“It’s higher to be late to enter a pattern than to enter a unsuitable commerce.” This is without doubt one of the issues {that a} mentor dealer mentioned that caught with me. That is the concept behind ready for affirmation when taking pattern reversals.

In case you would come to consider it, buying and selling pattern reversals is already a really troublesome job. Merchants are sometimes taking trades which might be towards the present pattern course. Taking trades with no affirmation is rather like betting that worth would reverse on a sure space with none indications that worth will reverse. Typically, merchants would watch for worth to indicate indicators of reversal previous to taking a commerce of their predicted course. The drawback with taking this strategy is that merchants may be giving up some earnings as they’re ready for worth to maneuver of their course a bit, previous to taking the commerce.

On the flip facet, there are additionally merchants preferring to take trades as worth enters the zone the place they count on worth to reverse. The argument is that they might somewhat have a excessive reward-risk commerce setup on the expense of a decrease win price. Both manner each approaches might work.

Atlas Momentum Foreign exchange Buying and selling Technique is a pattern reversal technique that makes use of pattern reversal alerts coming from two dependable indicators. It additionally requires merchants to look at worth motion momentum to be able to affirm a possible pattern reversal. This ends in a better likelihood commerce setup based mostly on momentum worth actions which have a excessive tendency to begin a pattern reversal.

BBands Cease v1

BBands Cease v1 is a pattern following technical indicator which relies the historic motion of worth in relation to a predetermined distance based mostly on normal deviations.

This indicator is considerably associated to the Bollinger Bands as a result of it additionally makes use of ordinary deviations to establish the space which worth ought to transfer to be able to contemplate a possible pattern reversal.

The indicator identifies the pattern course based mostly on historic costs then plots a line reverse the course of the pattern based mostly on its computation of the usual deviation of the typical motion of worth.

The road shifts to the other facet of worth motion at any time when worth closes past the plotted line. This could point out a pattern reversal.

This indicator can be utilized as a pattern course filter, a pattern reversal sign or a cease loss placement.

As a pattern course filter, merchants might choose to commerce solely within the course of the pattern as indicated by the BBands Cease v1 line.

As a pattern reversal entry sign, merchants can use the shifting of the road above or under worth motion as a pattern reversal entry sign.

Merchants might additionally use it as a cease loss placement indicator by trailing the cease loss behind the BBands Cease v1 line.

Slope Route Line

Slope Route Line is a pattern following technical indicator based mostly on a modified shifting common.

Transferring averages are one of the vital primary instruments used to establish pattern course. Merchants would normally take a look at the course of the slope of a shifting common line and the situation of worth motion in relation to a shifting common line to establish pattern course. Merchants additionally use crossovers of various shifting averages or a shifting common and worth to establish potential pattern reversals.

Transferring averages are usually very efficient instruments for trending markets and pattern reversal setups. Nonetheless, shifting averages is also very ineffective in uneven markets. It is because shifting averages might generally be very vulnerable to market noise. Merchants would typically discover methods to smoothen out shifting averages by modifying it to be able to make it extra immune to market noise.

One other drawback of shifting common strains is that it tends to be very lagging. Merchants might generally be too late to enter and exit trades due to pattern reversal alerts which might be very lagging.

Slope Route Line manages to smoothen out its shifting common line whereas reducing lag. This creates a shifting common line that’s much less vulnerable to market noise but could be very conscious of pattern reversals.

This model of the Slope Route Line additionally adjustments colour relying on the course of the pattern. A light-weight blue line would point out a bullish pattern, whereas a tomato line would point out a bearish pattern.

Buying and selling Technique

This buying and selling technique makes use of the confluence of the Slope Route Line and the BBands Cease v1 indicator to establish potential pattern reversals.

On the Slope Route Line, tendencies are merely based mostly on the situation of worth in relation to the Slope Route Line, in addition to the colour of the Slope Route Line.

The BBands Cease v1 indicator sign is solely based mostly on the shifting of the BBands Cease v1 line.

Though commerce alerts are based mostly on the confluence of the 2 indicators, we won’t take each commerce that’s introduced by the market. As a substitute, we’ll solely take trades the place there’s a momentum candle at the start of the pattern reversal.

