This can be a continuation of the earlier article. The Dow Jones Industrial Common, additionally known as The Dow by the monetary media, is a price-weighted measure of 30 U.S. blue-chip firms. The Dow covers all industries excluding transportation and utilities, that are lined by the Dow Jones Transportation Common and Dow Jones Utility Common. Whereas inventory choice isn’t ruled by quantitative guidelines, a inventory usually is added to The Dow provided that the corporate has a superb repute, demonstrates sustained development, and is of curiosity to numerous traders. Sustaining sufficient sector illustration throughout the indexes can also be a consideration within the choice course of.

This can be a continuation of the earlier article. The Dow Jones Industrial Common, additionally known as The Dow by the monetary media, is a price-weighted measure of 30 U.S. blue-chip firms. The Dow covers all industries excluding transportation and utilities, that are lined by the Dow Jones Transportation Common and Dow Jones Utility Common. Whereas inventory choice isn’t ruled by quantitative guidelines, a inventory usually is added to The Dow provided that the corporate has a superb repute, demonstrates sustained development, and is of curiosity to numerous traders. Sustaining sufficient sector illustration throughout the indexes can also be a consideration within the choice course of.

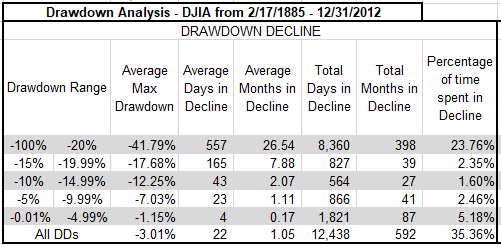

The next information is from the Dow Jones Industrial Common, not adjusted for dividends or inflation, over the interval from February 17, 1885 by December 31, 2012.

Observe: You probably have not learn the earlier article on Bear Markets and Drawdowns, a lot of the terminology used right here might be simpler to know.

Desk A is concentrated solely on the proportion decline of the assorted drawdowns. The columns within the desk are outlined as follows:

Drawdown Vary – that is the proportion of drawdown decline, it’s divided into numerous ranges which make of the rows within the desk. The highest row of information is for drawdowns with declines better than 20% and the underside row is the info for all drawdowns.

Common Max Drawdown – that is the typical of all of the drawdowns for the proportion decline within the first column.

Common Days in Decline – that is the typical variety of market days that the drawdowns had been within the decline whose share decline is outlined by the primary column.

Common Months in Drawdown – that is merely a calculation of dividing the typical market days in decline by 21, which is the typical variety of market days per 30 days, which yields calendar months.

Whole Days in Decline – that is the sum of all the times the actual decline vary was in decline.

Whole Months in Decline – that is the whole market days in decline divided by 21.

Proportion of time spent in Decline – that is the proportion of time that the declines had been in a state of decline based mostly upon the whole variety of market days for the interval of study.

Drawdown Decline – Dow Jones Industrial Common

Desk A

Desk A

From Desk A you may see that each one drawdowns better than 20%, that are additionally referred to as bear markets, had been in a state of decline for nearly 24% (23.76%) of the time, in different phrases bear market declines accounted for twenty-four% of the whole time from 1885 to 2012. The underside row within the desk above reveals that each one drawdowns, it doesn’t matter what their magnitude spent over 35% (35.36%) of the time declining.

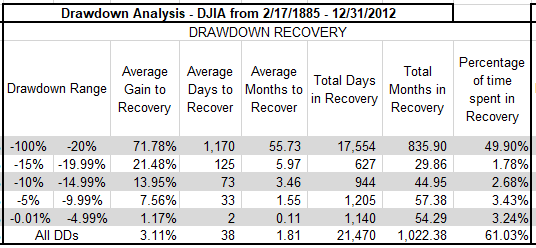

Drawdown restoration is the time period used to outline the time spent from when a drawdown bottoms (hits its absolute lowest level and biggest share of decline) and fully recovers (will get again as much as the place the drawdown started). The columns in Desk B are much like the Drawdown Decline desk in Desk A; I’m simply discussing the final portion of the drawdown right here as a substitute of the primary portion.

Drawdown Restoration – Dow Jones Industrial Common

Desk B

Desk B

We are able to see that Drawdown Recoveries, the place the magnitude of the drawdown was better than 20%, took virtually 50% (49.90%) of the whole time to recuperate. Do not forget that recoveries from declines all the time take longer than the declines. That is usually outlined by the truth that declines (promoting) are extra emotionally pushed so often are faster and extra abrupt. There’s a new column within the Drawdown Restoration desk, and it’s referred to as Common Acquire to Restoration. That is the proportion of achieve (restoration) wanted to get again to the place the drawdown started. This was mentioned in additional element in earlier article. From the Desk B you may see that for drawdowns better than 20%, on common it takes a achieve of over 71% (71.78%) to be get again to even. Keep in mind we’re coping with averages in these tables.

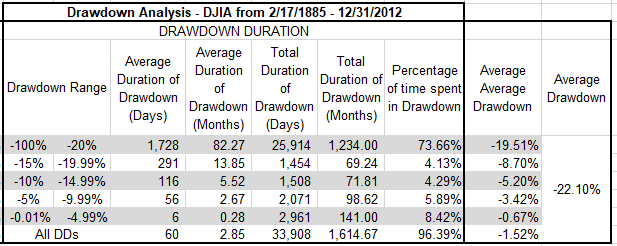

Drawdown length is proven in Desk C; that is the whole period of time {that a} full drawdown occurred. The earlier two tables handled the decline and the restoration, this desk is the whole of these two.

Drawdown Period – Dow Jones Industrial Common

Desk C

Desk C

Drawdowns of better than 20% averaged 1,728 days, which is over 82 months, or virtually 7 years. The overall variety of days of all drawdowns better than 20% was 33,908 market days. Now the true eye-catcher on this desk is the final row that reveals all drawdowns whatever the share decline. It reveals that the market from 1885 to 2012 was in a state of drawdown for over 96% (96.39%) of the time. In different phrases, the market was making new all-time highs lower than 4% of the time. Lastly, the final column reveals the typical of all drawdowns at -22.1%.

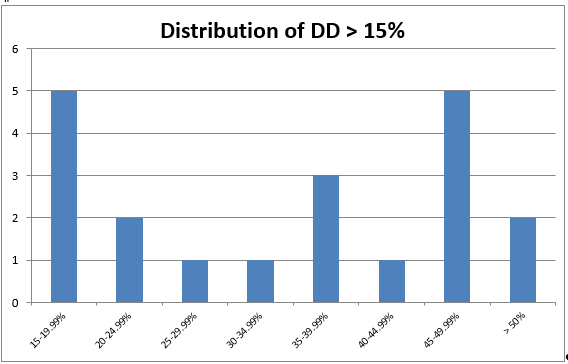

Chart A reveals all drawdowns that had been better than 15%. You may see that for the interval from 1927 to 2012, the S&P 500 had 5 drawdowns within the 15 – 19.99% vary, 2 within the 20 – 24.99% vary, and many others., for a complete of 20 drawdowns of magnitude better than 15%.

Distribution of Drawdowns – Dow Jones Industrial Common

Chart A

Chart A

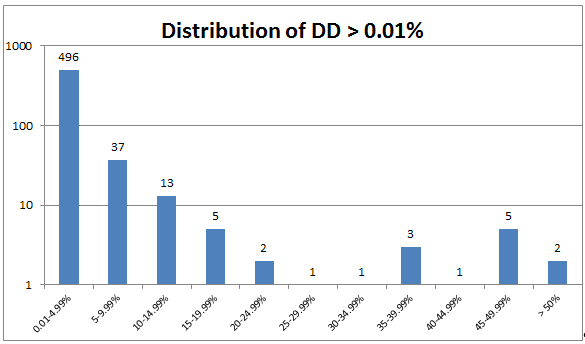

Chart B reveals all drawdowns regardless of how small. You may see that there have been 566 drawdowns, with 496 of them lower than 5%. 5 % declines are usually thought of simply noise and a part of the market pricing mechanism. Drawdowns between 5% and 10% are thought of pullbacks; there have been 37 pullbacks throughout this era. Corrections are drawdowns between 10% and 20%, you may see that there have been 18 (complete of 10-14.99% and 15-19.99%). There have been 15 drawdowns of 20% or better. Additionally discover that Chart A can also be mirrored in Chart B, simply that 3 extra distribution percentages had been added to the left finish.

Chart B

Chart B

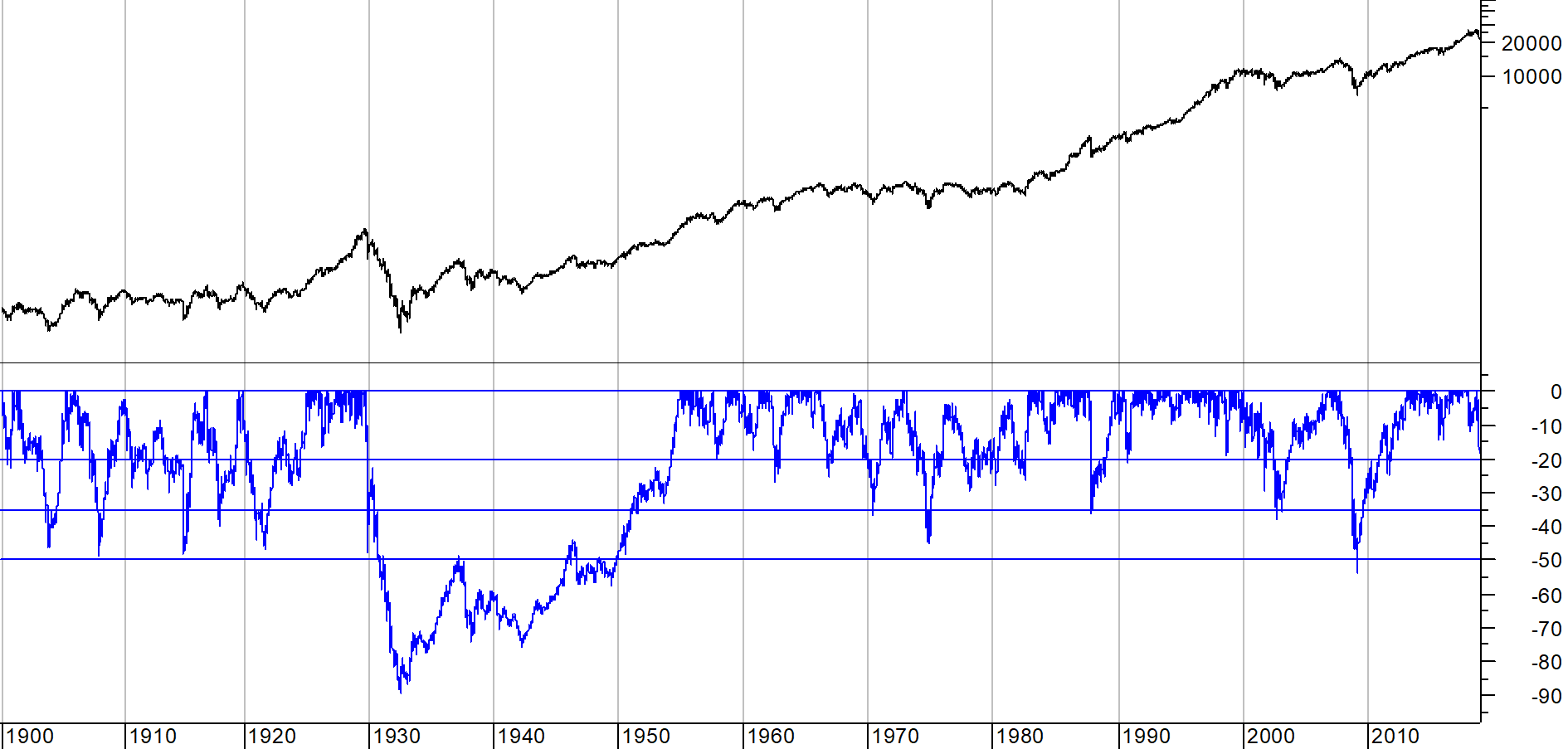

Chart C reveals you a visible of all drawdowns throughout the evaluation interval. The 1929 Drawdown is clearly distinctive not solely in magnitude of decline but in addition length; a lot in order that it skews the visible impact of the remaining drawdowns.

Cumulative Drawdown for Dow Industrials

Chart C

Chart C

These final two articles on Bear Markets and Drawdowns offered loads of information. Since I strongly imagine that danger is lack of capital which can also be drawdown, I really feel it essential that you just perceive the previous historical past on drawdowns (danger). I hardly ever use the Dow Industrials for evaluation, however it does provide over 30 years extra of day by day information.

Warning! Gross sales Pitch to Comply with: My e-book, Investing with the Pattern, has information and charts much like these, however not solely only for the worth, but in addition consists of information with out the bear markets, complete return evaluation, and rather more. Plus it does all that not just for the Dow Industrials, but in addition the S&P 500, Gold, Japan’s Nikkei 225, Copper. Decide up a replica, I want a brand new set of golf golf equipment. Thanks.

Dance with the Pattern,

Greg Morris

Greg Morris has been a technical market analyst for over 45 years starting from evaluation software program improvement, to web site evaluation and schooling, to cash administration. He has written 4 books: Candlestick Charting Defined (and its companion workbook), The Full Information to Market Breadth Indicators, and Investing with the Pattern. A graduate of the Navy Fighter Weapons “High Gun” Faculty, Greg is a former Navy fighter pilot who flew F-4 Phantoms on the USS Independence. He additionally holds a level in Aerospace Engineering from the College of Texas.

Greg has a protracted historical past of understanding market dynamics and portfolio administration.

Study Extra