Be aware On Charts: It’s vital you might be buying and selling with a dealer that provides True 5 Day New York Shut Charts.

Be aware On Brokers: Obtain our Most well-liked Dealer Platform with New York Shut Charts Right here.

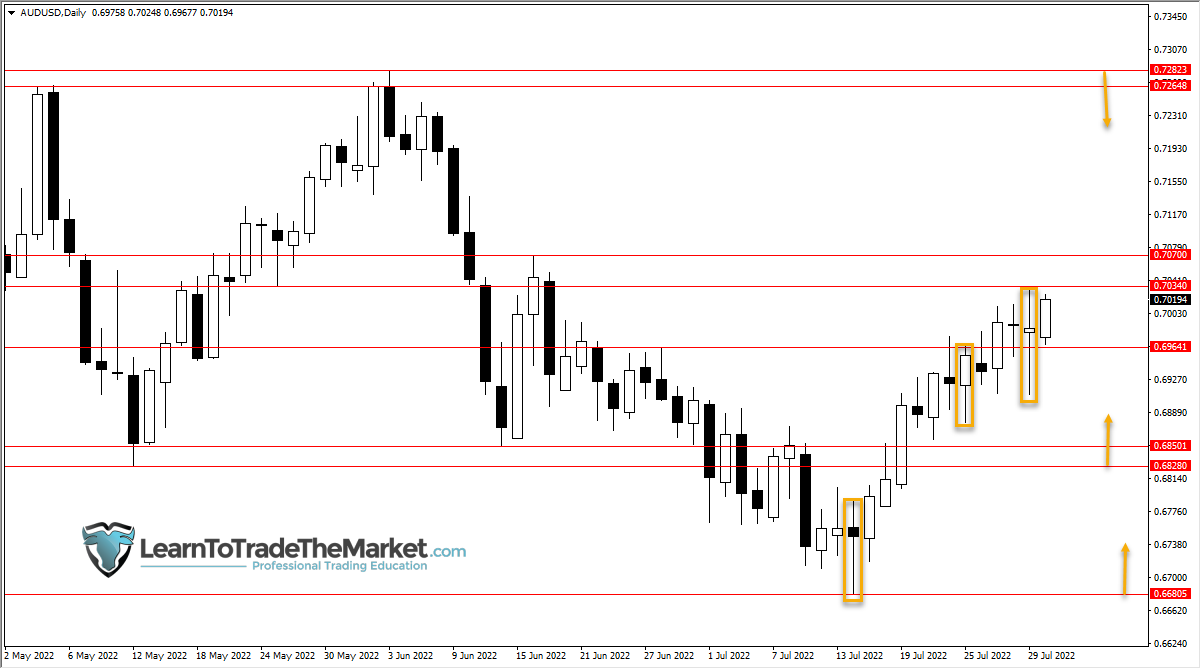

AUDUSD – SPOT: Promoting On A Retracement

Value Motion: Value shaped a Bullish Tailed Bar Sign late final week (We aren’t contemplating buying and selling this sign).

Value moved barely increased from the latest Bullish Pin Bar Sign that had shaped early final week (We didn’t think about buying and selling this sign).

Potential Commerce Thought: We’re contemplating promoting on a retracement increased and after a value motion promote sign, while value stays beneath the 0.7264 – 0.7282 key resistance space.

NOTE – You may commerce Spot AUDUSD through the buying and selling platform we use HERE. USDJPY – SPOT: Shopping for On A Retracement

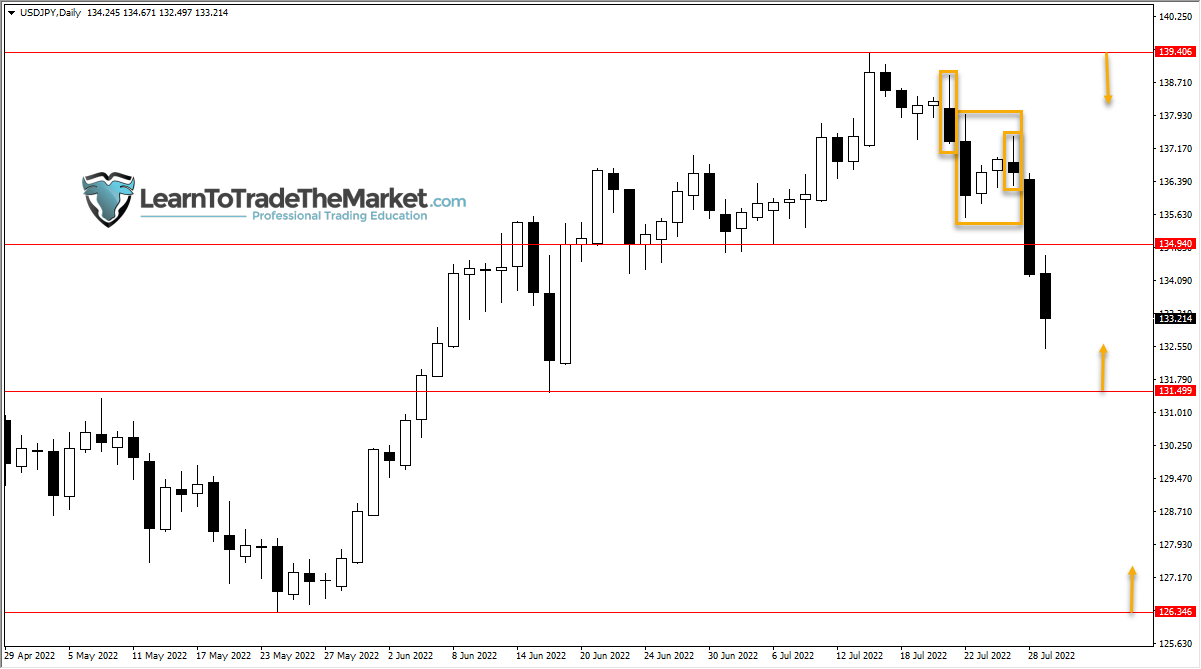

USDJPY – SPOT: Shopping for On A Retracement

Value Motion: Value moved decrease from the A number of Inside Bar Sample that had shaped early final week (We didn’t name this sample a Bearish A number of Inside Bar + Small Pin Bar (Combo Setup), as it’s counter-trend). (We didn’t think about buying and selling this sample).