Indicators:

- BBands_Stop_v1

- (T_S_R)-Huge Development

Most well-liked Time Frames: 1-hour, 4-hour and day by day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

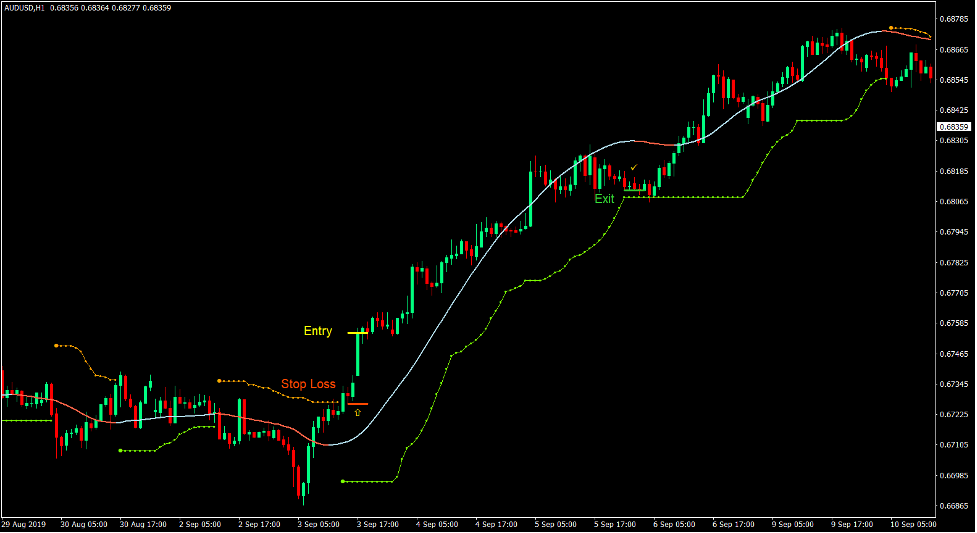

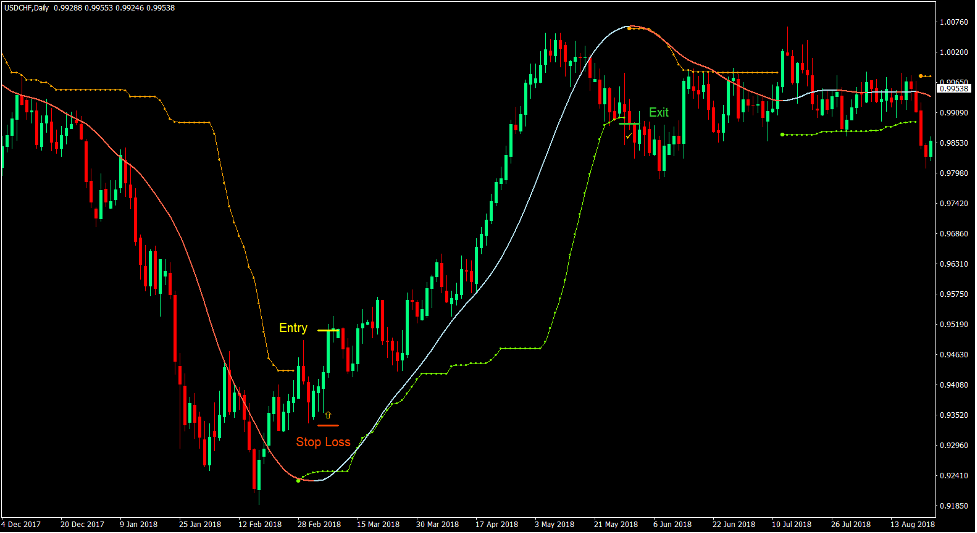

Purchase Commerce Setup

Entry

- The BBands Cease v1 line ought to shift under worth motion.

- Value motion ought to cross above the Slope Route Line.

- The Slope Route Line ought to change to gentle blue.

- A bullish momentum candle needs to be fashioned.

- Enter a purchase order upon the affirmation of those situations.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Shut the commerce as quickly as worth closes under the BBands Cease v1 line.

- Shut the commerce as quickly because the Slope Route Line adjustments to tomato.

