are down round 1.726% for Monday open. Asian markets already received clobbered with the Hold Seng down virtually -4%.

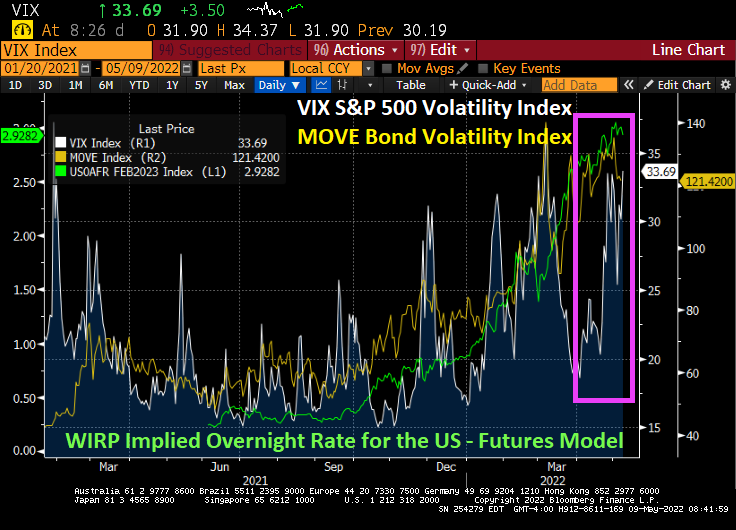

On the bond aspect, the 10Y Treasury Observe yield rose to three.20% early within the morning, however has retreated to three.1447% as of 8:40am EST.

Each inventory and bond market volatility measures are growing.

So, is it a Blue Monday impact? Or world stagflation?

Time for supplemental revenue underneath the Biden Administration.