Potential Commerce Thought: We’re contemplating shopping for on a retracement decrease and after a transparent value motion sign, at or across the 131.49 short-term help degree.

NOTE – You may commerce Spot USDJPY through the buying and selling platform we use HERE.

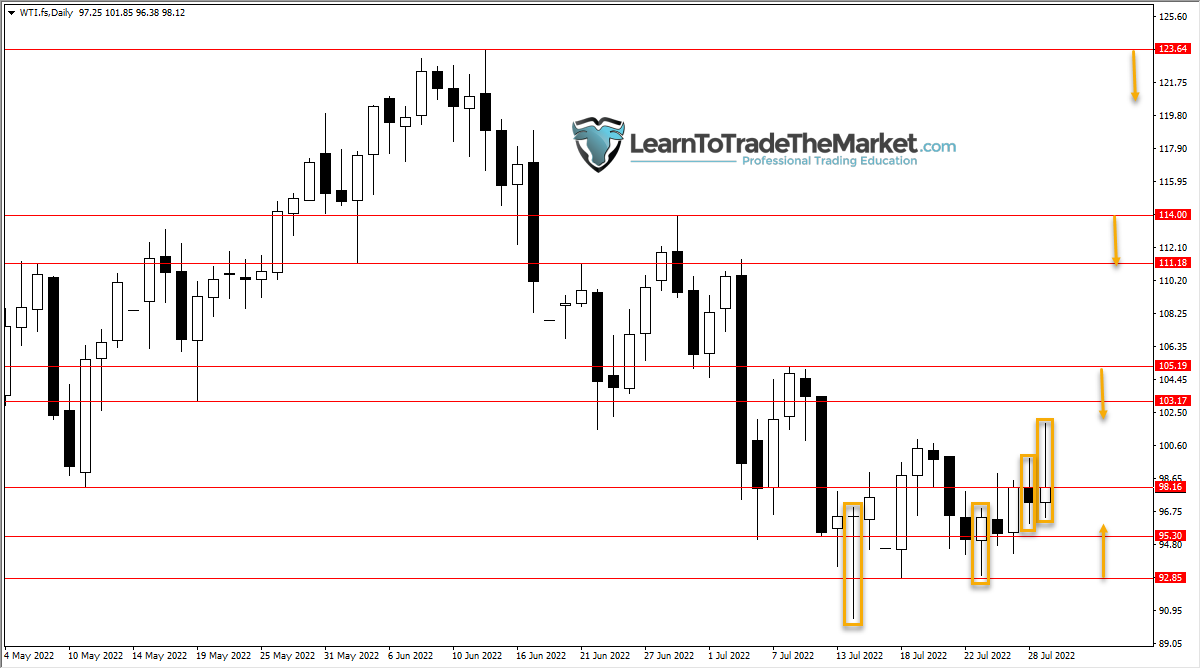

CRUDE OIL – Futures: Shopping for On A Retracement To Inside The Vary Of Lengthy-Tailed Bullish Pin Bar Sign

Value Motion: Value shaped a Lengthy-Tailed Bearish Pin Bar Sign late final week (We aren’t contemplating buying and selling this sign).

The Bearish Tailed Bar Sign that had shaped late final week failed (We didn’t think about buying and selling this sign).

Value moved increased from the latest Bullish Pin Bar Sign that had shaped early final week (We advised buying and selling this sign within the July twenty sixth day by day publication and hopefully some merchants acquired on board).

Value moved increased from inside the vary of the prior Lengthy-Tailed Bullish Pin Bar Sign that had shaped on Thursday July 14th (We’ve been suggesting shopping for on a retracement decrease into the vary of this sign since July fifteenth day by day publication).

Potential Commerce Thought: We’re contemplating shopping for on a retracement decrease to inside the vary of the prior Lengthy-Tailed Bullish Pin Bar Sign that had shaped on Thursday July 14th.

NOTE – You may commerce CRUDE OIL Futures through the buying and selling platform we use HERE.

Be part of My Professional Buying and selling Course & Commerce Concepts Publication: go to the Membership Web page Right here.

Get The Right Charts We Use: Obtain our Most well-liked Charting & Dealer Platform Right here.

Already A Member? Log In To Members Space Right here.

Please Depart A Remark Beneath With Your Questions or Suggestions.

Chart Commentary Disclaimer: Nial Fuller’s and Be taught To Commerce The Market’s evaluation and feedback beneath shouldn’t be thought of monetary recommendation or a suggestion to commerce or spend money on any monetary product. Your private monetary circumstances and danger limits haven’t been considered within the beneath evaluation and feedback. This text is for common instructional functions solely. Don’t blindly purchase and promote the monetary merchandise mentioned on this publication. At all times do your personal evaluation and analysis and be expressly conscious of the dangers and rewards in buying and selling or investing in any monetary product.