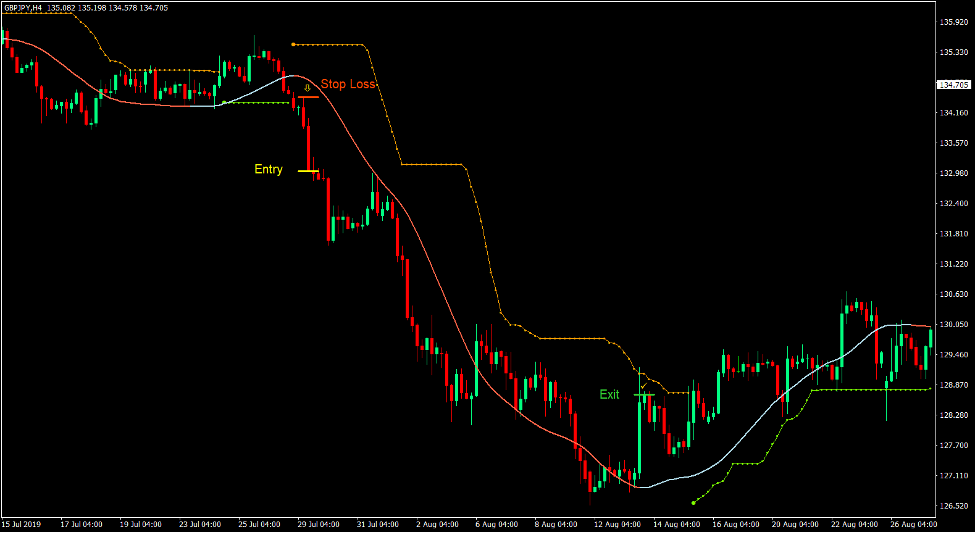

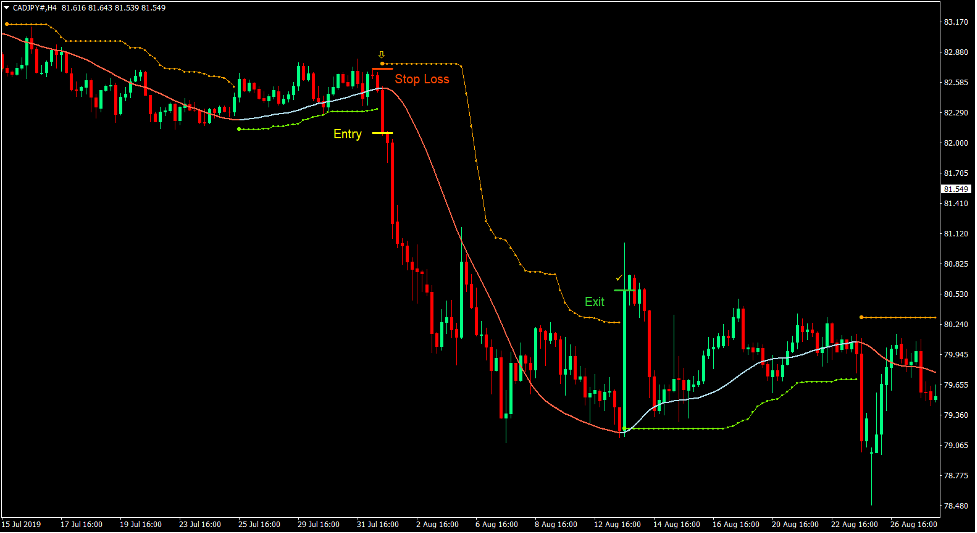

Promote Commerce Setup

Entry

- The BBands Cease v1 line ought to shift above worth motion.

- Value motion ought to cross under the Slope Route Line.

- The Slope Route Line ought to change to tomato.

- A bearish momentum candle needs to be fashioned.

- Enter a promote order upon the affirmation of those situations.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly as worth closes above the BBands Cease v1 line.

- Shut the commerce as quickly because the Slope Route Line adjustments to gentle blue.

Conclusion

This buying and selling technique is a sturdy pattern reversal buying and selling technique. The confluence of those excessive likelihood pattern following indicators give merchants an edge in relation to figuring out potential pattern reversals.

Nonetheless, merchants mustn’t take alerts from indicators as a closing commerce sign. Merchants ought to affirm the pattern reversal with worth motion. This technique incorporates each worth motion and technical indicators to be able to present excessive likelihood commerce setups.

Foreign exchange Buying and selling Methods Set up Directions

Atlas Momentum Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past information and buying and selling alerts.

Atlas Momentum Foreign exchange Buying and selling Technique gives a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

Methods to set up Atlas Momentum Foreign exchange Buying and selling Technique?

- Obtain Atlas Momentum Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Atlas Momentum Foreign exchange Buying and selling Technique

- You will notice Atlas Momentum Foreign exchange Buying and selling Technique is obtainable in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: